Join our Private Facebook group

Subscribe to our YouTube Channel

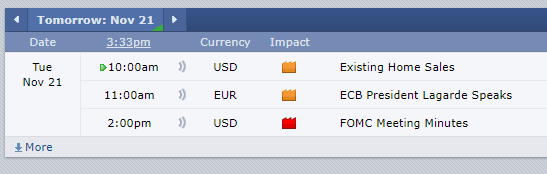

Tomorrow is the first trading day for December. Last and first trading days of the months can at times be more volatile and at times have a chance to become a trending day.

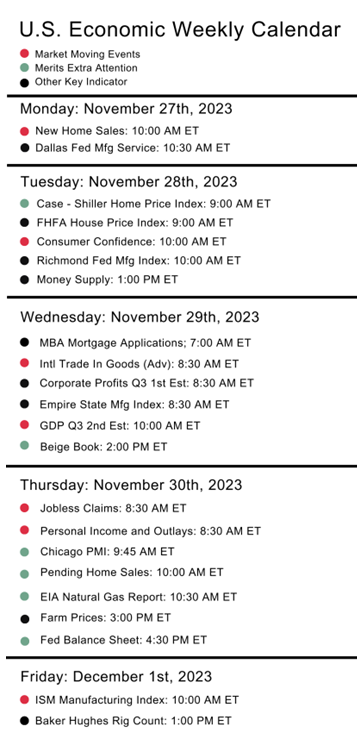

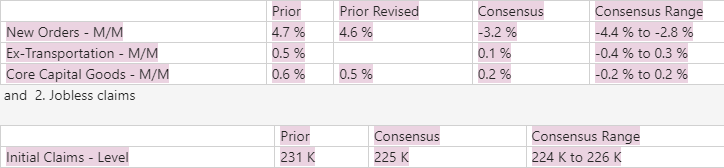

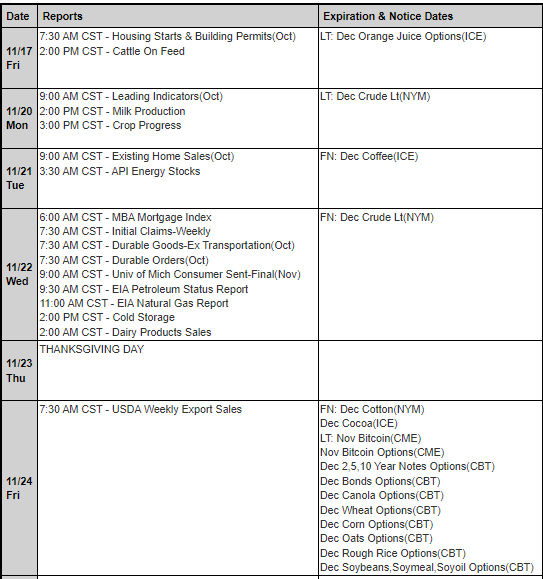

ISM and Fed’s Powell speaking are the highlights on the reports side.

Trader’s Check List:

· Review prior day statement

· Check for any working orders on your platforms.

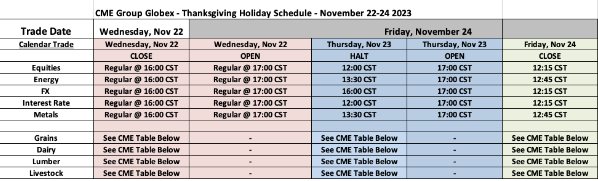

· Be aware of contract rollover dates

· Set a daily loss limit and learn NOT to overtrade

· Understand what reports are coming out today

· Make sure you are not distracted

· Calculate appropriate trading size based on current volatility and account size

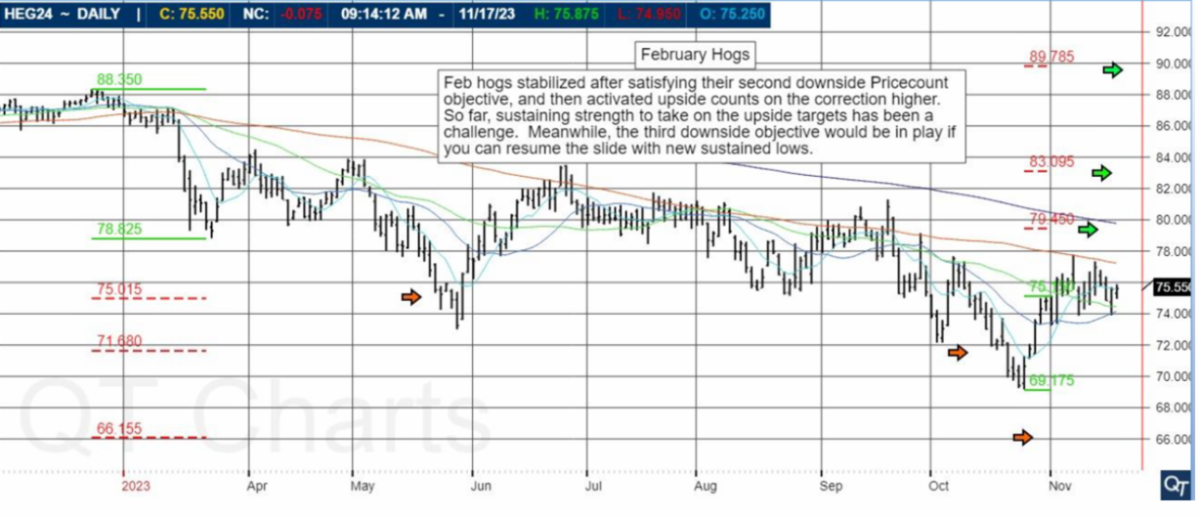

· Start with Larger Time Frame charts to get proper perspective

· Understand what your goal is

· Measure your success or lack of

· Spend time furthering your trading education and exploring different methods

· Put trading in perspective and make sure the overall psychology of trading fits you.

Plan your trade and trade your plan.

Download your FREE copy of Order Flow Essentials!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

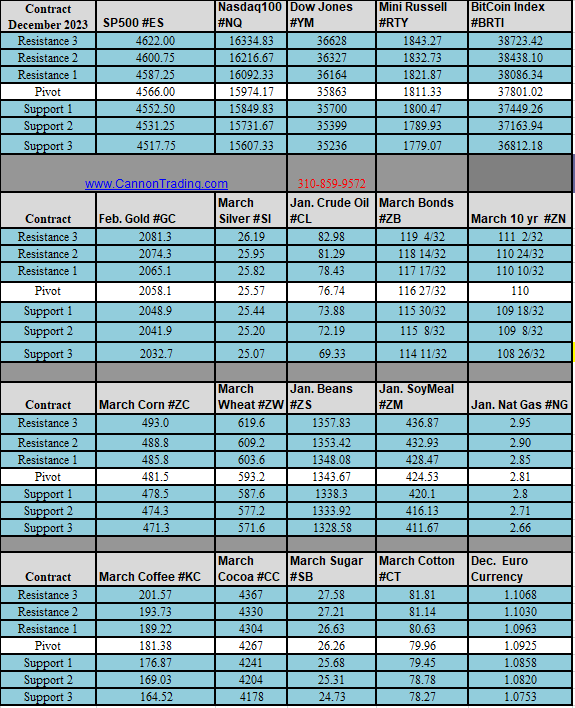

Futures Trading Levels

12-1-2023

Improve Your Trading Skills

Economic Reports,

Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.