|

Bulls are surviving…. for now.Earnings for Q4 to arrive mid-month.The January effect and more…By John Thorpe, Senior Broker |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Whether a person or a firm, a commodity broker is there to help you with your commodity trading needs. They either have a team of commodity traders under them or a platform that they manage electronically.

For all commodity trading beginners, commodity brokers are a point of contact that can be approached with individual commodity trading needs. To do good in commodity trading, it is important to take the advice of the commodity broker seriously. Under this category archive we discuss everything about commodity brokers and their expert skills.

We at Cannon Trading are there to help your commodity trading requirements. Whether you want to consult us and seek advice or to play a more active role for you in the markets, we are there to serve you with the best of our services. It is essential for you to choose only a certified broker and so, you can always trust us when it comes to qualifying on all quality parameters. No matter which commodity interests you, our trading experts give you the right and real-time advice always. Read our archive; share posts with your friends; or bookmark this page to stay up-to-date on commodity brokers.

|

Bulls are surviving…. for now.Earnings for Q4 to arrive mid-month.The January effect and more…By John Thorpe, Senior Broker |

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

In the fast-paced, high-stakes world of modern finance, information is the currency that matters most. For retail and professional traders alike, the difference between a profitable week and a significant drawdown often hinges on access to timely, accurate, and actionable market analysis. This is where blogs for futures trading play a critical role. While the internet is flooded with generic financial advice, discerning traders know that few resources rival the depth, history, and reliability found in the ecosystem of Cannon Trading Company and its sister sites, E-Futures.com and E-Mini.com.

As pioneers who helped transition the industry from the shouting pits of the 20th century to the digital screens of the 21st, Cannon Trading has cultivated a reputation not just as a brokerage, but as a premier educational hub. This analysis explores how their decades of experience, commitment to transparent education, and integration of cutting-edge technology have cemented their status as leaders in the futures trading blog space.

The Evolution of a Pioneer: From the Pit to the Blogosphere

To understand why Cannon Trading’s content stands out among futures trading blogs, one must first understand their history. Founded in 1988, Cannon Trading established itself long before the “blog” was even a concept. They operated during an era where market information was gated, expensive, and slow. When the digital revolution arrived in the late 1990s, Cannon was among the first to pivot, launching online trading services in 1998.

This early adoption gave them a unique advantage. Unlike modern “influencer” blogs that often lack real-world trading experience, Cannon’s content is rooted in over 37 years of operational history. When their analysts write about market volatility or order flow, they are drawing on institutional knowledge that spans the 1987 crash, the Dot-com bubble, the 2008 financial crisis, and the post-pandemic inflation surge. This depth of experience is palpable in their daily market commentary, making their site a “must-read” futures trading blog for those seeking historical context alongside technical levels.

The Cannon Trading Blog: A Daily Essential for Traders

The core of Cannon’s educational offering lies in its primary blog. It distinguishes itself from other blogs for futures trading through its practical, trade-ready focus. While many competitors publish vague macroeconomic fluff, Cannon Trading focuses on “Daily Support & Resistance Levels.”

For active traders, these posts are invaluable. Every trading day, the blog provides specific price levels for major indices like the E-mini S&P 500, Nasdaq 100, and crude oil. These aren’t just computer-generated numbers; they are curated updates that help traders frame their day. A trader looking for futures trading blogs that offer actionable data will find Cannon’s approach refreshing. Instead of reading 1,000 words on why the market might move, they get a clear map of where buyers and sellers are likely to clash.

Furthermore, their “Weekly Newsletter” has become a staple in the industry. It often combines technical analysis with fundamental insights—such as the impact of new tariffs or Federal Reserve interest rate decisions—breaking down complex geopolitical events into clear trading scenarios. This ability to synthesize macro news with micro-market structure is a hallmark of a high-quality futures trading blog.

E-Futures.com: The Technical and Platform Authority

While Cannon Trading serves as the flagship, its sister company, E-Futures.com, offers a slightly different flavor of content that is equally vital. E-Futures has carved out a niche as a leader in platform education and technical tutorials.

In the world of online trading, the software is the trader’s weapon. If you do not know how to use your platform efficiently—how to set a trailing stop, how to configure a DOM (Depth of Market), or how to set up an OCO (One-Cancels-Other) order—you are at a severe disadvantage. E-Futures.com excels here. Their blog and resource sections often feature deep dives into platform capabilities, specifically for the “CannonX” platform powered by CQG.

Reviewing the futures trading blogs available today, few go into the granular detail that E-Futures does regarding execution. They understand that a great trade idea is useless if the execution is botched. By providing content that bridges the gap between strategy and software, E-Futures.com ensures its readers are not just knowledgeable about the market, but proficient in navigating it. This focus on “how-to” content complements the “what-to-trade” content found on the main Cannon site, creating a comprehensive educational loop.

E-Mini.com: Specialized Content for the Index Trader

The third pillar of this educational triumvirate is E-Mini.com. As the name suggests, this entity focuses heavily on the E-mini and Micro E-mini contracts. With the explosive popularity of the Micro E-mini S&P 500 (MES) and Micro E-mini Nasdaq (MNQ), a new wave of retail traders has entered the market. These traders need specific guidance on margins, contract specifications, and the nuances of leverage.

E-Mini.com serves as a specialized futures trading blog for this demographic. Their content demystifies the barrier to entry, explaining how smaller contract sizes allow for more precise risk management. Articles detailing “Day Trading Margins” and “Contract Specs” are crucial for newer traders who might be intimidated by the full-sized contracts. By segmenting this content onto a dedicated site, the Cannon group ensures that information is tailored and accessible, preventing new traders from being overwhelmed by institutional-level jargon found on other blogs for futures trading.

TrustPilot and the “Human” Element of Digital Blogging

One might ask: “Anyone can write a blog; how do I know this advice is trustworthy?” This is where the Cannon ecosystem truly separates itself from the pack. In an age of AI-generated content and anonymous financial gurus, Cannon Trading backs its futures trading blog with verified reputation.

A quick glance at TrustPilot reveals a near-perfect 4.9-star rating, a rarity in the brokerage world. What is fascinating is how these reviews often reference the educational support provided by the brokers. Reviewers frequently mention brokers by name—Ilan, Kimberly, Joe, Mark—citing how they helped explain a difficult market concept or walked them through a platform issue.

This relates directly to their blog strategy because the blog is essentially an extension of this personalized service. The articles are written or vetted by licensed Series 3 professionals, not freelance copywriters. When you read a piece on E-Futures.com about “The Risks of Over-Leverage,” it is backed by a firm that has spent 37 years helping clients manage that exact risk. This credibility is the currency that makes them a trusted futures trading blog. Readers know that the entity publishing this advice has a vested interest in their longevity and success, verified by hundreds of third-party reviews.

Smooth Trade Execution: The End Goal of Every Blog Post

Ultimately, the purpose of reading blogs for futures trading is to execute better trades. Cannon Trading and its sister companies understand this pipeline better than anyone. Their educational content is designed to lead directly to smooth trade execution.

When a trader reads about a “Key Resistance Level at 4500” on the Cannon blog, they need confidence that their broker can execute that trade instantly when the price hits. Cannon’s infrastructure, utilizing top-tier clearing relationships and robust platforms like CQG and Rithmic, ensures that the latency between “idea” and “execution” is minimal.

The blog educates the trader on where to click; the brokerage technology ensures the click counts. This synergy is often missing from independent futures trading blogs that act purely as publishers. Because Cannon, E-Futures, and E-Mini are brokerages first and publishers second, their content is inherently practical. They do not publish theoretical strategies that are impossible to execute due to slippage or liquidity issues. They publish what works, backed by the technology to make it happen.

A “Sister” Ecosystem: Why Three is Better Than One

The decision to maintain three distinct brands—Cannon Trading, E-Futures, and E-Mini—might seem redundant to an outsider, but it is a strategic masterstroke in the realm of futures trading blogs. It allows for specialization.

This segmentation allows them to dominate the SEO landscape for blogs for futures trading. No matter what level of trader you are—a hedge fund manager hedging crude oil risk, or a retail trader scalping the Micro S&P—there is a specific site in their network speaking your language. This comprehensive coverage is why they remain leaders in the online futures blog space.

The Importance of SEO and Accessibility in Futures Education

In the digital age, accessibility is key. A futures trading blog is useless if traders cannot find it. Cannon Trading and its sister companies have optimized their content for modern search habits and LLM (Large Language Model) accessibility. Their articles use clear headers, bullet points for data (like margin requirements), and direct answers to complex questions.

This “Geo-agnostic” approach is vital. Futures trading is a global endeavor. A trader in London, Tokyo, or Sydney needs to access the same high-quality US market data as a trader in Chicago. Cannon’s blogs are designed to be globally accessible, providing time-zone relevant information (such as noting when reports are released in Eastern Time) and catering to a remote client base. Their rise as a trusted futures trading blog is partly due to this realization that the modern trading floor is digital and decentralized.

Personable Customer Service: The “Secret Sauce”

While this piece focuses on their blogs, one cannot decouple the content from the service. The reason Cannon Trading’s content resonates is the “personable customer service” ethos that underpins it.

Many futures trading blogs are dry and academic. Cannon’s content often feels like a conversation with a broker. They address common anxieties—fear of missing out (FOMO), the stress of margin calls, the discipline of waiting for a setup. This empathetic tone comes from their “Human Service Above Automation” philosophy. They know the psychological toll of trading because they have been on the phones with clients for three decades. This emotional intelligence makes their futures trading blog not just an analytical resource, but a psychological anchor for many traders.

The Gold Standard of Futures Blogging

In summary, Cannon Trading Company, along with E-Futures.com and E-Mini.com, has established a dynasty in the world of online trading education. They are not leaders simply because they have been around the longest, though their 1988 founding is significant. They are leaders because they have successfully translated that history into a digital format that empowers the modern trader.

Their ecosystem offers a masterclass in what blogs for futures trading should be: accurate, actionable, and backed by verified expertise. From the granular platform tutorials on E-Futures to the accessible entry-points on E-Mini, and the daily professional analysis on Cannon Trading, they cover every base.

For the trader seeking a reliable futures trading blog, the search often begins and ends here. The combination of positive TrustPilot reviews, decades of industry wisdom, personable service, and a seamless bridge between education and execution makes them the undisputed heavyweights of the sector. In a market defined by uncertainty, Cannon Trading provides the one thing traders need most: clarity.

FAQ: Futures Trading Blogs & Cannon Trading Services

Q: Why should I read blogs for futures trading instead of just watching news? A: Blogs for futures trading often provide more specific, actionable technical analysis than general financial news. For example, Cannon Trading’s blog provides specific support and resistance price levels for daily trading, whereas cable news typically covers broad economic trends that may not help with immediate trade execution.

Q: What makes Cannon Trading a trusted futures trading blog source? A: Cannon Trading is a licensed brokerage founded in 1988 with a clean regulatory record and a 4.9/5 rating on TrustPilot. Unlike anonymous financial bloggers, their content is produced by licensed professionals with decades of experience in the futures industry.

Q: Do E-Futures.com and E-Mini.com offer different content? A: Yes. While they are sister companies, their futures trading blogs focus on different niches. E-Futures often focuses on platform tutorials and technical software guides, while E-Mini focuses on index trading, micro contracts, and margin specifications for retail traders.

Q: Can I access these futures trading blogs from outside the United States? A: Absolutely. The content is optimized for global access. Whether you are trading from Europe, Asia, or South America, the futures trading blog content is relevant for anyone trading US-based futures markets like the CME Group products.

Q: How often is the Cannon Trading futures trading blog updated? A: Cannon Trading updates its blog daily with “Daily Support & Resistance Levels” and provides regular “Weekly Newsletters” and market commentary, ensuring traders have fresh data for every trading session.

Q: Does reading a futures trading blog guarantee profit? A: No. Futures trading involves substantial risk of loss and is not suitable for every investor. A futures trading blog is an educational tool to help inform your decisions, but past performance is not indicative of future results.

Q: How does the blog help with smooth trade execution? A: By providing clear technical levels and platform tutorials, the blogs help traders plan their trades in advance. Knowing exactly where to enter or exit (based on the blog’s analysis) and how to use the platform (based on E-Futures’ tutorials) leads to smoother, more confident trade execution.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

In the high-stakes arena of global finance, the re-emergence of aggressive tariff policies under the Trump administration has introduced a fresh wave of volatility to the markets. For active traders, commercial hedgers, and institutional investors, this political shift is not merely a headline—it is a direct call to action. The need for a competent, responsive futures brokerage has never been more critical. Whether you are a manufacturer fearing rising steel costs or a speculator looking to capitalize on currency fluctuations, understanding the mechanics of the futures market is your primary defense against geopolitical uncertainty.

This comprehensive guide will explore the intricate relationship between tariffs and futures pricing, the specific mechanisms of hedging, and why partnering with a top-tier firm like Cannon Trading Company—often cited as the best futures brokerage for customer service—is essential for responsible trading in this environment.

The Economic Landscape: Tariffs, Trade, and Volatility

To understand how to utilize a futures brokerage effectively, one must first grasp the economic impact of tariffs. A tariff is fundamentally a tax on imports, designed to protect domestic industries by making foreign goods more expensive. However, the ripple effects of such policies create a complex web of price distortions that play out aggressively in the futures markets.

When the Trump administration announces tariffs on materials like steel, aluminum, or lumber, the immediate reaction is often a spike in domestic prices. This creates an inflationary environment for manufacturers who rely on these raw materials. Conversely, retaliatory tariffs from trading partners can decimate the prices of U.S. exports, such as soybeans or pork, as foreign demand artificially collapses.

This dichotomy—rising input costs and potentially falling export prices—creates a “fork in the road” for market participants. A specialized futures brokerage becomes the navigator at this fork, offering the instruments needed to lock in prices today against the uncertainty of tomorrow.

Facilitating Your Futures Brokerage to Hedge Against Tariffs

Hedging is the practice of taking a financial position to offset the risk of price movements in the physical market. In the context of tariff increases, traders and businesses can “facilitate” their futures brokerage accounts to act as insurance policies. Here is how different market participants can utilize these strategies:

The Manufacturer’s Hedge (The Long Hedge)

Imagine a U.S. automotive manufacturer that anticipates a 25% tariff on imported steel. Such a policy would almost certainly drive up the domestic price of steel. To protect against this cost explosion, the manufacturer can use their futures brokerage to enter a “long” position (buy contracts) in steel futures.

The Producer’s Hedge (The Short Hedge)

Conversely, consider a U.S. soybean farmer. If a trade war escalates, countries like China may impose retaliatory tariffs on U.S. agriculture, causing demand—and prices—to plummet. The farmer can instruct their futures brokerage to sell soybean futures contracts at current market prices.

Tariffs often lead to significant fluctuations in currency values. If the U.S. dollar strengthens due to protectionist policies, it can hurt multinational companies with foreign revenue. Traders can use currency futures (like the Euro FX or British Pound futures) through their futures brokerage to hedge against foreign exchange risk, ensuring that currency volatility does not erode their operational profits.

Pros and Cons of Tariff-Induced Price Increases in Speculative Pricing

For the speculative trader—one who does not deal in physical goods but trades for profit—tariff news offers a distinct set of opportunities and risks. A high-quality futures brokerage will provide the data and execution speed necessary to navigate these pros and cons.

The Pros: Volatility and Trend Formation

The Cons: Artificial Pricing and Liquidity Risks

Cannon Trading Company: Facilitating Responsible and Timely Trading

When navigating the choppy waters of tariff-influenced markets, the quality of your broker is paramount. This brings us to Cannon Trading Company, a firm that has distinguished itself as a leader in the industry since 1988. In an era where many brokers have moved to purely automated, faceless support systems, Cannon Trading stands out by blending cutting-edge technology with high-touch, personal service.

Why Cannon Trading is a Contender for the “Best Futures Brokerage”

The Mechanics of Responsible Trading in a Tariff Era

To truly facilitate your futures brokerage account for success, one must move beyond the “what” and into the “how.” Responsible trading during administration changes requires a disciplined approach to leverage and information.

Leveraging the “Best Futures Brokerage” Tools

The best futures brokerage will offer tools that you must utilize. These include:

Understanding Contango and Backwardation

Tariffs can alter the forward curve of futures contracts.

The Role of Options on Futures

For those who find the unlimited risk of futures contracts too daunting during political uncertainty, options on futures are a responsible alternative. Buying a “Put” option on soybeans allows a farmer to profit if prices fall, but if prices rise, they only lose the premium paid for the option. Cannon Trading specializes in assisting clients with these complex derivative strategies, offering a layer of protection that simple futures contracts cannot.

Fortifying Your Portfolio

The return of tariff-heavy economic policies under the Trump administration signals a time of necessary vigilance for traders and commercial interests alike. The markets will offer significant opportunities for profit, but they will extract a heavy toll on the unprepared.

Facilitating your futures brokerage account to hedge against these risks is not just a sophisticated financial move; it is a necessary survival strategy for modern commerce. By understanding the mechanics of long and short hedging, and by recognizing the pros and cons of speculative pricing in a tariff environment, you position yourself to act rather than react.

However, strategy without execution is futile. This is why the choice of broker is critical. Cannon Trading Company has proven, through decades of service and unrivaled TrustPilot rankings, that it understands the needs of the modern trader. They offer the technology of a large firm with the boutique, protective service of a small partner. In the search for the best futures brokerage, their commitment to responsible, timely, and personal service makes them a standout choice for anyone looking to navigate the volatile waters of the Trump era markets.

Whether you are protecting a harvest, managing manufacturing costs, or speculating on the dollar, the right partner and the right strategy are your best hedge against the unknown.

FAQ Section

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

The financial landscape is being reshaped by the relentless march of technology, with algorithmic trading and Artificial Intelligence (AI) dominating large swaths of the market, particularly in high-frequency operations. However, for the serious futures trader, the notion that a computer can entirely replace a seasoned, professional futures broker is a dangerous oversimplification. While AI excels in speed and data analysis, the human element—rooted in judgment, empathy, and strategic partnership—remains absolutely indispensable.1

This deep dive explores the unique, high-value services that a human futures broker provides, details the critical pros and cons of human guidance versus AI, and highlights how a premier firm like Cannon Trading Company leverages this human-centric model to facilitate responsible and timely futures trading for its clients, all while maintaining its position as the highest-ranked futures broker on TrustPilot for top-tier customer service and trade execution.

What Human Futures Brokers Offer That Cannot Be Replaced by AI

Algorithmic systems are unparalleled at transactional tasks: generating quotes, matching orders, and executing trades in milliseconds.2 Yet, the core value proposition of a human futures broker lies in areas requiring nuanced judgment, interpersonal skills, and contextual understanding—qualities AI struggles to replicate.3

The Art of Crisis Management and Emotional Buffer

The futures market is a volatile environment, subject to “Black Swan” events—unforeseen, high-impact crises like geopolitical conflicts, sudden regulatory shifts, or pandemic announcements.

Personalized Strategy and Nuanced Risk Assessment

AI can compute risk based on quantifiable metrics, but it lacks the capacity for personalized, holistic risk assessment tied to a client’s unique life situation.

Account Protection and Oversight

While AI can automate compliance checks, a human broker acts as a second, experienced set of eyes to protect the client’s account from themselves.

⚖️ Pros and Cons: Human Guidance vs. AI/Algorithmic Data

The decision between relying on human guidance and employing AI/algorithmic systems is not about choosing a winner; it’s about finding the optimal balance. Each method has distinct advantages and disadvantages that futures traders must weigh carefully.

Human Guidance (Futures Broker)

| Pros | Cons |

|---|---|

| Contextual Judgment | Slower Execution Speed |

| Excels in interpreting unforeseen events (geopolitics, policy shifts) and applying wisdom beyond historical data. | Cannot execute trades in milliseconds like a high-frequency algorithm. |

| Emotional Discipline & Support | Susceptible to Human Error |

| Provides a rational buffer during crises, preventing panic selling or excessive greed-driven trading. | Risk of manual error in order entry or miscommunication, though mitigated by high standards of the best futures brokers. |

| Personalized Relationship | Limited Market Coverage |

| Tailored strategy, one-on-one consultation, and advocacy for unique client needs. | A human cannot monitor dozens of markets 24/7 without rest, unlike an AI. |

| Accountability & Oversight | Higher Commission Potential |

| Acts as a check against the trader’s behavioral biases, offering risk management intervention. | Full-service or broker-assisted models may involve higher costs than deep discount, self-directed platforms. |

AI and Generative Data (Algorithmic Trading)

| Pros | Cons |

|---|---|

| Speed and Execution | Lack of Contextual Understanding |

| Executes trades in microseconds (low latency), impossible for a human, ensuring the best possible price. | Struggles with novel events (Black Swans); operates strictly within the bounds of its training data. |

| Scale and Consistency | Risk of Over-Optimization |

| Monitors hundreds of markets 24/7 without fatigue, applying a strategy with unyielding discipline. | An algorithm can be perfectly optimized for historical data but fail dramatically in live markets (curve-fitting). |

| Emotionless Objectivity | High Initial Barrier and Maintenance |

| Decisions are purely data-driven, immune to psychological biases like fear or greed. | High setup costs, reliance on sophisticated technical infrastructure, and the need for constant maintenance. |

| Data Processing Power | Dependence on Data Quality |

| Analyzes massive datasets (volume, sentiment, correlation) far beyond human capacity to spot subtle patterns. | Flawed, biased, or incomplete historical data leads to poor, systematic decision-making. |

The future of successful futures trading is a hybrid model. The most successful traders will use algorithmic tools for fast, efficient execution and data mining, but they will rely on the strategic counsel and emotional intelligence of their human futures broker to navigate complexity and crisis.

Cannon Trading Company, with its decades-long legacy as a premier futures broker based in Los Angeles, California, embodies the powerful synergy of human expertise and advanced trading technology.10 The company facilitates responsible and timely trading through a multi-faceted approach centered on client support and execution excellence.11

The Human-Centric Service Model

Cannon Trading recognizes that while technology enables trading, people manage risk and build wealth. The firm’s service is built on direct, accessible human guidance:

Top-Tier Technology and Timely Access

To complement its human service, Cannon Trading provides robust and reliable technology infrastructure:15

Regulatory Integrity and Geographic Presence (GEO Optimization)

Cannon Trading’s long history and regulatory standing provide an essential layer of trust and responsibility.17

⭐ TrustPilot Excellence: The Highest-Rated Futures Broker

The proof of Cannon Trading Company’s success in blending human expertise and superior technology is reflected in its unparalleled customer feedback. Cannon Trading is widely recognized as the highest-rated futures broker on TrustPilot, boasting a near-perfect TrustScore, with hundreds of verified, five-star reviews.20

This stellar ranking is a direct testament to the firm’s commitment to two key areas:

The TrustPilot ranking validates the human futures broker model. In a world where traders can choose any platform, they choose Cannon Trading for the personal, knowledgeable, and reliable service that a machine cannot deliver.25 This superior customer service model ensures that every client receives the timely and responsible guidance necessary to navigate the complexities of the futures market successfully.26 Cannon Trading Company is not just a platform; it is a partnership.

❓ Frequently Asked Questions (FAQ)

What is the biggest advantage of a human futures broker over an AI trading system?

The biggest advantage is the irreplaceable human element of contextual judgment and emotional intelligence.27 AI excels at speed and pattern recognition in historical data but fails to interpret unforeseen “Black Swan” events (like a sudden geopolitical crisis) with the same strategic nuance as an experienced human futures broker.28 Furthermore, a human broker acts as an essential emotional barrier, preventing a client from making catastrophic, panic-driven trading errors during high-stress market volatility.

How does Cannon Trading Company ensure timely trade execution?

Cannon Trading ensures timely trade execution through a combination of dedicated human oversight for broker-assisted trades and a commitment to advanced, low-latency technology for self-directed traders. They offer a selection of industry-leading trading platforms (like CannonX powered by CQG) and maintain robust server connectivity to minimize the delay between order placement and exchange fulfillment, a crucial factor in the fast-moving futures market.29

Why is Cannon Trading Company the highest-rated futures broker on TrustPilot?

Cannon Trading has earned its status as the highest-rated futures broker on TrustPilot due to its unwavering commitment to top-tier customer service and reliable trade execution.30 Reviewers consistently praise the personalized attention from dedicated, licensed brokers, the responsiveness of their support team, and the professionalism in handling both routine and complex trading needs, demonstrating the superior value of a human-centric service model.31

Is algorithmic trading completely incompatible with using a futures broker?

No, the future of trading is a hybrid model.32 A trader can use algorithmic systems for automated execution and data analysis while still benefiting from the strategic counsel and human oversight of a futures broker.33 The broker’s role shifts from a pure order-taker to a strategic partner and risk manager, combining the speed of AI with the irreplaceable wisdom of human experience.

How does Cannon Trading help a new trader trade futures responsibly?

Cannon Trading promotes responsible trading through personalized guidance, risk management consultation, and extensive educational resources.34 They help new traders define realistic goals, set appropriate risk controls, understand complex margin requirements, and choose a trading platform and strategy that aligns with their experience level—ensuring they start their futures trading journey on a sound, informed foundation.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

Futures markets are dynamic arenas where traders speculate, hedge, and invest across commodities, indices, currencies, and more. The approaches to futures trading are as diverse as the markets themselves — ranging from fast-paced day trading to long-term position trading, and from discretionary methods to cutting-edge algorithmic systems.

In this article, we’ll explore every major type of futures trading in detail — what defines each, how they work, and which styles suit different trader profiles. Whether you’re just starting trading in futures or already deep into advanced automation, understanding these approaches can help refine your strategy and results.

1. Day Trading Futures

Definition:

Day trading in futures is all about capitalizing on intraday price movements. Traders buy and sell contracts within the same session, closing all positions before the market ends.

Core Features:

Common Methods:

Advantages:

Risks:

Ideal for: Traders who thrive in fast-paced environments and use advanced platforms for futures trading execution.

2. Swing Trading Futures

Definition:

Swing traders hold futures positions for several days or weeks, seeking to capture short- to mid-term trends rather than intraday volatility.

Core Features:

Techniques:

Advantages:

Risks:

Ideal for: Professionals who cannot monitor markets constantly but still want meaningful participation in trading in futures.

3. Position Trading Futures

Definition:

Position trading involves holding futures contracts for weeks, months, or even longer — targeting large, fundamental price trends.

Core Features:

Techniques:

Advantages:

Risks:

Ideal for: Investors and institutions involved in strategic futures trading over macroeconomic cycles.

4. Algorithmic (Algo) Futures Trading

Definition:

Algorithmic trading, or “algo trading,” uses computer programs to automatically execute trades based on coded strategies.

Core Features:

Popular Models:

Advantages:

Risks:

Ideal for: Quantitative traders, developers, and firms embracing automation in trading futures.

5. Systematic Futures Trading

Definition:

Systematic trading relies on a set of predetermined rules and quantitative models to generate trade signals. It’s the foundation for most professional futures trading systems.

Core Features:

Examples of Systems:

Advantages:

Risks:

Ideal for: Traders seeking long-term consistency and structure in trading in futures.

6. Discretionary Futures Trading

Definition:

Discretionary traders use experience, intuition, and interpretation rather than fixed systems to make trading decisions.

Core Features:

Advantages:

Risks:

Ideal for: Experienced individuals who have mastered their emotional discipline and chart interpretation.

7. Spread Trading Futures

Definition:

Spread trading involves taking offsetting long and short positions in related futures contracts to profit from price differentials rather than outright price direction.

Common Types:

Advantages:

Risks:

Ideal for: Intermediate traders who prefer lower-risk strategies in futures trading.

8. High-Frequency Futures Trading (HFT)

Definition:

HFT uses ultra-fast algorithms and low-latency connections to capture small price inefficiencies in milliseconds.

Core Features:

Advantages:

Risks:

Ideal for: Institutional participants and prop firms equipped with advanced connectivity.

9. Hedging Futures Trading

Definition:

Hedging uses futures contracts to protect against unfavorable price movements in physical assets or investment portfolios.

Examples:

Advantages:

Risks:

Ideal for: Commercial entities and portfolio managers mitigating exposure through trading futures.

10. Quantitative Futures Trading

Definition:

Quantitative trading combines mathematics, statistics, and machine learning to design predictive trading models.

Core Features:

Advantages:

Risks:

Ideal for: Data scientists and institutional desks focused on predictive futures trading models.

11. News-Based Futures Trading

Definition:

News-based traders act on price volatility triggered by economic releases, earnings, or geopolitical events.

Core Features:

Advantages:

Risks:

Ideal for: Traders with access to fast data feeds and economic calendars.

12. Arbitrage Futures Trading

Definition:

Arbitrage exploits pricing inefficiencies between related instruments or markets to generate low-risk profits.

Examples:

Advantages:

Risks:

Ideal for: Institutional or quantitative traders with robust execution infrastructure.

13. Social and Copy Futures Trading

Definition:

A modern trend in trading in futures, social or copy trading allows users to replicate trades of experienced professionals through integrated brokerage platforms.

Core Features:

Advantages:

Risks:

Ideal for: New traders looking to learn futures trading while participating in live markets.

Choosing the Right Futures Trading Style

Each method of trading futures comes with distinct benefits and challenges. The key is matching your capital, risk tolerance, and lifestyle to the right approach.

|

Trading Style |

Holding Period | Main Tools | Best For |

|---|---|---|---|

| Day Trading | Minutes–Hours | Charts, order flow | Active traders |

| Swing Trading | Days–Weeks | Technical + Fundamental | Balanced traders |

| Position Trading | Weeks–Months | Macroeconomics | Long-term investors |

| Algorithmic / Systematic | Milliseconds–Days | Data models | Quant traders |

| Discretionary | Variable | Experience + Intuition | Veteran traders |

| Spread / Hedging | Weeks–Months | Correlation analysis | Risk managers |

| Arbitrage / Quantitative | Seconds–Days | Statistical models |

Institutions |

The best strategy often blends multiple approaches — for example, combining systematic entry rules with discretionary exits, or using algo-driven signals to refine swing trades. The diversity of trading in futures strategies is what makes the market both challenging and rewarding.

The Power of Strategy in Futures Trading

Success in futures trading doesn’t come from predicting every market move but from developing a structured plan and following it with consistency. The type of strategy you choose defines your routine, tools, and mindset.

Whether you prefer the adrenaline of day trading, the structure of systematic models, or the depth of position trading, remember that risk management and discipline are the true foundations of profitable trading in futures.

For over 35 years, Cannon Trading Company has been a trusted name in the U.S. futures industry — offering access to powerful platforms, transparent pricing, and personalized support. Whether you’re exploring algorithmic trading, discretionary trading in futures, or professional futures trading for hedging and speculation, Cannon Trading’s experienced brokers and platform variety help you trade smarter and safer.

Explore the next level of trading futures with tailored brokerage solutions, competitive margins, and dedicated customer service — all under one roof.

Open a Futures Trading Account with Cannon Trading Company and experience the difference that expertise and technology make.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

|

| Instrument | S2 | S1 | Pivot | R1 | R2 | ||

|---|---|---|---|---|---|---|---|

Gold (GC)— Dec (GCZ5) |

3861.93 | 3910.07 | 3978.13 | 4026.27 | 4094.33 | ||

Silver (SI)— Dec (SIZ5) |

46.01 | 46.69 | 47.60 | 48.28 | 49.19 | ||

Crude Oil (CL)— Dec (CLZ5) |

59.02 | 59.67 | 60.34 | 60.99 | 61.66 | ||

Dec. Bonds (ZB)— Dec (ZBZ5) |

117 7/32 | 117 20/32 | 118 13/32 | 118 26/32 | 119 19/32 |

It wasn’t even apparent during Chair Jerome Powell’s post-announcement news conference what triggered the price jolts in several of the futures markets this afternoon – including a ±50-point decline in the E-mini S&P 500 and a ±200-point decline in the E-mini Nasdaq in the span of eight minutes, or the ±$40 sell-off in gold in the span of two minutes.

Regardless of the cause, they served as the latest real-world examples of why it’s so important for traders of all types to assess the risks of their trades – before you enter into them – and have a plan to manage that risk. Day traders and position traders alike should be aware of important planned events – just like FOMC announcements and press conferences – and anticipate the potential risks to those events (these days it’s wise to include occasions when the U.S. president speaks, considering his ongoing involvement and influence in global trade relations).

These events certainly create opportunities for traders – outsize moves can also result in outsize favorable outcomes – but the most important aspect to trading – is always to manage risk.

Day 29 of the U.S Government shut-down, now the second-longest on record.

The Federal Reserve cut interest rates by a quarter of a percentage point today – its second consecutive rate cut, lowering the Fed’s benchmark interest rate to a range of 3.75 to 4 percent, its lowest level in three years.

We’re amidst earning season for the third quarter. Moving into full swing, all eyes were on Microsoft, Google-parent Alphabet and Facebook-owner Meta today– all releasing their latest earnings results after the closing bell.

Apple and Amazon

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

Get An Edge With the Trading Psychology Course“You must understand that there is more than one path to the top of the mountain.”- Miyamoto Musashi, A Book of Five Rings: The Classic Guide to StrategyMany experienced traders say that the stiffest challenge you’ll face in becoming a futures trader is conquering your own psyche. Why? Because losing is part of trading, and people hate to lose.In this “Trading Psychology” Course you will learn: · How to examine your patterns and behaviors and recognize when they are holding you back · Maintaining self-confidence as a trader even in the face of inexperience · The mathematical expectation model and how it can decrease your losses · Determining the trading plan that is right for your trading personality · Understanding and using Motivation – Risk – Reward to its full advantage · Creating effective trading technique strategies · Qualities of Successful Traders START FREE COURSE NOW |

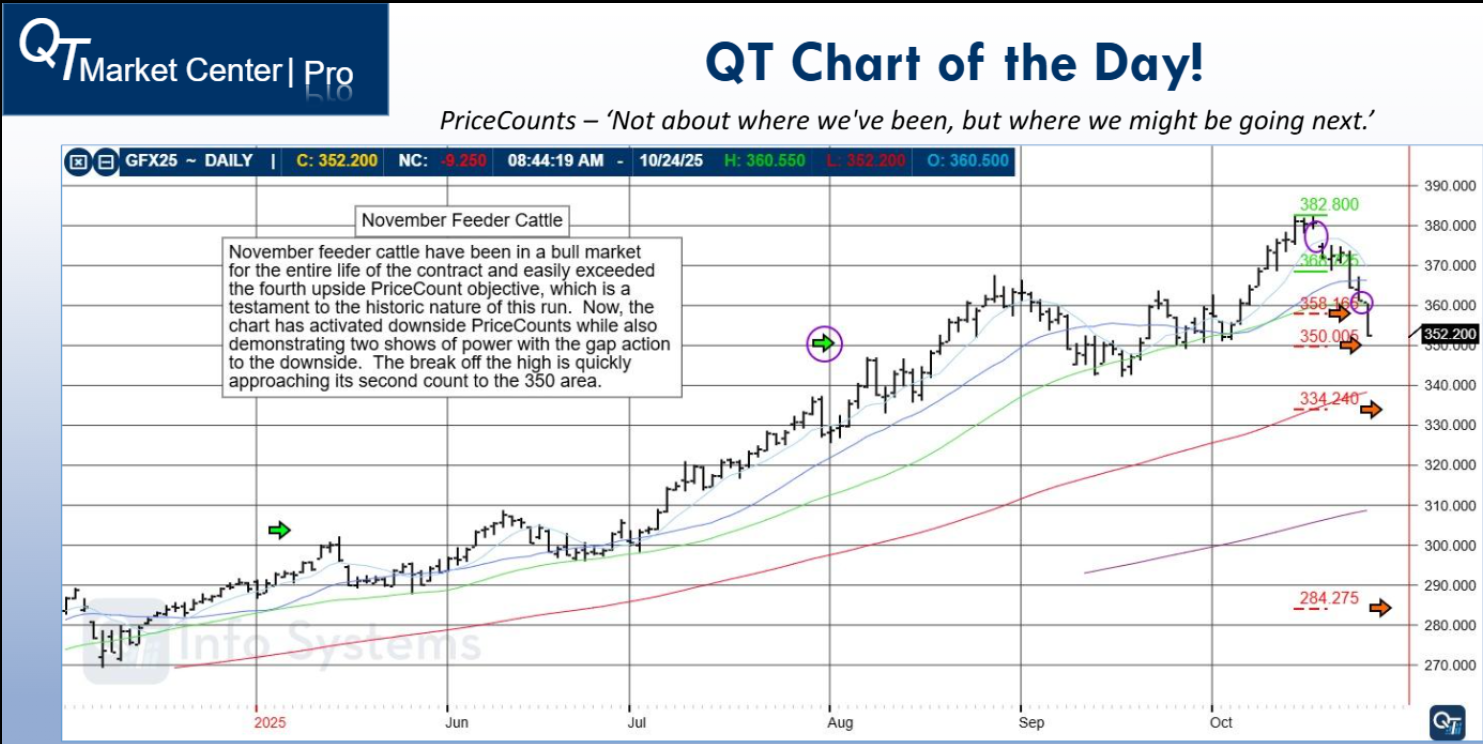

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

|

|

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|