Get Real Time updates and more on our private FB group!

NFP Report Tomorrow: By Mark O’Brien, Senior Broker

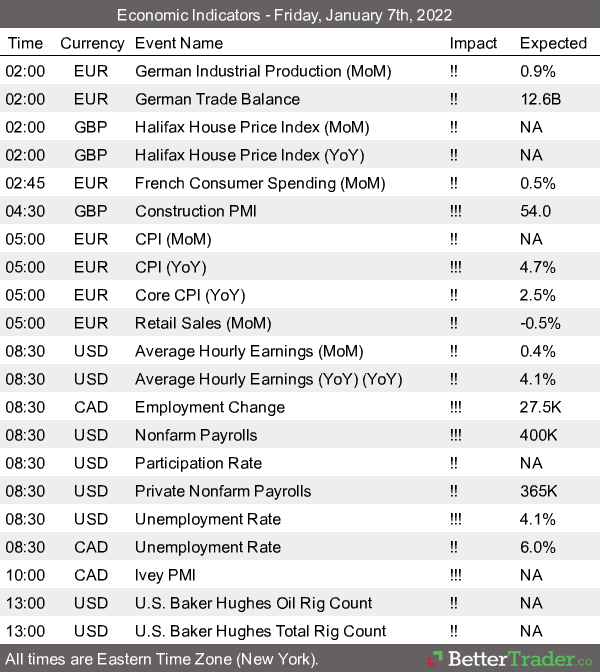

Here comes the Labor Department’s December Non-Farm Payrolls Report, long form for the unemployment report.

We just saw the surge in private hiring in the ADP National Employment Report on Wednesday. According to the report, private payrolls jumped by 807,000 jobs last month, the most in seven months and nearly double the early consensus after rising by 505,000 in November. Economists polled by Reuters had forecast private payrolls would increase by 400,000 jobs. The ADP report has a poor record of predicting the Labor Dept.’s numbers – primarily because of each report’s differing means of collecting data. The consensus for tomorrow’s report is to see 400,000 new jobs created, with a consensus range of 300,000 to 500,000. Private payrolls are expected to come in ±363,000.

This month’s backdrop includes a demand for workers reaching historic highs as businesses struggle to meet the rush of demand for goods and services. A record 4.5 million Americans quit their jobs in November as employers sought to fill 10.6 million job openings. Hires rose from 6.5 million in October to 6.7 million in November, a sign that most job-quitters are switching to new firms instead of dropping out of the workforce. On top of these variables, the rapid spread of the Omicron variant and its impact on jobs may not be reflected in this month’s report.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

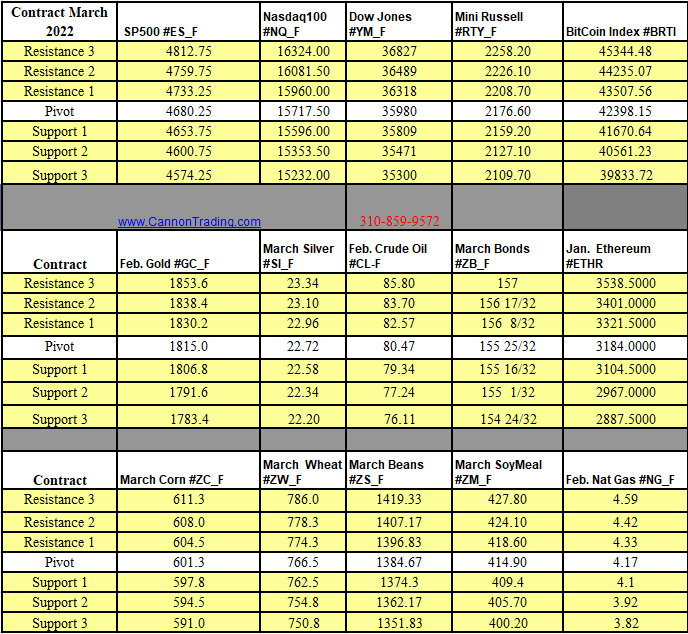

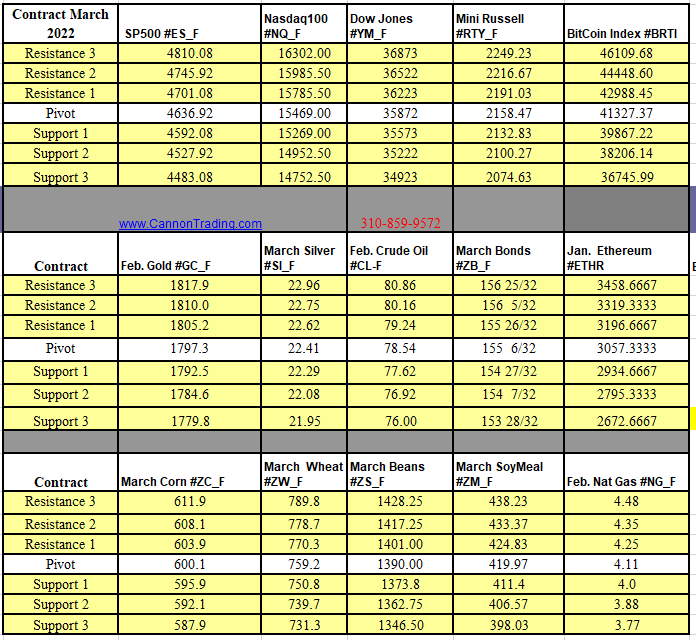

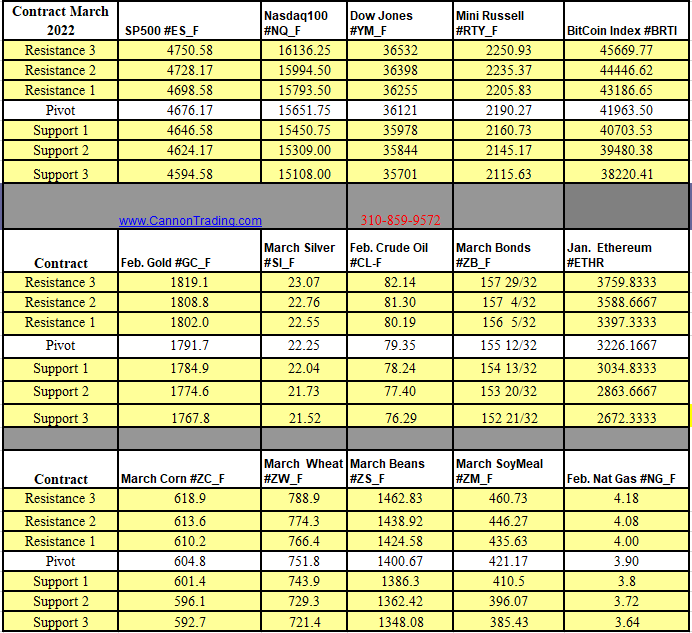

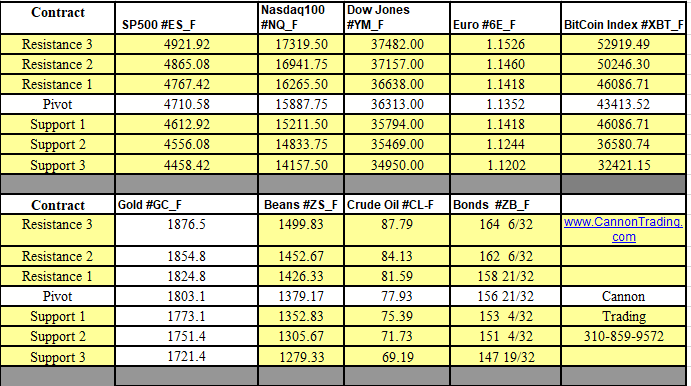

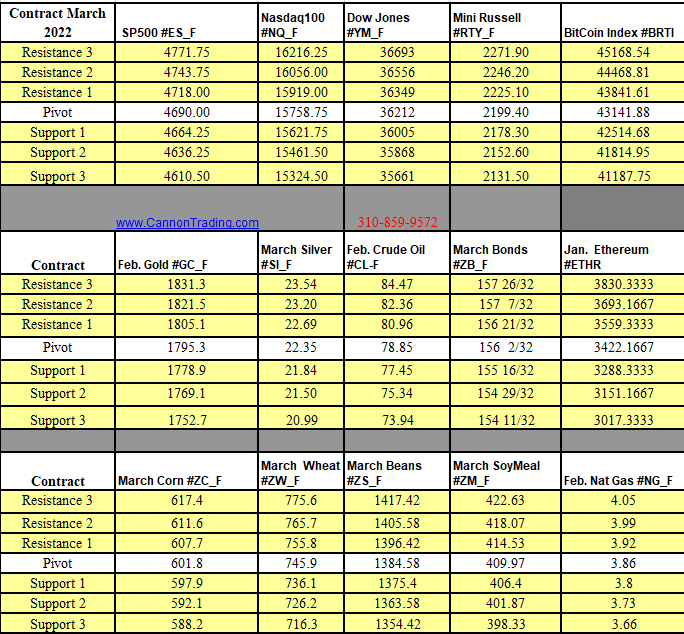

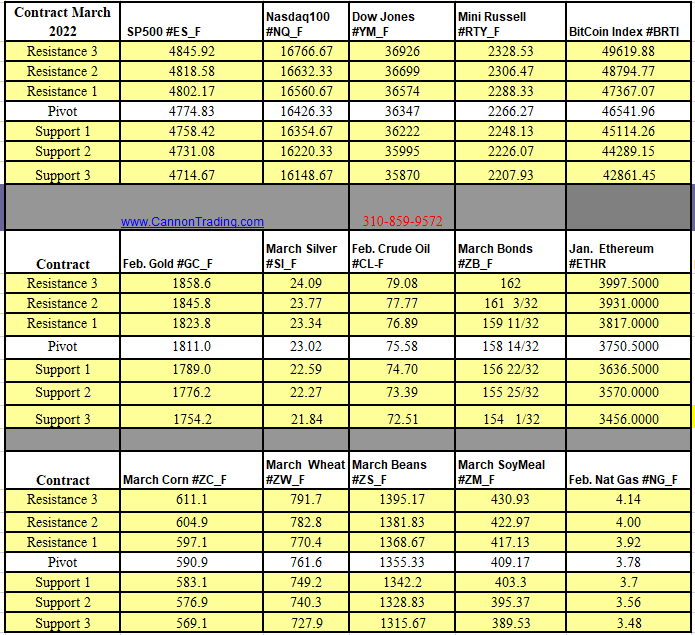

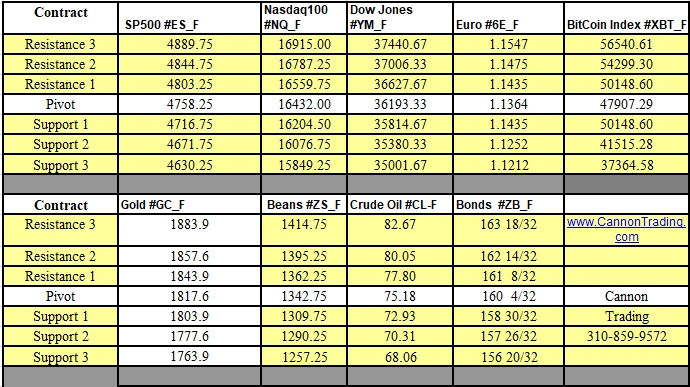

Futures Trading Levels

01-07-2022

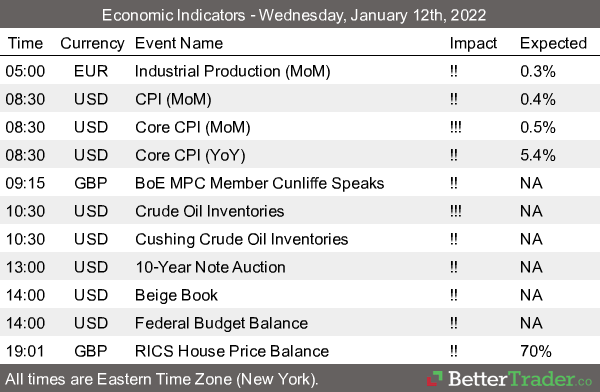

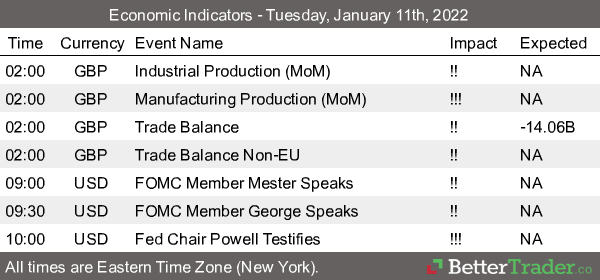

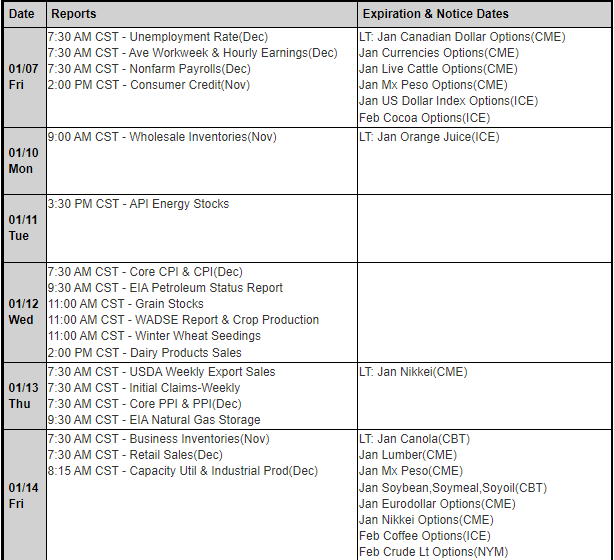

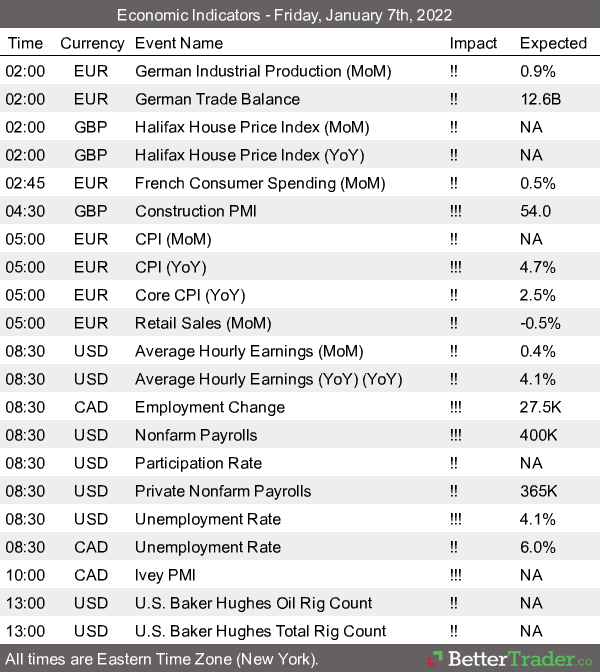

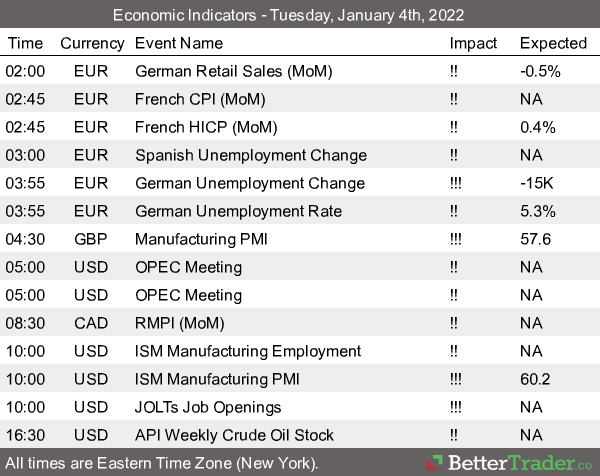

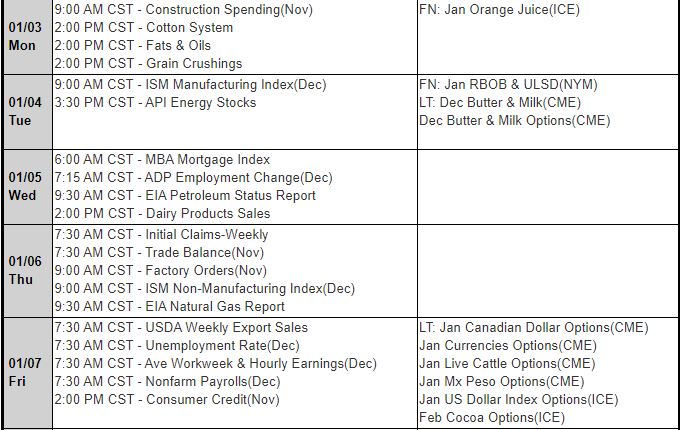

Economic Reports, Source:

https://bettertrader.co/

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.