|

|

|

|

Here is a subject that a lot of people don’t understand at all. Day Trading can be risky. So, it is something that you should stay away from unless and until you are absolutely sure about what you are doing.

There are a number of items about Day Trading such as the minimum mantaince requirementand more that need to be taken into consideration. With the blogs and write-ups listed in this section, you can learn a great deal about day trading.

We at Cannon Trading can help you understand the different concepts of trading and present you with the latest information on the same. Our team of professional and smart people can help you in your day trading transactions and more. In order to understand day trading more clearly, we advise that you go through all the write-ups listed in this category archive on Day Trading.

|

|

|

|

Standard and Poor’s 500 futures, commonly known as S&P 500 futures or SP500 index futures, are among the most widely traded financial instruments in global markets. These contracts offer exposure to the performance of the S&P 500 index, a benchmark that represents the performance of 500 large-cap U.S. companies. Whether used by institutions for hedging or speculators for profit opportunities, S&P futures play a pivotal role in the financial ecosystem. This detailed exploration delves into the mechanics of the S&P 500 futures contract, its components, trading strategies, and its appeal to various market participants.

S&P 500 futures are derivatives contracts that derive their value from the S&P 500 index. These contracts allow traders and investors to speculate on or hedge against the future performance of the index. Each S&P 500 futures contract represents a fixed dollar amount multiplied by the current index level. For instance, the standard S&P 500 futures contract has a multiplier of $50, while the micro SP futures contract has a multiplier of $5, making it more accessible to individual investors.

The contracts are traded on regulated exchanges, primarily the Chicago Mercantile Exchange (CME), under the product name E-mini S&P 500 futures and Micro E-mini S&P 500 futures. These products are available for trading nearly 24 hours a day, five days a week, ensuring flexibility for participants across time zones.

Trading the S&P 500 futures index requires understanding the contract’s specifications and the market dynamics. Here are the steps and considerations for trading:

The participants in the S&P 500 futures market are diverse, each with unique motivations. They include institutional investors, individual traders, and high-frequency trading firms.

Institutional Investors: Hedging and Portfolio Management

Institutions such as mutual funds, pension funds, and insurance companies frequently use S&P 500 futures to hedge their equity exposure. Hedging involves taking an opposite position in futures to offset potential losses in a portfolio. For instance, if a portfolio manager expects market volatility or a downturn, they might sell S&P 500 futures contracts. This allows them to lock in the current value of their holdings, reducing the impact of adverse price movements.

Speculators: Profiting from Price Movements

Speculators, including retail traders and hedge funds, are drawn to S&P 500 futures for their liquidity, leverage, and potential profitability. Unlike institutional hedgers, speculators aim to profit from price fluctuations in the S&P futures market. They can go long (buy) if they anticipate a market rally or go short (sell) if they expect a decline. The high liquidity of the S&P 500 futures index ensures minimal slippage, even for large trades, making it an attractive choice for speculative strategies.

Arbitrageurs and Market Makers

Arbitrageurs exploit price discrepancies between S&P 500 futures and the underlying index or related financial products. For example, if the futures price deviates significantly from the index value, arbitrageurs may simultaneously buy the underpriced asset and sell the overpriced one, locking in risk-free profits. Market makers, on the other hand, provide liquidity by quoting buy and sell prices, ensuring smooth market functioning.

The S&P 500 futures contract is closely tied to the S&P 500 index, which is composed of 500 large-cap U.S. companies across various sectors. Key components include:

Institutions favor S&P 500 futures for hedging due to their efficiency, liquidity, and alignment with broad market benchmarks. Here’s why these contracts are essential tools for risk management:

Speculators gravitate toward the S&P futures market for its unique features that cater to active trading strategies:

The Standard and Poor’s 500 futures market is a cornerstone of modern financial markets, serving the diverse needs of institutional hedgers and retail speculators alike. By providing exposure to the broad U.S. equity market, the S&P 500 futures index plays a critical role in risk management, price discovery, and speculative trading.

Institutions rely on the futures SP market for efficient hedging and portfolio protection, while speculators are drawn to its liquidity, leverage, and profit potential. With a detailed understanding of contract specifications, trading strategies, and market dynamics, participants can harness the full potential of the S&P 500 futures contract, whether as Micro SP futures or standard-sized contracts.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

|

|

|

|

|

|

|

In this issue:

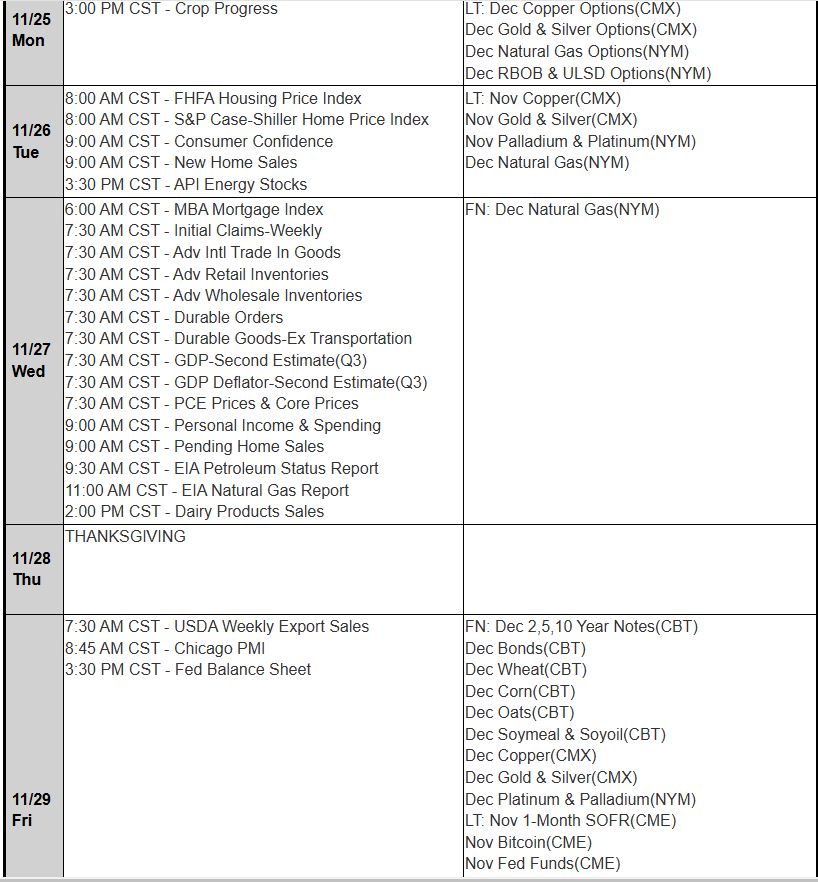

Important Notices – Next Week Highlights:

The Week Ahead

By John Thorpe, Senior Broker

503 corporate earnings reports and a number of meaningful Economic data releases.

FOMC Minutes 1:00P.M. Central this upcoming Tuesday!, highlights Thanksgiving week data points. No Fed speakers.

Prominent Earnings this Week:

FED SPEECHES:

Economic Data week:

Thanksgiving 2024 Holiday Schedule for CME Exchange HoursClick here for the detailed schedule

|

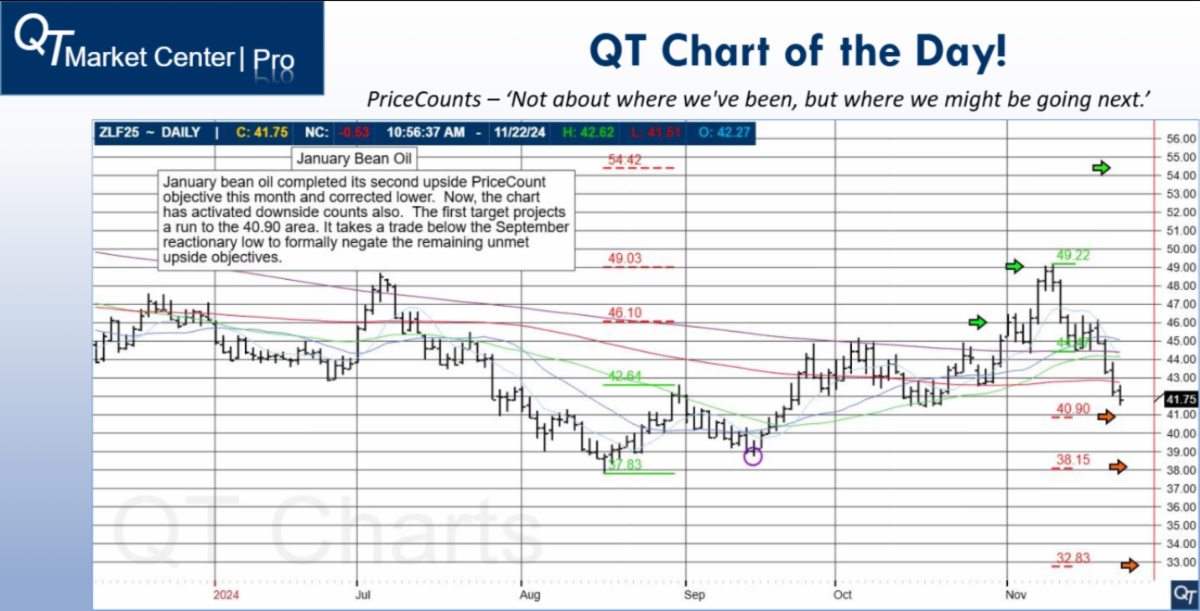

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

January Bean Oil

January bean oil completed its second upside PriceCount objective this month and corrected lower. Nw, the chart has activated downisde counts also. The first target projects a run to the 40.90 area. It takes a trade below the September reactionary low to formally negate the remaining unmet upside objectives.

PriceCounts – Not about where we’ve been , but where we might be going next!

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

|

|

|

|

|

The Dow Jones Industrial Average (DJIA), commonly known as the Dow, has long served as a benchmark for American stock market performance, capturing the movement of 30 prominent U.S. companies across various sectors. Since the inception of DJIA Index Futures, often referred to as Dow futures or Dow Jones futures, traders have had unique opportunities to speculate on the index’s movements, providing a way to manage risk and potentially earn profits based on the future value of the Dow. As the futures market evolved, DJIA Index Futures established themselves as some of the most versatile tools in a trader’s portfolio.

This article explores why DJIA Index Futures have remained a mainstay in the futures market, the key players involved in the development of the Dow Jones futures contract, and why Cannon Trading Company is an excellent brokerage for trading these futures contracts. With decades of expertise in futures trading and a reputation for exceptional customer service, Cannon Trading Company has earned its place as a premier option for traders looking to invest in DJIA Index Futures and emini Dow futures.

DJIA Index Futures have demonstrated remarkable versatility since their introduction to the market. This versatility stems from several key factors:

The idea of creating futures contracts based on major stock indices emerged in response to increased demand for risk management tools in the 1980s. The Chicago Board of Trade (CBOT) was instrumental in bringing this concept to life. The late Leo Melamed, a visionary in financial futures and a key figure at the Chicago Mercantile Exchange (CME), recognized the potential of introducing futures on financial indices. Working alongside industry pioneers, Melamed helped to popularize index futures as a way for investors to protect their portfolios from adverse movements in stock prices.

The initial success of the S&P 500 futures contract set the stage for further innovation in the market. The creation of DJIA Index Futures was a natural progression. In 1997, the CBOT launched the DJIA Index Futures contract, providing investors a means to speculate or hedge on the movements of one of the most well-known indices in the world. This product allowed for a diversified approach to futures trading, as it reflected the performance of the Dow Jones Industrial Average, a cornerstone of American financial markets.

While Melamed was a pivotal figure, the development and launch of DJIA Index Futures were collaborative efforts that involved input from regulators, financial institutions, and industry experts. Their goal was to create a futures product that mirrored the Dow Jones index and offered accessible, transparent, and efficient trading for institutions and retail investors alike.

With its reputation for excellence and over three decades of experience in futures trading, Cannon Trading Company has become a trusted broker for traders interested in DJIA Index Futures. Known for its high ratings on platforms like TrustPilot, where it maintains a 5-star rating, Cannon Trading Company has earned a solid reputation for customer service and reliability. Here’s why Cannon Trading Company is a standout choice for trading DJIA Index Futures and other futures contracts.

In addition to standard DJIA Index Futures, the introduction of emini Dow futures has expanded accessibility for retail traders. These miniaturized contracts represent a fraction of the size of traditional Dow futures, allowing traders with smaller capital to participate in Dow Jones futures trading. Emini Dow futures retain many of the features of standard contracts, including liquidity, leverage, and round-the-clock trading. Cannon Trading Company provides access to emini Dow futures, enabling retail traders to benefit from the versatility of Dow Jones futures without the large financial commitment of full-sized contracts.

As a futures trading instrument, DJIA Index Futures offer several advantages that make them popular among traders worldwide:

Since their inception, DJIA Index Futures have proven to be a valuable asset in the futures trading landscape. These contracts offer traders a unique combination of leverage, liquidity, and flexibility, making them suitable for a wide range of strategies, including hedging, speculation, and arbitrage. The versatility of Dow futures, combined with their close association with the U.S. stock market, has made them a go-to choice for traders seeking exposure to the American economy.

Cannon Trading Company’s dedication to providing a top-tier trading experience, combined with its 5-star TrustPilot rating, extensive experience, and regulatory compliance, makes it a highly recommended broker for trading DJIA Index Futures. With access to advanced trading platforms, educational resources, and high-quality customer service, Cannon Trading Company empowers traders to capitalize on opportunities in DJIA Index Futures and emini Dow futures with confidence.

Whether you’re a seasoned futures trader or just starting your journey with Dow Jones futures, the support and expertise offered by Cannon Trading Company make it a trustworthy partner for achieving your trading goals. DJIA Index Futures, with their unique attributes and market appeal, remain an indispensable tool for futures traders worldwide.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading