In the rapidly evolving world of futures trading, having access to a cutting-edge futures trading platform is critical. One such platform making waves in the trading community is Bookmap—an innovative tool designed to bring transparency and precision to trading decisions. With its unique visual approach, Bookmap trading enables both novice and professional traders to see beyond the basic charts and deeply understand market behavior in real time.

As the demand for advanced platforms increases, so does the need for reliable brokers. That’s where Cannon Trading Company shines. As one of the most respected firms in the industry, Cannon Trading has been helping traders navigate the complex world of online futures trading platforms for decades.

This article explores the most important features of Bookmap for futures trading, details how to access Bookmap download and pricing, and explains why Cannon Trading Company is an outstanding partner for using this platform.

What is Bookmap?

Bookmap is a high-performance futures trading platform that displays full-depth market data in an intuitive heatmap format. Unlike conventional charting tools, Bookmap trading enables you to see market liquidity and order flow with unprecedented clarity.

With Bookmap Web and Bookmap TradingView integration, users now have the flexibility to analyze markets on various devices and charting systems. This accessibility is enhanced by Bookmap free features that allow traders to try out the platform before committing financially.

The availability of granular market data is one of the core strengths of Bookmap. It visualizes market dynamics by showing historical order book activity and real-time transactions, enabling traders to spot opportunities before they appear on standard charts.

Key Features of the Bookmap Futures Trading Platform

- Real-Time Order Flow Analysis

Understanding order flow is crucial in futures trading. Bookmap allows traders to monitor limit orders, market orders, and cancellations in real-time. The heatmap visualization makes it easy to spot large resting orders that may act as support or resistance zones.

- Advanced Heatmap Visualization

At the heart of Bookmap trading is the heatmap, which shows liquidity changes over time. This feature reveals the true intent of market participants, allowing traders to anticipate moves rather than react to them.

- Volume Dots and Volume Delta

These unique features let traders analyze where trades are occurring and the volume behind them. It’s especially useful for scalp traders using online futures trading platforms where timing and precision are essential.

- Market Replay

This feature allows traders to rewind market action and study it frame-by-frame. Whether you’re refining strategies or backtesting ideas, Bookmap gives you the tools to sharpen your edge.

- Customizable Indicators and APIs

Bookmap offers a suite of built-in indicators and supports third-party plugins and APIs. This ensures that traders using futures trading platforms like Bookmap can tailor their setups for maximum efficiency.

- Multi-Asset Support

While it shines in futures trading, Bookmap also supports equities and cryptocurrencies. It’s a comprehensive solution that caters to all kinds of market participants.

- Bookmap Web and Bookmap TradingView Integration

Traders can now enjoy Bookmap from anywhere with Bookmap Web. Additionally, Bookmap TradingView integration bridges the gap between traditional charting and cutting-edge order flow analysis.

- Bookmap Free Version

Before you commit, try the Bookmap free edition. It offers access to historical data, basic visualizations, and a limited set of features—perfect for learning the ropes.

- High-Quality Market Data Feeds

To fully utilize Bookmap’s capabilities, accurate and timely data is essential. That’s why Bookmap data partnerships with top-tier providers ensure you get the best trading experience.

Bookmap Pricing and Subscription Plans

Understanding Bookmap pricing is key before diving in. There are several tiers based on your needs:

- Bookmap Free: A basic version to get familiar with the interface and features.

- Digital+: Includes enhanced indicators and limited access to market data.

- Global: Ideal for futures trading, offering full-depth data, custom studies, and add-ons.

- Global+: Unlocks premium add-ons like the Large Lot Tracker and advanced analytics.

Each tier offers flexibility depending on whether you’re new to Bookmap trading or a seasoned professional. Importantly, Bookmap download is straightforward, and the platform supports both Windows and macOS.

How to Get Started with Bookmap

- Visit the Website: Go to the official site to initiate your Bookmap download.

- Select a Plan: Choose from Bookmap Free, Digital+, Global, or Global+ depending on your trading style.

- Install the Platform: The installation process is simple and user-friendly.

- Connect to Market Data: Use your broker’s feed or opt for integrated Bookmap data providers.

- Start Trading: Dive into Bookmap trading using the powerful heatmap and visualization tools.

With Bookmap Web, you can even access your trading dashboard from any browser, making it ideal for traders on the go.

Why Cannon Trading is Your Ideal Partner for Bookmap Trading

When it comes to online futures trading platforms, broker selection is just as important as the platform itself. Cannon Trading Company stands out as an industry leader and is a perfect partner for anyone using Bookmap.

- Decades of Experience

Founded in 1988, Cannon Trading has decades of experience navigating complex futures trading platform landscapes. Their team of experienced brokers understands Bookmap trading inside and out, making onboarding seamless for new users.

- Stellar Reputation and Reviews

Cannon Trading boasts numerous 5 out of 5-star reviews on TrustPilot, showcasing the firm’s dedication to transparency, customer service, and integrity. Their long-standing relationships with clients speak volumes about their reliability.

- Regulatory Standing

As a registered Introducing Broker with the NFA and CFTC, Cannon Trading maintains an exemplary regulatory record. Compliance is paramount, which means your funds and data are in trusted hands.

- Wide Selection of FREE Trading Platforms

In addition to Bookmap free, Cannon Trading offers access to a wide array of online futures trading platforms. Whether you prefer Sierra Chart, CQG, or TradingView, Cannon ensures you’re well-equipped.

- Tailored Support for Bookmap Users

Cannon provides personalized setup assistance, real-time tech support, and educational resources. They ensure clients are maximizing their use of Bookmap trading, regardless of experience level.

Cannon Trading + Bookmap = Trading Excellence

Try a FREE Demo!

Combining the sophisticated features of Bookmap with the unmatched service of Cannon Trading Company creates a powerhouse for futures traders. Whether you’re leveraging the real-time heatmap for scalping or conducting detailed order flow analysis, Cannon Trading’s infrastructure and experience enhance your performance.

From Bookmap pricing transparency to expert help with Bookmap data feeds, Cannon ensures that your trading experience is as seamless and successful as possible.

The Bookmap Futures Trading Platform is revolutionizing how traders view and interact with the market. Its innovative visualization tools, integration with Bookmap TradingView, browser-based Bookmap Web, and robust Bookmap free version make it a go-to solution for serious traders. When combined with a top-tier brokerage like Cannon Trading Company, which offers industry experience, stellar reputation, regulatory compliance, and multiple futures trading platform options—including Bookmap—you have a winning formula for success.

Whether you’re exploring Bookmap download for the first time or looking to deepen your expertise in Bookmap trading, partnering with Cannon Trading will elevate your performance and confidence.

For more information, click here.

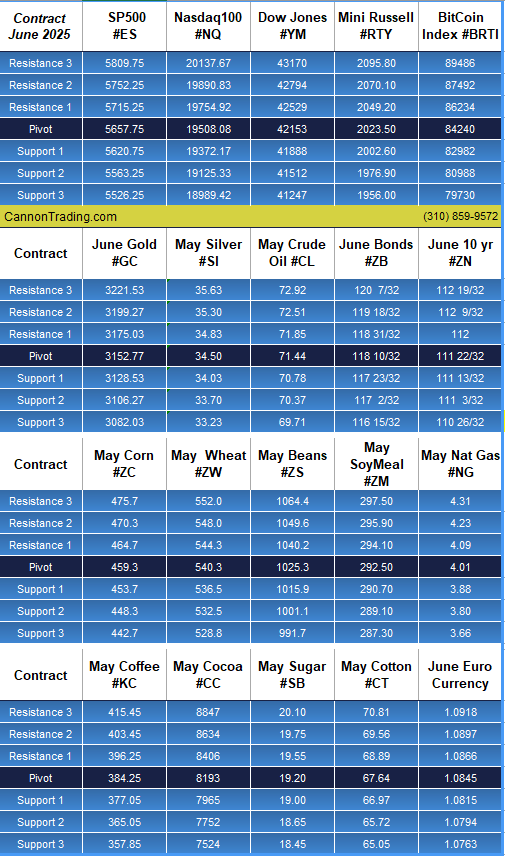

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading