Cannon Futures Weekly Letter Issue # 1191

In this issue:

- Important Notices – FOMC & NFP Next Week

- Futures 101 – Understanding Volume

- Hot Market of the Week – June Bonds

- Broker’s Trading System of the Week – ES intraday System

- Trading Levels for Next Week

- Trading Reports for Next Week

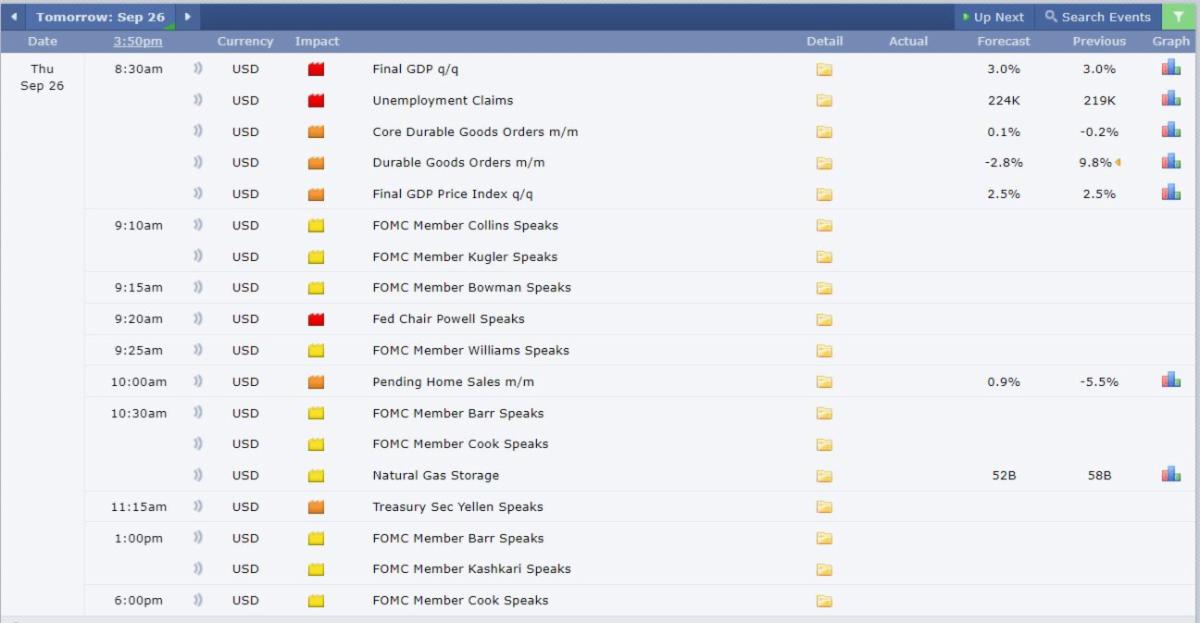

Important Notices – Next Week Highlights:

-

- FOMC Rate Announcement Wed.

- Heavy Earnings, AMZN and AMD Tues, AAPL Thur. all after the close

- Heavy Data, Chicago PMI, Consumer Confidence, Construction Spending, ISM Manufacturing PMI, Jobless Claims.

- NON FARM Payrolls to cap off the week on Fri. , preopening

Futures 101 : Understanding VOLUME

Volume is reported for all futures contracts. It is calculated by counting the number of contracts that have been bought and sold over a given time. You can track volume using different time intervals like daily or intraday.

When a futures contract is traded, whether bought or sold, it counts towards volume for that contract.

For example, a trader closes a short position in the

E-mini S&P 500 (ES) futures contract by buying one contract in the ES, so volume will increase by 1.

Traders often use and interpret the rise or decline of volume in a futures contract to help make trading decisions.

Volume can give important information to traders such as:

- Indicate the price levels at which traders are more or less interested in trading a futures contract

- During the roll, indicate to traders when to switch to trading the front month futures contract as volume decreases in the expiring contract

- Identify the times of day when a futures contract is most liquid

Price Levels

When volume changes as price of a futures contract moves towards certain levels, this can indicate to a trader that a change in direction may occur. Some traders may use this information to indicate whether to buy or sell at those key levels.

Contract Roll

During the futures rollover, traders pay attention to the contract that is taking the higher levels of volume. Traders use this information to determine when to start trading the next month contract. As volume decreases in the expiring contract, trading will shift to the next available month contract.

For example, say the June ES (E-mini S&P 500) futures contract is about to expire and September will become the new front month. On the Thursday of rollover week, watch how the June contract starts to lose volume and the September contract begins to pick up volume. When the September contract has more volume than the June contract, it is time to switch to the September contract.

Active Periods

Traders typically prefer higher volume times to trade, as it means that more traders are actively interested in buying and selling. When volume is high, the bid-ask spread is typically smaller, orders are filled faster and less gaps may exist between ticks.

For example, markets can have lower volume between the hours of 12:00 p.m.-2:00 p.m. ET, before major economic releases; conversely, market often see higher volume around the open and close of the trading day.

Traders also can look at average daily volume over a longer time period, such as a few weeks or months, to see if the markets currently are in a lower or higher volume than is typical.

Summary

What volume can’t show however, is whether traders are buying or selling, or opening or closing a position.

For example, if the ES contract is trading at 2375 and suddenly pushes down to 2360 while volume increases, the volume that comes into the market could be from traders opening new long positions at key levels of support. That could indicate a bullish sentiment. Volume also can be generated by liquidation of exiting long positions or opening of new short positions, a possible bearish indication.

A spike in volume at 2360 doesn’t necessarily mean that buyers are coming into the market and that the price will bounce.

Volume data is readily available for each futures contract and for the market as a whole. Although traders may use volume in different ways to interpret how to trade, volume can be an important factor to help inform your trading decisions.

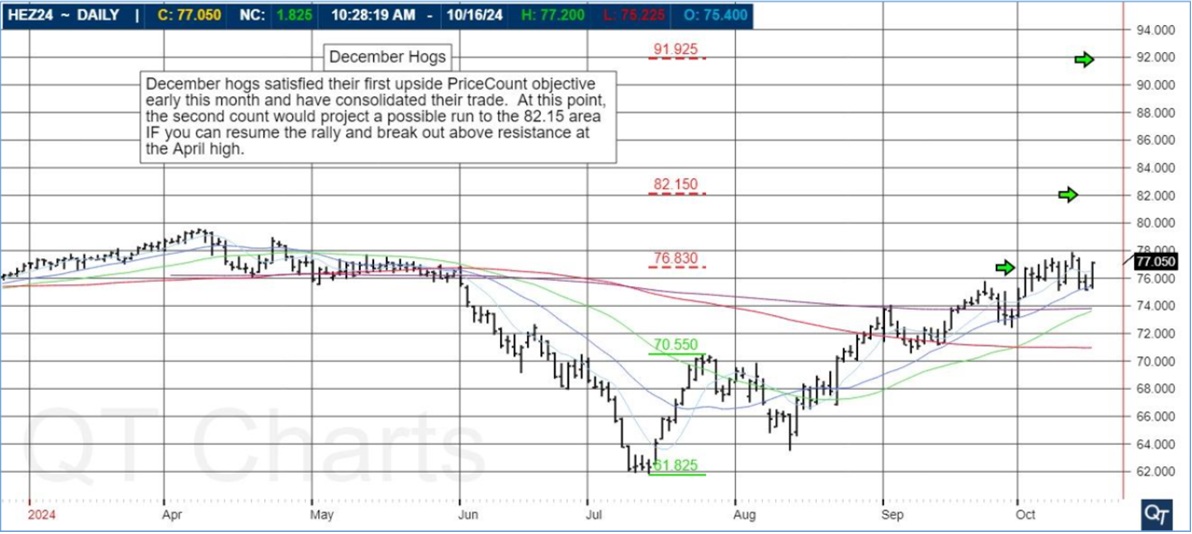

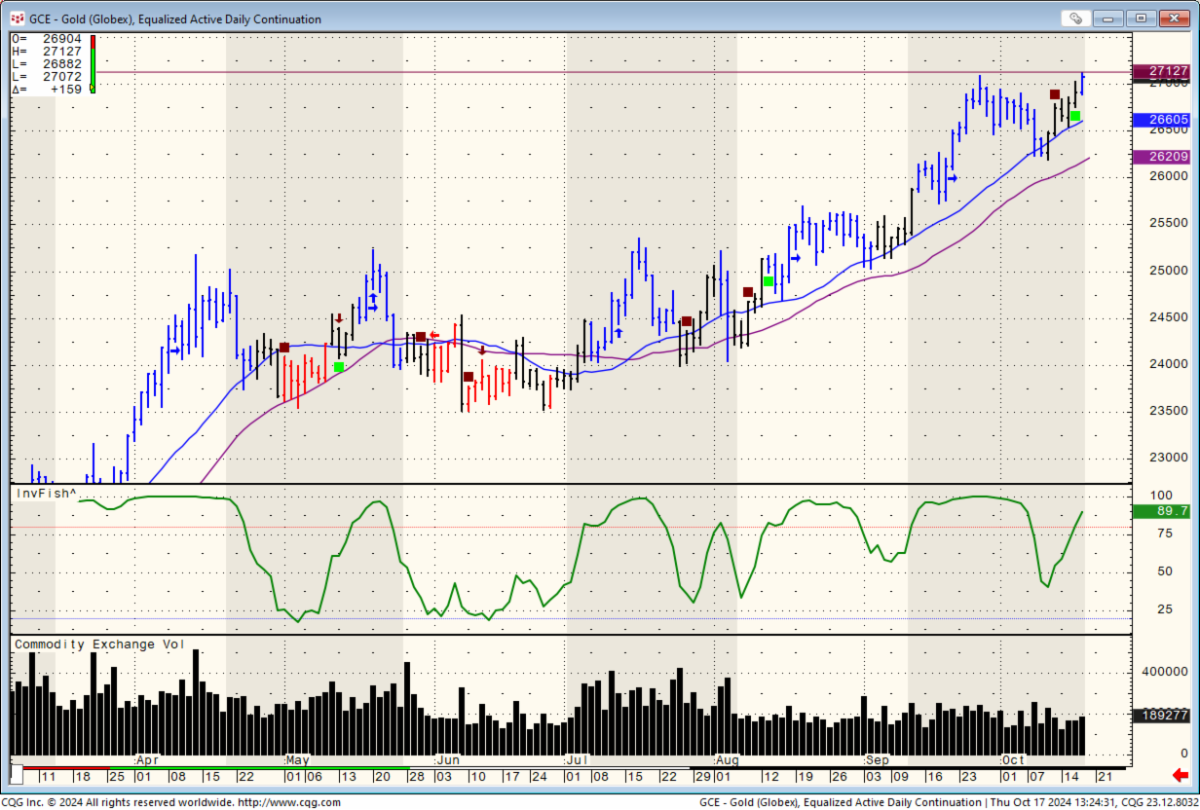

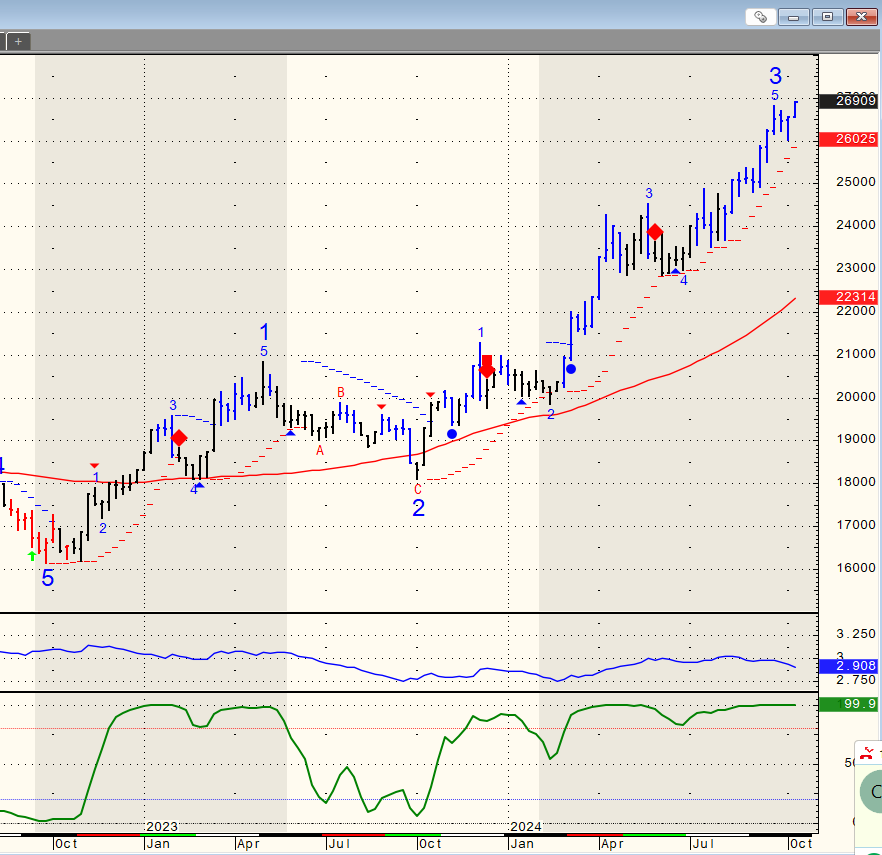

- Hot Market of the Week – June Bonds

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

June 30 Year T-Bonds

The

June 30 Year T-Bond break found temporary stability at its second downside PriceCount objective recently. Now, the chart has resumed its slide into new lows which, if sustained, would project a run to the third count in the 109^20 area.

PriceCounts – Not about where we’ve been , but where we might be going next!

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved. It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at

www.qtchartoftheday.comTrading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

-

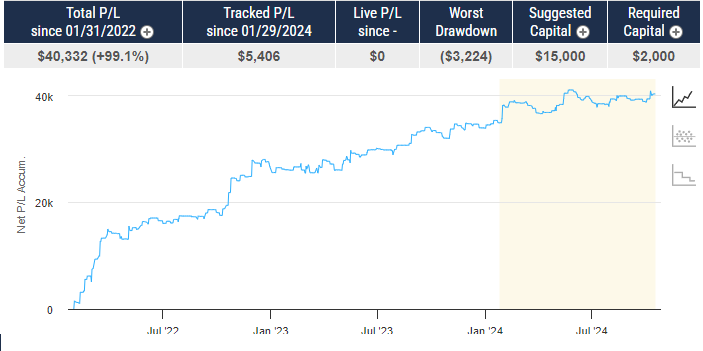

Broker’s Trading System of the Week

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

PRODUCT

SYSTEM TYPE

Intraday

COST

USD 110 / monthly

Recommended Cannon Trading Starting Capital

$10,000

The performance shown above is hypothetical in that the chart represents returns in a model account. The model account rises or falls by the average single contract profit and loss achieved by clients trading actual money pursuant to the listed system’s trading signals on the appropriate dates (client fills), or if no actual client profit or loss available – by the hypothetical single contract profit and loss of trades generated by the system’s trading signals on that day in real time (real‐time) less slippage, or if no real time profit or loss available – by the hypothetical single contract profit and loss of trades generated by running the system logic backwards on back adjusted data.

Please read full disclaimer HERE.

|

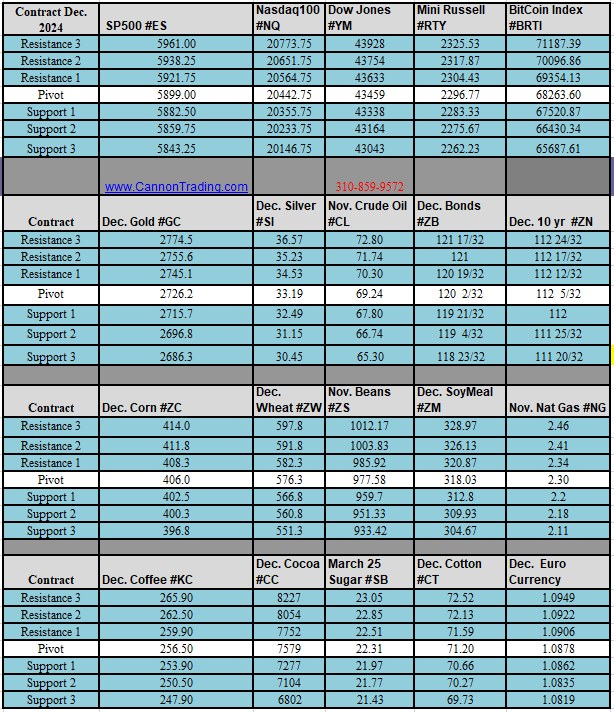

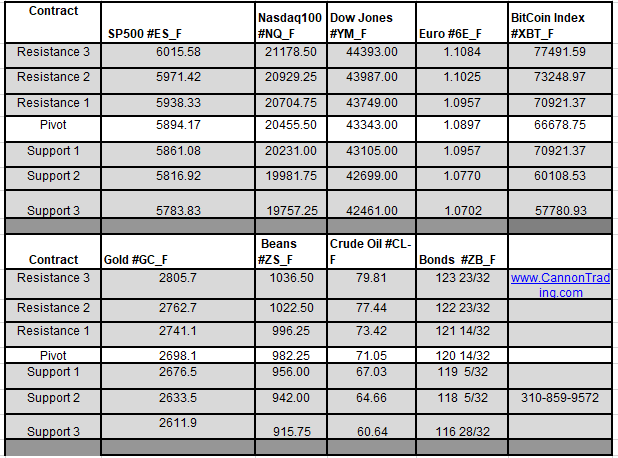

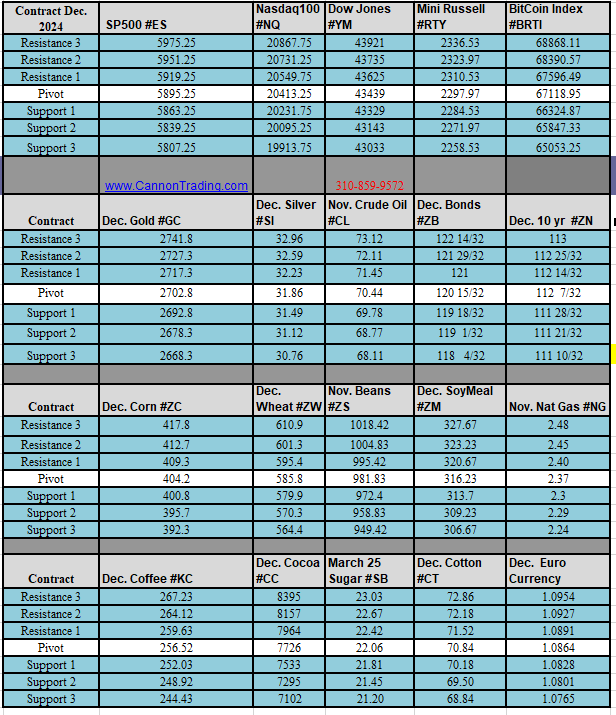

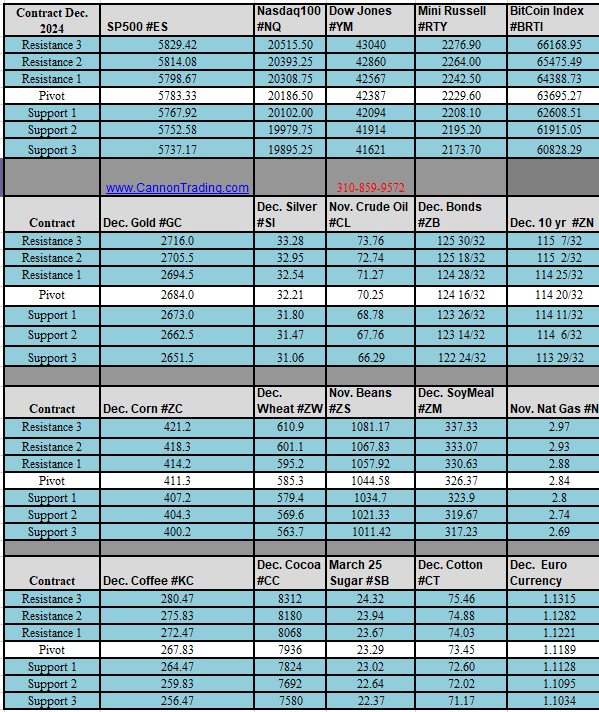

Would you like to receive daily support & resistance levels?

|

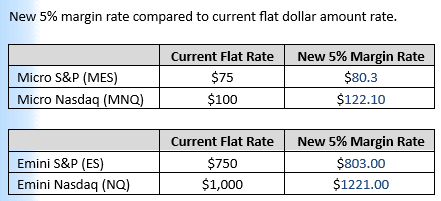

Daily Levels for April 29th 2024

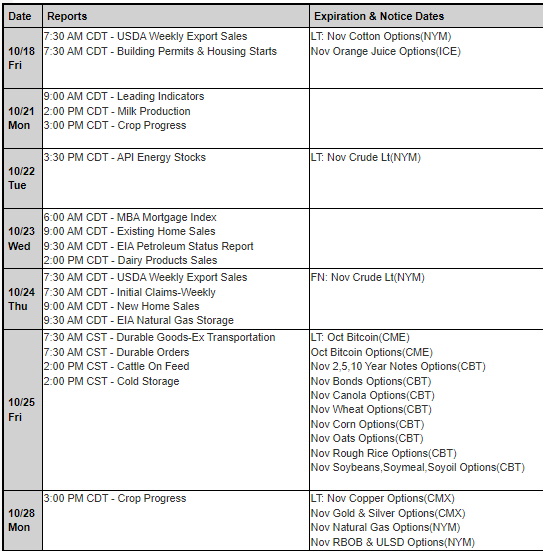

Trading Reports for Next Week

First Notice (FN), Last trading (LT) Days for the Week:

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

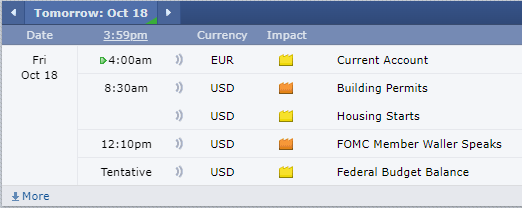

Economic Reports

provided by:

Economic Reports

provided by: