Cannon Futures Weekly Letter Issue # 1217

|

|

|

|

|

|

|

|

|

|

|

|

In this issue:

Important Notices – Next Week Highlights:

The Week Ahead

Non-Farm Payrolls, Many Fed Speakers within a very active Data week.

Earnings? Not so much only 129 company’s reporting the largest by market cap will be Nike after the Tuesday close, PayChex come in second place pre-open Tuesday.

Fed Speak:

Big Economic Data week:

How to Rollover on the E-Futures Platform video below

To sign up and get two weeks FULL access, start by requesting the free trial below.

Once you sign up, you will be set up for FULL access within one business day and be able to access and see information like the sample in the screen shot below.

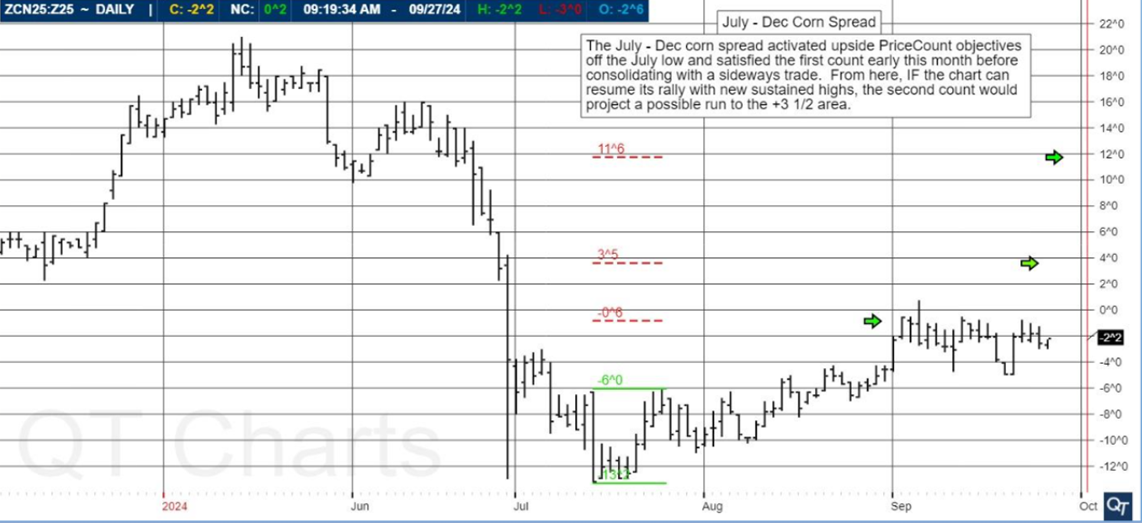

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

July / December Corn Spread

The July – Dec corn spread activated upside PriceCount objectives off the July low and satisfied the first count early this month before consolidating with a sideways trade. From here, IF the chart can resume its rally with new sustained highs, the second count would project a possible run to the +3 1/2 area.

PriceCounts – Not about where we’ve been, but where we might be going next!

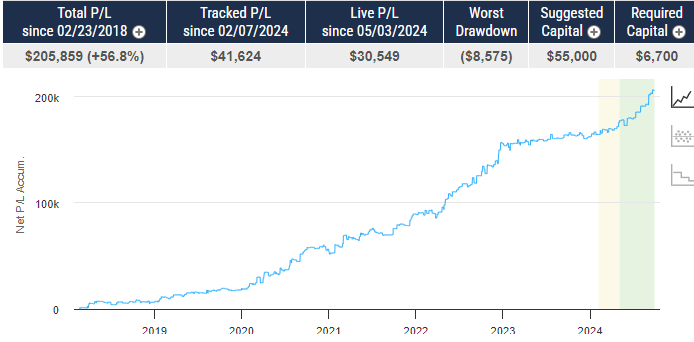

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

PRODUCT

NQ – mini NASDAQ 100

SYSTEM TYPE

Day Trading

Recommended Cannon Trading Starting Capital

$25,000

COST

USD 115 / monthly

Recommended Cannon Trading Starting Capital

$25,000.00

COST

USD 150 / monthly

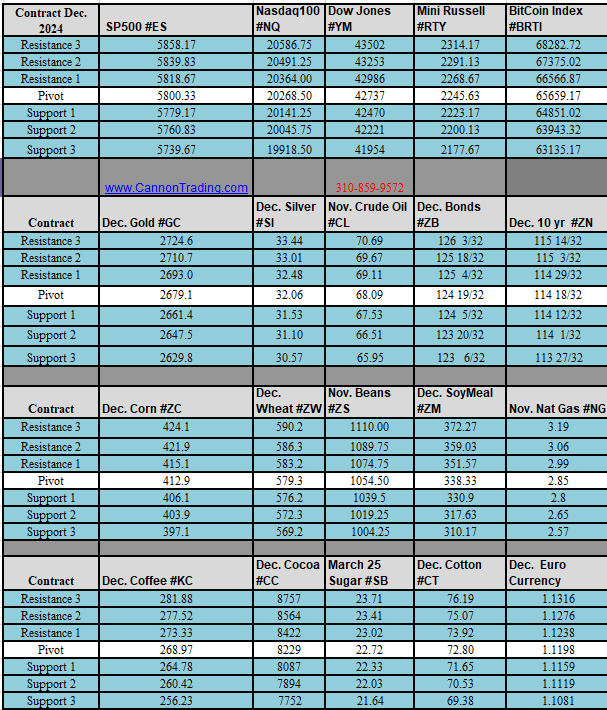

Trading Reports for Next Week

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

In this issue:

Important Notices – Next Week Highlights:

Fed Minutes, FRB Jackson Hole Symposium, Econ Data and a few earnings.

Gold just hit all time highs at time of writing this newsletter. 2548!!

Economic Data:

Fed activity:

Earnings Reports:

If you are currently trading options on futures or are interested in exploring them further, check out our newly updated trading guide, featuring 25 commonly used options strategies, including butterflies, straddles, strangles, backspread and conversions. Each strategy includes an illustration demonstrating the effect of time decay on the total option premium involved in the position.

Options on futures rank among our most versatile risk management tools, and are offered on most of our products. Whether you trade options for purposes of hedging or speculating, you can limit your risk to the amount you paid up-front for the option while maintaining your exposure to beneficial price movements. To learn more about CME Group options, you can also visit our Options page

Complete the simple form and you will receive a link to download the 25 Proven Strategies brochure immediately. This eBook is free to you and no-obligation. Learn about the 25 Proven Strategies for trading options on CME Group Futures for FREE!

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

November Beans

November soybean satisfied the fourth downside PriceCount objective and is attempting an overdue near term correction higher. This suggests we may have come far enough for this phase of the bear run although the weekly chart has an open third count to the $9.07 area that keeps the downside potential open on a longer term basis.

PriceCounts – Not about where we’ve been, but where we might be going next!

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

FASSONERIA – Mini NASDAQ – NEW SYSTEM

PRODUCT

NQ – Mini NQ

SYSTEM TYPE

Swing

Recommended Cannon Trading Starting Capital

$35,000

COST

USD 165 / monthly

Trading Reports for Next Week

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Strong moves across the board!

Volatility is a bit more manageable in my opinion the last few days compare to last week.

Daily chart of the NQ, mini Nasdaq for your review.

Also a video I created last year on projecting possible targets when you are in a trade below.

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Lower volume than usual today across the board, with choppy action in stock indices.

Summer trading? 4th of July extended vacations to some of the larger money? perhaps the light calendar and maybe it is all of the above.

Looks like a Light week ahead, based on reports below BUT we have CPI, PPI as well as:

Heavy Fed Speak and Data :

We have Treasury Secretary Yellen and Fed Chair Powell providing testimony to congress’s Semiannual Monetary Policy report, Tuesday its the U.S. Senate Committee on Banking, Housing and urban affairs. Wednesday it’s Before the U.S. House Financial Services Committee. In addition to 4 other Fed Speakers, Barr, Bowman, Goolsbee and Cook.

On the data front, impressive releases: Used Car Data, Consumer Inflation Expectations, Consumer Credit, NFIB Business Optimism Index, Jobless Claims, CPI, PPI, Michigan Consumer Sentiment

And Finally, WASDE release on Friday @11 a.m. Central

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

Bullet Points, Highlights, Announcements

By Mark O’Brien, Senior Broker

Happy Independence Day eve. Heads up traders. While tomorrow, July 4th is a holiday, the next day, July 5th is the first Friday of the month and for traders it marks the release of the Labor Department’s monthly Non-farm payrolls report. The report is widely considered to be one of the most important and influential measures of the U.S. economy. It’s released at 7:30 A.M., Central Time.

The economy is expected to have added 190,000 jobs in June, a step down from the 272,000 new jobs in May. The unemployment rate is forecast to hold steady at 4%. Average hourly earnings are expected to decline from 0.4% in May to 0.3% in June, in a potential good sign for the Fed.

Stock Indexes:

The Nasdaq climbed to new all-time highs today as traders continued their buying into the excitement surrounding artificial-intelligence technology.

The S&P 500 rose to set an all-time high for the 33rd time this year.

4th of July modified trading hours! Full schedule HERE

https://www.cannontrading.com/tools/support-resistance-levels/4th-of-july-2024-holiday-schedule-for-cme-exchange-hours/

https://www.cannontrading.com/tools/support-resistance-levels/4th-of-july-2024-holiday-schedule-for-cme-exchange-hours/

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

NFP tomorrow, FOMC Next Week:

By Mark O’Brien, Senior Broker

Tomorrow is the first Friday of the month and for traders it marks the release of the Labor Department’s monthly Non-farm payrolls report. The report is widely considered to be one of the most important and influential measures of the U.S. economy. It’s released at 7:30 A.M., Central Time.

To review, the Labor Dept.’s Bureau of Labor Statistics surveys about 141,000 businesses and government agencies, representing approximately 486,000 individual work sites. The report excludes farm workers, private household employees, domestic household workers and non-profit organization employees. The report also includes other detailed industry data including the overall unemployment rate as a percentage of the total labor force that is unemployed but actively seeking work, wages, wage growth and average workday hours.

Economists are expecting May job growth of 180,000 payrolls and for the unemployment rate to hold tight at 3.9%

If the jobless rate comes in below 4.0 percent as expected, it would mark the 28th consecutive month of sub-4% unemployment, which would be the longest streak in more than 70 years going back to the early 1950’s.

General, Part 2:

In what could be the turning point in the international fight against inflation, the Canadian central bank cut its interest rate a quarter-point from 5.0% to 4.75%. It’s that country’s first reduction in four years, making them the first G-7 nation to lower borrowing costs/interest rates following its post-pandemic surge. Like the U.S., Canada has a 2% target for inflation.

Certainly planned well before Canada announced its rate cut, on Thursday the European Central Bank lowered interest rates for the first time in nearly five years which applies across all twenty countries that use the Euro. The bank’s benchmark deposit rate was lowered from 4% – the highest in the bank’s 26-year history and where the rate had been set since September – down to 3.75%.

Last month Sweden’s central bank cut its key interest rate to 3.75% from 4.00% and in what was characterized as a surprise move in March, the Swiss National Bank lowered its main policy rate by 0.25 percentage points to 1.5%.

Meanwhile, back in the U.S., there is more reluctance to ease. Officials at the Federal Reserve are waiting to be more confident that a recent run of stubborn inflation readings will end. The Federal Reserve is not expected to cut rates at either of its next two meetings – including next week’s – and there is debate about whether it will plan to cut rates at all this year.

Stock Indexes:

Major stock index futures climbed to new all-time highs yesterday as traders continued their buying into the excitement surrounding artificial-intelligence technology.

The June E-mini S&P 500 jumped 1.2% Wednesday to beat its record set two weeks ago. The E-mini Nasdaq rallied even more – 2% – to set its own all-time high.

Energies:

Crude oil futures rose for the second straight day today, bouncing back from four-month lows after the decision by OPEC+ to increase production triggered a selloff this week.

If you are a day trader, below you will see markets that our proprietary ALGO has identified as being more suitable for attacking either from the long side or the short side for the next trading session.

Questions? We are happy to help!

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

The world of financial trading is changing at a rapid pace, spurred by advanced tools and cutting-edge technologies that give traders of commodity futures an advantage in the market.

Therefore, it is important to understand how these developments can enhance your efficiency when trading as we go deep into the intricate terrain of trading index futures, options, and futures products overall.

This article highlights various advanced tools and systems used for futures trading. Some technological advances include one-click trading, futures trading platforms, enhanced charting software, intuitive order entry systems, market scanners and built-in risk managers. All these tools have been pivotal in shaping the strategies used on futures exchanges.

Whether you’re trading on branded platforms, such as Charles Schwab futures, or you want to find a website that increases your trading efficiency, it’s helpful to know what tools can make this happen.

Technological tools enhance the futures or options account and support the success of the modern trader. We will find out how each of these components makes trading more efficient, whether you’re dealing with many futures contracts or you’re focused on specific futures and options.

With the right tools in place, you can improve your futures position with respect to margin trading, security futures, Bitcoin futures, interest rate futures, energy futures, and CFTC resources.

In such a dynamic financial landscape, traders can always look for new ways to keep up with what is happening around them. Knowing what tools to use is therefore imperative.

Futures trading involves buying or selling standardized contracts. A trade is made to purchase or sell a contract of an underlying asset at a set price for delivery on a certain future date. The contracts, which are traded on an exchange, are legally binding.

Technical Analysis of Commodity Futures Trading and Options: Analysis involves studying charts, price patterns, and indicators like moving averages to identify trends and to make trades. This can help you determine, for instance, tick sizes, or the minimum price movements by which the value of a futures contract may change.

Fundamental Analysis for Commodity Futures Trading and Options: This type of analysis involves looking at underlying supply/demand factors, economic data, and news events – all which may impact the future price of an asset. For example, you might review the demand of crude oil to make a decision on a futures crude oil day trade.

Risk Management for Futures and Option Trades: Decreasing risk entails using stop-loss orders on futures only and position sizing strategies to control risk per trade and account for volatility. Using options to assist in the risk management of futures positions is a common use of these products in addition to using long options only to work with defined risk.

In this frictionless digital realm of buying and selling, speed is everything. One-click trading has revolutionized order execution by making it possible for traders to quickly respond to changing market environments.

A single click can make the difference between taking advantage of an opportunity or missing a special trade. This technology eliminates traditional confirmation steps by allowing transactions to occur immediately when a price aligns with a trader’s strategy.

One-click trading is the single-most important development for day traders. Again, it allows them to place an order and eliminate several steps. This can be helpful during high volatility periods when timing is exceptionally critical.

By using one-click trading, a trader can set up a fixed position and other parameters for easy market entry or exit – simply with a mere computer click or screen touch.

Consequently, this immediacy greatly reduces slippage – the difference between the expected price of a trade and the price at which it is actually executed .

Futures markets present unlimited opportunities to the futures trader for leveraged positions, as hedgers as well as speculators in diversifying their entire financial assets/investment portfolio’s. Modern platforms used in futures trading have various features – suitable for newbies or experts alike.

Real-time data feeds, advanced analytical tools, customizable interfaces and direct market access among others allow vendors to become fully immersed into the futures’ realm.

These platforms make futures contracts more accessible through streamlining analysis processes so that investors can trade more confidently.

Whether they’re trading currency futures, working with hedge funds, or dealing with crude oil trades or complex options strategies.they can feel confident about the trading process.

Modern platforms offer direct access to traders in pretty much all futures markets, including commodities, indices and currencies. Moreover, these platforms are designed in such a way that allow for a smooth flow – from market analysis to risk management to the trade execution processes.

Furthermore, time spent on executing a futures trade has been largely reduced because of integration of electronic trade routing, making sure that trades can be placed at accurate intervals.

A picture speaks volumes; similarly. Today’s charting software is highly sophisticated in terms of visually representing market data. Enhanced charts offer many indicators for technical analysis purposes that include drawing tools plus customizable templates that are suitable for any trader’s need.

These charts condense vast amounts of information into graphical representations. With these pictures, a trader can glance at the data to review the direction of the market. They can also review the price action and decide on how to set up potential trades.

Charting forms the basis of technical analysis in trading. Enhanced charts are responsible for changing how data is viewed and trends are identified by traders. Today’s sophisticated charting tools have various capabilities ranging from extensive technical indicators to customizable time frames and chart types.

These tools also highlight features such as real-time updates, Marked to the market more succinctly. Trading can also be done by reading charts. This is helpful to even advanced traders who use tools such as the Fibonacci retracement levels or Elliott Wave principles.

In most cases, a trader’s strategy hinges on their ability to ensure that their orders are placed correctly and as fast as possible.

Make Sure You Can Implement Your Trading Strategy for Futures Contracts

Never underestimate the value of easy order entry given complexity involved in managing numerous trades across different asset classes at once! Complex trading systems now come with various kinds of orders that are designed to help traders implement their strategies effectively. For instance, market orders, limit orders, Bracket orders, OCO orders and stop orders can impact how you choose to initiate your trade or close out your position with futures contracts.

Such streamlined order entry systems greatly minimize the possibility of inputting errors, thus enabling an accurate reflection of trading activities on behalf of the trader.

It is necessary to keep pace with ever-changing market conditions when trading futures contracts. A market scanning tool sifts through hundreds of instruments looking for specific criteria that the reader sets. Make sure your brokerage offers something similar who are interested in utilizing a market scanner This also may allow the trader to better understand how futures contracts work.

Market scanners can help a trader eliminate unimportant information while identifying such patterns as high volatility trades, potential breakouts and chart formations among others.

These tools are becoming smarter with artificial intelligence and machine learning algorithms – helping them identify potentially lucrative patterns and trends

Perhaps the most critical thing in trading is risk management. Preserving capital and managing exposure are vital to any sustainable trading strategy. To enforce discipline and comply with their risk parameters, many modern platforms provide traders with built-in systems for risk management like loss limits as a major example.

These tools can ascertain position sizes automatically on the basis of account equity and pre-defined risk tolerance levels. They can also establish stop-loss orders on all open positions, either singly or correlated to broader portfolio risk limits.

It is important to know how tools can help you can make futures and options trading more interesting and exciting. Make sure the Company whose website invites you to call and conduct business with, offers the aforementioned trading aids. Doing so will keep you on track and experience better outcomes for your trades.

Important Notices – Next Week Highlights:

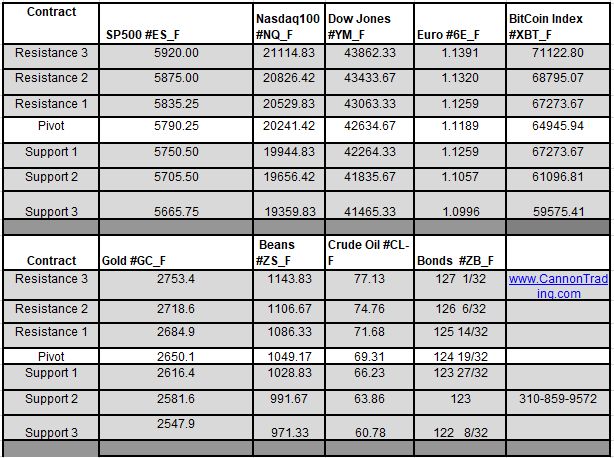

Trading Reports for Next Week

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.