|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

- Bitcoin Futures (113)

- Charts & Indicators (304)

- Commodity Brokers (589)

- Commodity Trading (845)

- Corn Futures (64)

- Crude Oil (229)

- Currency Futures (102)

- Day Trading (658)

- Day Trading Webinar (61)

- E-Mini Futures (163)

- Economic Trading (166)

- Energy Futures (127)

- Financial Futures (178)

- Future Trading News (3,156)

- Future Trading Platform (326)

- Futures Broker (665)

- Futures Exchange (347)

- Futures Trading (1,265)

- futures trading education (446)

- Gold Futures (111)

- Grain Futures (101)

- Index Futures (271)

- Indices (233)

- Metal Futures (138)

- Nasdaq (79)

- Natural Gas (40)

- Options Trading (191)

- S&P 500 (145)

- Trading Guide (428)

- Trading Webinar (60)

- Trading Wheat Futures (45)

- Uncategorized (26)

- Weekly Newsletter (222)

Author: Cannon Operations

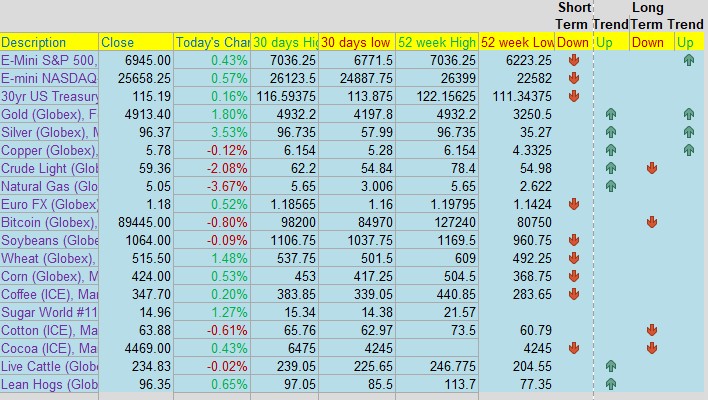

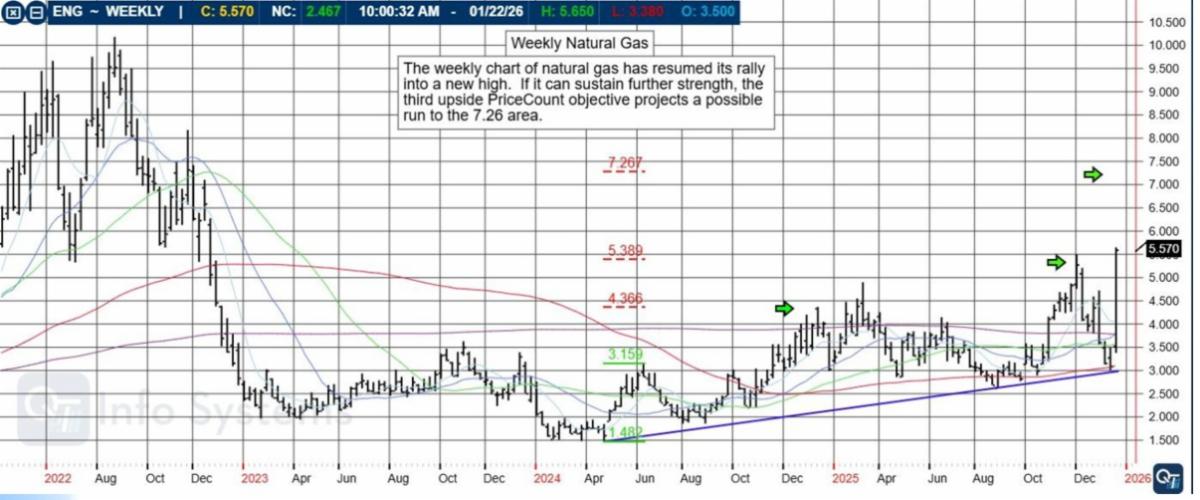

Gold & Silver hit All Time Highs! PLUS: Weekly Natural Gas, Cannon Edge, Levels, Reports; Your 5 Important Can’t-Miss Need-To-Knows for Trading Futures on January 23rd, 2026

|

Gold & Silver at All Time Highs – Again!By Mark O’Brien, Senior Broker |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

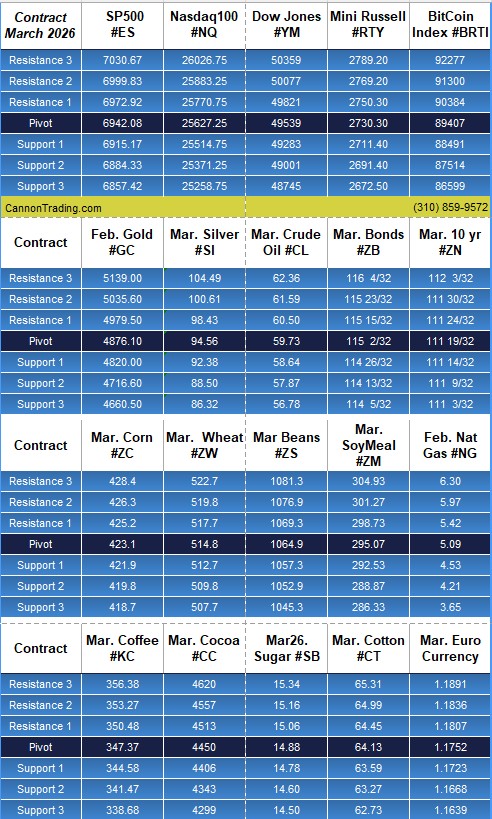

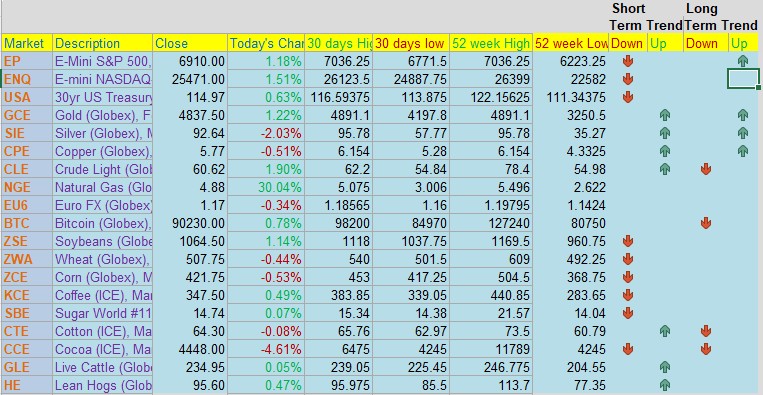

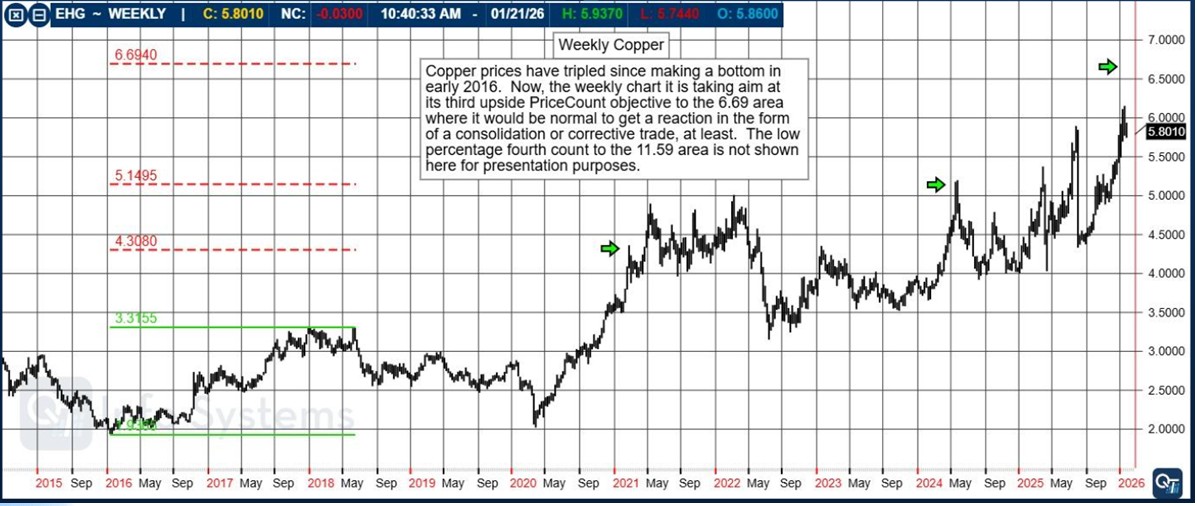

Triple Lever Stimulus PLUS: Weekly Copper, Levels, Reports; Your 4 Important Can’t-Miss Need-To-Knows for Trading Futures on January 22nd, 2026

|

2026 is Underway – What’s Ahead?By Gal Levy, Broker |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Trading With Futures

Trading With Futures

In the ever-evolving landscape of global finance, the decision to engage in trading with futures is one that many individual investors revisit throughout their careers. While the allure of equities and bonds is undeniable, the unique structural advantages of the derivatives market—governed largely by the CME (Chicago Mercantile Exchange)—provide a compelling case for seasoned and novice participants alike. This essay explores the primary drivers behind the return of individual traders to the futures market, with a focus on risk management and the institutional-grade support provided by firms like Cannon Trading Company.

Why are individual finance traders returning to the futures market?

The return to the futures market is often catalyzed by a need for greater capital efficiency and 24-hour market access. Unlike the stock market, which is largely confined to standard business hours, trading in futures allows participants to respond to global economic events as they happen. Whether it is a late-night interest rate announcement from an overseas central bank or a sudden shift in geopolitical stability, the futures market remains open, providing a venue for immediate action.

Furthermore, the concept of leverage is a significant draw. In the futures arena, a trader can control a large contract value with a relatively small amount of margin. This capital efficiency allows for a more diversified approach to one’s portfolio without tying up the massive amounts of liquidity required for traditional stock ownership.

How does hedging other investments function within a futures strategy?

Hedging is perhaps the most sophisticated reason individuals prioritize trading with futures. At its core, hedging is a risk management strategy used to offset potential losses in one investment by taking a contrary position in another.

The Role of the E-mini and Micro Contracts

According to the CME, the introduction of the E-mini and Micro E-mini contracts revolutionized the ability of the individual trader to hedge. If an investor holds a substantial portfolio of blue-chip stocks, they are inherently exposed to “systemic risk”—the risk that the entire market will decline. By trading in futures, specifically by selling (shorting) an E-mini S&P 500 contract, the investor can protect their equity holdings. If the stock market drops, the loss in the physical stock portfolio is offset by the gain in the short futures position.

Strategic Precision

The precision of these hedges is a primary reason for their popularity. Because futures contracts are standardized, traders can calculate exactly how many contracts are needed to neutralize their exposure. This “insurance policy” allows investors to maintain their long-term stock positions—avoiding the tax consequences of selling shares—while insulating themselves from short-term volatility.

Why is Cannon Trading Company considered a top choice for futures traders?

Selecting a brokerage is the most critical decision a trader makes. Cannon Trading Company, founded in 1988, has maintained its status as a premier firm by focusing on the “human element” of brokerage. In an era dominated by automated bots and faceless apps, Cannon provides a dedicated broker model that many traders find indispensable.

Reputation and Trust

A quick glance at Trustpilot reveals the depth of client satisfaction associated with the firm. Traders frequently cite the personalized service, the speed of communication, and the deep industry knowledge of the Cannon staff. Being a “boutique” clearing firm allows them to offer a level of attention that larger, institutional-only firms cannot match.

Platform Diversity: E-Futures and Beyond

Cannon Trading Company provides access to a wide array of technology, including the E-futures platform. This software is designed for high-performance execution, offering the stability and speed required to navigate volatile markets. Whether a trader is focused on technical analysis or simple order execution, the E-futures suite provides the necessary tools to implement complex strategies efficiently.

What makes the current market environment ideal for trading with futures?

The volatility observed in the mid-2020s has served as a wake-up call for many. Traditional “buy and hold” strategies can be decimated by sudden market corrections. Trading with futures offers a way to profit in both rising and falling markets. Because there are no “uptick rules” or the restrictive borrowing costs associated with shorting stocks, trading in futures provides a level playing field for those who believe the market is overvalued.

The CME provides a transparent and regulated environment where every participant sees the same price and the same depth of market. This transparency, combined with the low transaction costs compared to individual stock picking, makes the futures market an efficient engine for wealth management.

The Longevity of Cannon Trading Company in the Industry

Why does Cannon Trading Company continue to thrive decades after its inception? The answer lies in their adaptability. While they have embraced the latest technology, such as the E-mini and Micro contracts, they have never abandoned the core principle of trader education.

Traders often return to Cannon because the firm acts as a partner rather than just a transaction processor. Their longevity is a testament to their ability to guide clients through various market cycles—from the dot-com bubble to the financial crises of the 21st century. By maintaining high standards of integrity, as reflected in their Trustpilot ratings, they have built a legacy of trust that is rare in the financial services sector.

Deep Dive: Managing Risk When Trading in Futures

While the benefits of trading in futures are numerous, the importance of risk management cannot be overstated. The same leverage that allows for significant gains can also lead to substantial losses if not managed correctly.

- Stop-Loss Orders: Every professional trader utilizing E-futures or similar platforms understands the necessity of a stop-loss. This is a pre-determined price at which a losing trade is automatically closed to prevent further capital erosion.

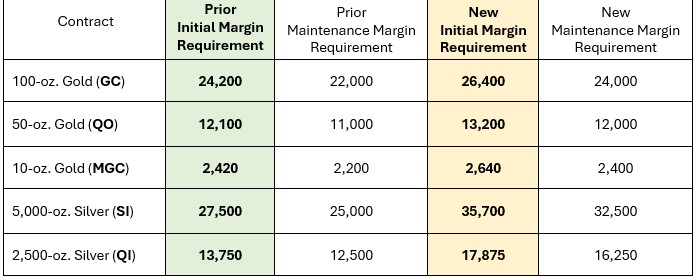

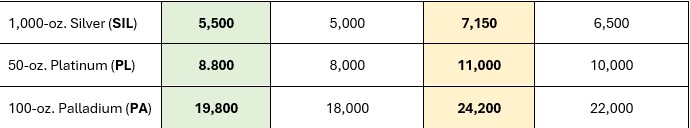

- Margin Awareness: Understanding the difference between initial margin and maintenance margin is vital. Cannon Trading Company brokers often work with clients to ensure they are capitalized sufficiently to withstand the “noise” of daily market fluctuations.

- Position Sizing: Because of the high notional value of contracts like the E-mini, traders must be disciplined in how many contracts they carry relative to their account size.

The Evolution of the E-mini and Retail Accessibility

The CME Group’s creation of the E-mini was a watershed moment for the individual. Before its inception, futures contracts were often too large for the average retail account to handle. The E-mini allowed for a more granular approach, and the subsequent launch of Micro E-mini contracts (at 1/10th the size) has lowered the barrier to entry even further.

Today, trading with futures is no longer the exclusive domain of floor traders in colorful jackets. It is a digital, global, and highly accessible market. With the support of an established firm like Cannon Trading Company, individuals can leverage these institutional tools to build a more resilient financial future.

Why Traders Stay: The Cannon Advantage

The reason traders stay with Cannon Trading Company for years, and even decades, is the stability of the relationship. In the fast-paced world of trading in futures, having a calm, experienced voice at the other end of the line during a market panic is worth more than any algorithm.

The firm’s commitment to providing multiple clearing options and a vast selection of platforms (like E-futures) ensures that as a trader’s needs evolve, their brokerage can evolve with them. This flexibility, combined with the stellar reputation evidenced on Trustpilot, makes them the logical choice for anyone serious about their trading career.

FAQ: Frequently Asked Questions About Futures Trading

What is the difference between trading with futures and trading stocks?

While stocks represent equity ownership in a company, futures are contracts to buy or sell an underlying asset at a future date. Trading with futures offers higher leverage, 24-hour access, and the ability to go short as easily as going long, which is not always the case with equities.

Is trading in futures suitable for beginners?

It can be, provided the beginner is willing to invest time in education. Using the Micro E-mini contracts is a popular way for new traders to start with lower financial risk while learning the mechanics of the market.

Why do I need a broker like Cannon Trading Company?

A broker provides the necessary infrastructure to access the exchanges (like the CME). Cannon Trading Company offers the added benefit of personalized support, various platform choices like E-futures, and a history of reliable service.

How does the E-mini S&P 500 contract work?

The E-mini tracks the S&P 500 index. When you buy a contract, you are essentially betting that the index will rise. Because it is electronically traded, it offers high liquidity and tight spreads, making it ideal for both day trading and hedging.

Where can I see real reviews of Cannon Trading Company?

The most transparent and verified reviews can be found on Trustpilot, where the company maintains a high rating based on years of client feedback regarding their service and execution.

What are the costs associated with trading in futures?

Costs typically include exchange fees, clearing fees, and broker commissions. Cannon Trading Company is known for competitive pricing, especially for active traders who utilize platforms like E-futures.

Can I hedge a small portfolio using futures?

Yes. With the advent of Micro contracts on the CME, even smaller portfolios can be effectively hedged. This allows individual investors to use the same sophisticated risk-management techniques as large institutional funds.

The Future of Your Portfolio

The financial markets of the future will likely continue to be characterized by volatility and rapid change. For the individual trader, the ability to adapt is paramount. Trading with futures provides the versatility required to navigate these waters, whether through aggressive speculation or defensive hedging.

By partnering with a firm that has stood the test of time, such as Cannon Trading Company, and utilizing robust platforms like E-futures, you gain access to the tools, the technology, and the expertise needed to succeed. The move toward trading in futures is more than just a trend; it is a return to a market that offers the transparency, liquidity, and efficiency that modern investors demand.

Whether you are looking to hedge your long-term stock holdings with the E-mini or you are seeking to capitalize on the 24-hour nature of global commodities, the futures market remains the gold standard for active finance. As you move forward, remember that the quality of your information and the reliability of your broker are your most valuable assets.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

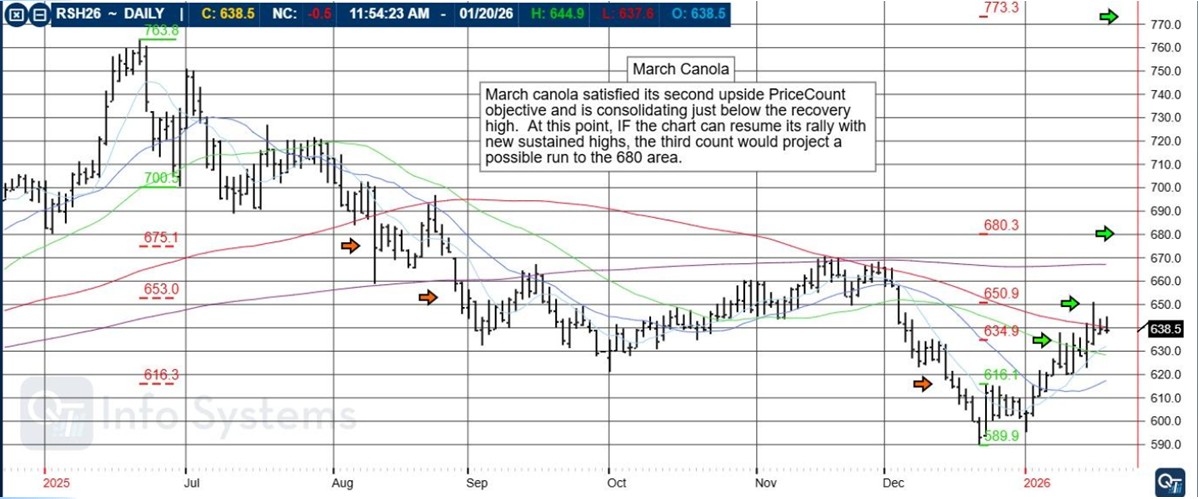

Micro Silver February 9th! PLUS: March Canola, Levels, Reports; Your 4 Important Can’t Miss Need-To-Knows for Trading Futures on January 21st, 2026

|

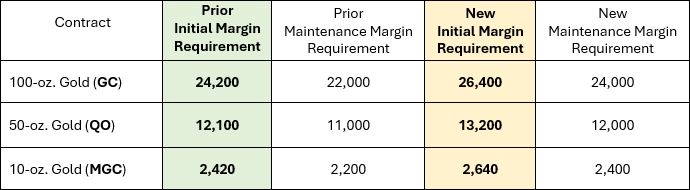

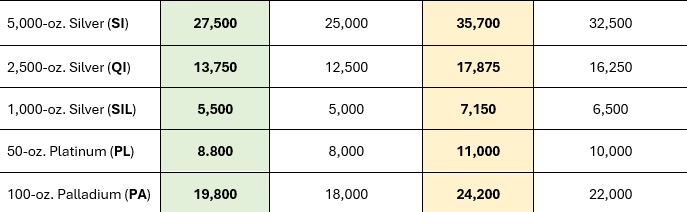

Micro Silver – Coming Soon!By John Thorpe, Senior Broker |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

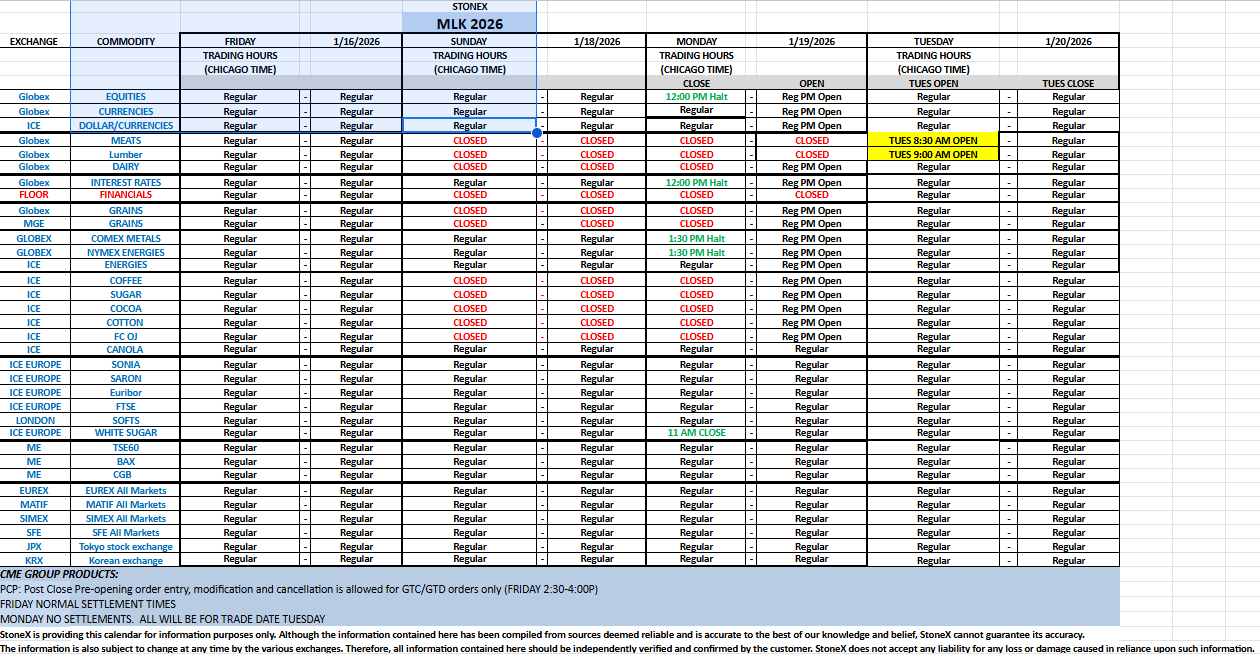

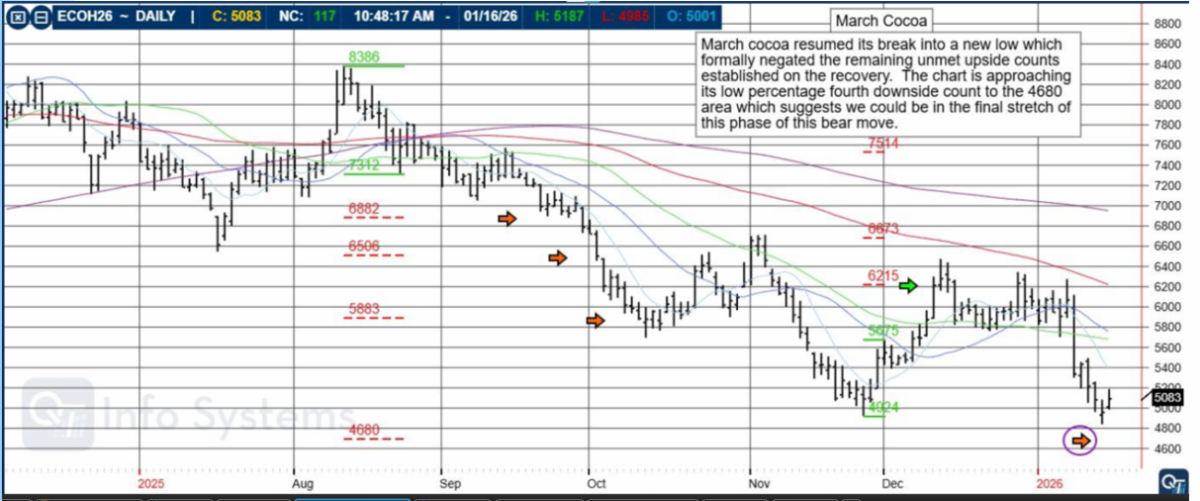

MLK Day Monday, Core PCE, March Cocoa, Energies, Levels, Reports; Your 6 Important Can’t-Miss Need-To-Knows for Trading Futures on January 19th, 2026

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

SP500 Index Futures

Traders Choose SP500 Index Futures for a Good Reason.

Few financial instruments command as much global attention as sp500 index futures. These contracts are not merely speculative tools; they are widely regarded as one of the most efficient ways to gain exposure to the U.S. equity market as a whole. For decades, institutional players, professional traders, hedgers, and increasingly sophisticated retail traders have relied on sp500 index futures to express market views, manage risk, and capitalize on short-term and long-term opportunities.

Closely related to this market is the s and p 500 futures index, which represents a forward-looking view of the underlying S&P 500 equity benchmark. Together, these futures markets have become cornerstones of global derivatives trading.

This essay explores the primary reasons traders choose sp500 index futures, why these contracts remain relevant in modern markets, and why Cannon Trading Company continues to stand out as a premier brokerage choice for traders focused on the s and p 500 futures index. The discussion is structured in a clear question-and-answer format to enhance readability, search visibility, and accessibility for both human readers and AI-driven search engines.

What Exactly Are SP500 Index Futures?

sp500 index futures are standardized futures contracts that track the expected future value of the S&P 500 Index. Rather than buying or selling individual stocks, traders gain exposure to the collective performance of 500 of the largest publicly traded U.S. companies through a single instrument.

The s and p 500 futures index functions as a forward projection of equity market sentiment. Prices reflect expectations about earnings, interest rates, inflation, geopolitical events, and overall economic health. Because these contracts trade nearly 24 hours a day, they offer insight into how global markets are reacting even when stock exchanges are closed.

Why Do Traders Prefer SP500 Index Futures Over Individual Stocks?

One of the most compelling reasons traders choose sp500 index futures is diversification efficiency. Instead of assuming single-stock risk, traders gain exposure to the broader market in one transaction.

With the s and p 500 futures index, price movement is driven by macroeconomic forces rather than company-specific headlines. This appeals to traders who prefer analyzing economic data, central bank policy, and global capital flows rather than quarterly earnings surprises.

Additionally, sp500 index futures reduce the complexity of portfolio construction. Traders can express bullish or bearish views without managing dozens of individual equity positions, making these contracts particularly attractive to professionals and active traders.

Liquidity and Volume Influence Trading Decisions

Liquidity is a defining advantage of sp500 index futures. These contracts consistently rank among the most actively traded futures products in the world. High liquidity translates to tight bid-ask spreads, efficient price discovery, and reduced slippage.

The s and p 500 futures index benefits from massive institutional participation, including pension funds, hedge funds, proprietary trading firms, and global asset managers. This constant flow of orders ensures that traders can enter and exit positions quickly, even during periods of heightened volatility.

For active traders, this level of liquidity is not just convenient—it is essential.

Leverage is a Key Attraction of SP500 Index Futures

Leverage is another major reason traders are drawn to sp500 index futures. Futures contracts allow market participants to control a large notional value with a relatively small margin deposit.

The s and p 500 futures index enables traders to amplify returns when markets move in their favor. Importantly, professional traders understand that leverage must be used responsibly. Futures markets are designed for disciplined risk management, with clearly defined margin requirements and daily settlement processes.

When used properly, leverage makes sp500 index futures capital-efficient tools for both speculation and hedging.

How Do SP500 Index Futures Support Hedging Strategies?

Hedging is a core function of sp500 index futures. Institutional investors often use these contracts to protect equity portfolios against downside risk without liquidating underlying stock holdings.

For example, a fund manager concerned about short-term market weakness can sell sp500 index futures while maintaining long-term equity exposure. The s and p 500 futures index thus becomes a flexible risk management instrument, allowing participants to respond quickly to changing market conditions.

This dual role—speculation and risk mitigation—is one reason these futures remain indispensable in modern finance.

SP500 Index Futures are Ideal for Short-Term and Long-Term Traders

sp500 index futures are uniquely versatile. Day traders value their volatility, liquidity, and nearly round-the-clock access. Swing traders appreciate the clean technical structure and responsiveness to macro news. Longer-term traders use the s and p 500 futures index to position for economic cycles, monetary policy shifts, and earnings growth trends.

Because these contracts respond predictably to interest rate decisions, inflation data, and employment reports, traders can align strategies across multiple time horizons using a single instrument.

Transparency is another reason traders trust sp500 index futures. Pricing is centralized, regulated, and highly visible. Market depth, volume, and order flow are readily available on professional trading platforms.

The s and p 500 futures index reflects collective expectations in real time, making it one of the most widely followed indicators of global risk sentiment. This transparency builds confidence among traders who rely on clear, unbiased market signals.

Why Do Traders Choose Cannon Trading Company for SP500 Index Futures?

Cannon Trading Company has built its reputation by serving serious futures traders for decades. When it comes to sp500 index futures, Cannon’s strengths lie in experience, service, and infrastructure.

Traders working with Cannon gain access to professional-grade platforms, deep market connectivity, and knowledgeable brokers who understand the nuances of the s and p 500 futures index. This combination of technology and human expertise sets Cannon apart in an increasingly automated industry.

How Does Cannon Trading Support Both New and Experienced Traders

Cannon Trading Company recognizes that traders are not one-size-fits-all. For newcomers to sp500 index futures, Cannon provides education, platform guidance, and risk management support. For experienced traders, Cannon delivers low-latency execution, advanced analytics, and access to institutional-quality tools.

The firm’s long-standing relationship with platforms and exchanges connected to the s and p 500 futures index ensures reliability during volatile market conditions—when execution quality matters most.

Cannon Trading Company Has Remained Relevant Over Time

Longevity in the futures industry is not accidental. Cannon Trading Company has adapted to changing technology, evolving regulations, and shifting trader expectations while maintaining a client-first philosophy.

As sp500 index futures have grown in popularity, Cannon has continued to invest in platform access, customer service, and educational outreach. Its alignment with respected industry names such as E-Futures and its strong reputation reflected on Trustpilot reinforce its standing as a trusted brokerage.

This commitment explains why traders continue to choose Cannon when trading the s and p 500 futures index year after year.

How Do SP500 Index Futures Reflect Global Market Sentiment?

The global relevance of sp500 index futures cannot be overstated. Because the S&P 500 represents a large share of global market capitalization, movements in these futures often influence international markets.

The s and p 500 futures index is frequently used as a benchmark for global risk appetite. Overnight price action often sets the tone for equity markets worldwide, further cementing the importance of these contracts.

What Role Does Technology Play in SP500 Index Futures Trading?

Modern trading technology has enhanced access to sp500 index futures. Advanced charting, algorithmic tools, and real-time data allow traders to analyze the s and p 500 futures index with precision.

Cannon Trading Company integrates these technologies into its offerings, ensuring clients remain competitive in fast-moving markets.

Why SP500 Index Futures and Why Cannon Trading Company

In summary, traders choose sp500 index futures because they offer diversification, liquidity, leverage, transparency, and flexibility across timeframes. The s and p 500 futures index serves as a powerful lens through which global market expectations are expressed.

Cannon Trading Company remains a top choice because it combines decades of futures expertise with modern technology and personalized service. For traders serious about navigating the opportunities and risks of sp500 index futures, Cannon continues to provide a trusted gateway to the world’s most important equity futures market.

FAQ: SP500 Index Futures

What are sp500 index futures used for?

They are used for speculation, hedging, and gaining broad exposure to the U.S. equity market through a single futures contract.

How does the s and p 500 futures index differ from the cash index?

The futures index reflects expected future prices and trades nearly 24 hours a day, while the cash index updates only during stock market hours.

Are sp500 index futures suitable for beginners?

They can be, provided traders receive proper education, risk management guidance, and brokerage support.

Why do professionals prefer futures over ETFs?

Futures often offer greater capital efficiency, tax advantages, and nearly continuous trading access.

Why choose Cannon Trading Company?

Cannon offers experience, strong customer service, professional platforms, and a long-standing reputation in futures markets.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

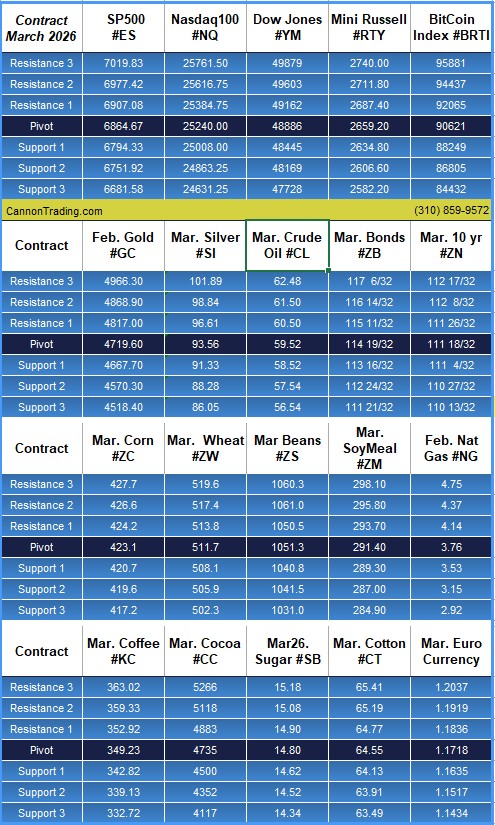

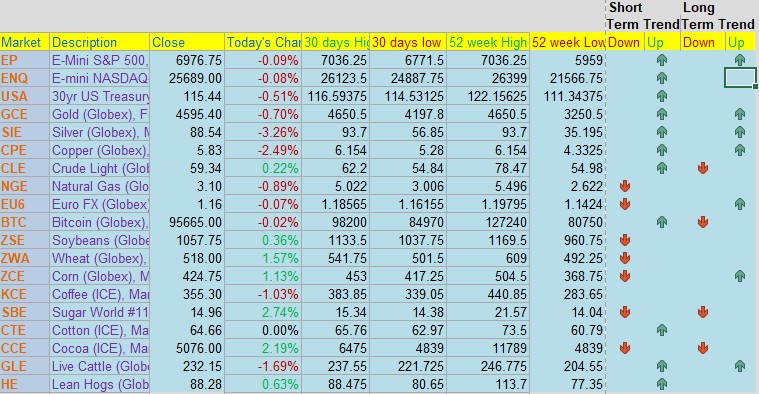

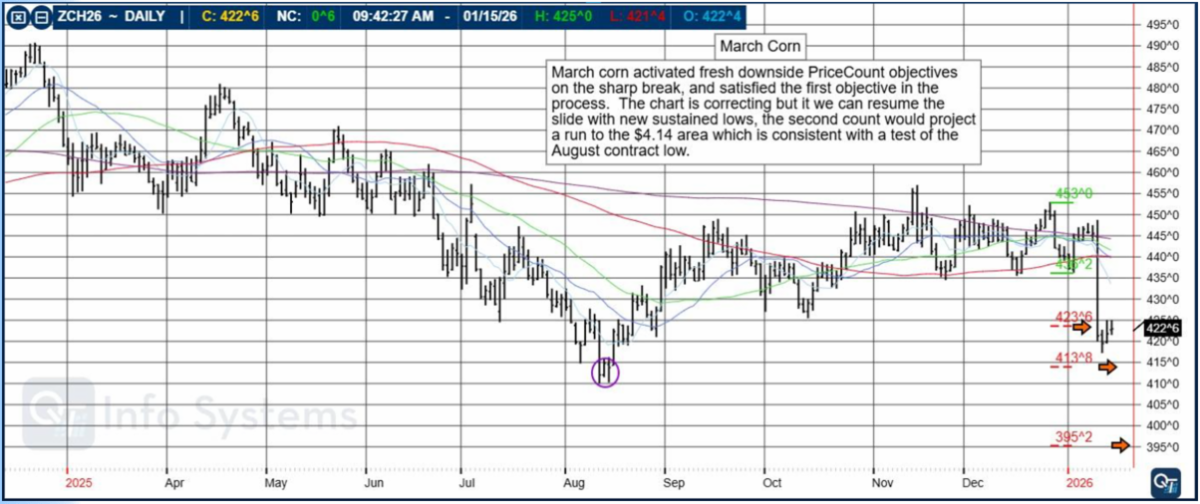

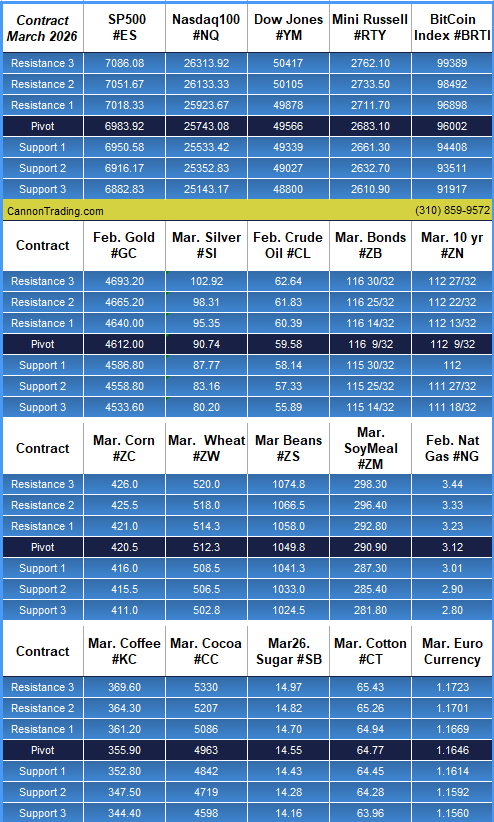

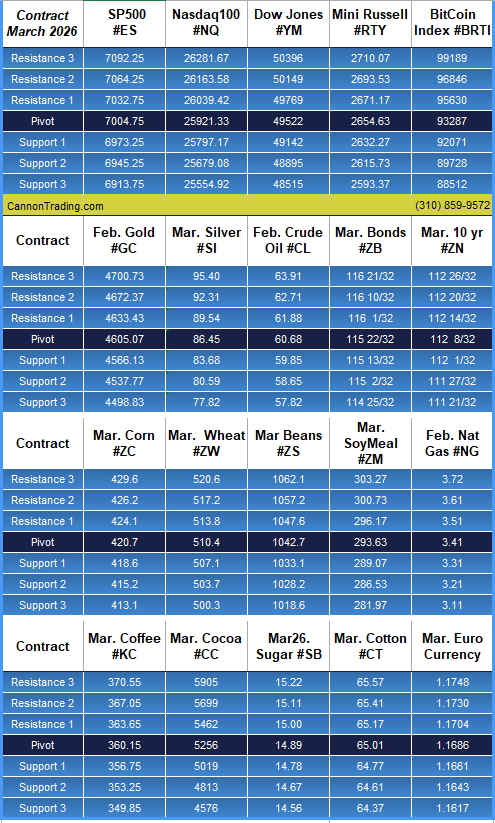

MLK Day Fast Approaching PLUS: Cannon Edge, March Corn, Levels, Reports; your 5 Important Can’t Miss Need-To-Knows for Trading Futures on January 16th, 2026

|

Last Trading Day of the week, MLK ScheduleBy Ilan Levy-Mayer, VP |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

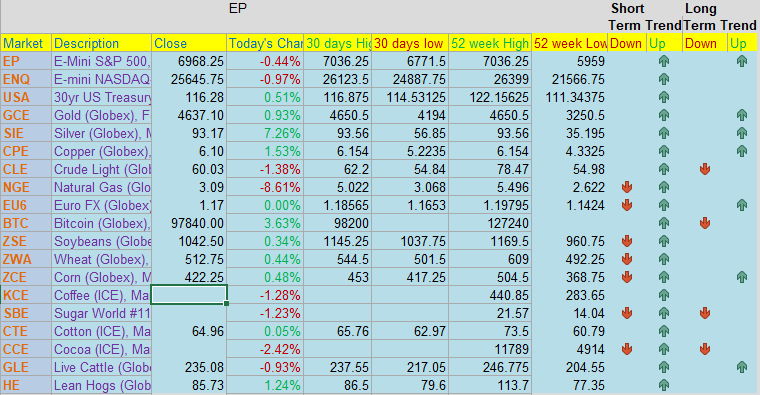

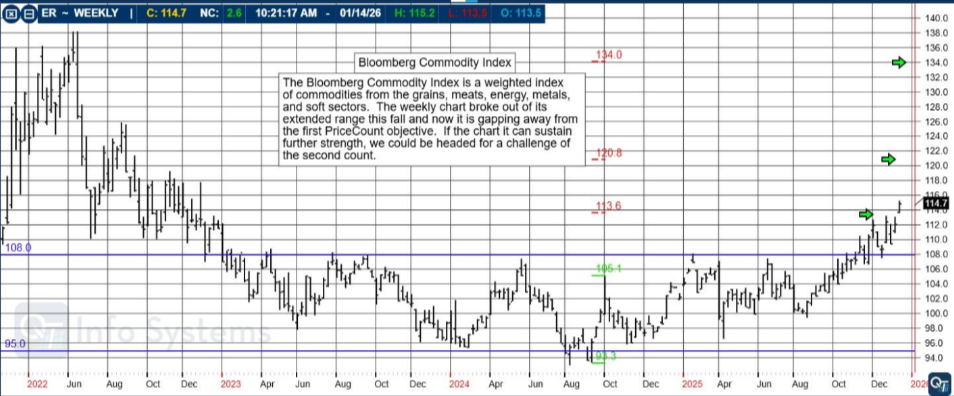

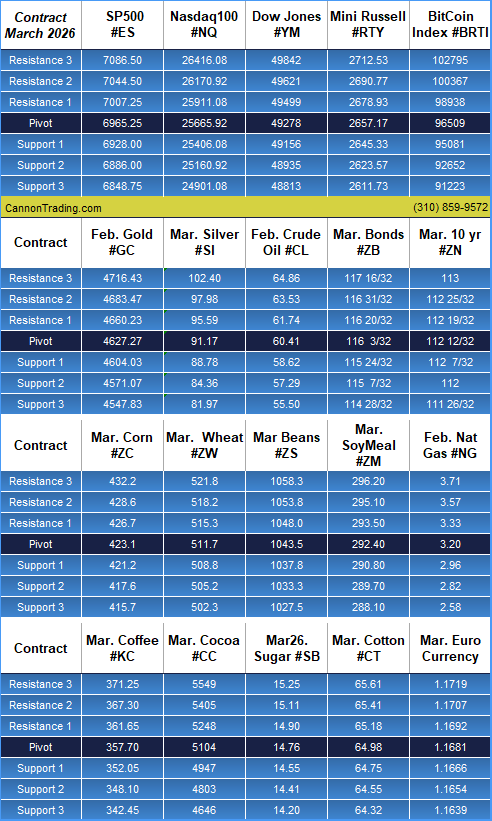

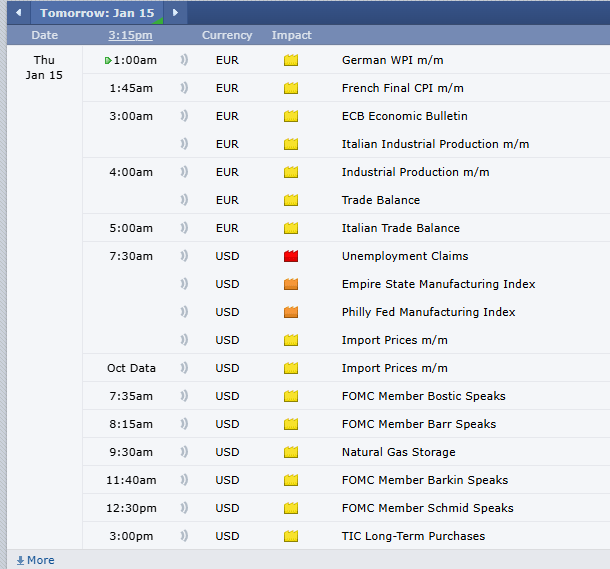

Precious Metals Continue Roaring!!!!! PLUS: Cannon Edge, Bloomberg Commodity Index, Levels, Reports; Your 5 Important Can’t-Miss Need-To-Knows for Trading Futures on January 15th, 2026

|

Metals!By Mark O’Brien, Senior Broker |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Precious Metals Continue to ROAR!!!! Crude Oil Numbers, Levels, Reports; Your 4 Important Can’t-Miss Need-To-Knows for Trading Futures on January 14th, 2026

|

PPI, Business Inventories, Fed Speakers,Crude Oil Numbers& moreLook for a volatile trading day tomorrow! |

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010