In today’s ever-evolving financial landscape, futures trading remains a vital instrument for hedging risk, maximizing leverage, and speculating on global markets. With complex regulatory standards, rapidly changing markets, and fierce competition, establishing the best futures brokerage in the United States requires much more than just a license and a trading platform. It demands rigorous planning, continuous adaptation, and unwavering dedication to client success. In this expansive overview, we explore what makes the best futures brokers stand out from the pack, the essential considerations that underpin their success, and how Cannon Trading Company rises as a leader among the top rated futures brokers and top rated commodity brokers in the nation.

Try a FREE Demo!

I. The Blueprint for Building the Best Futures Brokerage

Creating a truly exceptional futures brokerage involves more than offering access to contracts and exchanges. It necessitates:

- Deep Understanding of Client Needs

The best futures brokerage begins with a thorough comprehension of the diverse clientele it serves. From institutional traders and CTA-managed accounts to retail investors and algorithmic quants, a top-tier broker tailors its tools, support, and services to meet the unique needs of each segment. Customization is key.

- Regulatory and Market Compliance

A brokerage must meet and exceed standards set by the National Futures Association (NFA), Commodity Futures Trading Commission (CFTC), and relevant Self-Regulatory Organizations (SROs). The top rated futures brokerage is one that integrates compliance into its operations, proactively monitors risk, and maintains transparent relationships with oversight bodies.

- State-of-the-Art Technology Infrastructure

No modern brokerage can survive without a robust, secure, and high-speed trading infrastructure. To be considered among the top rated futures brokers, a firm must offer low-latency order routing, API access, customizable front-ends, and access to diverse platforms. Traders today demand seamless multi-asset execution, mobile access, and stability under stress.

- Client-Centered Service and Support

Personalized, expert support separates average brokers from the best futures brokers. The top rated commodities brokerage offers hands-on onboarding, fast response times, multilingual support, and access to professional trading consultants. It’s not about a call center — it’s about delivering institutional-quality service.

- Educational Resources and Market Intelligence

The top rated commodity brokers empower traders by providing timely insights, tutorials, webinars, platform training, and market outlooks. Whether it’s a beginner learning the basics of margin or an advanced trader implementing hedging strategies, education is a critical pillar.

II. Cannon Trading Company: A Legacy of Excellence

Founded nearly 40 years ago, Cannon Trading Company has stood the test of time in one of the most competitive and regulated sectors of the financial industry. Headquartered in Los Angeles and registered with the NFA and CFTC, Cannon has built a sterling reputation that positions it squarely among the top rated futures brokers and top rated commodities brokerage operations in America.

- Decades of Proven Industry Experience

With roots stretching back to the 1980s, Cannon Trading has amassed institutional knowledge and expertise that few can rival. This experience translates to a deep understanding of market cycles, regulatory shifts, and the evolving needs of futures traders. Their nearly 40-year history is a testament to consistent excellence and adaptability in a volatile field.

This longevity also reflects stability and trust — key attributes sought by those vetting the best futures brokerage to partner with.

- Regulatory Integrity and Trust

Compliance is not just a checkbox for Cannon Trading — it is embedded in their culture. The firm enjoys a flawless record with regulators, including the NFA and CFTC. This places Cannon in the upper echelon of top rated commodity brokers, reinforcing its reputation as a firm that places transparency and accountability at the forefront of operations.

In an industry where one misstep can lead to loss of trust, Cannon Trading’s unblemished record speaks volumes. It’s no wonder they are often listed among the top rated futures brokerage names on industry comparison lists.

III. A Client-First Philosophy that Delivers Results

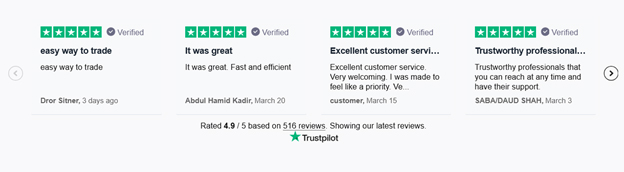

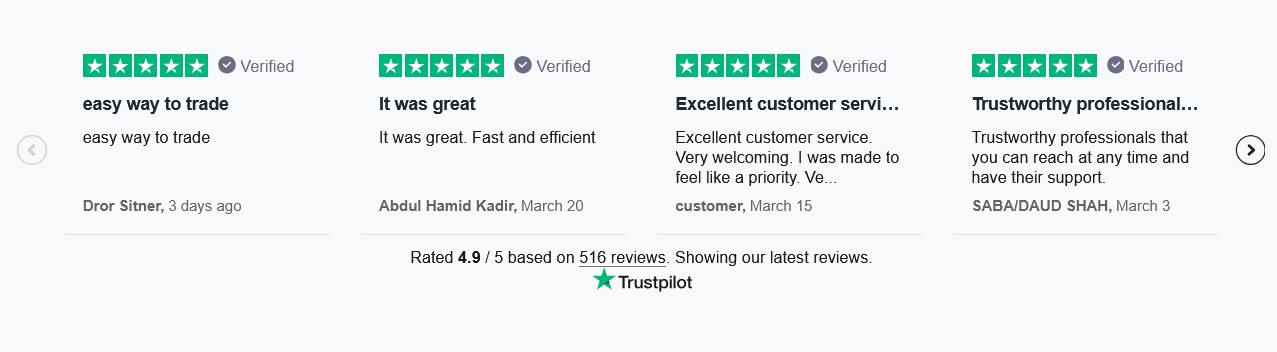

- 5-Star Ratings on TrustPilot

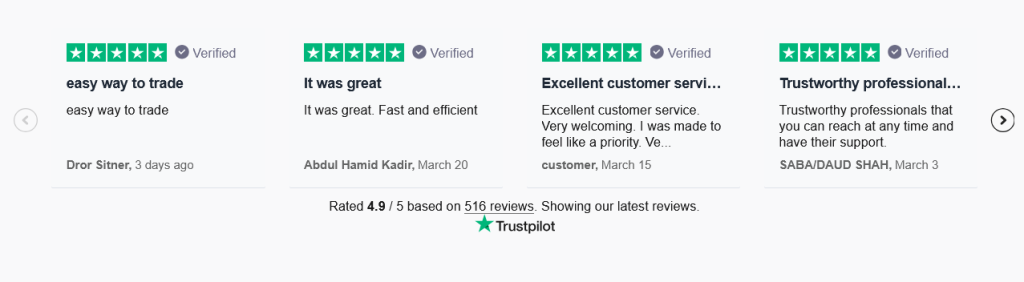

Exceptional service isn’t a claim — it’s a reality backed by 5 out of 5-star ratings on TrustPilot. This rating reflects hundreds of satisfied clients who consistently praise the firm’s knowledgeable staff, speed of support, ease of onboarding, and platform diversity.

In a space saturated with brokers making bold promises, few actually deliver consistently. Cannon Trading’s online reviews are a beacon of what the best futures brokers should aspire to.

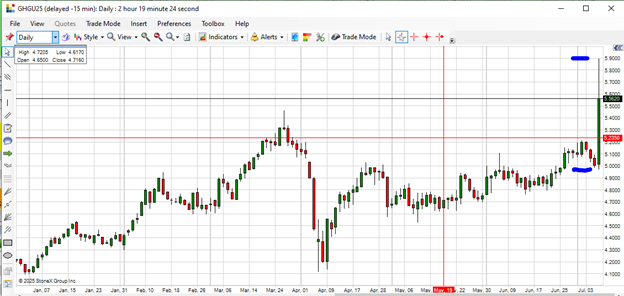

- Full Spectrum of Top-Performing Trading Platforms

What truly sets Cannon Trading apart is its wide selection of powerful trading platforms, including:

This suite accommodates everything from discretionary day trading to automated algorithmic systems. Whether a trader needs advanced volume analysis tools or cloud-based charting, Cannon provides a tailored experience — a hallmark of the top rated commodity brokers.

Such platform diversity isn’t just about convenience. It shows the firm’s commitment to ensuring clients can execute their edge — whatever it may be — effectively and affordably.

Try a FREE Demo!

IV. Tailored Offerings for Every Trader Profile

- For Beginners

Cannon Trading is widely recognized as a top rated commodities brokerage for novice traders due to its educational library, risk management tools, paper trading environments, and live chat assistance. New clients receive hands-on support to help them avoid early pitfalls — an often-overlooked factor when searching for the best futures brokerage.

- For Advanced Traders and CTAs

Professional clients benefit from direct exchange access, colocation services, advanced APIs, and back-office integration. This positions Cannon as a strategic partner — not just a middleman — making it one of the top rated futures brokers for institutional-level trading.

V. Risk Management and Clearing Relationships

Cannon Trading partners with multiple clearing firms and Futures Commission Merchants (FCMs) to give clients options on account types, margin structures, and fee models. This flexibility allows clients to scale, hedge, or trade tactically across different market conditions.

It’s this versatility that makes Cannon a frontrunner among the best futures brokers.

Their teams offer proactive margin management, real-time trade monitoring, and platform support — especially during volatile periods, when many brokers falter.

VI. Education and Trader Development

Knowledge is power in futures trading. Cannon Trading stands out as a top rated commodity broker by investing in:

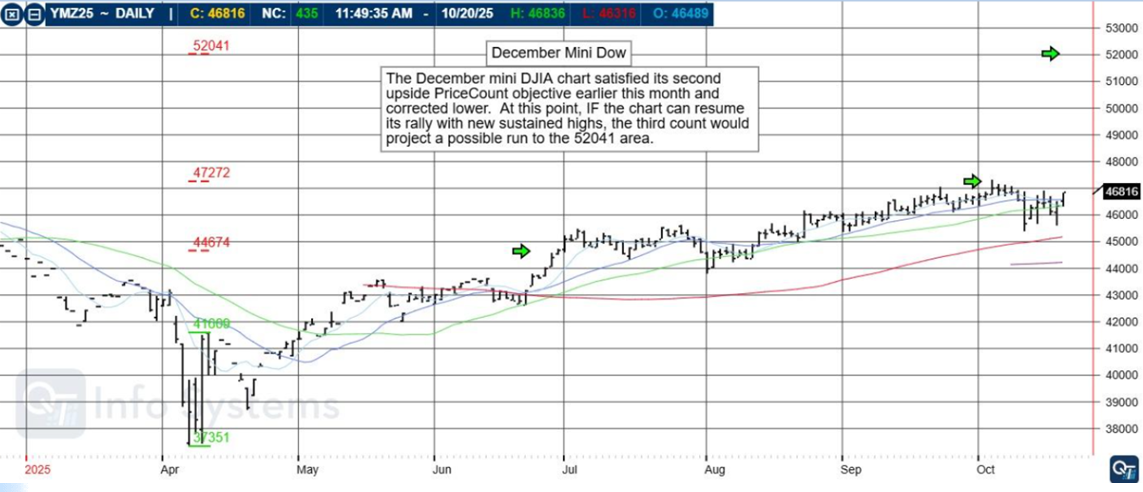

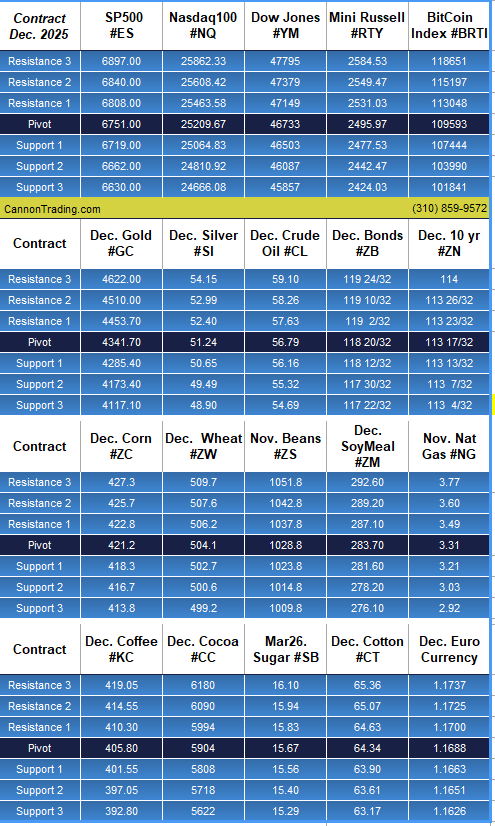

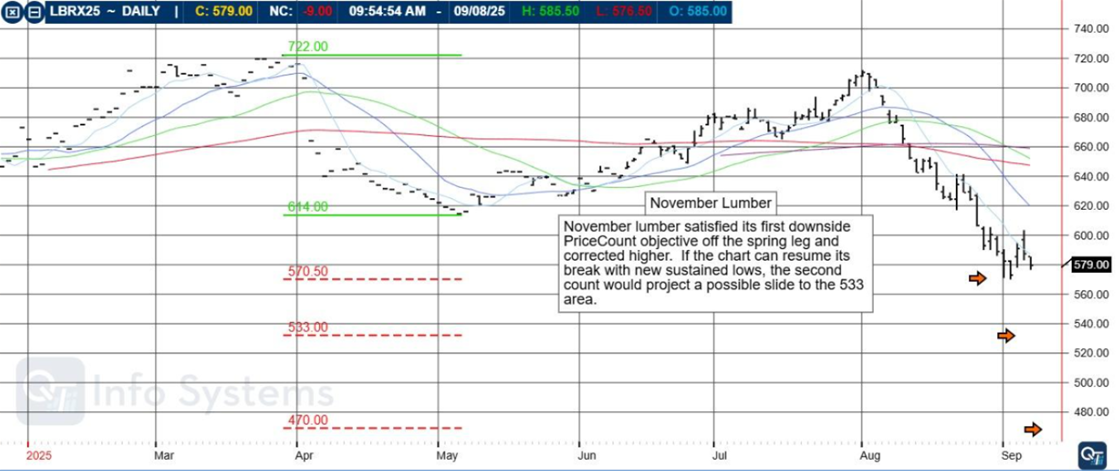

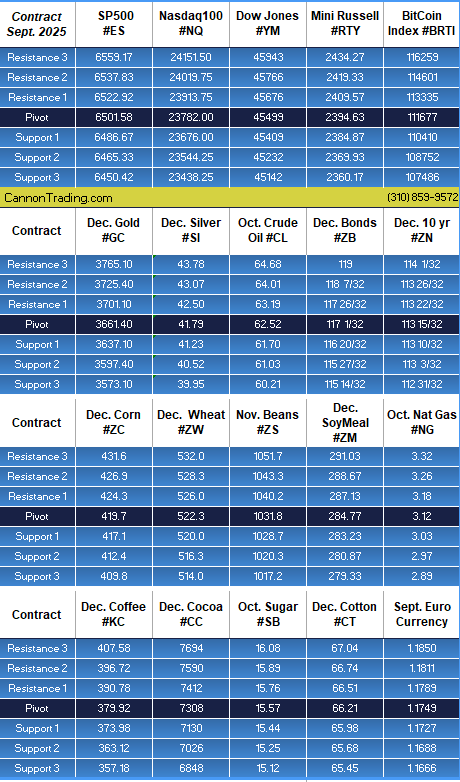

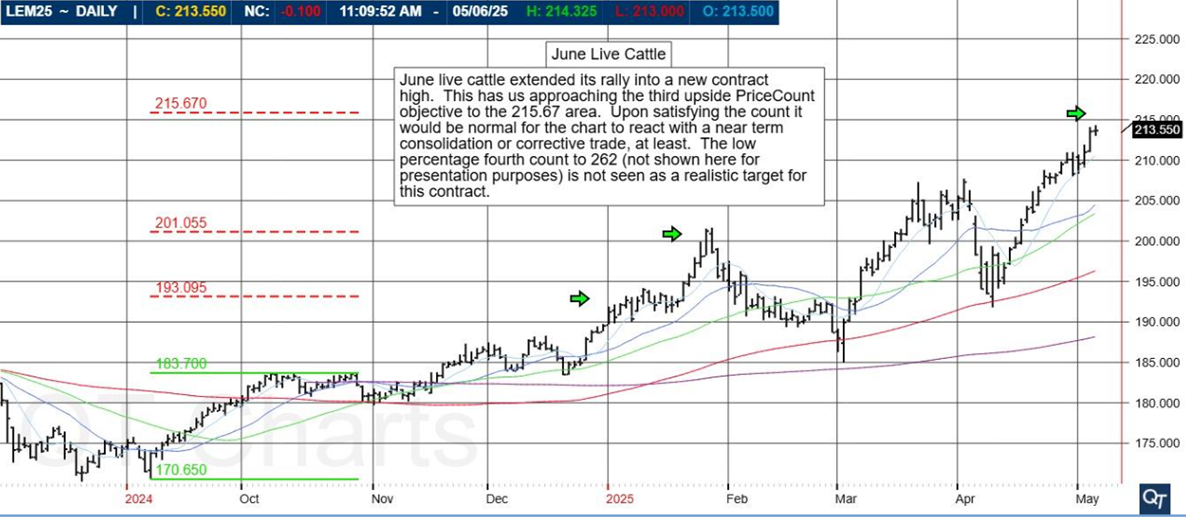

- Live Market Commentary

- Recorded Webinars and Workshops

- Platform Training Sessions

- Technical and Fundamental Strategy Videos

- Risk Management Tutorials

- Daily Trading Newsletters

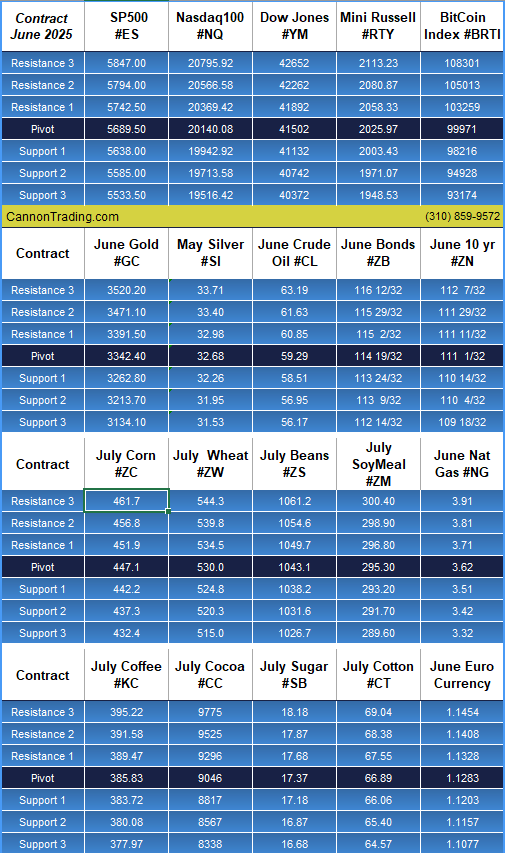

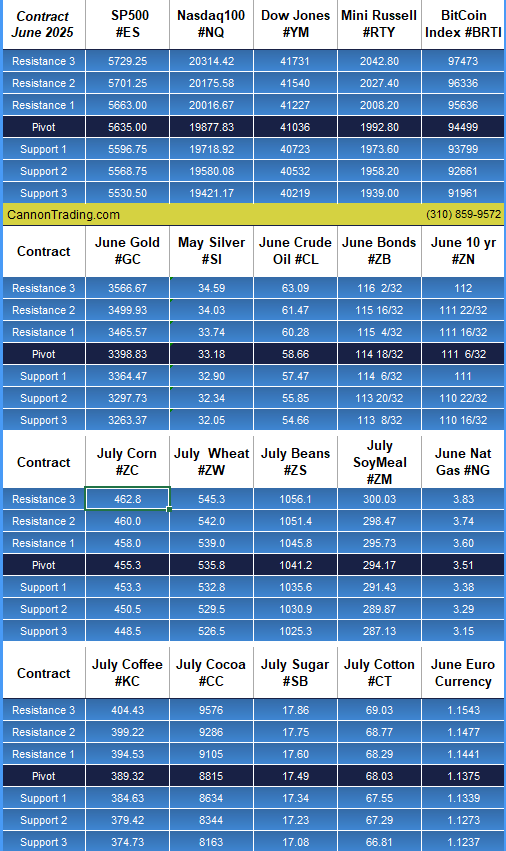

These resources empower clients to make better decisions — whether they’re scalping the E-mini S&P 500 or hedging grain exposure in the commodities pits.

This emphasis on education is why Cannon is frequently chosen by traders looking for the top rated futures brokerage that doesn’t just transact — it teaches.

VII. Custom Brokerage Services and Managed Futures Access

Cannon also caters to traders interested in managed futures, custom execution strategies, and spread trading. Through curated relationships with Commodity Trading Advisors (CTAs) and the ability to open multi-manager portfolios, Cannon Trading opens the door for advanced investing solutions.

This full-service model is rare and is a primary reason Cannon is a standout among the top rated commodity brokers in the U.S.

VIII. Transparent Pricing, Competitive Commissions

Unlike many brokers who shroud their pricing in mystery, Cannon offers fully transparent pricing models with competitive commission structures and no hidden fees. This openness — paired with the ability to choose from multiple FCMs — is a critical differentiator and a primary consideration for those comparing the best futures brokers.

Whether it’s high-volume traders negotiating lower per-contract rates or new traders looking for fee clarity, Cannon delivers.

IX. A National Leader in a Competitive Market

The United States is home to the most developed and complex futures markets in the world. Naturally, it also hosts some of the best futures brokerage firms globally. But within this competitive environment, Cannon Trading Company stands tall by checking every box:

- Experience: Nearly four decades in business.

- Compliance: Excellent standing with regulators.

- Platforms: Broadest platform selection in the industry.

- Service: Personalized attention and top TrustPilot reviews.

- Education: Free, detailed, and constantly updated.

- Flexibility: Multiple FCMs and account types.

- Technology: Cutting-edge execution and charting tools.

- Community: A trader-first culture.

The result? A brokerage that doesn’t just serve clients — it partners with them.

Cannon Trading Company – A Brokerage Built for Every Trader

Becoming the best futures brokerage isn’t an accident. It’s a result of deliberate strategy, expert staff, regulatory excellence, and a laser-focus on client success. Cannon Trading Company exemplifies all of these attributes.

In an industry where brokers come and go, Cannon Trading Company’s enduring presence and stellar reputation make it a go-to name among the top rated futures brokers and top rated commodity brokers. For traders seeking a firm that offers both depth and flexibility, education and execution, integrity and innovation — Cannon Trading Company is not just an option, but a benchmark.

As the U.S. continues to dominate the global derivatives landscape, Cannon’s leadership will remain central to helping clients hedge, speculate, and grow in a dynamic world.

Try a FREE Demo!

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading