The corn futures contract remains one of the most actively traded agricultural commodities in the futures markets. As global demand for corn continues to rise due to its essential role in food production, animal feed, and ethanol production, futures traders seeking profitable opportunities often turn to corn futures as a key component of their portfolio.

10 Essential Tips for Trading Corn Futures in 2025

- Understand Supply and Demand Dynamics

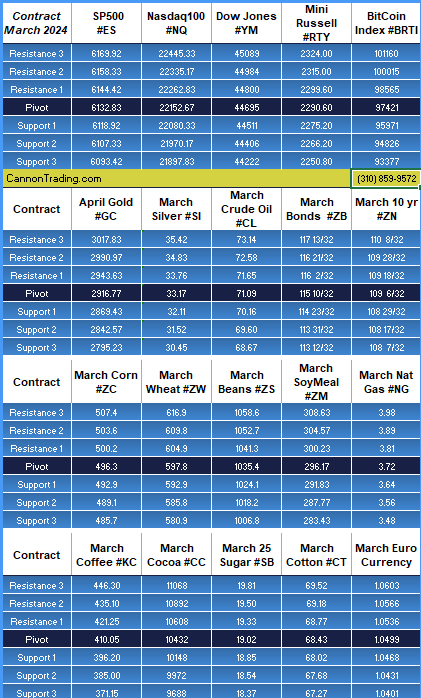

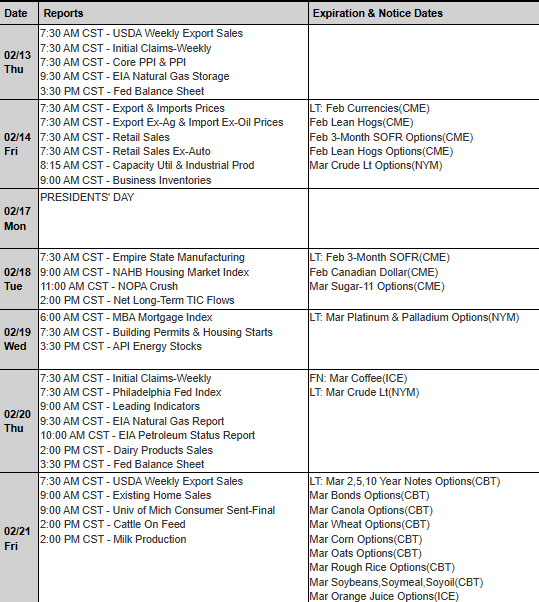

Corn prices are highly sensitive to global supply and demand. Factors such as droughts, floods, and geopolitical trade policies can drastically affect supply, while increased biofuel production and livestock feed demand can drive prices higher. - Monitor USDA Reports

The United States Department of Agriculture (USDA) publishes reports such as the World Agricultural Supply and Demand Estimates (WASDE), Crop Progress Reports, and Grain Stocks Reports. These provide valuable insights into corn production, yield forecasts, and potential price movements. - Follow Seasonal Trends

Historically, corn futures contracts tend to follow seasonal price patterns. Prices often drop during harvest (September-November) when supply increases and rise in the planting months (April-May) when weather concerns create uncertainty. - Choose a Reliable Futures Broker

Working with a reputable futures trading broker is essential for executing trades efficiently. Firms like Cannon Trading Company offer a wide selection of futures trading platforms and have a solid track record with 5-star ratings on TrustPilot, making them a great choice for traders of all levels. - Hedge Against Price Volatility

Agribusinesses and institutional investors often use corn futures contracts to hedge against price fluctuations. Understanding how to use these contracts for risk management can provide a strategic edge. - Utilize Technical and Fundamental Analysis

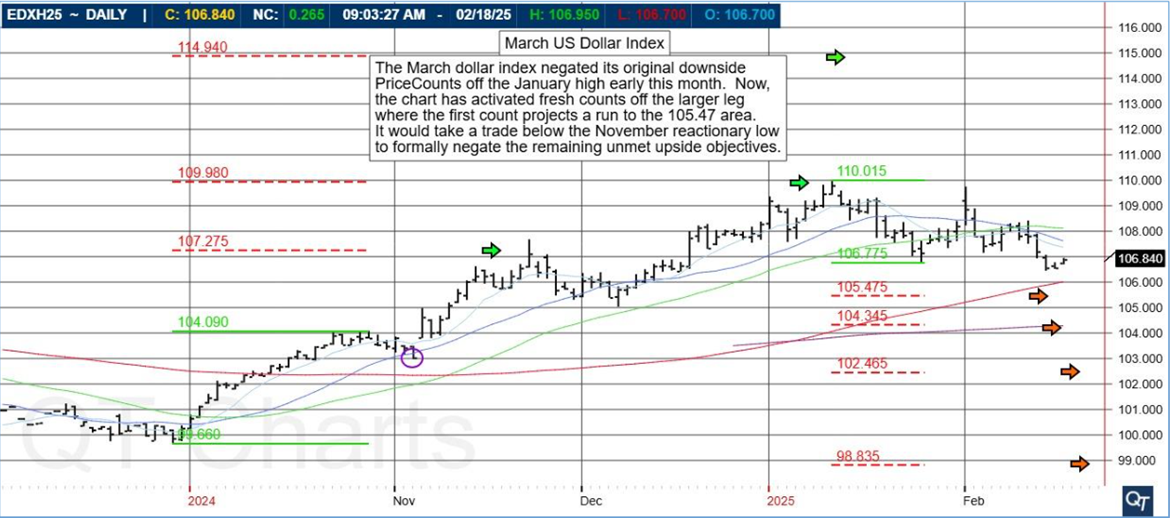

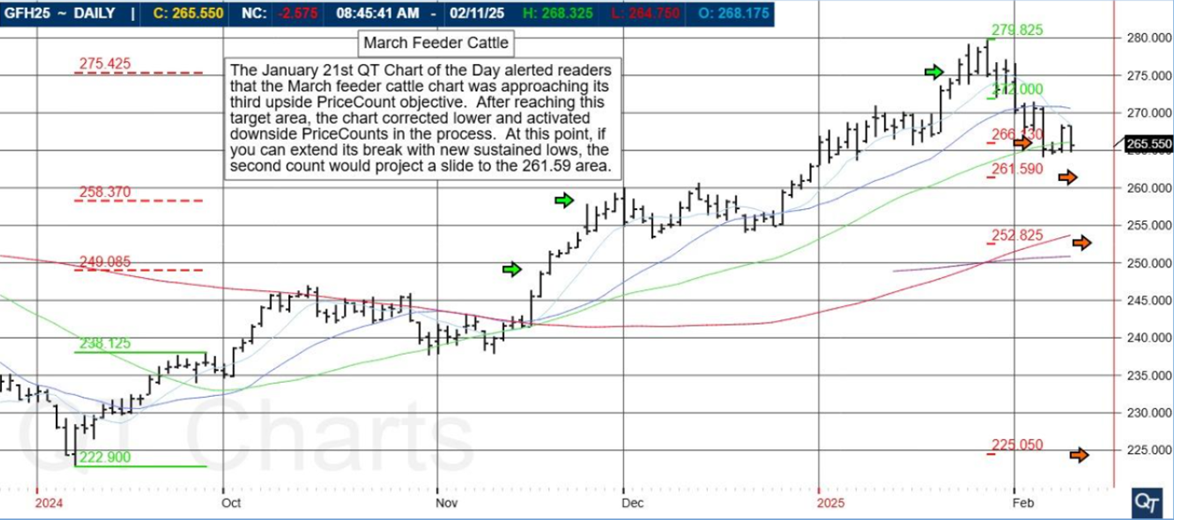

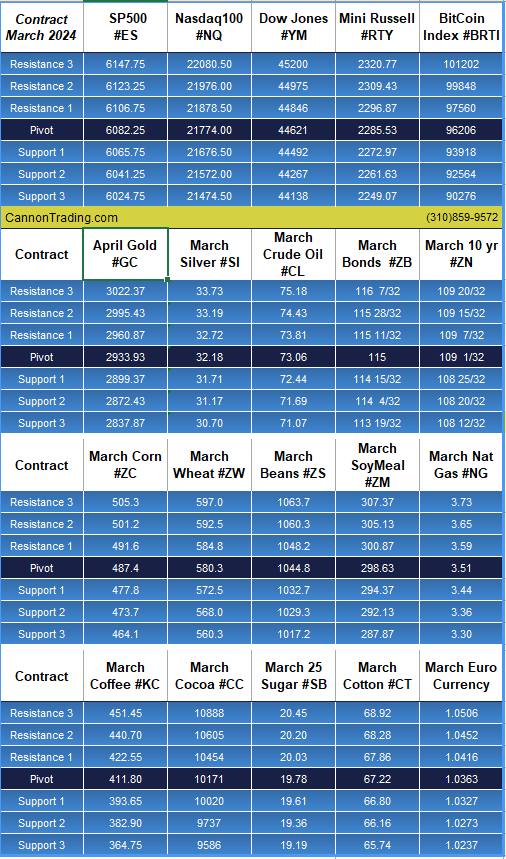

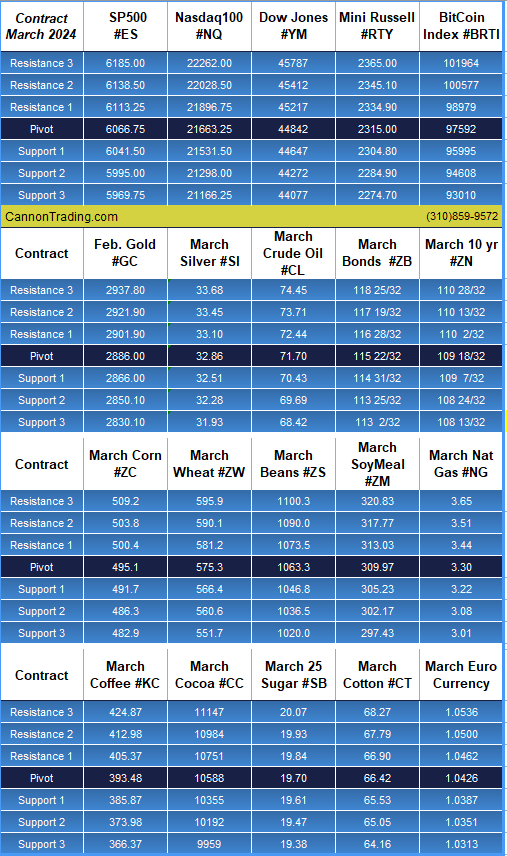

Successful futures traders rely on both technical indicators (such as moving averages and Fibonacci retracements) and fundamental analysis (such as crop reports and geopolitical news) to make informed decisions. - Watch for Inflation and Interest Rate Trends

Economic factors such as inflation and interest rates influence the overall commodity markets. Rising interest rates can strengthen the U.S. dollar, making corn exports more expensive and potentially lowering demand. - Stay Updated on Trade Agreements

Global trade agreements and tariffs, particularly between the U.S., China, and the European Union, significantly impact corn prices. Keeping track of new trade deals is crucial for trading futures successfully. - Consider Algorithmic and Automated Trading

Advanced trading technology has made futures contract trading more accessible through algorithmic and automated trading strategies. Platforms offered by Cannon Trading Company enable traders to execute trades with precision and speed. - Diversify with Other Agricultural Futures

While trading futures in corn can be profitable, diversifying with soybean, wheat, and other crop futures can reduce risk and enhance overall portfolio stability.

Expected Trends for Corn Futures in 2025

Climate Change and Weather Volatility

Extreme weather conditions are expected to continue affecting global corn production. Unpredictable droughts and flooding could lead to significant price swings in corn futures contracts.

Biofuel and Ethanol Demand

The global push for renewable energy sources will likely keep ethanol demand high, increasing the need for corn as a primary biofuel ingredient.

Rising Input Costs

Fertilizer and transportation costs have been climbing, impacting production expenses and potentially pushing corn prices higher in 2025.

Geopolitical Tensions and Trade Policies

The U.S.-China trade relationship remains a key factor. Tariffs or trade barriers could significantly impact corn exports and futures prices.

Key Reports to Monitor for Corn Futures Trading

- USDA WASDE Report – Offers supply and demand projections.

- Grain Stocks Report – Provides insights into corn inventory levels.

- Crop Progress Report – Tracks planting and harvesting progress.

- CFTC Commitment of Traders Report – Shows market sentiment among traders.

- EIA Ethanol Production Report – Measures ethanol demand, affecting corn consumption.

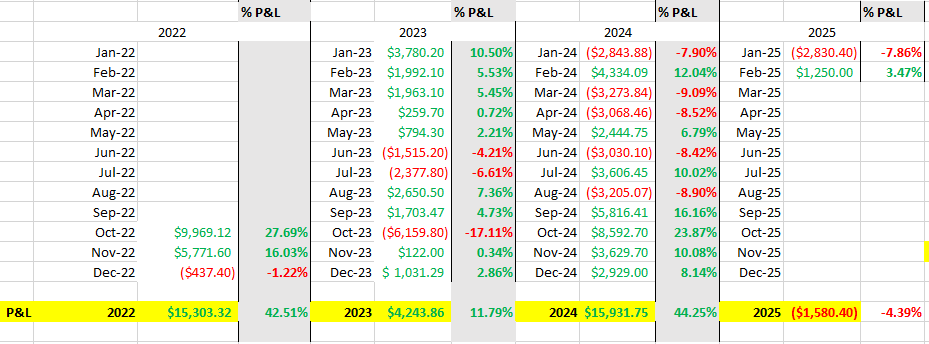

Historical Performance of Corn Futures and Agricultural Commodities

Historically, corn futures contracts have shown cyclical patterns influenced by weather conditions, government policies, and technological advancements in agriculture. The 2012 drought, for example, caused record-high prices, while increased yields in the following years led to price stabilization. Other crop futures contracts, such as wheat and soybeans, have followed similar trends, often correlating with corn prices due to their shared agricultural and economic factors.

Why Choose Cannon Trading Company for Futures Trading?

For traders looking to engage in futures contract trading, selecting a reputable futures trading broker is essential. Cannon Trading Company stands out for several reasons:

- Top-Performing Trading Platforms: Offering a range of advanced platforms for both beginner and experienced futures traders.

- Decades of Experience: With a long history in the futures trading industry, Cannon Trading provides expert guidance.

- Outstanding Customer Support: Rated 5 out of 5 stars on TrustPilot, the firm is recognized for its commitment to client satisfaction.

- Regulatory Compliance: Fully compliant with NFA regulations, ensuring transparency and security for trading futures.

The corn futures contract presents numerous opportunities for profit in 2025. By staying informed on market trends, monitoring key reports, and partnering with a reputable futures trading broker like Cannon Trading Company, traders can navigate the complexities of futures contract trading with confidence.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading