FOMC Tomorrow

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Here is a subject that a lot of people don’t understand at all. Day Trading can be risky. So, it is something that you should stay away from unless and until you are absolutely sure about what you are doing.

There are a number of items about Day Trading such as the minimum mantaince requirementand more that need to be taken into consideration. With the blogs and write-ups listed in this section, you can learn a great deal about day trading.

We at Cannon Trading can help you understand the different concepts of trading and present you with the latest information on the same. Our team of professional and smart people can help you in your day trading transactions and more. In order to understand day trading more clearly, we advise that you go through all the write-ups listed in this category archive on Day Trading.

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

However, with volatility, you need to double check the status daily at:

Below you will see a quick video on how to set and utilize the bracket orders feature on the StoneX futures platform/ CQG desktop

BRACKET ORDERS VIDEO

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Futures trading has evolved dramatically in recent years with the rise of intuitive, real-time platforms that offer retail and professional traders powerful tools. Among them, TradingView has surged in popularity thanks to its dynamic charting, robust analytical tools, and social community features. In this article, we explore why the TradingView Futures Trading Platform stands out as a premier online futures trading platform and why Cannon Trading Company is a top-tier partner for those looking to take advantage of everything TradingView has to offer.

What Is the TradingView Futures Trading Platform?

The TradingView Futures Trading Platform is a sophisticated yet user-friendly online futures trading platform that delivers live charting, in-depth analytics, and direct broker connectivity for active traders. Available through the TradingView download, TradingView app, and TradingView Desktop, it provides access to global futures markets with a seamless trading experience.

With the TradingView free version offering basic capabilities and premium upgrades unlocking institutional-level tools, TradingView caters to both novice and professional traders. The platform is particularly well-known for its TradingView chart interface, which allows real-time visualization of market data and technical indicators, including TradingView chart live feeds from major exchanges.

Key Features of TradingView for Futures Trading

When it comes to futures trading, specific platform features can make all the difference. Here are the most important features of the TradingView Futures Trading Platform that set it apart:

The combination of precision and flexibility in the TradingView chart tool enables futures traders to analyze trends and execute strategies efficiently.

While the platform is critical, your choice of broker is equally important in determining your success in the futures markets. That’s where Cannon Trading Company truly shines. Here’s why they make an ideal partner for those using TradingView for futures trading:

Established in 1988, Cannon Trading Company has over 35 years of futures industry experience. Their team includes brokers with backgrounds in institutional trading, risk management, and commodity trading. This depth of expertise helps clients make informed decisions and leverage the full potential of tools like the TradingView chart.

Cannon Trading is a registered member of the National Futures Association (NFA) and operates under the strict oversight of the Commodity Futures Trading Commission (CFTC). Their spotless compliance record demonstrates an unwavering commitment to transparency and ethical standards in all client dealings.

This makes them a trusted partner when integrating a robust online futures trading platform like TradingView.

Cannon Trading has earned numerous 5 out of 5-star ratings on TrustPilot. Clients consistently praise their excellent customer service, fast execution speeds, and educational support. These accolades reflect their client-first philosophy and ensure a smooth TradingView app experience when connected to Cannon.

While TradingView is a premier choice, Cannon provides access to a broad array of trading software at no cost, including:

Unlike many large brokerage firms, Cannon Trading provides personalized service. You can speak to experienced professionals who will walk you through connecting your account to TradingView Desktop or help you troubleshoot features like TradingView chart live.

They also provide insights into using TradingView indicators and settings tailored to your risk tolerance and market goals.

Getting started is simple. Follow these steps to launch your journey with one of the best online futures trading platforms:

This partnership brings together the best of both worlds:

Whether you’re trading energy futures, metals, interest rate products, or indices, the TradingView and Cannon combo gives you the insight, control, and speed needed to succeed.

The TradingView Futures Trading Platform has revolutionized how traders approach the markets, offering intuitive tools like TradingView chart, TradingView chart live, and multi-device access through the TradingView app, TradingView Desktop, and TradingView free editions.

But pairing this cutting-edge platform with a highly rated, industry-respected broker like Cannon Trading Company takes your trading to the next level. With their decades of futures expertise, free platform offerings, personalized broker assistance, and a sterling reputation among regulators and clients, Cannon is a trusted name in futures trading.

Whether you’re just beginning or are a seasoned trader seeking to optimize your setup, leveraging TradingView through Cannon Trading is one of the smartest moves you can make in today’s futures landscape.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

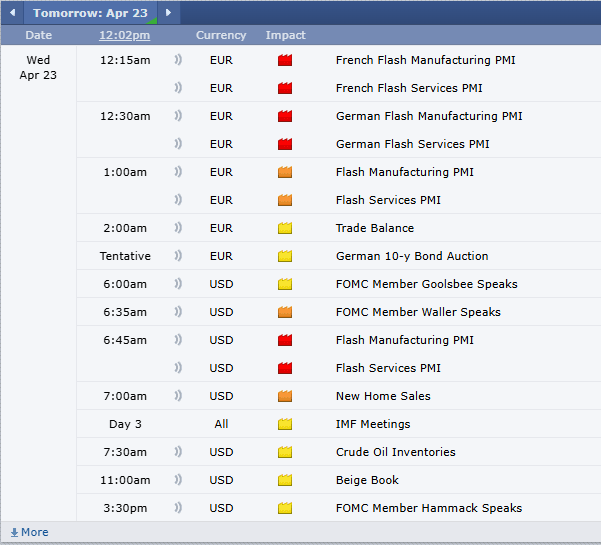

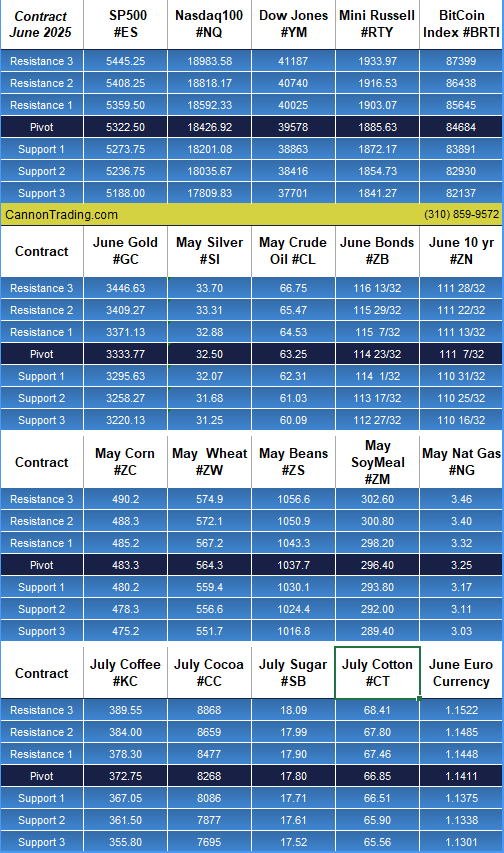

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

By John Thorpe, Senior Broker

|

|

|

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

|

|

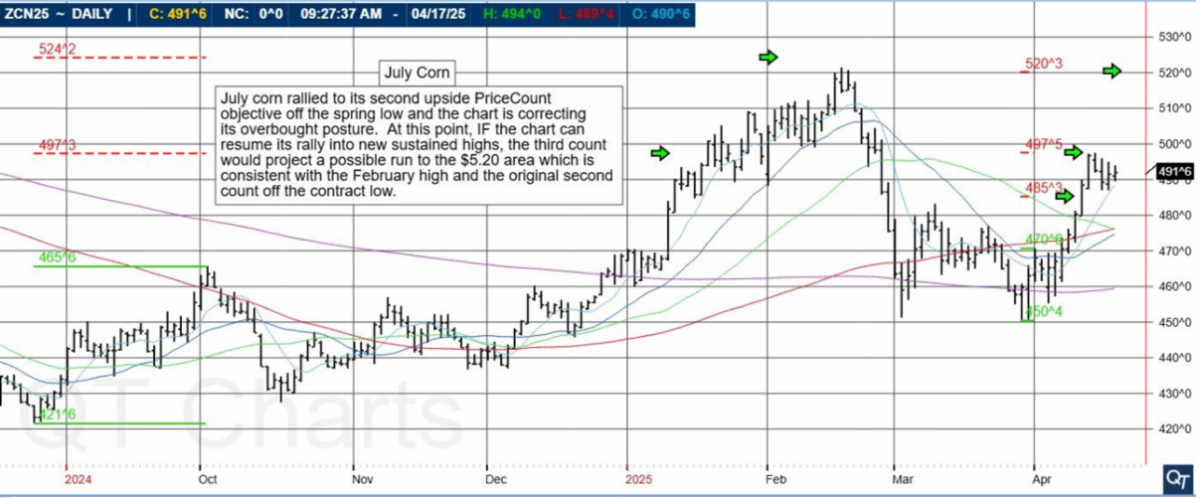

July corn rallied to its second upside PriceCount objective off the spring low and the chart is correcting its overbought posture. At this point, IF the chart can resume its rally into new sustained highs, the third count would project a possible run to the $5.20 area which is consistent with the February high and the original second count off the contract low.

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk.

Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

|

|

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

|

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

|

|

|

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

The May wheat – corn spread is threatening to break down into a new contract low. At this point, new sustained lows would project a possible slide to the third PriceCount objective in the 16 area.

|

|

|

|

|

|

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|