Have a great weekend!! take time to clear your “trading brain” and allow it to recharge.

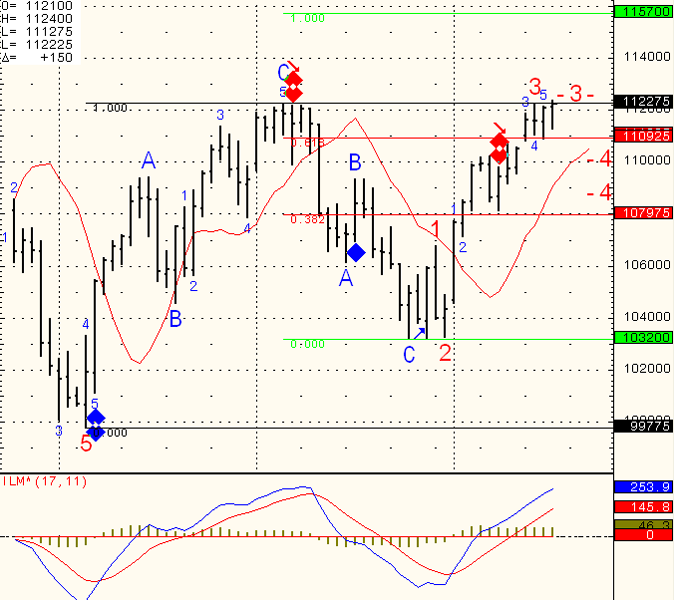

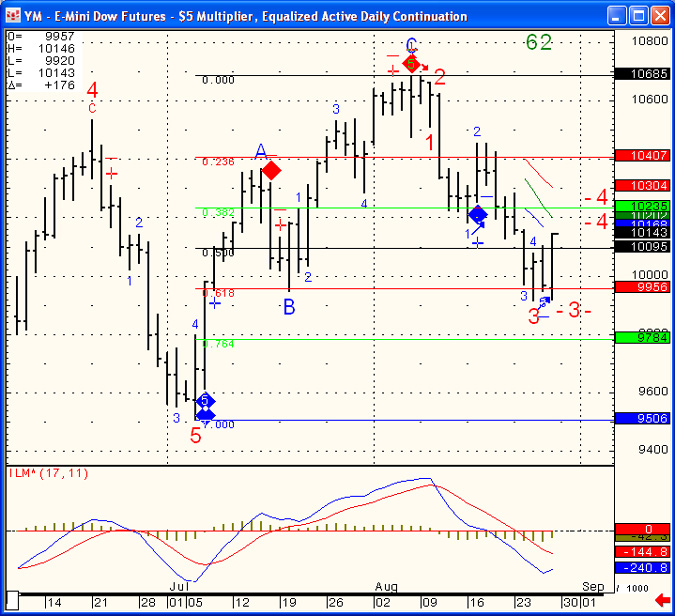

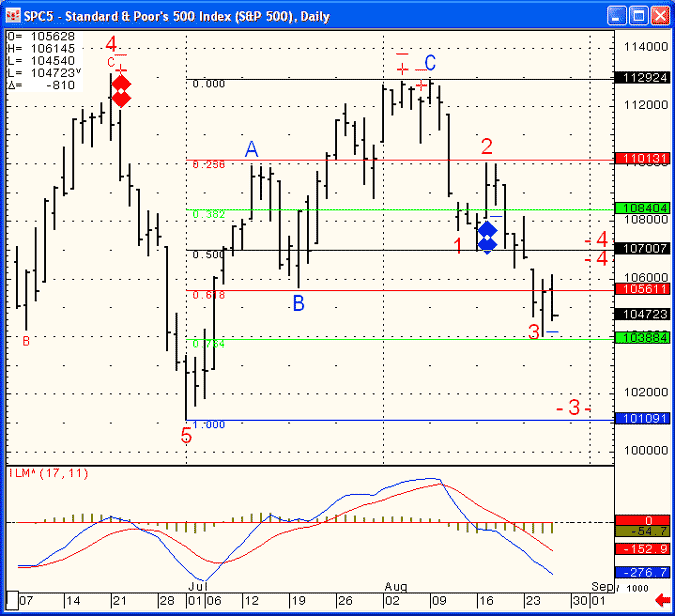

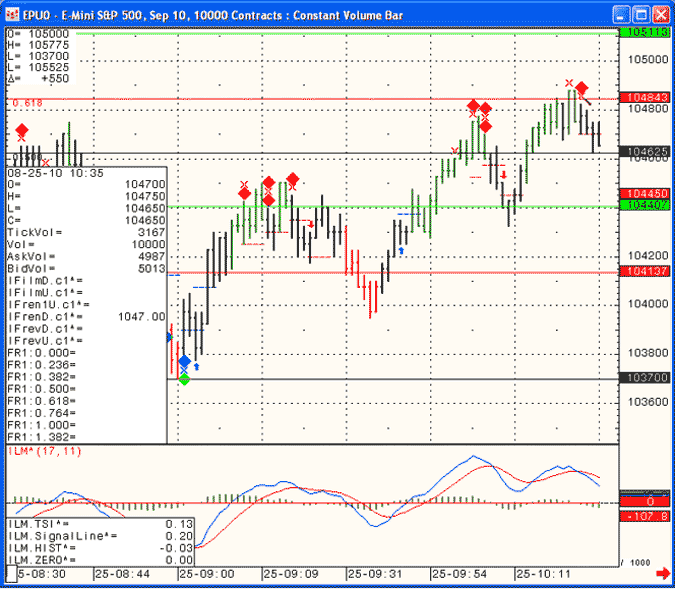

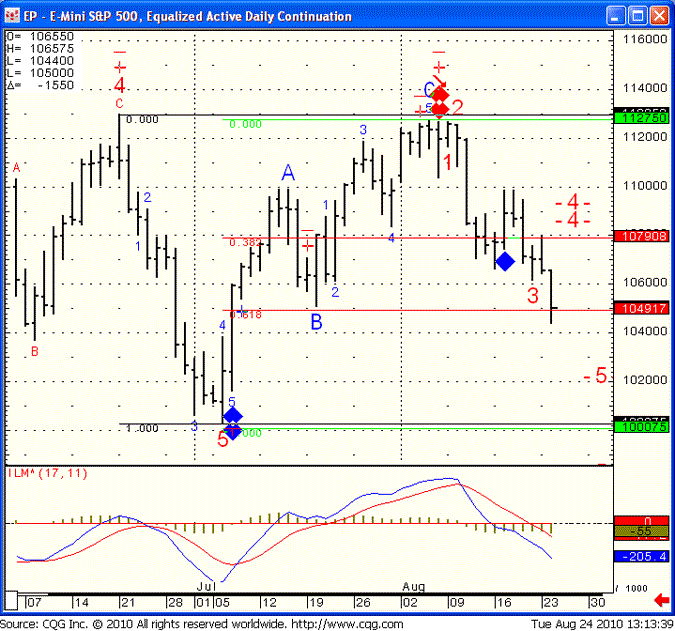

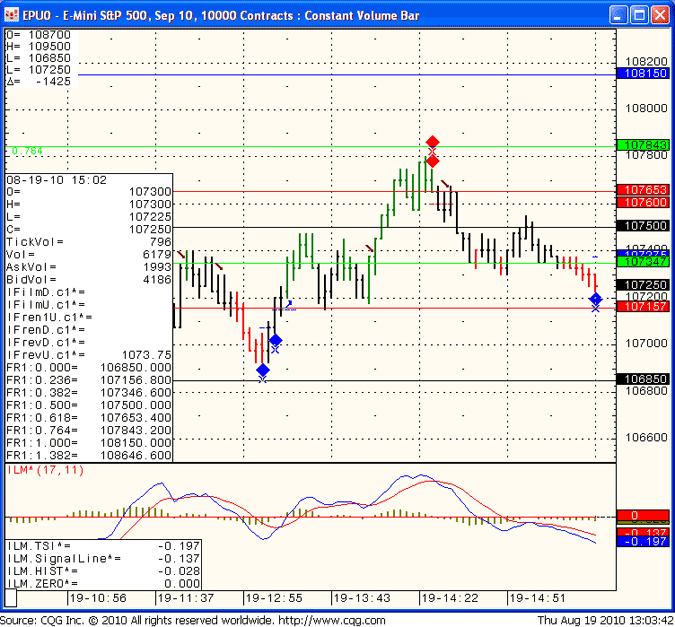

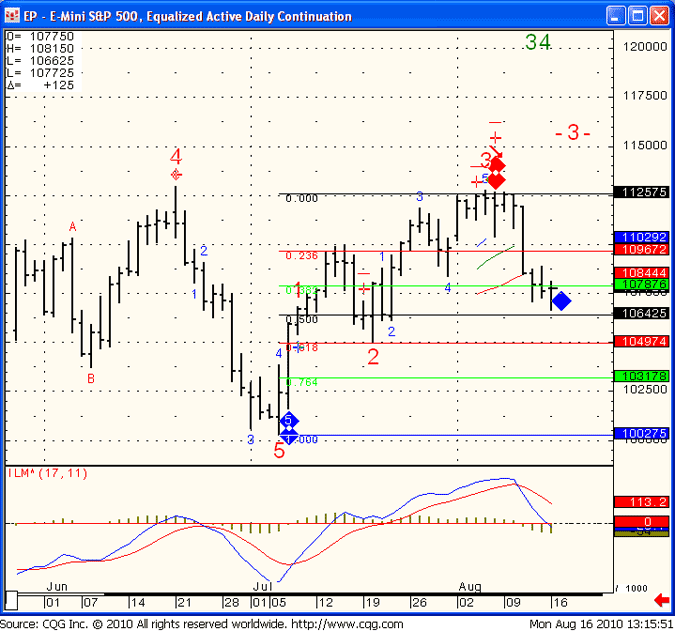

Screen shot from today’s session during our “live charts” service where one can see real-time trade set ups like below

(blue diamonds = possible buy, red diamonds = possible sell)

Charts included in this service are: Mini SP 500, Euro Currency and Crude oil.

For a Free Day Trading Webinar Trial Please Visit:

**************************************************************

https://www.cannontrading.com/tools/intraday-futures-trading-signals

**************************************************************

Continue reading “Free Day Trading Webinar Trial, October 18th 2010”