Coffee futures, a type of futures contract trading, have long been a staple in the soft commodities market. They allow traders to speculate on the price movements of coffee, one of the most widely consumed beverages globally. Futures contracts for coffee were introduced to provide price stability for producers and consumers. Over time, they evolved into a tool for futures traders seeking profits from price volatility.

The origins of coffee futures trace back to the early 20th century when coffee-producing countries sought ways to stabilize the volatile coffee market. In the 1920s, Brazil, the world’s largest coffee producer, played a pivotal role in developing mechanisms to manage price fluctuations. This effort laid the groundwork for coffee’s introduction to the global futures market.

Advantages of Trading Coffee Futures

Price Transparency and Liquidity

Coffee futures provide a transparent pricing mechanism influenced by global supply and demand dynamics. This transparency benefits futures traders by offering clear entry and exit points for trades. Additionally, coffee futures markets, such as those on the Intercontinental Exchange (ICE), are highly liquid, enabling traders to execute large trades without significantly impacting prices.

Hedging Opportunities

Futures trading offers robust hedging opportunities. Coffee producers can lock in future prices to mitigate risks associated with fluctuating market conditions. Similarly, companies reliant on coffee as a raw material can hedge against rising prices to protect profit margins. For instance, a coffee shop chain might use futures contracts to secure a stable cost of coffee for a year, ensuring predictable operating expenses.

Speculative Potential

The volatility inherent in coffee prices makes it an attractive asset for speculative trading. Factors such as weather conditions, geopolitical events, and currency fluctuations can cause significant price swings, presenting futures traders with opportunities to profit.

Disadvantages of Trading Coffee Futures

High Volatility

While volatility can be advantageous for speculative futures trading, it also poses substantial risks. Price swings driven by unpredictable factors like droughts, floods, or political instability can lead to significant losses. For example, a futures trader who goes long on coffee futures during a predicted supply shortage may face unexpected losses if a bumper crop suddenly boosts supply.

Complexity and Leverage

Futures contract trading is inherently complex and requires a deep understanding of market dynamics. Leverage amplifies both gains and losses, making it possible to lose more than the initial investment. Novice traders often underestimate these risks, leading to financial distress.

Market Manipulation Risks

Soft commodities like coffee are vulnerable to market manipulation. Large market participants can influence prices, potentially disadvantaging smaller futures traders. For instance, coordinated efforts by major players to stockpile coffee can artificially inflate prices, impacting futures contract values.

Real-Life Anecdotes and Case Studies

The 1975 Brazilian Frost

One of the most notable events in the history of coffee futures was the 1975 Brazilian frost. A severe freeze wiped out a significant portion of Brazil’s coffee crop, leading to a dramatic price surge. Futures traders who anticipated the frost’s impact reaped substantial profits, while those caught on the wrong side of the trade suffered heavy losses. This event highlighted the importance of weather monitoring in coffee futures trading.

Hypothetical Scenario: Hedging with Coffee Futures

Imagine a medium-sized coffee roaster anticipating a rise in coffee prices due to projected adverse weather conditions in Colombia. The company enters into a futures contract to buy 10,000 pounds of coffee at $1.50 per pound, locking in the price. When the market price later rises to $2.00 per pound, the roaster avoids the increased cost, saving $5,000. This hypothetical example underscores how futures trading can protect businesses from price volatility.

Anecdote: A Futures Trader’s Journey

Sarah, a novice futures trader, started trading futures contracts in 2015. She initially faced challenges understanding the nuances of soft commodities like coffee. After attending a seminar by Cannon Trading Company, she gained insights into advanced trading strategies and risk management. By leveraging the educational resources and top-performing trading platforms provided by Cannon Trading, Sarah transitioned from learning lessons to confident, informed trading within two years.

The Role of Cannon Trading Company in Futures Trading

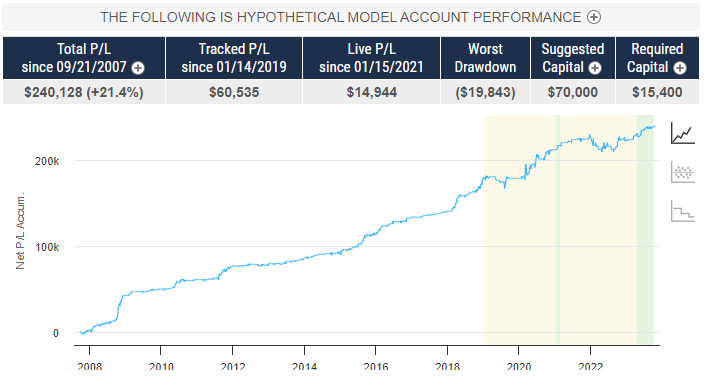

Cannon Trading Company has established itself as a trusted partner for traders of all experience levels. With decades of experience in the futures markets, it offers an exemplary combination of technology, expertise, and customer support. Let’s explore why this firm stands out:

Top-Performing Trading Platforms

Cannon Trading provides a wide selection of trading platforms tailored to different trading styles and experience levels. Whether you are a beginner seeking user-friendly tools or an advanced futures trader requiring sophisticated analytics, their platforms cater to all needs. For instance, their Sierra Chart platform offers advanced charting tools and algorithmic trading capabilities.

Unparalleled Customer Support

Cannon Trading’s team of experienced futures brokers is committed to providing personalized support. From onboarding new clients to offering market insights, their proactive approach ensures traders feel supported at every step of their journey.

Regulatory Excellence

With a 5 out of 5-star rating on TrustPilot and an exemplary reputation with regulatory bodies, Cannon Trading demonstrates a commitment to transparency and ethical practices. This trustworthiness is crucial for traders seeking a reliable partner in the volatile world of futures trading.

Strategies for Trading Coffee Futures

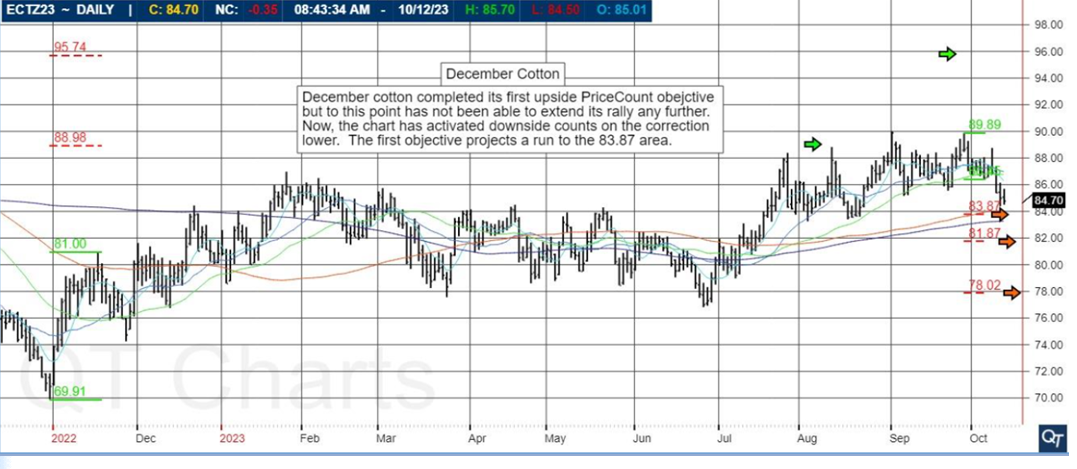

Technical Analysis

Technical analysis is a cornerstone of futures trading. Traders use tools like moving averages, Fibonacci retracements, and candlestick patterns to predict price movements. For example, a trader identifying a bullish flag pattern on a coffee futures chart might decide to go long, anticipating a price increase.

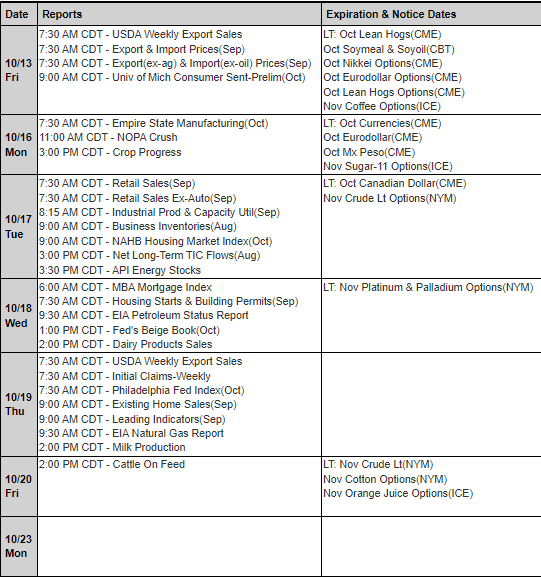

Fundamental Analysis

Understanding the fundamentals driving coffee prices is equally important. Futures traders must stay informed about weather patterns, geopolitical developments, and economic trends. For instance, a report forecasting lower coffee yields in Vietnam, the second-largest coffee producer, could signal an impending price increase.

Risk Management

Effective risk management is critical for successful futures trading. Strategies like setting stop-loss orders, diversifying positions, and limiting leverage help mitigate potential losses. A seasoned futures trader might risk only 1-2% of their capital on a single trade, ensuring long-term sustainability.

Hypothetical Trading Scenarios

Scenario 1: A Bullish Trade

John, an experienced futures trader, notices that coffee inventories are at a 10-year low, and weather forecasts predict drought conditions in Brazil. He enters a long position in coffee futures at $1.40 per pound. Two months later, prices rise to $1.80 per pound due to supply constraints. John exits the trade, earning a profit of $4,000 on a 10,000-pound contract.

Scenario 2: A Bearish Trade

Maria, a futures trader with a focus on macroeconomic trends, anticipates a strengthening U.S. dollar, which typically pressures coffee prices. She sells short a coffee futures contract at $1.60 per pound. As the dollar strengthens, coffee prices fall to $1.40 per pound. Maria closes her position, securing a $2,000 profit.

Future Outlook for Coffee Futures

As global coffee consumption continues to grow, the importance of coffee futures in the trading landscape is likely to increase. Emerging technologies, such as AI-driven analytics and blockchain-based supply chain tracking, promise to revolutionize futures trading. For futures traders, staying ahead of these trends will be key to capitalizing on future opportunities.

Coffee futures represent a dynamic and rewarding segment of the futures market. With the right strategies and tools, futures traders can harness the advantages of trading futures contracts in this volatile yet lucrative commodity. Cannon Trading Company’s combination of top-performing trading platforms, experienced futures brokers, and a stellar reputation makes it an ideal partner for trading futures.

Whether you are new to futures trading or an experienced futures trader, leveraging the resources provided by trusted future brokers like Cannon Trading can significantly enhance your trading journey. By staying informed, managing risks, and continuously honing your skills, you can navigate the complexities of trading futures with confidence.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading