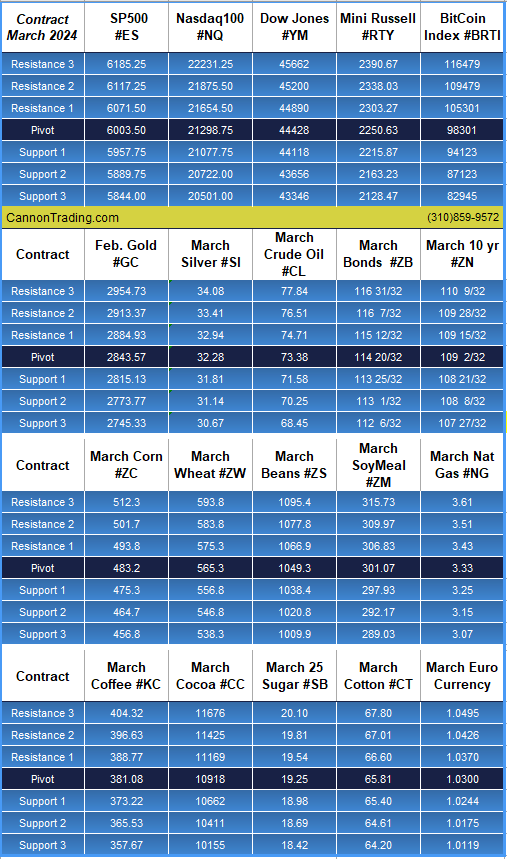

| Market turbulence and volatility is here to stay for the foreseeable future as global tensions rise.

Choose your opportunities wisely.

Updated: February 4, 2025 11:19 am

WSJ on Tuesday now reporting President Trump and China’s leader Xi will not speak to each other later today

Updated: February 4, 2025 11:24 am

Bloomberg reported on Tuesday that around 20,000 US federal employees accepted buyout offers. The Washington Post today is reporting layoffs of federal employees is likely if too few of them choose to accept buyouts or quit.

Updated: February 4, 2025 2:17 pm

Pres. Trump said he would have talks with his Iranian counterpart, but also said Iran is too close to having and cannot have nuclear weapons

Updated: February 4, 2025 2:23 pm

Pres Trump he would like to Palestinians taken in by Egypt and Jordan, adding they have no alternative but to leave. He is not in favor of Israeli’s settling in Gaza

Russia – Ukraine War Update

–Reuters reports Ukraine’s military said on Tuesday its air force had struck a Russian military command post in Russia’s Kursk region the previous day causing sustained significant damage and casualties. Reuters could not independently verify the statement.

–Ukraine’s military has reported numerous strikes on Russian military and energy facilities in recent weeks. Ukrainian forces have been battling Russian troops in the Kursk region since Ukraine mounted a cross border operation there last year.

–A pro-Russian Ukrainian paramilitary leader, Armen Sarkisyan, was killed along with one other person, and three more people were wounded in a bomb blast inside a residential building in northwest Moscow, Russian state news agency TASS reports.

–Russia’s Investigative Committee said it opened a criminal inquiry after the explosion on charges of murder by means injurious to the public, attempted murder of two or more people and arms trafficking.

–Ukrainian forces are believed to be behind a series of assassinations in Russia. In mid-December, Russian General Igor Kirillov died in a remote-controlled blast in Moscow.

–The United Nations echoed Ukraine’s growing concerns that Russia killed 79 captured Ukrainian soldiers in 24 separate incidents since September.

–A former United Kingdom MP, Jack Lopresti, has joined the Ukrainian International Legion to help fight against Russia, media reports said. Lopresti reportedly travelled to Kyiv in November to help a charity.

|