Futures Trading

Futures markets are dynamic arenas where traders speculate, hedge, and invest across commodities, indices, currencies, and more. The approaches to futures trading are as diverse as the markets themselves — ranging from fast-paced day trading to long-term position trading, and from discretionary methods to cutting-edge algorithmic systems.

In this article, we’ll explore every major type of futures trading in detail — what defines each, how they work, and which styles suit different trader profiles. Whether you’re just starting trading in futures or already deep into advanced automation, understanding these approaches can help refine your strategy and results.

1. Day Trading Futures

Definition:

Day trading in futures is all about capitalizing on intraday price movements. Traders buy and sell contracts within the same session, closing all positions before the market ends.

Core Features:

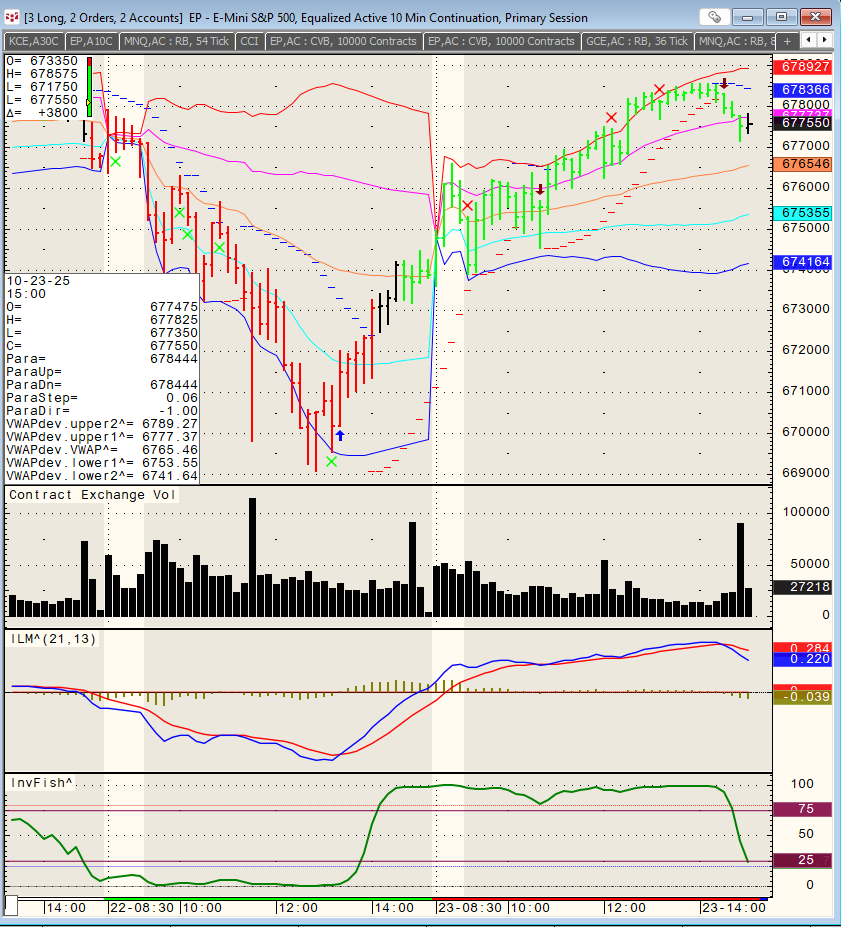

- Positions are opened and closed within minutes or hours.

- Traders rely heavily on real-time technical analysis and order flow.

- High-frequency decision-making and execution speed are critical.

Common Methods:

- Scalping: Executing numerous small trades to profit from tiny price moves.

- Momentum trading: Entering trades during strong directional pushes.

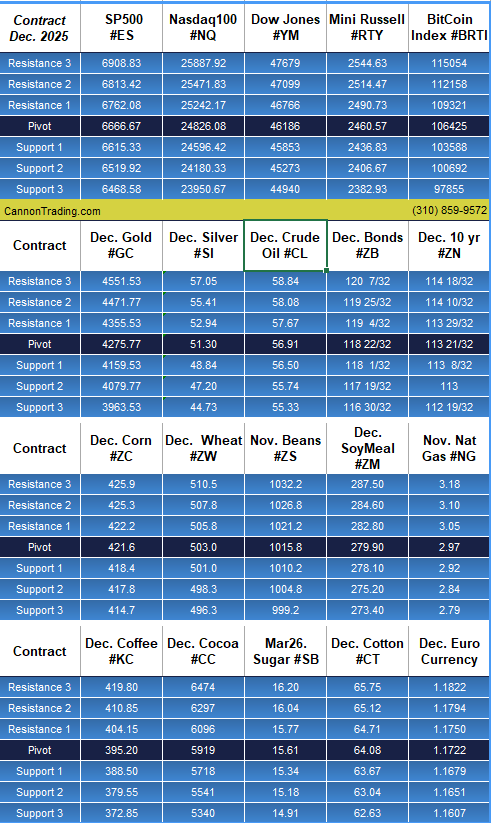

- Breakout trading: Acting when prices breach key levels of support or resistance.

Advantages:

- No overnight risk from global market gaps.

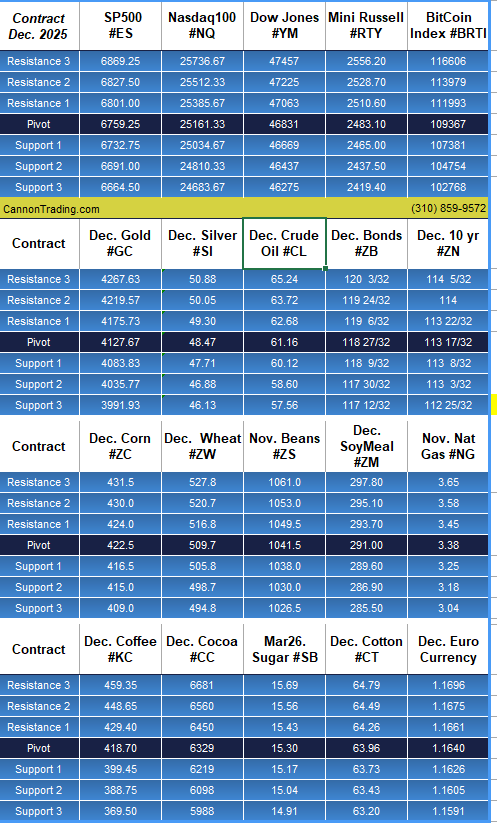

- Highly liquid markets like E-mini S&P 500, crude oil, and gold offer tight spreads.

Risks:

- Requires precision and emotional discipline.

- Frequent trades can lead to higher commissions and fatigue.

Ideal for: Traders who thrive in fast-paced environments and use advanced platforms for futures trading execution.

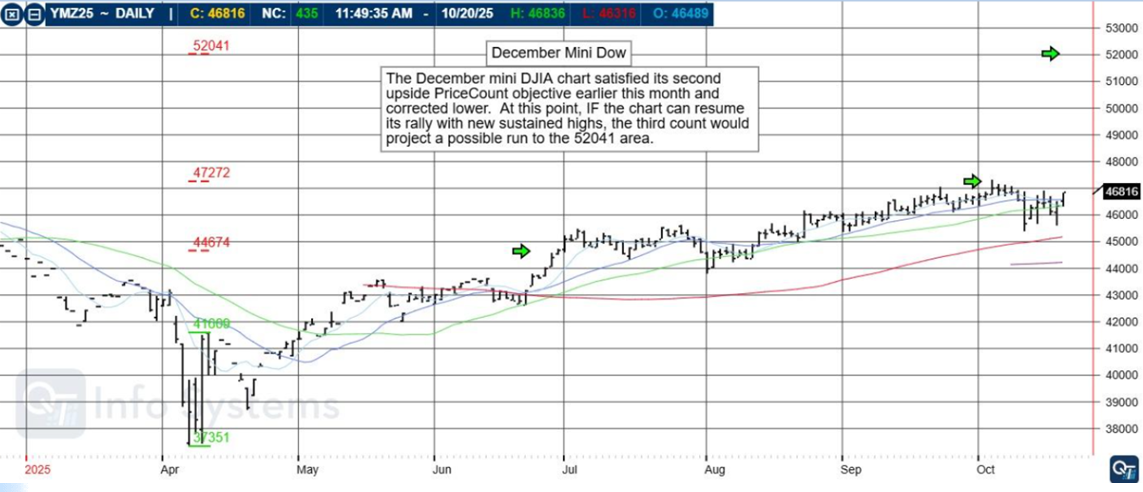

2. Swing Trading Futures

Definition:

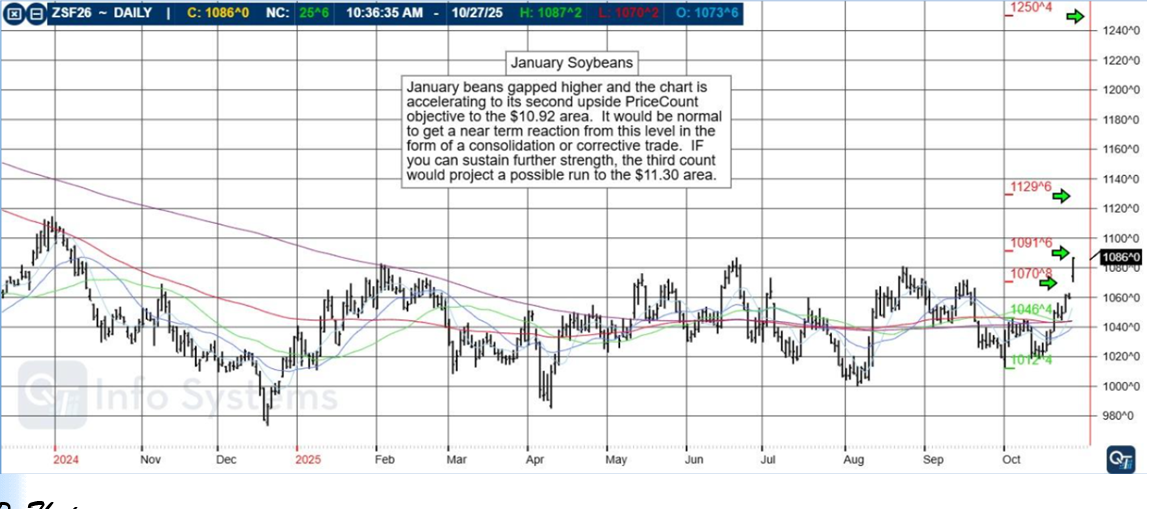

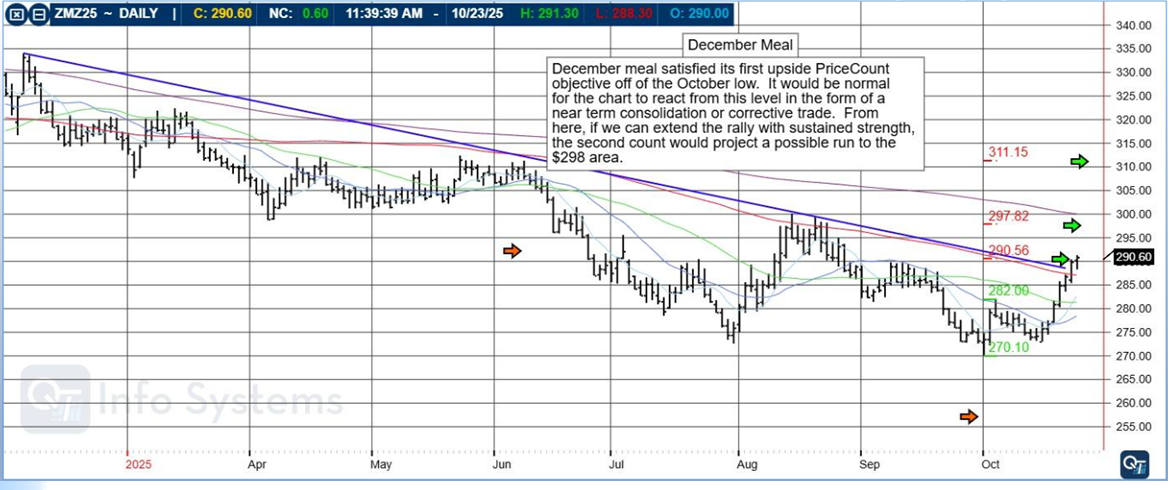

Swing traders hold futures positions for several days or weeks, seeking to capture short- to mid-term trends rather than intraday volatility.

Core Features:

- Combines technical and fundamental analysis.

- Positions last long enough to benefit from established market swings.

- Traders use stop-loss and profit targets wider than those of day traders.

Techniques:

- Trend-following with moving averages.

- Retracement or reversal entries using Fibonacci levels.

- Chart patterns like triangles or head-and-shoulders setups.

Advantages:

- Fewer trades and less screen time.

- Potential to capture larger percentage moves in price.

Risks:

- Overnight gaps can affect performance.

- Requires patience and strong risk management.

Ideal for: Professionals who cannot monitor markets constantly but still want meaningful participation in trading in futures.

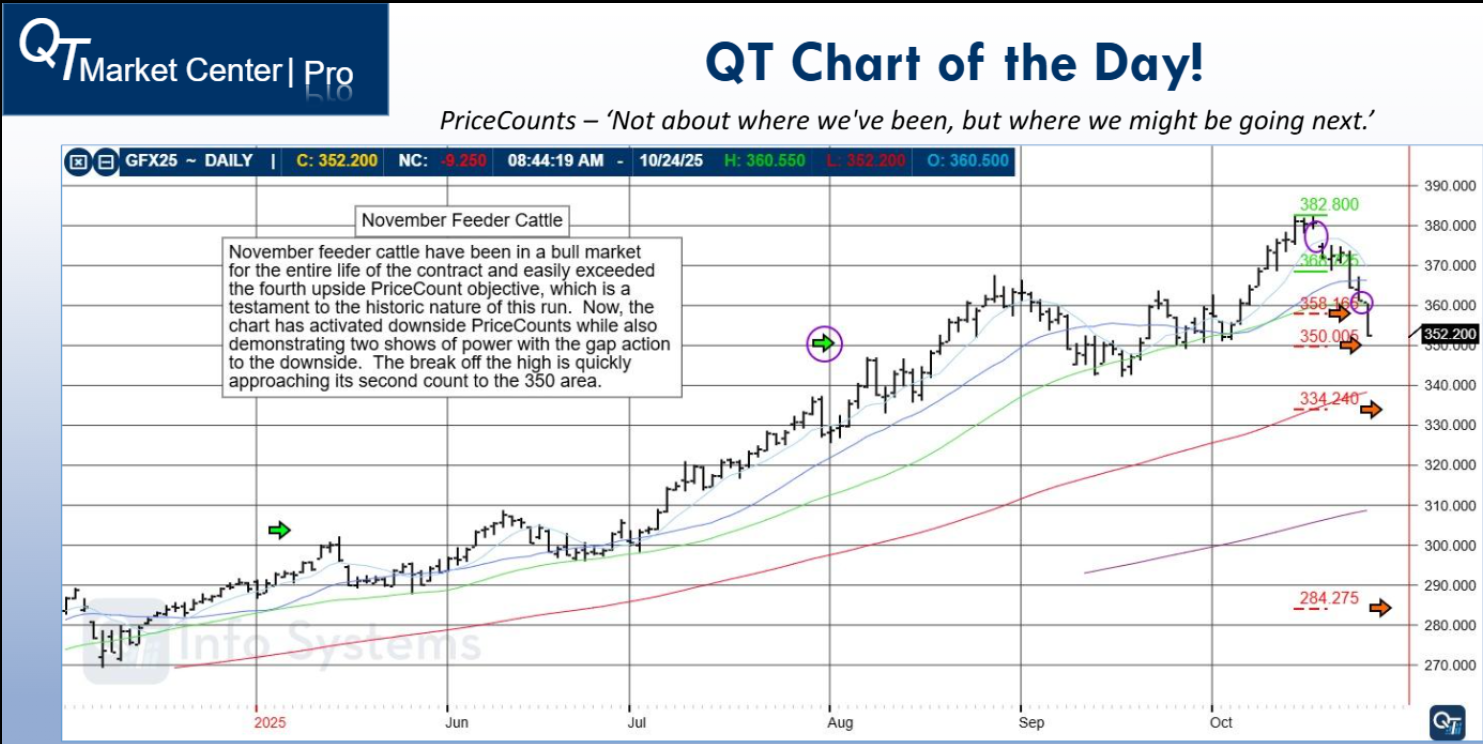

3. Position Trading Futures

Definition:

Position trading involves holding futures contracts for weeks, months, or even longer — targeting large, fundamental price trends.

Core Features:

- Focus on macroeconomic factors, such as interest rates, supply-demand cycles, and global sentiment.

- Traders often “roll over” expiring contracts to maintain exposure.

Techniques:

- Fundamental trend analysis using global data.

- COT (Commitment of Traders) reports for institutional sentiment.

- Seasonal trading in commodities (e.g., grains, natural gas).

Advantages:

- Big reward potential from major market cycles.

- Less emotional decision-making due to long-term perspective.

Risks:

- High margin requirements.

- Prolonged exposure to market and policy shifts.

Ideal for: Investors and institutions involved in strategic futures trading over macroeconomic cycles.

4. Algorithmic (Algo) Futures Trading

Definition:

Algorithmic trading, or “algo trading,” uses computer programs to automatically execute trades based on coded strategies.

Core Features:

- Removes emotional bias and executes trades at machine speed.

- Can scan multiple markets simultaneously.

- Commonly used by funds and proprietary firms.

Popular Models:

- Trend-following algos: Ride sustained market momentum.

- Mean reversion systems: Bet on prices reverting to their average.

- Arbitrage algorithms: Exploit price discrepancies across exchanges.

Advantages:

- High accuracy and backtesting capability.

- Round-the-clock monitoring of global markets.

Risks:

- Model errors or faulty data can trigger rapid losses.

- Requires technical expertise and system maintenance.

Ideal for: Quantitative traders, developers, and firms embracing automation in trading futures.

5. Systematic Futures Trading

Definition:

Systematic trading relies on a set of predetermined rules and quantitative models to generate trade signals. It’s the foundation for most professional futures trading systems.

Core Features:

- Fully rule-based decision-making process.

- Can be executed manually or automatically.

Examples of Systems:

- Moving average crossovers.

- Volatility breakout strategies.

- Trend channel trading.

Advantages:

- Removes emotion from trading.

- Backtestable and easy to scale across instruments.

Risks:

- Performance can deteriorate when markets shift regimes.

- Requires periodic optimization and review.

Ideal for: Traders seeking long-term consistency and structure in trading in futures.

6. Discretionary Futures Trading

Definition:

Discretionary traders use experience, intuition, and interpretation rather than fixed systems to make trading decisions.

Core Features:

- Combines technical setups, market news, and sentiment analysis.

- Entry and exit decisions are made manually.

Advantages:

- Highly flexible; allows adaptation to unique market conditions.

- Intuitive recognition of patterns beyond algorithmic logic.

Risks:

- Emotional decisions may lead to inconsistency.

- Hard to backtest or delegate.

Ideal for: Experienced individuals who have mastered their emotional discipline and chart interpretation.

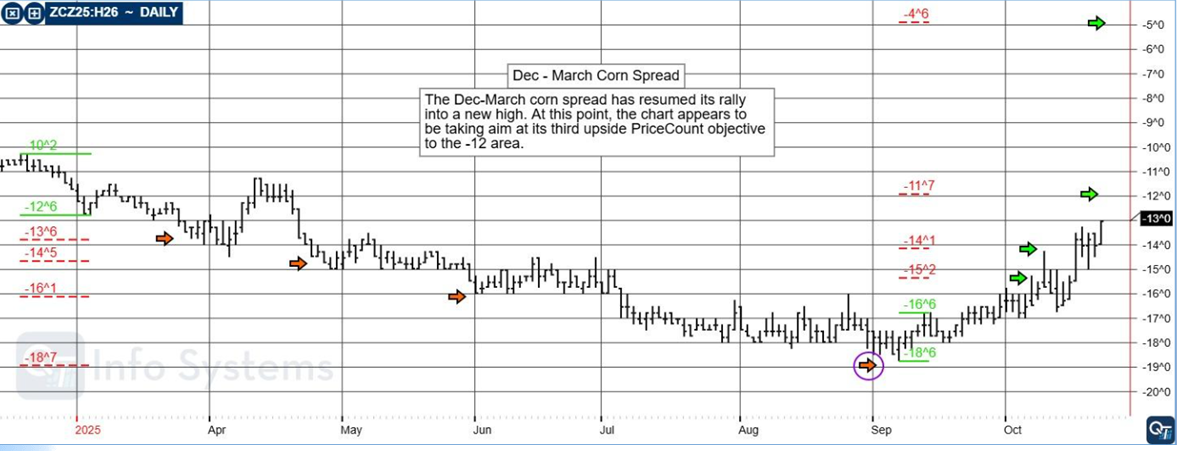

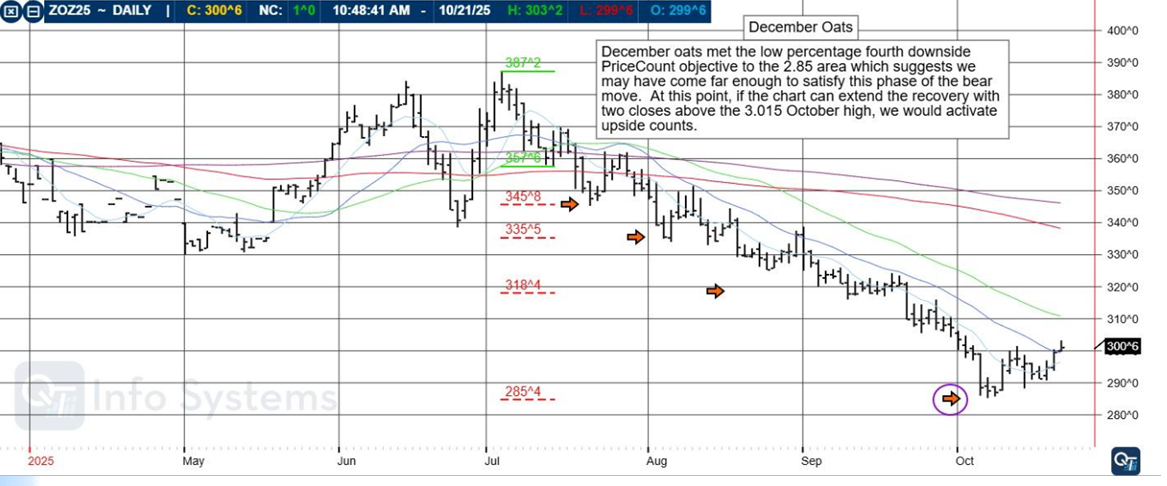

7. Spread Trading Futures

Definition:

Spread trading involves taking offsetting long and short positions in related futures contracts to profit from price differentials rather than outright price direction.

Common Types:

- Calendar spreads: Buying one month’s contract and selling another.

- Inter-market spreads: Trading two correlated commodities (e.g., long corn, short wheat).

- Inter-exchange spreads: Arbitrage between exchanges.

Advantages:

- Lower volatility than directional trades.

- Smaller margin requirements.

Risks:

- Narrow profit potential.

- Spread relationships can widen unexpectedly.

Ideal for: Intermediate traders who prefer lower-risk strategies in futures trading.

8. High-Frequency Futures Trading (HFT)

Definition:

HFT uses ultra-fast algorithms and low-latency connections to capture small price inefficiencies in milliseconds.

Core Features:

- Focused on microstructure of markets.

- Executes thousands of trades per day.

Advantages:

- Tiny profits magnified by massive volume.

- Minimal human involvement.

Risks:

- High infrastructure costs.

- Dependent on technological edge and regulation.

Ideal for: Institutional participants and prop firms equipped with advanced connectivity.

9. Hedging Futures Trading

Definition:

Hedging uses futures contracts to protect against unfavorable price movements in physical assets or investment portfolios.

Examples:

- A farmer sells corn futures to lock in harvest prices.

- A fund buys S&P 500 futures to hedge equity exposure.

Advantages:

- Reduces risk and stabilizes returns.

- Allows better financial planning.

Risks:

- Limits upside potential.

- Requires accurate hedge ratio calculation.

Ideal for: Commercial entities and portfolio managers mitigating exposure through trading futures.

10. Quantitative Futures Trading

Definition:

Quantitative trading combines mathematics, statistics, and machine learning to design predictive trading models.

Core Features:

- Data-driven; uses historical and real-time data for optimization.

- Often overlaps with algorithmic and systematic strategies.

Advantages:

- Objective, scalable, and research-based.

- Enables diversification across markets.

Risks:

- Models can fail in extreme volatility or low liquidity.

- Requires continuous validation.

Ideal for: Data scientists and institutional desks focused on predictive futures trading models.

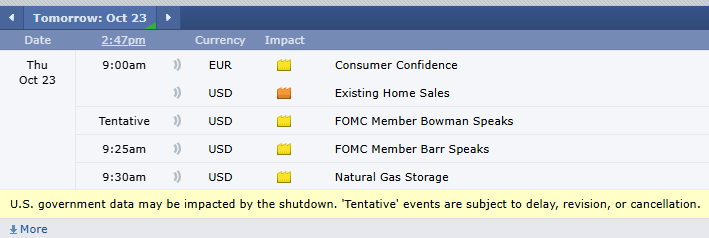

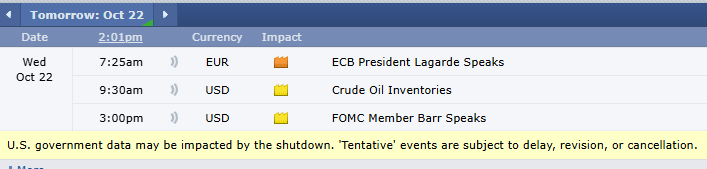

11. News-Based Futures Trading

Definition:

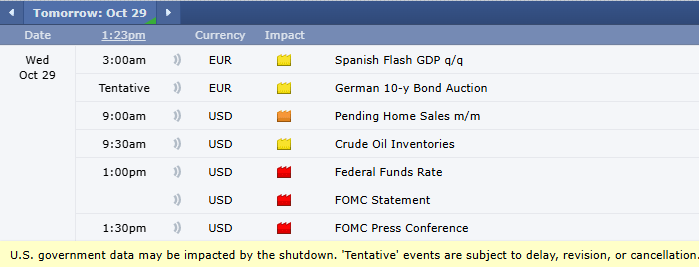

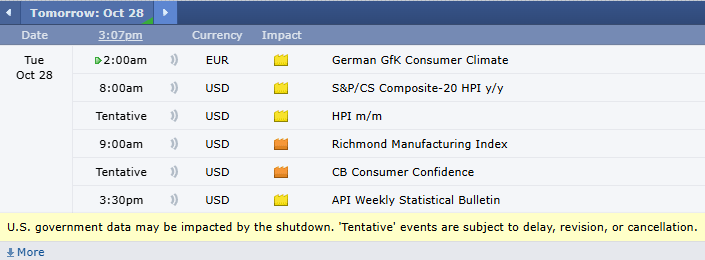

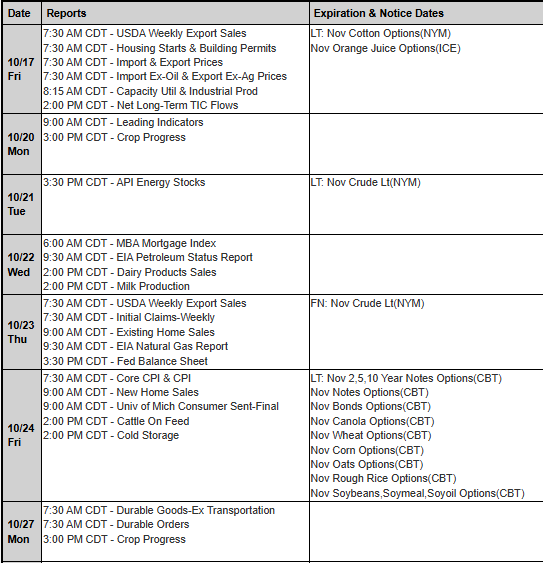

News-based traders act on price volatility triggered by economic releases, earnings, or geopolitical events.

Core Features:

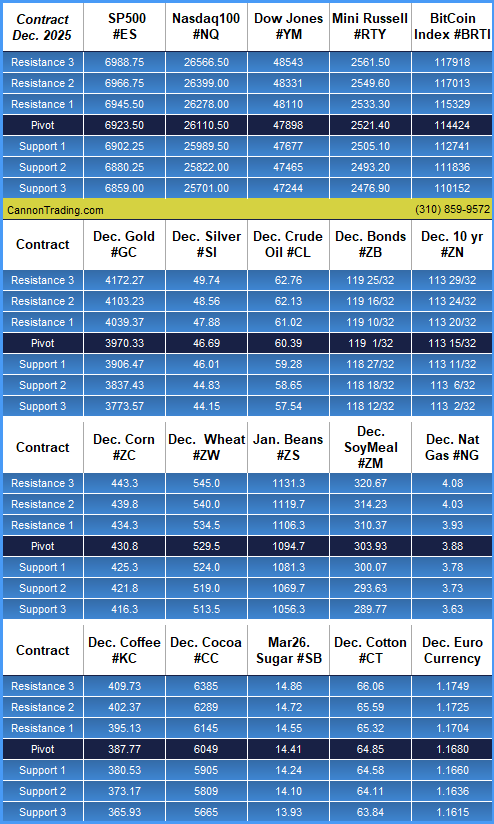

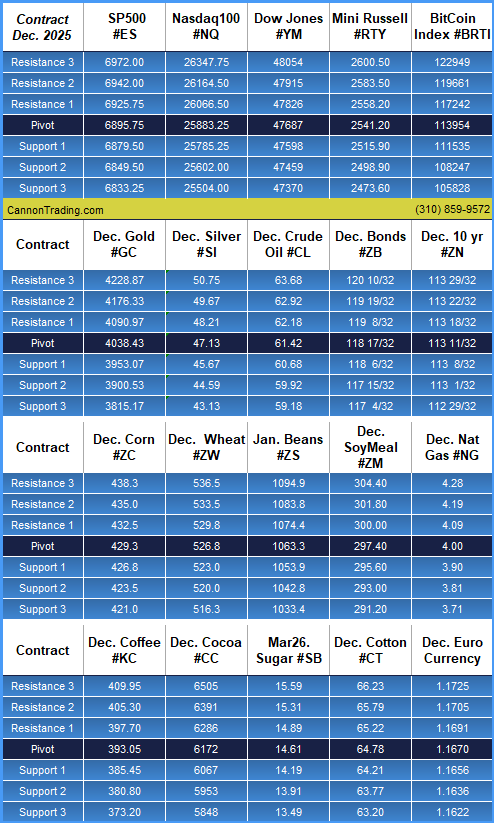

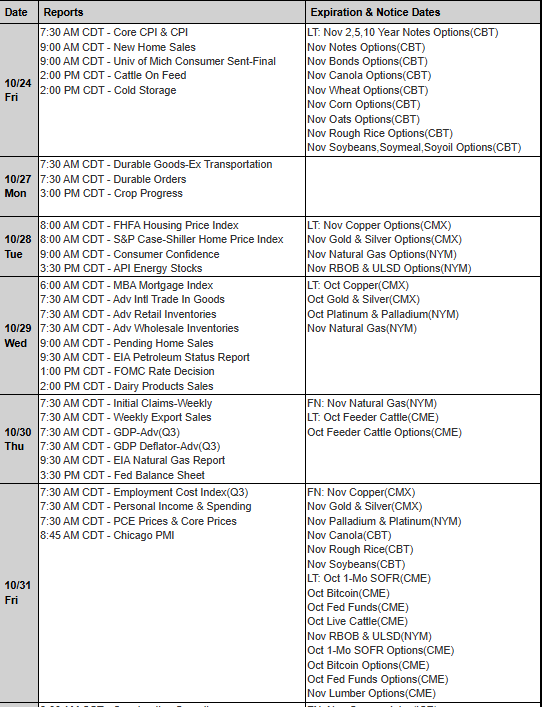

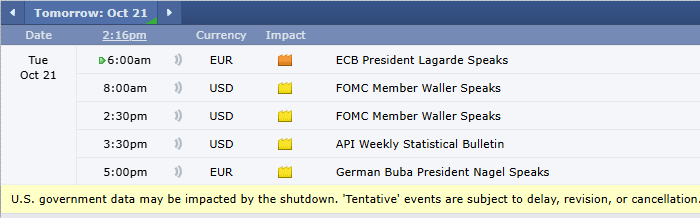

- Short-term trading around announcements (like CPI, FOMC, or inventory data).

- Relies on fast execution and market awareness.

Advantages:

- High potential during volatility bursts.

- Can be automated for event-based responses.

Risks:

- Slippage and widening spreads can occur.

- Requires speed and timing precision.

Ideal for: Traders with access to fast data feeds and economic calendars.

12. Arbitrage Futures Trading

Definition:

Arbitrage exploits pricing inefficiencies between related instruments or markets to generate low-risk profits.

Examples:

- Cash-and-carry arbitrage: Buying spot and selling futures when futures trade above fair value.

- Statistical arbitrage: Pair trading correlated instruments.

Advantages:

- Low directional exposure.

- Reliable when opportunities exist.

Risks:

- Execution delay can erase profit margin.

- Rare opportunities in highly efficient markets.

Ideal for: Institutional or quantitative traders with robust execution infrastructure.

13. Social and Copy Futures Trading

Definition:

A modern trend in trading in futures, social or copy trading allows users to replicate trades of experienced professionals through integrated brokerage platforms.

Core Features:

- Leverages collective insights.

- Provides learning opportunities for beginners.

Advantages:

- Easier entry point for new traders.

- Real-time exposure to proven strategies.

Risks:

- Over-reliance on others’ decisions.

- Results depend entirely on chosen signal providers.

Ideal for: New traders looking to learn futures trading while participating in live markets.

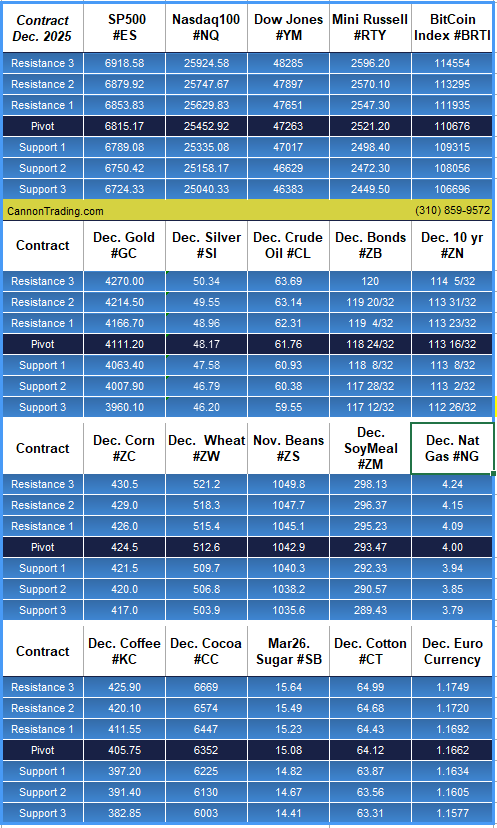

Choosing the Right Futures Trading Style

Each method of trading futures comes with distinct benefits and challenges. The key is matching your capital, risk tolerance, and lifestyle to the right approach.

|

Trading Style |

Holding Period | Main Tools | Best For |

|---|---|---|---|

| Day Trading | Minutes–Hours | Charts, order flow | Active traders |

| Swing Trading | Days–Weeks | Technical + Fundamental | Balanced traders |

| Position Trading | Weeks–Months | Macroeconomics | Long-term investors |

| Algorithmic / Systematic | Milliseconds–Days | Data models | Quant traders |

| Discretionary | Variable | Experience + Intuition | Veteran traders |

| Spread / Hedging | Weeks–Months | Correlation analysis | Risk managers |

| Arbitrage / Quantitative | Seconds–Days | Statistical models |

Institutions |

The best strategy often blends multiple approaches — for example, combining systematic entry rules with discretionary exits, or using algo-driven signals to refine swing trades. The diversity of trading in futures strategies is what makes the market both challenging and rewarding.

The Power of Strategy in Futures Trading

Success in futures trading doesn’t come from predicting every market move but from developing a structured plan and following it with consistency. The type of strategy you choose defines your routine, tools, and mindset.

Whether you prefer the adrenaline of day trading, the structure of systematic models, or the depth of position trading, remember that risk management and discipline are the true foundations of profitable trading in futures.

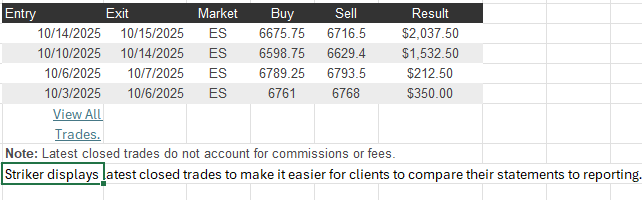

Start Trading Futures with Cannon Trading Company

For over 35 years, Cannon Trading Company has been a trusted name in the U.S. futures industry — offering access to powerful platforms, transparent pricing, and personalized support. Whether you’re exploring algorithmic trading, discretionary trading in futures, or professional futures trading for hedging and speculation, Cannon Trading’s experienced brokers and platform variety help you trade smarter and safer.

Explore the next level of trading futures with tailored brokerage solutions, competitive margins, and dedicated customer service — all under one roof.

Open a Futures Trading Account with Cannon Trading Company and experience the difference that expertise and technology make.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading