|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

- Bitcoin Futures (114)

- Charts & Indicators (307)

- Commodity Brokers (589)

- Commodity Trading (846)

- Corn Futures (64)

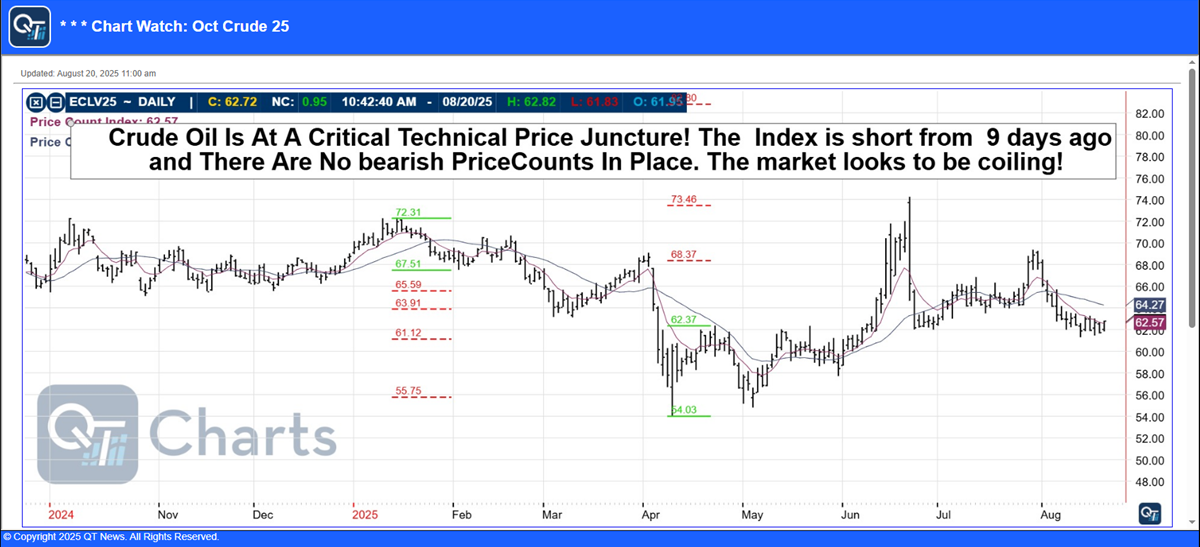

- Crude Oil (230)

- Currency Futures (102)

- Day Trading (658)

- Day Trading Webinar (61)

- E-Mini Futures (163)

- Economic Trading (166)

- Energy Futures (127)

- Financial Futures (178)

- Future Trading News (3,159)

- Future Trading Platform (327)

- Futures Broker (665)

- Futures Exchange (347)

- Futures Trading (1,266)

- futures trading education (446)

- Gold Futures (111)

- Grain Futures (101)

- Index Futures (271)

- Indices (233)

- Metal Futures (141)

- Nasdaq (79)

- Natural Gas (40)

- Options Trading (191)

- S&P 500 (145)

- Trading Guide (431)

- Trading Webinar (60)

- Trading Wheat Futures (45)

- Uncategorized (26)

- Weekly Newsletter (223)

Category: Commodity Brokers

Whether a person or a firm, a commodity broker is there to help you with your commodity trading needs. They either have a team of commodity traders under them or a platform that they manage electronically.

For all commodity trading beginners, commodity brokers are a point of contact that can be approached with individual commodity trading needs. To do good in commodity trading, it is important to take the advice of the commodity broker seriously. Under this category archive we discuss everything about commodity brokers and their expert skills.

We at Cannon Trading are there to help your commodity trading requirements. Whether you want to consult us and seek advice or to play a more active role for you in the markets, we are there to serve you with the best of our services. It is essential for you to choose only a certified broker and so, you can always trust us when it comes to qualifying on all quality parameters. No matter which commodity interests you, our trading experts give you the right and real-time advice always. Read our archive; share posts with your friends; or bookmark this page to stay up-to-date on commodity brokers.

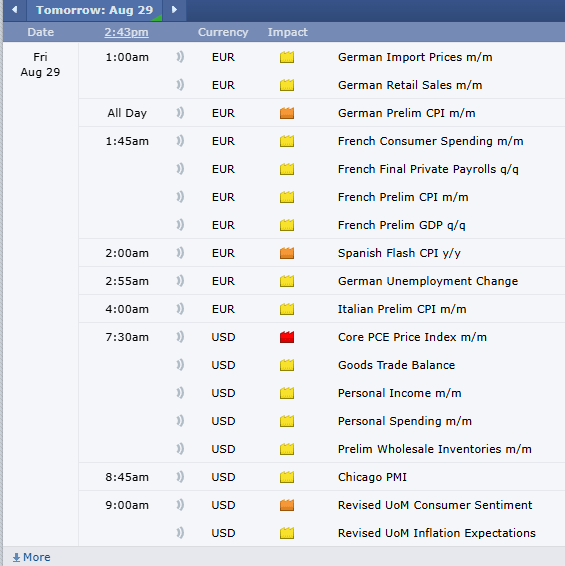

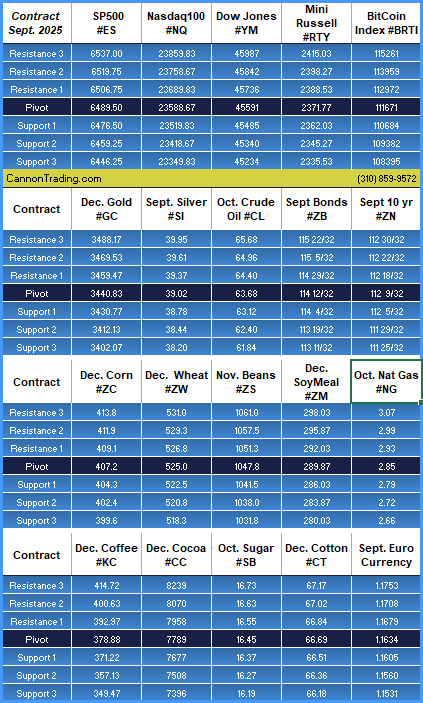

PCE Tomorrow, Labor Day Weekend Trading Hours, Levels, Reports; Your 5 Important Need-To-Knows for Trading Futures on August 29th, 2025

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Silver Futures Contract; Your 6 Important Need-To-Knows for Trading Silver Futures Contracts

Silver Futures Contract

The silver futures contract is a powerful instrument for investors and speculators seeking exposure to the silver market without directly owning the physical metal. As we move into the final two trimesters of 2025, the silver market stands at a critical juncture influenced by macroeconomic shifts, industrial demand, and investor sentiment. In this detailed analysis, we’ll explore the expected trajectory of silver futures prices, key drivers shaping the market, and how reputable firms like Cannon Trading Company provide a robust foundation for trading success.

With decades of experience, 5-star TrustPilot ratings, and a reputation for excellence with both federal and independent regulators, Cannon Trading Company is one of the best futures brokers for navigating the complexities of trading futures—particularly in volatile markets like silver.

The Role and Mechanics of a Silver Futures Contract

A silver futures contract is a legally binding agreement to buy or sell a specific quantity of silver (typically 5,000 troy ounces) at a predetermined price and date in the future. These contracts are traded on commodities exchanges like the CME Group and are used for hedging, speculation, and price discovery.

Key Features

- Standardization: Contracts are standardized, ensuring uniformity in terms of quantity and quality of silver.

- Leverage: Futures trading allows traders to control large amounts of silver with a relatively small amount of capital.

- Liquidity: Silver futures are among the most actively traded contracts, providing high liquidity.

Whether you’re hedging against inflation or speculating on silver futures prices, this instrument offers a level of flexibility and exposure that spot silver simply cannot match.

Macroeconomic Landscape: What Lies Ahead for Silver Futures Contracts in 2025?

As we enter the second half of 2025, several critical factors are shaping the outlook for silver future prices.

- Monetary Policy and Interest Rates

The Federal Reserve’s trajectory in the latter half of 2025 is expected to shift slightly dovish after a series of rate hikes between late 2024 and early 2025. A cooling labor market and slowing inflation have raised the possibility of modest rate cuts. This could benefit precious metals, particularly silver, which tends to thrive in low-interest-rate environments.

Silver futures are inversely correlated with real interest rates. As yields decline, the opportunity cost of holding non-yielding assets like silver diminishes, potentially driving up silver futures prices.

- Geopolitical Uncertainty

Escalating tensions in Eastern Europe and disruptions in global trade routes have increased the appeal of safe-haven assets. Investors traditionally turn to gold, but silver, being both a precious and industrial metal, sees dual inflows from risk-averse and opportunistic investors.

These geopolitical developments could lead to increased volatility in the silver futures contract market, attracting traders looking for profitable price swings.

- Industrial Demand Boom

Silver’s unique properties make it indispensable for several high-growth industries:

- Green Energy: Solar panels use large quantities of silver. With global solar deployment expected to hit record levels in late 2025, demand will rise.

- EV Manufacturing: Electric vehicles utilize silver in batteries, wiring, and semiconductors.

- Electronics: 5G infrastructure and AI server farms require significant silver input.

As industrial usage rises, silver future prices may experience strong upward pressure, especially during Q3 and Q4 when many factories ramp up production ahead of the holiday and fiscal year-end cycles.

Silver Futures Price Forecast for the Final Trimesters of 2025

Q3 2025: Moderate Bullish Outlook

- Expected range: $33.00 – $42.00 per ounce

- Drivers:

- Rate cut expectations from the Federal Reserve

- Strong Q2 earnings in renewable energy and EV sectors

- Ongoing geopolitical instability

Market participants may see silver futures prices move steadily upward in Q3, but not without periods of pullbacks and profit-taking.

Q4 2025: High Volatility with Bullish Tilt

- Expected range: $33.50 – $40.00 per ounce

- Drivers:

- End-of-year fund reallocations

- Strong holiday season demand for electronics

- Potential short-covering rallies

Q4 may witness explosive moves in silver futures, driven by institutional repositioning and tight physical supply constraints. Traders should be prepared for sudden price swings, making risk management crucial.

Why Cannon Trading Company Is a Leading Futures Brokerage for Silver Traders

Navigating the nuanced world of trading futures, especially something as volatile as silver, requires expertise, reliable tools, and exceptional client support. That’s exactly what Cannon Trading Company delivers.

- Decades of Experience

Established in 1988, Cannon Trading Company has weathered every major market storm, from the Dot-Com Bubble to the 2008 financial crisis to the COVID-19 crash. Their longevity is a testament to their deep knowledge of futures trading and their ability to adapt to new challenges.

When dealing with complex instruments like the silver futures contract, experience is everything.

- Exceptional Regulatory Reputation

Cannon Trading maintains an exemplary standing with both federal regulators (such as the CFTC and NFA) and independent industry watchdogs. This ensures clients operate in a secure, compliant, and transparent trading environment.

Among futures brokers USA, very few match the regulatory track record of Cannon Trading Company.

- TrustPilot Reviews: A Testament to Client Satisfaction

Cannon boasts numerous 5 out of 5-star ratings on TrustPilot, an independent consumer review platform. Clients routinely praise their responsiveness, personalized service, and the quality of their trading insights. This makes them a strong contender among the best futures brokers in the world.

“Knowledgeable brokers and amazing service. Always willing to help. Highly recommend!” – Verified TrustPilot Reviewer

- Wide Selection of Top-Tier Trading Platforms

Whether you’re a scalper, swing trader, or long-term investor in silver futures, Cannon Trading provides access to powerful trading platforms:

- CannonX powered by CQG: A premium platform known for lightning-fast execution and detailed market data. Ideal for traders who require precision and speed.

- MultiCharts and RTrader Pro: Advanced platforms offering robust charting and risk management tools.

Having access to multiple platforms allows traders to customize their strategy, which is essential when dealing with unpredictable silver future prices.

CannonX Powered by CQG: The Game-Changer

Among the various platforms offered, CannonX powered by CQG stands out. Built on one of the most reliable infrastructures in the industry, this platform enables:

- Real-time quotes for silver futures contracts

- Depth-of-market views to analyze order flow

- Risk management tools tailored for trading futures

- Mobile and desktop compatibility

For traders focused on silver futures prices, speed, accuracy, and low latency can mean the difference between a gain and a missed opportunity. CannonX delivers all three with finesse.

Futures Brokers vs. Best Futures Brokers: Why Cannon Leads

The difference between ordinary futures brokers and the best futures brokers lies in the details:

| Criteria | Average Brokers | Cannon Trading Company |

| Years in Business | 5–10 | 35+ |

| Platform Variety | 1–2 | 10+ |

| Regulatory Standing | Mixed | Exceptional |

| TrustPilot Ratings | 3.5–4.0 stars | 5 out of 5 stars |

| Client Support Hours | Limited | Extended (phone/email/chat) |

| Educational Resources | Basic | Extensive (blogs, webinars, 1-on-1 coaching) |

Traders seeking the best futures brokers for silver contracts will find that Cannon offers unmatched value in service and tools.

Educational Support: Equipping Traders for Success

Beyond just account management, Cannon Trading believes in empowering its clients. Their suite of educational materials includes:

- Webinars on silver futures contract trading

- Daily market commentaries

- Technical and fundamental analysis

- One-on-one mentorship sessions

This commitment to client growth distinguishes them from many future brokers who focus solely on transactional relationships.

Risk Management Strategies for Silver Futures Contracts

Trading silver futures contracts involves inherent risks due to leverage and market volatility. Here are some essential strategies Cannon brokers recommend:

- Set Stop-Loss Orders

To prevent catastrophic losses during rapid price reversals, use stop-loss levels based on technical indicators or volatility bands.

- Use Hedging Techniques

For portfolio managers, hedging with silver futures can protect against price fluctuations in physical holdings or ETFs.

- Stay Informed

Track economic indicators like interest rates, GDP data, and industrial production. These elements directly impact silver futures prices.

Cannon Trading supports these efforts by offering real-time market updates and personalized trading alerts, making it one of the most responsive futures brokers USA has to offer.

Silver Futures Contracts in the Global Context

It’s essential to remember that silver futures prices are influenced not just by domestic trends but by global events. Key international factors include:

- Chinese industrial output: China is the largest consumer of silver in manufacturing.

- Latin American mining supply: Peru and Mexico supply a significant portion of global silver.

- Currency volatility: A weakening dollar generally supports higher silver future prices.

Cannon Trading provides global insights through its research desk, ensuring clients stay ahead of international trends affecting silver futures.

The silver futures contract continues to be one of the most dynamic and rewarding financial instruments available to modern traders. With the final two trimesters of 2025 promising high volatility and potential bullish momentum, now is a pivotal time to get involved. Whether you’re a seasoned veteran or new to trading futures, choosing the right brokerage partner is crucial.

Cannon Trading Company stands out among futures brokers USA thanks to its:

- Decades of market expertise

- Top-tier platforms like CannonX powered by CQG

- 5-star TrustPilot reputation

- Commitment to education and client success

- Strong standing with federal and independent regulators

When evaluating futures brokers, there’s a clear distinction between average and elite. Cannon belongs in the upper echelon of best futures brokers, delivering consistent value, integrity, and results.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

Cattle, Crude Oil, Levels, Reports, Highlights; Your 5 Important Need-To-Knows for Trading Futures on August 28th, 2025

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

NVDIA, December Corn, Levels, Reports – even Kelce/Swift! Your 5 Important News for Trading Futures on August 27th, 2025

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

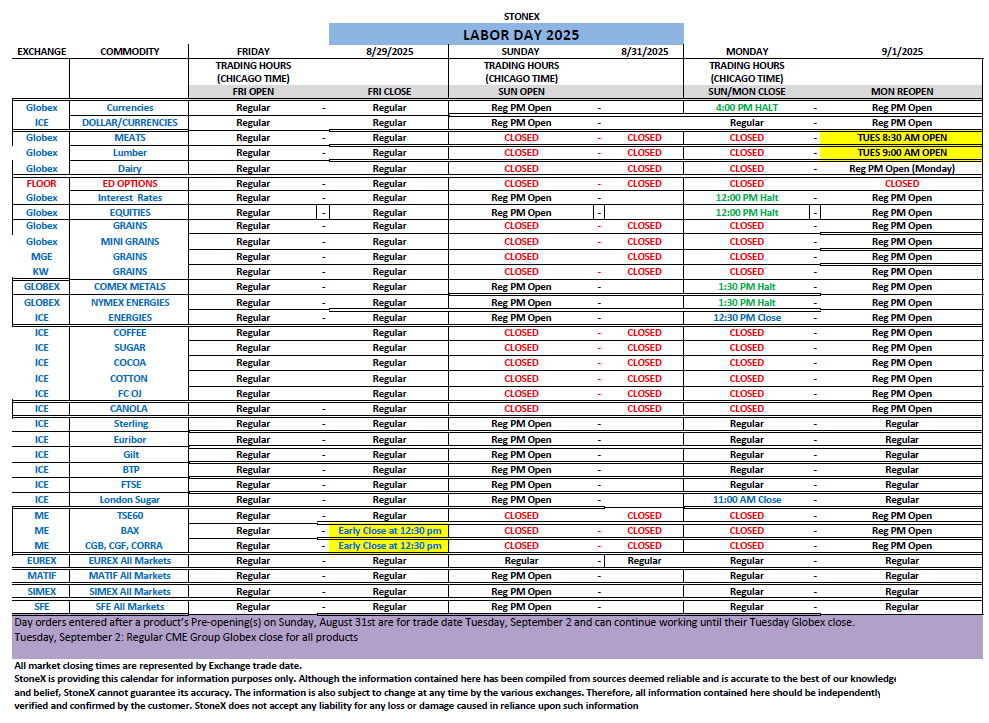

Labor Day 2025; Your Important Trading Calendar for the 3-Day Weekend

Labor Day 2025 FULL SCHEDULE

|

|

|

Micro XRP Futures; Your 8 Important Need-To-Knows for Trading Micro XRP Futures

Micro XRP Futures

The world of digital assets continues to evolve, and among the key innovations driving trader interest in 2025 is the emergence and growing popularity of micro XRP futures. As a smaller contract size of the more traditional XRP futures, micro XRP futures allow traders to access this fast-moving asset class with lower capital requirements, increased flexibility, and hedging precision. In the last two trimesters of 2025—covering the months of May through December—market watchers are keen to anticipate price trajectories, macroeconomic impacts, and the infrastructure supporting this segment.

In this in-depth article, we’ll explore what traders can expect from micro XRP futures in the remainder of 2025, delve into micro XRP futures price dynamics, and illustrate why Cannon Trading Company stands as one of the best futures brokers in the U.S. for those involved in trading futures—particularly digital asset derivatives.

Try a FREE Demo!

Understanding Micro XRP Futures: A Strategic Gateway to Digital Asset Derivatives

Before diving into forecast-based analysis, it’s essential to understand what micro XRP futures are and why they matter. Micro futures contracts are smaller versions of standard futures—often just 1/10th the size—which allow traders to manage exposure in a more controlled manner. In the case of micro XRP futures, these contracts allow speculators and hedgers to track XRP’s price movement without having to commit to the larger notional value of traditional XRP futures.

These contracts are particularly attractive for retail traders and institutions looking to fine-tune their strategies. With increased volatility in the digital asset space and growing adoption of XRP in international remittances and banking systems, micro XRP futures present an effective, capital-efficient trading tool.

The Second Two Trimesters of 2025: What Traders Can Expect

The remaining two trimesters of 2025—Q3 (July through September) and Q4 (October through December)—will be critical periods for XRP and by extension, micro XRP futures. Several macroeconomic, regulatory, and technical factors are likely to play significant roles.

- Ripple’s Expanding Use Case and Institutional Interest

Ripple Labs, the company behind XRP, continues to expand its partnerships with financial institutions across Europe, the Middle East, and Asia. By mid-2025, announcements regarding adoption of XRP for cross-border settlements and treasury management are expected to intensify. These developments will likely stimulate upward pressure on the micro XRP futures price, especially as institutional participation grows.

Institutional investors typically use futures contracts to hedge risk or gain leveraged exposure, and the availability of micro contracts allows even smaller institutions or sophisticated retail traders to follow suit. Expect volume in micro XRP futures to increase in parallel with the announcement of such partnerships.

- U.S. Regulatory Landscape and Clarity on XRP Classification

One of the main points of contention in the crypto space has been regulatory clarity. XRP has been at the center of legal and regulatory scrutiny for several years, particularly involving the U.S. Securities and Exchange Commission (SEC). However, as we move through 2025, there are expectations of finalized legislation around digital asset classification in the United States.

If XRP receives a formal designation as a commodity or a digital payment token, this could create positive momentum in the market. That kind of certainty would bolster trader confidence, increase institutional involvement, and potentially drive micro XRP futures prices higher in the last half of the year.

- Technical Analysis and XRP Price Trends

XRP entered 2025 with a moderate upward trend, building upon a strong Q4 in 2024. After a brief consolidation in Q2 2025, technical analysts expect a breakout pattern in Q3 based on symmetrical triangle formations and increasing trade volume.

As XRP’s spot price aims for the $1.50–$1.75 resistance zones by late Q3, micro XRP futures are likely to show significant price responsiveness. Traders involved in trading futures will need to watch closely for short-term volatility spikes, likely driven by speculative volume and news cycles. Precise entry and exit points will become crucial, and utilizing the flexibility of micro contracts will allow for tighter risk controls.

- Macro Influences: Fed Policy, Inflation, and Risk Appetite

The U.S. Federal Reserve’s interest rate policies and inflation data remain pivotal to all financial instruments, including crypto-based futures. If the Fed leans toward dovish policies in Q3 and Q4 2025, risk-on assets like XRP could experience tailwinds. That would reflect positively on micro XRP futures price movement as well.

Moreover, growing risk appetite due to a softer dollar and improving economic indicators may lead to broader participation in the futures trading space, including alternative digital assets like XRP. Micro contracts will serve as the gateway product for this fresh influx of interest.

Why Cannon Trading Company Is the Broker of Choice for Micro XRP Futures

Selecting a trustworthy, experienced futures broker is a critical decision when entering volatile, innovative markets like digital asset derivatives. In this respect, Cannon Trading Company stands out as a beacon of excellence.

- Decades of Experience in Futures Trading

Founded in 1988, Cannon Trading Company brings over three decades of experience to the table. Unlike newer entrants in the digital asset brokerage space, Cannon has weathered numerous market cycles and built its reputation on integrity, expertise, and client service.

Their long-standing presence gives them unique insight into the evolution of futures trading, including newer asset classes like crypto futures. Whether you’re trading commodities, interest rates, indices, or micro XRP futures, Cannon Trading Company ensures robust support, compliance, and execution quality.

- Top Ratings on TrustPilot and Industry Reputation

With many 5 out of 5-star ratings on TrustPilot, Cannon Trading Company is repeatedly recognized by clients as one of the best futures brokers in the United States. These reviews frequently cite the firm’s customer service, fast response times, and educational resources—all of which are indispensable for those trading complex instruments like micro XRP futures.

Moreover, Cannon has earned an exemplary reputation with both federal regulators (such as the CFTC) and independent oversight bodies like the National Futures Association (NFA). This clean compliance record provides peace of mind for traders who prioritize transparency and security.

- Access to Industry-Leading Futures Trading Platforms

One of Cannon’s strongest assets is its diverse selection of top-performing futures trading platforms, all tailored to various trading styles and asset focuses. For digital assets and micro XRP futures, the firm offers access to the CannonX platform, which is CannonX powered by CQG—a sophisticated trading solution designed for speed, precision, and real-time analytics.

CannonX delivers professional-grade tools including advanced charting, automated trading, and powerful risk management—all of which are essential for navigating micro XRP futures prices. With CQG’s ultra-low latency routing and Cannon’s dedicated client support team, traders can execute with confidence.

Try a FREE Demo!

The Micro Advantage: How Futures Brokers USA Are Shaping the Market

Micro contracts are democratizing access to futures markets across the U.S., especially with digital assets like XRP. While traditional contracts were once the domain of institutional players, micro futures provide the necessary granularity and flexibility that today’s trader demands.

Cannon Trading Company Leads Among Futures Brokers USA

Among all the futures brokers USA has to offer, Cannon Trading Company is especially notable for its hybrid approach: high-tech trading environments paired with personalized, human-led service. Traders can call in, chat online, or work one-on-one with an advisor to discuss their strategies for trading futures, including those in the digital asset space.

As one of the best futures brokers operating in the U.S., Cannon’s ability to tailor solutions based on client needs stands as a unique advantage. They aren’t a one-size-fits-all brokerage; instead, they adapt to your trading objectives, platform preferences, and risk tolerances.

The Future of Micro XRP Futures: Speculation, Strategy, and Support

As we move through the rest of 2025, micro XRP futures will increasingly serve as a key instrument for crypto-savvy traders. Whether you’re looking to hedge spot XRP positions, engage in speculative plays, or simply dip your toes into digital asset derivatives, these contracts offer unmatched accessibility.

Key considerations for traders in Q3 and Q4 2025 include:

- Staying informed on regulatory outcomes, especially involving the SEC and Ripple Labs.

- Tracking spot XRP movement and aligning futures strategies accordingly.

- Leveraging volatility spikes for short-term trades using micro contracts.

- Utilizing platforms like CannonX powered by CQG for advanced execution and strategy testing.

- Working with reputable futures brokers who understand both legacy commodities and new digital frontiers.

Why Cannon Trading Company is a Great Choice For Your Go-To Future Broker

In a trading environment where speed, reliability, and deep product knowledge matter, Cannon Trading Company continues to shine. Their commitment to transparency, client education, and platform excellence has helped them maintain a top-tier status among futures brokers USA.

If you’re considering entering the micro XRP futures market, Cannon offers every tool you need—from access to CannonX, to regulatory peace of mind, to five-star-rated service. They’re not just a futures broker; they are a long-term trading partner.

Whether you’re an experienced trader scaling down to micro contracts or a newcomer seeking high-touch service and smart execution, Cannon is the logical choice. With their assistance, you’ll be well-equipped to navigate the opportunities and risks that the final two trimesters of 2025 will bring in the world of micro XRP futures.

Try a FREE Demo!

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

For More Information On Micro Bitcoin Futures, click here

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

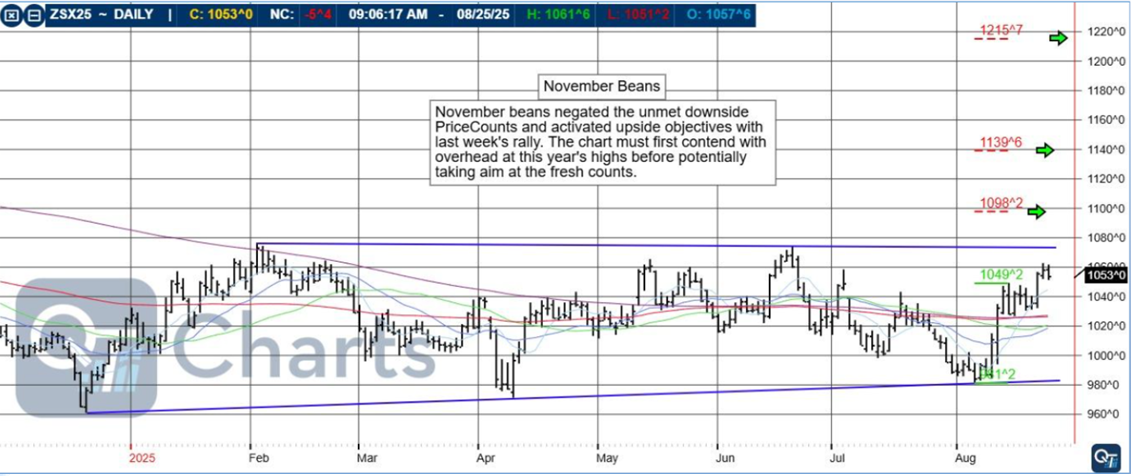

Markets post-Friday Surge, November Beans, Levels, Reports; Your 4 Crucial, Important Need-To-Knows for Trading Futures on August 26th, 2025

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

NVDIA, Interest Rates, September Mini Dow, Levels, Reports; Your 5 Crucial, Important Need-To-Knows for Trading Futures the Week of August 25th, 2025

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Trading Alerts – Free Trial! Plus Levels, Reports; Your 3 Crucial, Important Need-To-Knows for Trading Futures on August 22nd, 2025

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010