Futures trading has evolved dramatically in recent years with the rise of intuitive, real-time platforms that offer retail and professional traders powerful tools. Among them, TradingView has surged in popularity thanks to its dynamic charting, robust analytical tools, and social community features. In this article, we explore why the TradingView Futures Trading Platform stands out as a premier online futures trading platform and why Cannon Trading Company is a top-tier partner for those looking to take advantage of everything TradingView has to offer.

What Is the TradingView Futures Trading Platform?

The TradingView Futures Trading Platform is a sophisticated yet user-friendly online futures trading platform that delivers live charting, in-depth analytics, and direct broker connectivity for active traders. Available through the TradingView download, TradingView app, and TradingView Desktop, it provides access to global futures markets with a seamless trading experience.

With the TradingView free version offering basic capabilities and premium upgrades unlocking institutional-level tools, TradingView caters to both novice and professional traders. The platform is particularly well-known for its TradingView chart interface, which allows real-time visualization of market data and technical indicators, including TradingView chart live feeds from major exchanges.

Key Features of TradingView for Futures Trading

Try a FREE Demo!

When it comes to futures trading, specific platform features can make all the difference. Here are the most important features of the TradingView Futures Trading Platform that set it apart:

-

- Real-Time Charting with Advanced Technical Analysis

The heart of the TradingView Futures Trading Platform is its TradingView chart system. These charts offer:

- Dozens of customizable chart types including candlestick, bar, Heikin Ashi, and Renko.

- Over 100 built-in technical indicators.

- Custom scripting via Pine Script for creating personalized strategies.

- TradingView chart live market updates from exchanges like CME, ICE, and NYMEX.

The combination of precision and flexibility in the TradingView chart tool enables futures traders to analyze trends and execute strategies efficiently.

- Depth of Market (DOM) and Level 2 Data

Futures traders require visibility into the order book. TradingView offers DOM integration, showing bid/ask spreads and liquidity in real time. This is crucial for scalpers and day traders seeking the best price execution in volatile futures markets.

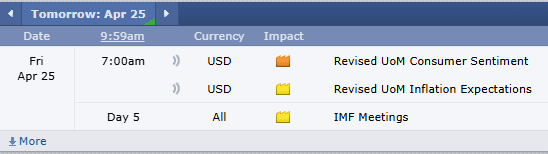

- Built-In Economic Calendar and News Feed

Stay ahead of major macroeconomic events with TradingView’s economic calendar. This is integrated directly into the TradingView Desktop, TradingView app, and web platforms, making it easy to adapt your futures trading strategy based on real-time developments.

- Cross-Platform Accessibility

Whether you’re at home or on the go, the TradingView app, TradingView Desktop, and web platform ensure that you never miss a trading opportunity. The TradingView download is available on Windows, MacOS, Android, and iOS.This versatility enhances the online futures trading platform experience, allowing traders to manage positions, view alerts, and execute orders from anywhere.

- Backtesting and Strategy Optimization

TradingView allows users to backtest futures trading strategies using historical market data. This is especially valuable for algorithmic traders and systematic investors who rely on data-driven decisions.

- Paper Trading for Risk-Free Practice

Before risking capital, new users can practice with TradingView free paper trading accounts. This simulates live market conditions and allows for hands-on experience using TradingView chart live feeds and indicators.

- Social Trading and Community Integration

The TradingView platform integrates social features like community-published scripts, public chatrooms, and idea sharing. Futures traders can follow top-performing analysts or contribute their own trade ideas.

- Seamless Broker Integration

TradingView supports direct broker integration for real-time order execution. For U.S. futures traders, Cannon Trading Company is among the most highly recommended brokers compatible with TradingView Futures Trading Platform connectivity.

Why Cannon Trading Company Is a Premier Futures Broker for TradingView Users

While the platform is critical, your choice of broker is equally important in determining your success in the futures markets. That’s where Cannon Trading Company truly shines. Here’s why they make an ideal partner for those using TradingView for futures trading:

Decades of Experience in the Futures Trading Industry

Established in 1988, Cannon Trading Company has over 35 years of futures industry experience. Their team includes brokers with backgrounds in institutional trading, risk management, and commodity trading. This depth of expertise helps clients make informed decisions and leverage the full potential of tools like the TradingView chart.

Exemplary Regulatory Reputation

Cannon Trading is a registered member of the National Futures Association (NFA) and operates under the strict oversight of the Commodity Futures Trading Commission (CFTC). Their spotless compliance record demonstrates an unwavering commitment to transparency and ethical standards in all client dealings.

This makes them a trusted partner when integrating a robust online futures trading platform like TradingView.

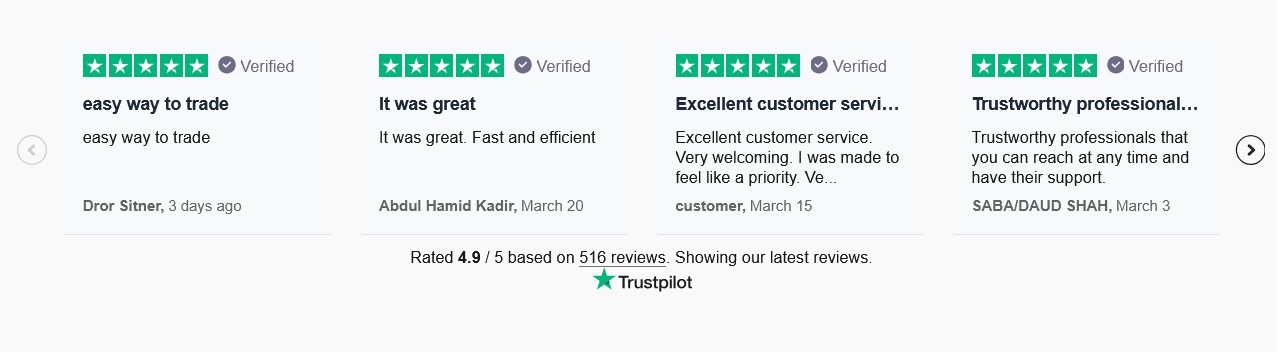

5-Star Client Satisfaction Ratings

Cannon Trading has earned numerous 5 out of 5-star ratings on TrustPilot. Clients consistently praise their excellent customer service, fast execution speeds, and educational support. These accolades reflect their client-first philosophy and ensure a smooth TradingView app experience when connected to Cannon.

Try a FREE Demo!

Wide Selection of Free Trading Platforms

While TradingView is a premier choice, Cannon provides access to a broad array of trading software at no cost, including:

- TradingView free integration.

- CQG, R-Trader, MultiCharts, and Sierra Chart.

- Mobile trading options via Android and iOS.

Personalized Broker Support

Unlike many large brokerage firms, Cannon Trading provides personalized service. You can speak to experienced professionals who will walk you through connecting your account to TradingView Desktop or help you troubleshoot features like TradingView chart live.

They also provide insights into using TradingView indicators and settings tailored to your risk tolerance and market goals.

How to Start Futures Trading with TradingView and Cannon Trading

Getting started is simple. Follow these steps to launch your journey with one of the best online futures trading platforms:

- Sign Up on TradingView

- Download the TradingView app or TradingView Desktop via the TradingView download.

- Create a TradingView free account to start exploring the platform and familiarizing yourself with the TradingView chart tools.

- Open a Cannon Trading Account

- Visit Cannon Trading’s official site to open a futures trading account.

- Select TradingView as your preferred trading platform and receive support from Cannon’s team.

- Integrate Your Accounts

- Connect your Cannon Trading credentials to the TradingView Futures Trading Platform.

- Begin analyzing TradingView chart live data and executing trades.

Why the TradingView-Cannon Combo Is Ideal

This partnership brings together the best of both worlds:

- A technologically advanced futures trading platform with a sleek interface and comprehensive analytics.

- A seasoned brokerage with decades of proven expertise, regulatory trust, and stellar customer reviews.

Try a FREE Demo!

Whether you’re trading energy futures, metals, interest rate products, or indices, the TradingView and Cannon combo gives you the insight, control, and speed needed to succeed.

The TradingView Futures Trading Platform has revolutionized how traders approach the markets, offering intuitive tools like TradingView chart, TradingView chart live, and multi-device access through the TradingView app, TradingView Desktop, and TradingView free editions.

But pairing this cutting-edge platform with a highly rated, industry-respected broker like Cannon Trading Company takes your trading to the next level. With their decades of futures expertise, free platform offerings, personalized broker assistance, and a sterling reputation among regulators and clients, Cannon is a trusted name in futures trading.

Whether you’re just beginning or are a seasoned trader seeking to optimize your setup, leveraging TradingView through Cannon Trading is one of the smartest moves you can make in today’s futures landscape.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading