One Way to Eliminate Fear and Greed While Day Trading

Posted By:- Ilan Levy-Mayer Vice President, Cannon Trading Futures Blog

One Way to Eliminate Fear and Greed While Day Trading

It is a known fact that fear and greed can be a trader’s worst enemies. I’ve found one way that has helped some clients deal with fear and greed and their cousin, “getting out of winners too soon and staying in losers too long.”

What is it? Entering multiple contracts

In order to enter multiple contracts while day trading, one has to have the appropriate risk capital and margin requirements. But the advantage of trading more than one “unit” or splitting your trading size into two or more parts is as such:

If you enter a trade with one contract (or if you are treating your trading size as one unit, meaning you enter a trade with 4 contracts and exit the trade with 4 contracts), you can face a very quick dilemma (especially when day-trading). Consider the two following scenarios:

1. You get in and very quickly you are up 2 mini SP points…what do you do? Do you take profit? Bring your stop loss closer? How do you avoid getting out too early or too late?

2. You enter a trade and it goes against you rather quickly…if you get out then it is a loser…but the little voice in your head says “what if the market goes back up?”

In the first case scenario, when market decided to be nice to us and moved in our direction, I like to exit half of my positions relatively quickly. In the case of the mini SP, this would be around 7 ticks profit.

What I’ve found is that this will allow me to manage the rest of the trade in a much more relaxed manner. Since I’ve already locked profits in, now I can look for a proper stop close to my break-even level. I can analyze my next target more realistically and, if the market provides room for additional gains, be there to participate.

If you like to see what my INTRADAY chart looks like, live during the trading session, sign up for my Live Day Trading Webinar:

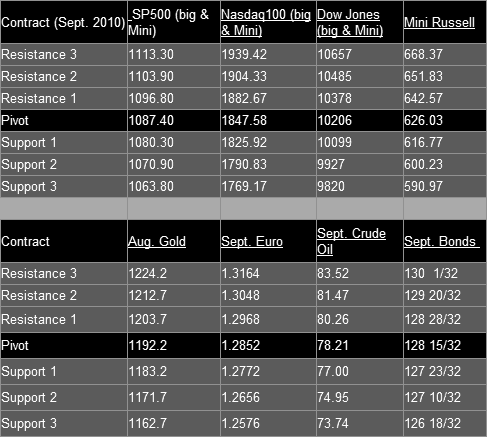

Trading Levels:

This Week’s Calendar from Econoday.Com

Futures Trading Levels for July 22nd 2010

All reports are EST time

Friday July 23rd – http://mam.econoday.com/byweek.asp?cust=mam

- MBA Purchase Applications – 7:00 AM ET

- Ben Bernanke Speaks – 10:00 AM ET

- EIA Petroleum Status Report – 10:30 AM ET

Disclaimer:

Trading commodity futures and options involves substantial risk of loss. The recommendations contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results. This is not a solicitation of any order to buy or sell, but a current futures market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!