What to Know Before Trading Futures on May 20th, 2025

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

In simple terms, a currency futures contract is a futures contract where you agree to exchange one currency for another, on a specified date at a price that is fixed on the date when the contract is purchased.

Having been around since the 1970s, currency futures are counted as medium to high risk contracts. One thing worth knowing about forex is that they are not traded on a centralized exchange, futures currencies however do and that is an advantage for traders in our opinion. Now, in order to bring down the risk of trading currency futures, one can rely on hedging. This blog archive on currency future lists a number of write-ups on currency futures and hedge funds.

At Cannon Trading, we can help you with all that you need to know about currency futures trading. Our professional team educates and assists you in dealing with tricky trade situations. Please do read the informative articles that have been listed under this category.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Trading futures is a dynamic and high-stakes endeavor, attracting traders with the promise of leveraged profits and diverse opportunities across commodities, financial indices, currencies, and more. In futures trading, participants buy or sell standardized contracts that speculate on the future price of an asset, allowing them to profit from correct market predictions. This arena is not only about speculation; it also serves a critical role in risk management—many investors and businesses use trading futures contracts to hedge against price fluctuations in raw materials, interest rates, or stock markets. The combination of potential for rapid gains, global market access, and hedging utility has made futures trading a popular pursuit for both individual traders and institutions.

However, succeeding in this competitive field requires more than just enthusiasm. Modern futures traders rely on a blend of proven techniques, disciplined daily routines, and the support of a reliable futures broker to navigate volatility. The most successful traders deploy a range of strategies—from technical chart analysis to fundamental market research—to make informed decisions each day. Equally important is partnering with the right brokerage; the best futures broker will provide quality trade execution and support that can make or break a trading strategy. In this comprehensive paper, we explore the most widely practiced techniques in futures trading today and how traders can implement these methods in their day-to-day trading routines. We also shine a spotlight on Cannon Trading Company, a futures broker with decades of industry leadership. Cannon Trading Company’s historical and ongoing contributions—reflected in its stellar reputation, 5-star client ratings, regulatory compliance, and cutting-edge trading platforms—underscore what it means to have an industry-leading partner in the futures market.

Traders in the futures markets have developed a variety of approaches to profit from price movements. Below are some of the most popular futures trading techniques practiced today, each with its own style and implementation:

Having a solid strategy is one thing, but consistent success in trading futures comes from diligent day-to-day execution. Effective traders turn their chosen techniques into structured daily habits. Below is an example of how a futures trader can implement these strategies through a typical trading day:

Among futures brokers, Cannon Trading Company stands out as a firm that has consistently set a high standard for service and expertise. Established in 1988, Cannon Trading has spent decades honing its reputation and is widely regarded as a trusted future broker for traders around the world. Over the years, the company has contributed significantly to the futures industry—being one of the early adopters of online trading technology, sharing market insights through educational resources, and exemplifying best practices in client service. Cannon’s longevity in the competitive futures brokerage field speaks to its adaptability and unwavering commitment to clients’ success. Today, it is not just a brokerage but a partner in its clients’ trading journeys, distinguished by qualities that few others can match. Below are key aspects that highlight Cannon Trading Company’s leadership in the futures trading arena:

With these strengths, Cannon Trading Company has firmly established itself as a leader in the futures trading community. The combination of top-tier customer satisfaction, unimpeachable trustworthiness, deep industry experience, and technological excellence makes Cannon a one-stop destination for traders seeking the best futures broker to support their trading journey. The firm’s historical and ongoing contributions—be it through pioneering trading solutions, guiding traders with expert knowledge, or simply being a dependable partner—have left an indelible mark on the industry. In an era where traders have many choices, Cannon continues to differentiate itself by blending old-school integrity with modern innovation. For anyone serious about trading futures, Cannon Trading Company represents the gold standard of what a futures brokerage should be.

The world of trading futures offers immense potential for those equipped with knowledge, discipline, and the right support. By mastering popular trading techniques—whether it’s a quick scalp on an index future or a carefully hedged commodity spread—and integrating them into a consistent daily routine, traders can approach the futures markets with confidence. Equally important is having a strong partner in your corner. As we’ve seen, a seasoned and reliable futures broker can provide the technology, guidance, and security that elevate a trading experience. When traders combine well-honed strategies with the resources offered by the best futures broker, the results can be truly powerful. Cannon Trading Company exemplifies this synergy: its decades of expertise and client-focused services empower traders to apply their skills effectively in the market. In essence, success in futures trading comes down to preparation and partnership. With sound strategies, steadfast risk management, and a brokerage like Cannon Trading Company supporting your goals, you can navigate the futures landscape with greater clarity and purpose. As the futures industry continues to evolve, those who stay educated, disciplined, and well-supported will be best positioned to thrive in the exciting opportunities that lie ahead.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572(International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

In the rapidly evolving world of futures trading, having access to a cutting-edge futures trading platform is critical. One such platform making waves in the trading community is Bookmap—an innovative tool designed to bring transparency and precision to trading decisions. With its unique visual approach, Bookmap trading enables both novice and professional traders to see beyond the basic charts and deeply understand market behavior in real time.

As the demand for advanced platforms increases, so does the need for reliable brokers. That’s where Cannon Trading Company shines. As one of the most respected firms in the industry, Cannon Trading has been helping traders navigate the complex world of online futures trading platforms for decades.

This article explores the most important features of Bookmap for futures trading, details how to access Bookmap download and pricing, and explains why Cannon Trading Company is an outstanding partner for using this platform.

Bookmap is a high-performance futures trading platform that displays full-depth market data in an intuitive heatmap format. Unlike conventional charting tools, Bookmap trading enables you to see market liquidity and order flow with unprecedented clarity.

With Bookmap Web and Bookmap TradingView integration, users now have the flexibility to analyze markets on various devices and charting systems. This accessibility is enhanced by Bookmap free features that allow traders to try out the platform before committing financially.

The availability of granular market data is one of the core strengths of Bookmap. It visualizes market dynamics by showing historical order book activity and real-time transactions, enabling traders to spot opportunities before they appear on standard charts.

Understanding Bookmap pricing is key before diving in. There are several tiers based on your needs:

Each tier offers flexibility depending on whether you’re new to Bookmap trading or a seasoned professional. Importantly, Bookmap download is straightforward, and the platform supports both Windows and macOS.

With Bookmap Web, you can even access your trading dashboard from any browser, making it ideal for traders on the go.

When it comes to online futures trading platforms, broker selection is just as important as the platform itself. Cannon Trading Company stands out as an industry leader and is a perfect partner for anyone using Bookmap.

Combining the sophisticated features of Bookmap with the unmatched service of Cannon Trading Company creates a powerhouse for futures traders. Whether you’re leveraging the real-time heatmap for scalping or conducting detailed order flow analysis, Cannon Trading’s infrastructure and experience enhance your performance.

From Bookmap pricing transparency to expert help with Bookmap data feeds, Cannon ensures that your trading experience is as seamless and successful as possible.

The Bookmap Futures Trading Platform is revolutionizing how traders view and interact with the market. Its innovative visualization tools, integration with Bookmap TradingView, browser-based Bookmap Web, and robust Bookmap free version make it a go-to solution for serious traders. When combined with a top-tier brokerage like Cannon Trading Company, which offers industry experience, stellar reputation, regulatory compliance, and multiple futures trading platform options—including Bookmap—you have a winning formula for success.

Whether you’re exploring Bookmap download for the first time or looking to deepen your expertise in Bookmap trading, partnering with Cannon Trading will elevate your performance and confidence.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Sierra Charts is widely regarded as one of the best futures trading platforms available today. Known for its depth, precision, and robust customization, Sierra Chart software is built for traders who value speed, stability, and flexibility in their charting and order execution. Whether you’re a new entrant exploring the world of trading futures or a seasoned institutional trader looking for a powerful toolset, Sierra Charts is designed to meet your needs with professional-grade features.

Cannon Trading Company stands out as the ideal brokerage partner for users of Sierra Charts, offering decades of experience, unmatched client support, and a suite of benefits that enhance every trader’s workflow.

Sierra Chart software is a high-performance, low-latency platform tailored for futures trading. It delivers a comprehensive solution with advanced technical analysis tools, real-time market data, and support for automated trading systems. Developed with an emphasis on efficiency and control, Sierra Charts is not only an institutional trading platform but also accessible to independent traders who demand performance.

Key Advantages:

With support for multiple data providers and brokers, Sierra Charts positions itself as a true institutional trading platform with appeal across the professional spectrum.

Cannon Trading Company is uniquely positioned to support Sierra Charts users for several compelling reasons:

✅ Decades of Experience

With over 35 years in the industry, Cannon Trading is one of the most trusted names in futures trading. Their deep expertise ensures clients receive insightful guidance for both platform use and market strategies.

✅ Stellar Reputation

The firm boasts a near-perfect TrustPilot rating, with many reviews applauding its fast support and knowledgeable brokers—ideal for trading futures confidently.

✅ Regulatory Excellence

Cannon Trading has maintained an exemplary record with regulators, giving traders peace of mind that they are working with a reliable and transparent partner.

✅ Diverse Platform Suite

In addition to Sierra Chart software, Cannon Trading provides access to a top-tier selection of platforms including CTS T4, Firetip, Rithmic, and more—cementing its reputation as a leader in best futures trading platform solutions.

Whether you’re a short-term scalper or a long-term trend trader, Sierra Charts delivers a versatile, robust, and high-performance experience that meets the demands of modern futures trading. When paired with the trusted, experienced team at Cannon Trading Company, you gain not only the tools but also the support to take your trading futures journey to the next level.

From institutional-grade features to tailored service, the synergy between Sierra Chart software and Cannon Trading is unmatched in the industry.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

The Trader/Rithmic Futures Trading Platform has emerged as one of the leading solutions for active futures traders seeking high-performance market connectivity, advanced order execution, and precise risk management tools. Known for its ultra-low latency and institutional-grade technology, this platform is powered by Rithmic, a prominent name in the industry offering direct market access and high-fidelity data feeds. Whether you’re an individual retail trader or a professional prop firm operator, the Trader/Rithmic suite, especially RTrader Pro, equips you with powerful tools to navigate volatile futures markets effectively.

At the core of the Trader/Rithmic Futures Trading Platform is the Rithmic infrastructure—a robust trading engine that delivers real-time market data and trade execution with minimal latency. Rithmic provides API solutions, enabling seamless integration with various charting and order execution platforms. Traders using the Trader/Rithmic system can access a vast network of exchanges with direct market routing capabilities, ensuring that their orders are executed at top speed and accuracy.

The platform is often accessed through RTrader Pro, Rithmic‘s flagship graphical user interface. RTrader Pro is designed to deliver an advanced trading experience with real-time P&L tracking, automated trading support, and customizable market views. Together, Rithmic, Trader/Rithmic, and RTrader Pro form a comprehensive ecosystem that supports a wide array of futures trading strategies.

Below are the most important features that make the Trader/Rithmic Futures Trading Platform a top-tier choice for futures traders:

The Trader/Rithmic Futures Trading Platform caters to a wide spectrum of trading profiles:

RTrader Pro provides an intuitive interface that bridges these user types with the depth of the Rithmic infrastructure.

The Trader/Rithmic Futures Trading Platform is a high-performance solution tailored for futures market participants who demand speed, precision, and flexibility. Powered by Rithmic’s advanced infrastructure and complemented by RTrader Pro’s user-centric design, this platform caters to the full spectrum of trading needs—from day trading to algorithmic execution.

Whether you’re a retail trader seeking an edge or a professional managing multiple accounts, the Trader/Rithmic platform delivers the tools and technology required to thrive in today’s fast-paced futures markets.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

|

|

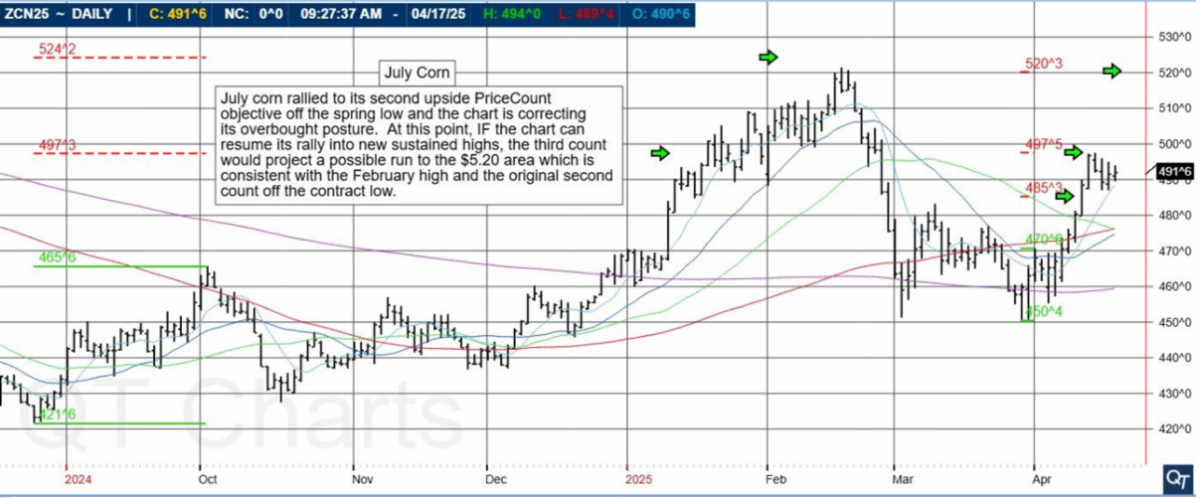

July corn rallied to its second upside PriceCount objective off the spring low and the chart is correcting its overbought posture. At this point, IF the chart can resume its rally into new sustained highs, the third count would project a possible run to the $5.20 area which is consistent with the February high and the original second count off the contract low.

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk.

Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

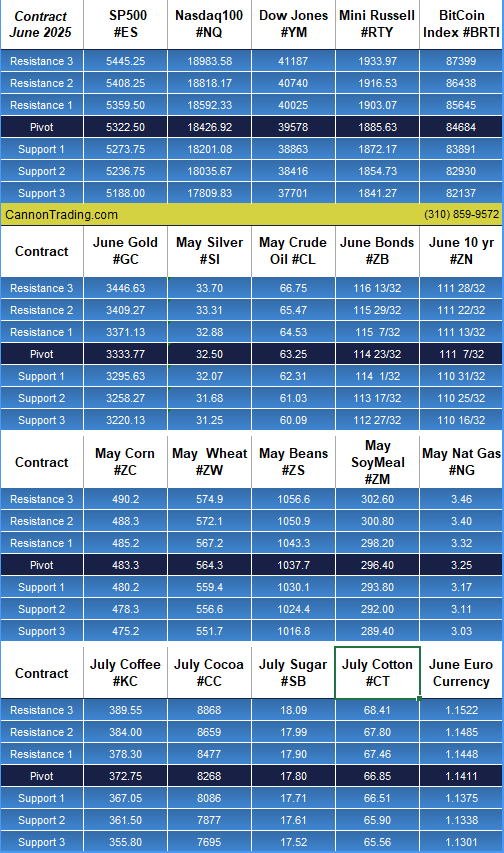

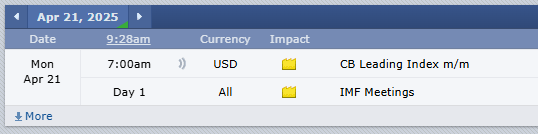

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|