| Buckle your seatbelts, Huge Rally in equities and Commodities on the move.

Your Summer of ‘25 burgers will be the most expensive in your lifetime!

Please speak with your broker about ways that you may not be aware of to assist you with your risk management plans. They may surprise you with the creative solutions you may find more efficient than simple stop orders or the old “hand on the mouse blow yourself out” strategy.

Market volatility is here to stay for the foreseeable future

Choose your opportunities wisely.

Have you looked at the Cattle market lately? All time high prices?

I bet you have checked the recent price of your favorite cut of beef at the local Piggly Wiggly.

The Live cattle futures and Feeder cattle futures contracts are at all-time highs. The biggest supporting data, you ask? The US Cattle herd is the smallest it has been in over 65 years.

Think about that for a minute. The US Population in 1960 was a mere 179,323,000 souls. In 2025? Estimates are near the 341,662,000 mark. I doubt the 162,339 000 Americans that represent this population growth can’t all be Vegan! Low supply meets big demand until……

The overnight initial margin req. for 1 Live Cattle contract (40,000 lbs) is 3025.00 and for the Feeder cattle, 4537.00. Please call for more details.

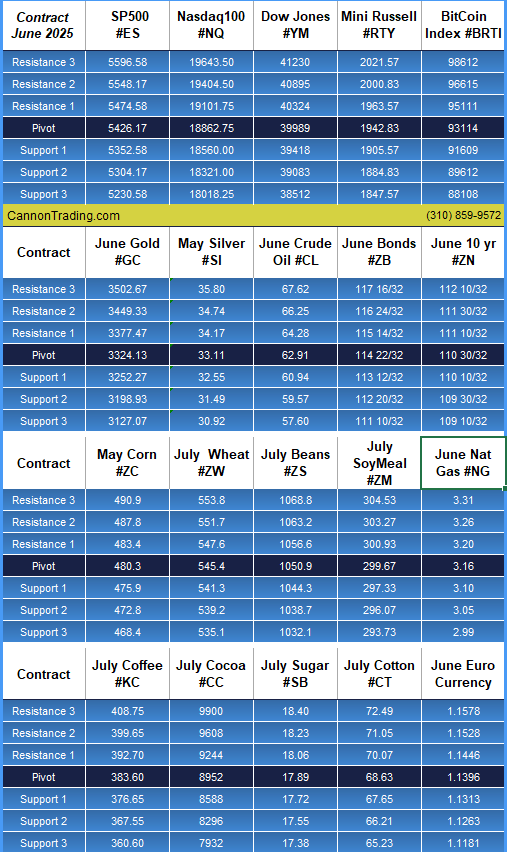

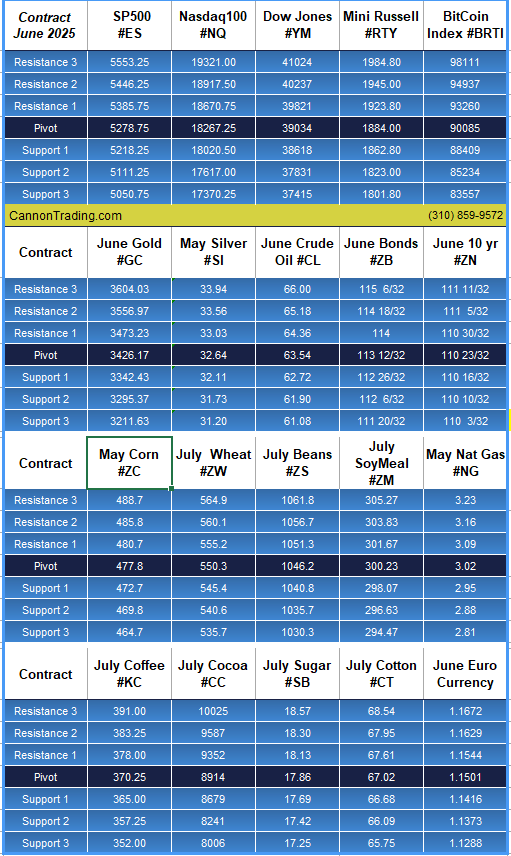

Mini Dow’s range today? 1203 points $value? = $6015.00 from hi to lo

Mini S & P’s range today? 167.50 points $ Value? = $8375.00 from hi to lo

Mini Nasdaq’s range today? 650.25 points $value? = $13005.00 from hi to lo

How gold is your portfolio?

All time highs in the yellow metal today. 3509.9 per troy ounce currently trading @ 3366.00 +/- over $144.00 per oz. what a correction for this over bought market as it reacted to the recovery in the equities. We offer all exchange traded contract sizes, from 1 oz to 100 ounces.

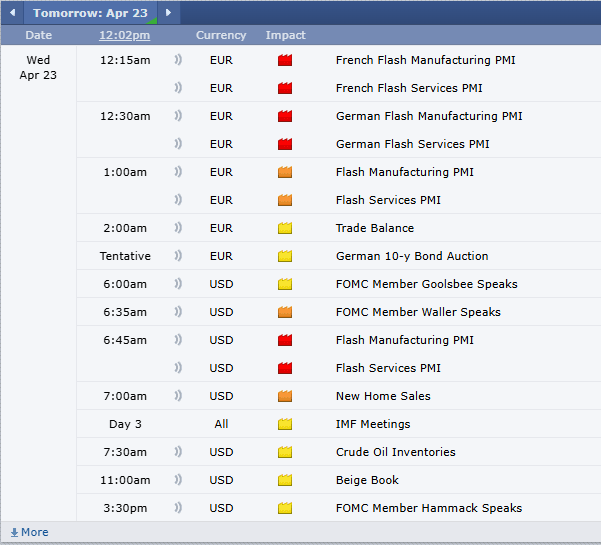

Tomorrow:

Econ Data: New Home Sales, Beige Book, EIA Energy stocks.

FED Speak: Musalem and Waller @ 8:35am CDT

Earnings: IBM, AT&T, Phillip Morris

Tariff news: Anything goes! |