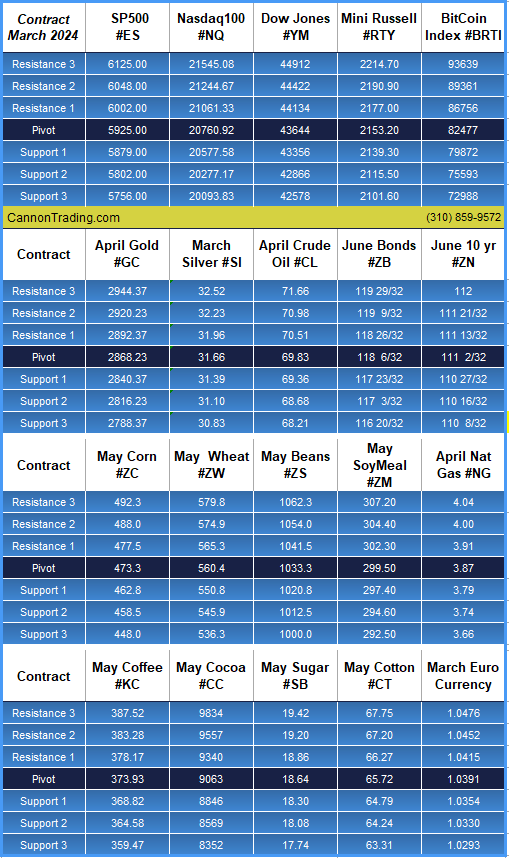

The Standard and Poor 500 futures contract is one of the most actively traded financial instruments in the world. Often referred to as S&P 500 futures contracts, these derivatives allow investors to speculate on the future price movements of the Standard & Poor’s 500 index futures and hedge their portfolios against market volatility. As the cornerstone of futures trading, futures on S&P 500 are widely used by institutions, hedge funds, and individual traders alike.

The Rise of Standard & Poor’s 500 Index Futures

The S&P 500 future didn’t emerge in a vacuum. The foundation for this contract was laid in the early 1980s when financial markets began adopting electronic and index-based trading instruments. The Chicago Mercantile Exchange (CME) pioneered the introduction of futures trading based on stock indices, with the launch of futures on S&P 500 in 1982. This marked a watershed moment for the industry, making the SPX index futures an essential trading tool.

Before the introduction of these contracts, traders and institutional investors had limited avenues to hedge against broad market movements without individually trading numerous stocks. The advent of futures SP500 contracts revolutionized risk management and speculation by providing a single, liquid instrument that mirrored the broader market.

Key Figures Behind the Innovation

Several key figures played pivotal roles in developing and popularizing the S&P 500 futures contract. Among them was Leo Melamed, chairman of the CME, who spearheaded the development of financial futures. Working alongside economist Richard Sandor, often dubbed the “father of financial futures,” Melamed championed the concept that stock indices could be effectively used as underlying assets for future trading.

Richard Dennis, a legendary futures trader, also had a profound impact on the early adoption of futures on S&P 500. Dennis, known for his famous “Turtle Traders” experiment, was one of the earliest speculators to see the potential in index-based futures trading. Alongside traders like Paul Tudor Jones, who used Standard and Poor’s 500 futures to hedge his equity exposure, these pioneers helped cement the contract’s place in the financial ecosystem.

Forgotten Terms and Trading Techniques

Many traders today overlook some of the early terminology and trading techniques used in futures trading for stock indices. Terms such as “program trading,” “delta hedging,” and “synthetic futures” were once part of the daily jargon among traders.

- Program Trading: Introduced in the 1980s, this involved using computer algorithms to execute large buy or sell orders in futures SP500 contracts.

- Delta Hedging: A strategy used to manage risk by offsetting price fluctuations in the S&P 500 future through options.

- Synthetic Futures: Created using a combination of options to mimic the price movements of SPX index futures.

Notable Trades and Case Studies

One of the most famous trades in Standard and Poor’s 500 futures history occurred during the 1987 Black Monday crash. Large institutional traders employed portfolio insurance, a strategy involving selling futures on S&P 500 to hedge against falling stock prices. However, this strategy exacerbated the downturn, leading to a record 22% drop in the market.

Another significant case study involves the 2008 financial crisis. During this period, hedge funds and proprietary trading firms leveraged futures SP500 to hedge against credit defaults. Traders such as John Paulson and Michael Burry made billions betting against subprime mortgage securities while managing risk through S&P 500 futures contracts.

Risks Associated with Trading Standard & Poor’s 500 Index Futures

Despite their benefits, futures trading in the S&P 500 future market is not without risks. Some of the most significant risks include:

- Leverage Risk: Because futures trading involves significant leverage, traders can experience amplified gains or losses.

- Market Volatility: Standard and Poor 500 futures are highly sensitive to macroeconomic events, geopolitical risks, and Federal Reserve policies.

- Liquidity Risk: While SPX index futures are highly liquid, sudden market shocks can lead to slippage and unexpected losses.

- Margin Calls: Traders must maintain sufficient margin in their accounts to avoid forced liquidations.

The Role of a Good Futures Broker

Navigating future trading successfully requires the right futures broker. This is where Cannon Trading Company excels. With decades of experience, Cannon Trading Company provides traders with access to high-performance trading futures platforms, professional guidance, and a robust regulatory standing. Their commodity brokerage services cater to traders of all experience levels, offering:

- Top-tier Trading Platforms: Access to cutting-edge tools for futures trading e mini futures and micros futures.

- 5-Star Ratings on TrustPilot: A testament to their superior customer service and reliability.

- Comprehensive Educational Resources: Helping traders understand what is futures trading and how to navigate the complexities of futures SP500 markets.

- Regulatory Compliance: Ensuring transparency and adherence to industry best practices.

The Standard and Poor 500 futures contract has cemented itself as an indispensable financial instrument for traders and institutional investors alike. Its evolution from an innovative financial tool in 1982 to a globally traded contract has been marked by influential figures, technological advancements, and historic market events. While futures trading offers immense potential, understanding the risks, strategies, and market nuances is crucial for success.

For traders looking to excel in futures on S&P 500, choosing the right futures broker is critical. Cannon Trading Company stands out with its top-tier commodity brokerage services, commitment to client success, and a range of powerful trading platforms. Whether engaging in futures SP500, S&P 500 futures contracts, or micros futures, partnering with an experienced broker like Cannon Trading Company can make all the difference in achieving trading success.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572(International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading