NFP – Non Farm Payrolls Tomorrow

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Investment is a game of money of securing future money by taking a risk today. Trading therefore comes with a list of rules to play by. Commodity trading in particular offers tremendous potential for becoming a completely different asset class.

However, before investing in any kind of commodity, you must do an in depth research and also ask your broker as many questions as possible. Through this category archive we provide you as much information and valuable insights into the world of commodity trading.

We at Cannon Trading are here to help you with your commodity trading needs. You as a trader should select your commodity trading advisor only after performing a due diligence on him/her. We in fact do that for you. This way, you get only the best advice to help you with your commodity trading.

We’ve got the information that you might need at every step of commodity trading, and you’ll find it all right here in the commodity trading section of our blog. Read up, and read on to get equipped!

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Futures trading has evolved dramatically in recent years with the rise of intuitive, real-time platforms that offer retail and professional traders powerful tools. Among them, TradingView has surged in popularity thanks to its dynamic charting, robust analytical tools, and social community features. In this article, we explore why the TradingView Futures Trading Platform stands out as a premier online futures trading platform and why Cannon Trading Company is a top-tier partner for those looking to take advantage of everything TradingView has to offer.

What Is the TradingView Futures Trading Platform?

The TradingView Futures Trading Platform is a sophisticated yet user-friendly online futures trading platform that delivers live charting, in-depth analytics, and direct broker connectivity for active traders. Available through the TradingView download, TradingView app, and TradingView Desktop, it provides access to global futures markets with a seamless trading experience.

With the TradingView free version offering basic capabilities and premium upgrades unlocking institutional-level tools, TradingView caters to both novice and professional traders. The platform is particularly well-known for its TradingView chart interface, which allows real-time visualization of market data and technical indicators, including TradingView chart live feeds from major exchanges.

Key Features of TradingView for Futures Trading

When it comes to futures trading, specific platform features can make all the difference. Here are the most important features of the TradingView Futures Trading Platform that set it apart:

The combination of precision and flexibility in the TradingView chart tool enables futures traders to analyze trends and execute strategies efficiently.

While the platform is critical, your choice of broker is equally important in determining your success in the futures markets. That’s where Cannon Trading Company truly shines. Here’s why they make an ideal partner for those using TradingView for futures trading:

Established in 1988, Cannon Trading Company has over 35 years of futures industry experience. Their team includes brokers with backgrounds in institutional trading, risk management, and commodity trading. This depth of expertise helps clients make informed decisions and leverage the full potential of tools like the TradingView chart.

Cannon Trading is a registered member of the National Futures Association (NFA) and operates under the strict oversight of the Commodity Futures Trading Commission (CFTC). Their spotless compliance record demonstrates an unwavering commitment to transparency and ethical standards in all client dealings.

This makes them a trusted partner when integrating a robust online futures trading platform like TradingView.

Cannon Trading has earned numerous 5 out of 5-star ratings on TrustPilot. Clients consistently praise their excellent customer service, fast execution speeds, and educational support. These accolades reflect their client-first philosophy and ensure a smooth TradingView app experience when connected to Cannon.

While TradingView is a premier choice, Cannon provides access to a broad array of trading software at no cost, including:

Unlike many large brokerage firms, Cannon Trading provides personalized service. You can speak to experienced professionals who will walk you through connecting your account to TradingView Desktop or help you troubleshoot features like TradingView chart live.

They also provide insights into using TradingView indicators and settings tailored to your risk tolerance and market goals.

Getting started is simple. Follow these steps to launch your journey with one of the best online futures trading platforms:

This partnership brings together the best of both worlds:

Whether you’re trading energy futures, metals, interest rate products, or indices, the TradingView and Cannon combo gives you the insight, control, and speed needed to succeed.

The TradingView Futures Trading Platform has revolutionized how traders approach the markets, offering intuitive tools like TradingView chart, TradingView chart live, and multi-device access through the TradingView app, TradingView Desktop, and TradingView free editions.

But pairing this cutting-edge platform with a highly rated, industry-respected broker like Cannon Trading Company takes your trading to the next level. With their decades of futures expertise, free platform offerings, personalized broker assistance, and a sterling reputation among regulators and clients, Cannon is a trusted name in futures trading.

Whether you’re just beginning or are a seasoned trader seeking to optimize your setup, leveraging TradingView through Cannon Trading is one of the smartest moves you can make in today’s futures landscape.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

In the dynamic world of online futures trading platforms, few names stand out as boldly as MotiveWave. As technology continues to evolve, traders demand more robust, analytical, and user-friendly tools. The MotiveWave Futures Trading Platform meets these demands head-on, delivering a comprehensive suite of features that elevate the trading experience for both novice and professional futures traders alike.

This article provides a deep dive into the MotiveWave trading environment, highlights key features that make it a premier choice for futures trading, and explores why Cannon Trading Company is the ultimate partner for leveraging MotiveWave’s power.

What is MotiveWave?

MotiveWave is a professional-grade futures trading platform known for its advanced charting tools, algorithmic trading capabilities, and comprehensive market analysis features. Initially gaining traction among forex and equity traders, MotiveWave has carved a prominent space within the online futures trading platform sector due to its reliability and feature-rich design.

Whether you’re focused on short-term scalping or long-term market trend analysis, MotiveWave trading tools are tailored to adapt to your trading style. From MotiveWave mobile access to full desktop integration via MotiveWave download, the platform ensures seamless continuity for traders on the move. Additionally, it supports custom workspaces and scripting with Java-based extensions, further enhancing the functionality for sophisticated trading needs.

Most Important Features for Futures Trading on MotiveWave

Accessing your trading environment is easy with the MotiveWave login process. The interface is secured with two-factor authentication, ensuring your data and trading activities are protected. Users can customize their workspace upon login, allowing for a personalized experience that matches individual trading preferences.

The MotiveWave download is available directly from the official website. Installation is straightforward, with support available for Windows, macOS, and Linux operating systems. Regular updates ensure the platform remains secure and compatible with the latest system features.

A common query among new users is: Is MotiveWave free? While MotiveWave offers a free trial version, its full capabilities are unlocked through tiered pricing plans. This freemium model allows users to test the interface and decide on the best plan that suits their trading needs. Considering its robust toolset, the MotiveWave price offers excellent value compared to competitors.

There are also occasional promotions through partners like Cannon Trading, which may include extended trial periods or discounted subscriptions. This makes testing the MotiveWave trading experience even more accessible.

Choosing the right brokerage is as crucial as selecting the right futures trading platform. Cannon Trading Company excels in this regard. Here’s why:

MotiveWave Review Summary

The feedback from users paints a highly favorable MotiveWave review. Traders cite the platform’s depth of analysis, customizability, and professional-grade tools as reasons for their loyalty. Whether evaluating MotiveWave software for the first time or switching from another futures trading platform, users consistently highlight its seamless performance and insightful analytics.

Professional traders appreciate how MotiveWave trading aligns with institutional tools, while new users benefit from the clear documentation and visual guides. This inclusivity ensures a smoother learning curve, especially when paired with educational materials from Cannon Trading.

Furthermore, the synergy between MotiveWave and Cannon Trading amplifies the platform’s benefits. Combining advanced technology with decades of industry expertise creates a powerful trading environment that is both innovative and secure.

The MotiveWave Futures Trading Platform stands out in a crowded marketplace by offering unparalleled features, powerful analytical tools, and wide-ranging compatibility. The repeated queries of MotiveWave login, MotiveWave price, and MotiveWave download are justified by the platform’s capabilities and reliability. While MotiveWave mobile ensures traders are never disconnected, the question “Is MotiveWave free” is best answered by its generous trial options and value-packed pricing tiers.

When partnered with a top-tier brokerage like Cannon Trading Company, traders gain access to world-class tools, unbeatable service, and a trusted advisor in their futures trading journey. If you’re looking to elevate your futures trading game, MotiveWave combined with Cannon Trading is a combination worth serious consideration.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

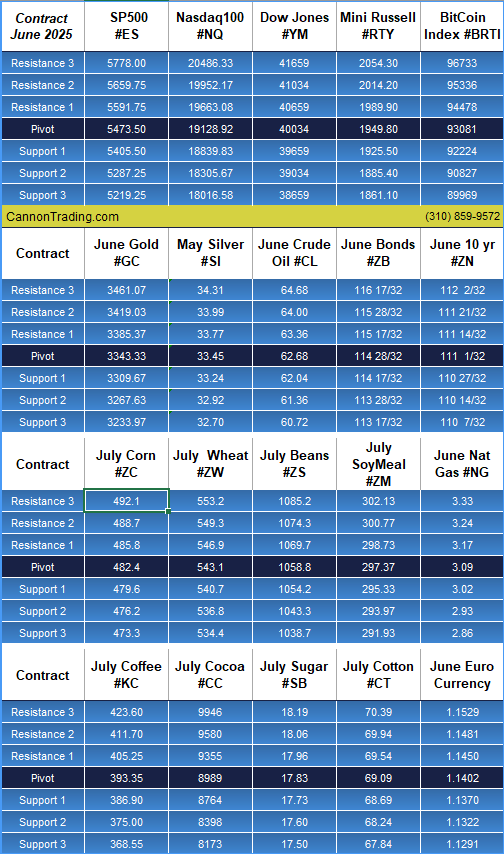

However, with volatility, you need to double check the status daily at:

We have a full day tomorrow! Reports, earnings and more global news in general.

Below you will see a quick video on how to set and utilize the bracket orders feature on the StoneX futures platform/ CQG desktop

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

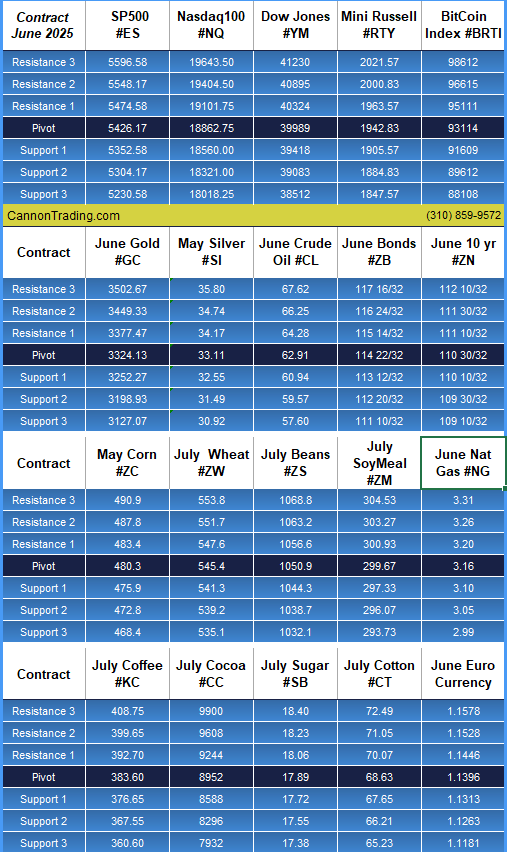

Day Trading margins are back to normal!

However, with volatility, you need to double check the status daily at:

Below you will see a quick video on how to set and utilize the bracket orders feature on the StoneX futures platform/ CQG desktop

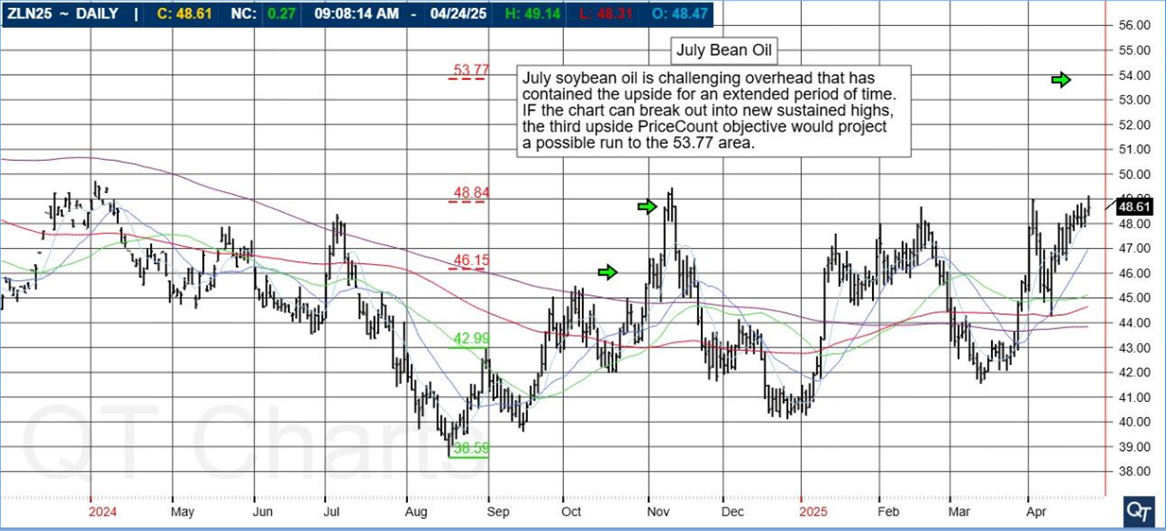

July soybean oil is challenging overhead that has contained the upside for an extended period of time. IF the chart can break out into new sustained highs, the third upside PriceCount objective would project a possible run to the 53.77 area.

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk.

Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

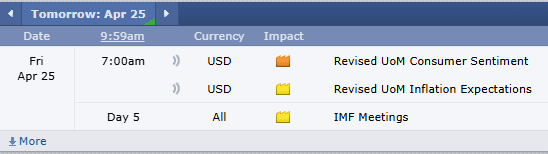

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

In a world that never stops shifting, futures trading has remained a core pillar of modern financial markets. With increased geopolitical uncertainties, ongoing economic upheavals, and recent shifts in U.S. trade policy, professional traders have turned to sophisticated strategies to adapt, survive, and thrive.

At the heart of these strategies is the use of futures contracts, leveraged financial instruments that allow traders to speculate on the direction of prices for commodities, currencies, indices, and interest rates. Today’s article not only highlights 10 expert trading techniques used during market volatility but also explains how your futures broker plays a critical role in facilitating these trades while managing risk. Special attention is given to the ripple effects of tariffs imposed by President Donald Trump and their lingering influence on futures markets. Finally, we’ll spotlight Cannon Trading Company, one of the best futures brokers in the business, exploring how it has built and maintained its impressive legacy.

The tariffs President Trump’s administration imposed—especially on steel, aluminum, and Chinese goods—continue to affect futures markets today. These policies have reshaped global supply chains and introduced lasting price distortions in key commodities like soybeans, crude oil, and industrial metals.

Lingering Impacts Include:

As a result, professional futures trading strategies must now incorporate macroeconomic forecasting and geopolitical analysis to remain effective.

For more than three decades, Cannon Trading Company has been synonymous with excellence in futures trading. Here’s why traders—from beginners to professionals—consider it among the best futures brokers in the industry:

No automated voice systems. At Cannon, real brokers—many with over 20 years of experience—are a call away. This direct human connection ensures that your trades and concerns receive immediate attention.

Whether you prefer technical analysis, fast execution, or automated strategies, Cannon offers FREE access to leading platforms like:

These platforms empower futures traders with speed, precision, and customization.

Boasting numerous 5-star reviews on TrustPilot, Cannon Trading is recognized for its ethical practices and reliability. With a clean regulatory track record and transparent fee structures, clients know they’re in safe hands.

Founded in 1988, Cannon has weathered every market storm from the dot-com bubble to the COVID-19 pandemic. Its endurance is a testament to strong leadership, financial prudence, and client-centric philosophy.

From grains to cryptocurrencies, Cannon supports trading across a broad spectrum of futures contracts, offering both diversity and specialization.

Cannon maintains stellar standing with industry regulators such as the NFA and CFTC. This instills trust and peace of mind for clients around the globe.

In volatile markets, survival depends on precision, discipline, and the right partnerships. Advanced trading techniques are only as good as the tools and guidance behind them. A seasoned futures broker not only facilitates trades but also acts as a strategic ally.

In this ever-evolving landscape, trading futures remains both a science and an art. And with Cannon Trading Company by your side, you gain not just a service provider, but a legacy partner committed to your success.

For more information, click here.

Ready to start trading futures? Call us at1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

In the fast-paced, high-stakes world of futures trading, where precision, timing, and insight spell the difference between profit and peril, the role of a qualified futures broker is not only instrumental—it is indispensable. For seasoned traders and novices alike, the guidance of an experienced, trustworthy broker can determine not just individual trade outcomes but also the overall trajectory of one’s trading career. As trading becomes more technologically advanced and globally interconnected, the need for human expertise, personalized guidance, and reliable support becomes even more essential.

This comprehensive article will delve deep into the inherent, undeniable values of commissioning a qualified, reliable futures broker, outline the key characteristics of successful professionals in this field, evaluate the risks and benefits clients face depending on their broker selection, and spotlight why Cannon Trading Company has become synonymous with trust, longevity, and client-first service in the futures trading industry.

A futures broker plays a multifaceted role in facilitating and optimizing the futures trading experience. Unlike automated trading systems or impersonal platforms, a qualified futures broker provides individualized insights, robust risk management strategies, technical expertise, and access to essential trading tools.

Futures trading involves contracts based on the anticipated future value of commodities, indices, currencies, interest rates, and more. Each contract type comes with its own rules, liquidity profiles, margin requirements, and risk profiles. A competent futures broker is trained to understand these nuances and can help traders make informed decisions.

A futures broker can offer traders a strategic advantage by evaluating market conditions, identifying opportunities, and guiding clients toward actionable trades. Importantly, brokers can help tailor risk management strategies to each client’s tolerance and goals—be it through stop-loss placement, diversification, or hedging techniques. This personalized risk governance is invaluable, especially when trading leveraged instruments like futures contracts.

The best futures brokers bring real-time insights to the table, staying abreast of economic data, geopolitical developments, and technical signals that could impact markets. Their expertise can be the linchpin between capitalizing on a trend or suffering an avoidable loss. They also ensure that orders are executed swiftly and precisely—critical in volatile markets where every tick counts.

While many claim to offer trading services, only a select few are consistently recognized as top-tier futures brokers. Here are the most common characteristics found in highly reviewed professionals:

Every trader seeks an edge, and partnering with a top-notch futures broker offers precisely that. Here’s how these inherent values translate into direct benefits:

By gaining access to timely market insights, analytical support, and strategic guidance, traders can enhance their trading. A great futures broker serves as both a mentor and a partner in profit.

Proper risk controls are a hallmark of professional trading. Reliable brokers ensure that each trade aligns with a client’s risk appetite and financial goals. They can help prevent catastrophic losses through sound advice and oversight.

Knowing that a trusted expert is monitoring your trades, is available for consultation, and is proactively looking out for your interests; these facets can bring peace of mind—a crucial psychological advantage in a high-pressure environment.

For new traders, a qualified futures broker can dramatically shorten the learning curve. Their insights, explanations, and mentorship help build foundational knowledge and avoid rookie mistakes.

As beneficial as it is to have a reliable futures broker, the inverse is equally true. Choosing the wrong broker introduces significant risks:

Therefore, careful vetting of any futures broker is essential before committing capital.

With over 35 years of excellence, Cannon Trading Company has established itself as one of the best futures brokers in the industry. The firm has successfully managed to uphold a legacy of trust, performance, and unwavering client commitment.

In a time when many firms route clients through layers of automated menus and chatbots, Cannon Trading remains proudly personal. Every client has direct access to seasoned brokers—some with over 25 years of individual experience. No automated answering service stands between a trader and expert advice. This model isn’t just old-school—it’s best-in-class.

The company boasts a pristine reputation with industry regulators, including the NFA and CFTC. This reflects their rigorous adherence to ethical practices, secure fund management, and transparent dealings. Their numerous 5 out of 5-star TrustPilot rankings further attest to their stellar service and client satisfaction.

Cannon Trading empowers traders with a wide selection of FREE, top-performing trading platforms. Whether a trader prefers advanced analytical tools, fast execution speeds, mobile access, or intuitive interfaces, there’s a platform tailored to meet their needs. Their lineup includes platforms like SierraChart, TradingView, CQG, and others—each chosen for reliability and performance.

From commodities and indices to currencies and interest rate products, Cannon Trading enables clients to access virtually all futures trading markets. This breadth allows clients to diversify and hedge their portfolios efficiently, with expert support for every asset class.

Cannon’s culture emphasizes education, empowerment, and long-term relationships. They offer free consultations, educational webinars, market newsletters, and timely updates to help traders remain informed and proactive. This holistic support system makes them a favorite among both retail and institutional clients.

How has Cannon Trading Company not only survived but thrived in a notoriously competitive industry? Several key factors account for their enduring success:

Founded by industry veterans who recognized the importance of client trust and market expertise, Cannon Trading has always prioritized ethical conduct and innovation. Their forward-thinking approach has kept them ahead of the curve.

While staying true to their core values, Cannon has continually evolved technologically. They’ve integrated new platforms, leveraged real-time data feeds, and offered cloud-based solutions to ensure clients have the most advanced tools at their disposal.

Cannon Trading invests heavily in client education. From beginner tutorials to advanced trading techniques, they provide a treasure trove of resources to foster client success. This not only builds loyalty but also enhances trading outcomes.

Many brokers at Cannon have remained with the company for decades. This stability ensures that clients receive guidance from experts who have weathered numerous market cycles and who understand long-term trading dynamics.

Futures trading offers enormous potential—but also significant complexity and risk. In this high-stakes arena, the value of partnering with a qualified, experienced, and client-focused futures broker cannot be overstated. Such professionals are strategic allies, risk managers, educators, and gatekeepers to success.

Among the many choices available, Cannon Trading Company stands out as one of the best futures brokers due to its client-first approach, stellar regulatory record, long-serving staff, top-rated customer satisfaction, and commitment to trading excellence. Their unmatched combination of human touch, technological savvy, and institutional integrity makes them a benchmark in the world of futures trading.

Whether you are a new trader taking your first steps or a seasoned professional seeking a partner for sophisticated strategies, Cannon Trading offers a rare blend of tradition and innovation—a partnership built to last in the dynamic world of trading futures.

For more information, click here.

Ready to start trading futures? Call us at1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

|

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

In today’s increasingly uncertain and complex financial environment, futures brokers play a more crucial role than ever. As markets are rocked by volatility, shaped by unpredictable geopolitical shifts, and molded by regulatory fluctuations, futures trading has become a key strategy for both institutional and retail investors seeking to hedge risks and discover opportunities. Within this context, future brokers act as indispensable guides, facilitating access to markets, providing strategic insight, and ensuring compliance and precision in execution.

This research paper explores why futures brokers are more important than ever, how they help traders manage risk, and how global policies—particularly tariffs introduced by President Trump—are shaping the futures markets. It also highlights why Cannon Trading Company stands as one of the best futures brokers in the industry, backed by its legacy, reputation, and client-first approach.

The financial world has changed dramatically in recent decades. With high-frequency trading, algorithmic systems, global interconnectedness, and mounting political instability, today’s investors face complexities that demand expertise and personalized support. Here’s why futures brokers have become indispensable:

Futures trading is inherently riskier than traditional equity investing due to its leveraged nature. However, with volatility comes opportunity, and future brokers are uniquely positioned to help traders harness this potential while mitigating risk.

These services offer more than convenience. They are a shield against market upheaval. [need to be qualified, like maybe “They are a collective set of tools to help shield against market upheaval.” With political and financial dynamics changing by the day, a skilled futures broker can mean the difference between profit and peril.

The imposition of tariffs by President Donald Trump during this administration fundamentally altered international trade dynamics. These changes had significant ripple effects across the futures markets, especially in commodities, metals, and agricultural products.

Key Impacts of Trump’s Tariffs on Futures Trading:

Agricultural Markets

China retaliated with tariffs on U.S. soybeans, pork, and corn, causing American farmers to potentially suffer and prices to plummet. These shifts increased volume and volatility in the agricultural futures trading sector.

Steel and Aluminum Futures

As domestic industries were protected by tariffs, global prices fluctuated, leading to volatility in metals contracts.

Currency Futures Volatility

Trade tensions created uncertainty in forex markets. The U.S. dollar saw unpredictable moves, affecting currency futures brokers and traders.

Inflation and Interest Rate Speculation

Tariffs contributed to inflation concerns, leading traders to speculate in interest-rate futures trading markets. Brokers helped traders navigate these shifts.

Market Uncertainty and Sentiment

Tariffs shook investor confidence and led to unpredictable price movements across multiple asset classes. This amplified the need for skilled futures brokers who could help interpret news and guide strategic responses.

Navigating the turbulent waters of trade wars and tariffs requires a seasoned futures broker who can become a trusted partner in weathering storms. Here’s how traders can collaborate effectively with their brokers:

Sharing one’s financial goals and risk tolerance helps the futures broker tailor a suitable trading strategy.

Best futures brokers, like Cannon Trading Company offer daily market commentary, reports, and real-time alerts that traders can use to stay ahead of policy shifts.

If tariffs threaten supply chains or input costs, traders can work with brokers to hedge those risks through carefully chosen futures contracts.

Cannon Trading’s multiple FREE trading platforms allow traders to switch strategies, automate positions, and adapt to market developments instantly.

By working closely with brokers, traders can monitor exposure, modify stops, and rebalance portfolios.

In the realm of futures trading, few names carry the gravitas and trust that Cannon Trading Company commands. Founded in 1988, Cannon has remained a stalwart in the industry, offering traders the tools, service, and expertise needed for long-term success.

With over 35 years in the business, Cannon has weathered multiple economic cycles, earning credibility and trust among traders.

Clients never speak to machines. Cannon Trading Company ensures that real, licensed futures brokers are just a call away—a rarity in today’s automated world.

Hundreds of satisfied clients have awarded Cannon with consistent 5/5-star ratings on TrustPilot, citing integrity, responsiveness, and deep expertise.

Unlike many firms that limit clients to a single system, Cannon offers access to a diverse array of high-performing platforms at no extra cost.

Cannon boasts an exemplary compliance record with the NFA and CFTC, offering traders peace of mind in an era of increased scrutiny.

Through their infrastructure, clients can trade futures contracts on global exchanges across sectors such as energy, metals, currencies, indices, and more.

Whether a novice or a professional, each client receives personalized attention. This commitment to service sets Cannon apart from other futures brokers.

What makes a company thrive for over three decades in such a competitive space? The answer lies in consistency, ethics, innovation, and relationships.

Their sustained excellence makes them one of the best futures brokers in an industry where firms come and go with the tides.

The role of future brokers is not just preserved but elevated in today’s financial ecosystem. With the global economy growing more unpredictable, futures brokers offer a lighthouse amid the fog of market volatility and political shifts. They provide risk mitigation, strategic insight, regulatory compliance, and platform support that no automated system can match.

Cannon Trading Company, with its decades of service, client-first model, regulatory integrity, and top-tier tools, stands as a beacon among the best futures brokers. Their legacy of trust, combined with modern infrastructure and personalized support, makes them the ideal partner for anyone serious about futures trading.

Whether you are navigating tariffs, leveraging diversification, or simply seeking to hedge against uncertainty, working with a top-tier futures broker like Cannon Trading can elevate your trading journey to new heights.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading