Futures trading, a cornerstone of global financial markets, demands precision, foresight, and agility. In this high-stakes arena, the best futures brokers serve as indispensable allies for retail and institutional traders alike. These brokers facilitate access to markets, provide vital data and analysis tools, offer risk management solutions, and help ensure compliance with complex regulatory frameworks. In the 2020s, the criteria for what constitutes the best futures broker have evolved, shaped by technological advances, user expectations, and heightened competition.

This paper will assess the evolving role of the best futures brokers, the innovations that streamline trading futures, and the defining features that make firms like Cannon Trading Company industry leaders. Special emphasis will be placed on how brokers have consistently met the shifting demands of traders, serving as both enablers and educators in an increasingly complex market environment.

Defining the Best Futures Brokers in the 2020s

To understand the appeal and necessity of the best futures brokers, it is essential to define the criteria by which they are judged. Traders today demand more than simple execution services; they expect comprehensive support, from educational resources to advanced trading platforms.

Key characteristics of the best futures brokers include:

- Technological Adaptability: A best futures broker must offer fast, reliable execution with access to real-time market data and advanced analytics.

- Platform Versatility: The availability of diverse, top-performing platforms enables traders to select tools best suited to their strategies.

- Regulatory Excellence: Strong compliance with regulatory authorities ensures client funds and trades are protected.

- Client Support and Education: The best online futures brokers educate their clients, helping both beginners and seasoned traders understand futures 101 and complex trading strategies.

- Transparency and Trustworthiness: High client ratings, such as 5 out of 5 stars on TrustPilot, reflect consistent performance and client satisfaction.

These features define not only competence but resilience and versatility—qualities essential for enduring success in futures trading.

Technological Advancements and Their Impact on Futures Trading

The 2020s have seen an explosion in fintech innovations that reshape the futures trading landscape. Technologies like artificial intelligence (AI), algorithmic trading, cloud-based platforms, and mobile accessibility have significantly enhanced both the trader’s and broker’s capabilities.

- AI and Automation: AI allows brokers to offer predictive analytics, risk management algorithms, and personalized trading insights. These tools help traders anticipate market movements and adjust strategies quickly.

- Cloud-Based Trading Platforms: Brokers now offer browser-based platforms that eliminate the need for cumbersome installations. These platforms provide flexibility, enabling users to trade futures anywhere, anytime.

- API Integrations: For sophisticated traders and developers, brokers that offer robust API support allow for custom strategy building and automation.

- Mobile and Remote Accessibility: Traders can now manage portfolios, set alerts, and execute trades from mobile apps with institutional-grade features.

The best futures brokers leverage these technologies not just as features but as integral components of the client experience, transforming how traders interact with global futures markets.

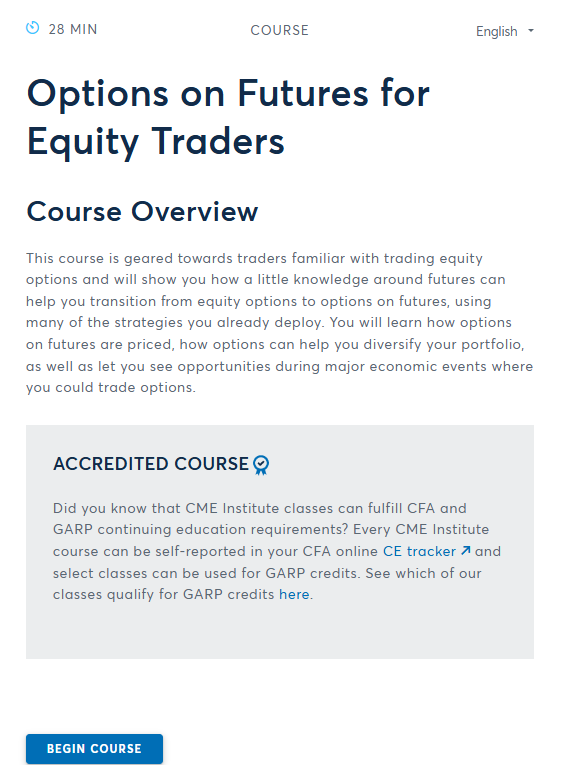

Futures 101: The Broker’s Role in Education and Onboarding

As futures trading attracts a new wave of retail participants, education becomes a crucial broker responsibility. Futures 101 resources—ranging from video tutorials to live webinars and downloadable guides—are now standard offerings among the best online futures brokers.

These educational tools serve dual purposes:

- Empower New Traders: By teaching the basics of trading futures, brokers enable clients to make informed decisions.

- Build Trust and Loyalty: Brokers who invest in client education demonstrate a long-term commitment to trader success.

A best futures broker doesn’t just execute trades; it mentors. With futures 101 content, traders are better equipped to understand contracts, margin requirements, rollover processes, and technical indicators.

Cannon Trading Company: A Case Study in Brokerage Excellence

Founded in Los Angeles, California, Cannon Trading Company exemplifies what it means to be a best futures broker. With decades of experience and an unwavering commitment to client satisfaction, Cannon Trading seamlessly combines old-school integrity with modern innovation.

- TrustPilot Ratings: The company consistently receives 5 out of 5 stars on TrustPilot, reflecting excellence in service, transparency, and client satisfaction.

- Regulatory Reputation: Cannon Trading adheres to the highest standards of regulatory compliance, earning recognition for its transparent practices.

- Platform Diversity: Cannon Trading offers a wide selection of top-performing FREE trading platforms, including advanced charting tools, order execution systems, and mobile applications.

- Experienced Team: With a legacy team of brokers, Cannon Trading provides hands-on guidance tailored to individual trader needs.

Through its commitment to education, support, and technology, Cannon Trading has proven itself one of the best online futures brokers time and time again.

Regulatory Integrity: A Hallmark of the Best Futures Brokers

A critical element that separates a best futures broker from mediocre alternatives is regulatory compliance. Futures trading is governed by organizations such as the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). These bodies ensure that brokers uphold financial solvency, ethical conduct, and client transparency.

Cannon Trading Company’s spotless record and industry acknowledgment affirm its role as a regulatory role model. In an industry where even minor infractions can erode trust, Cannon’s adherence to stringent compliance is a major reason it remains a best futures broker in both reputation and results.

The Role of Trust and User Reviews in Broker Selection

Traders today are increasingly guided by peer reviews and public ratings. Sites like TrustPilot offer transparent assessments of broker performance. Cannon Trading’s consistent 5-star ratings indicate more than just satisfaction—they signal reliability, accessibility, and ethical business practices.

These reviews often cite attributes such as:

- Responsive customer support

- Transparent fee structures

- Easy-to-navigate platforms

- Educational resources on trading futures

These features not only satisfy user expectations but elevate Cannon Trading into the echelon of best futures brokers recognized globally.

Platform Accessibility and Free Tools: Democratizing Futures Trading

The provision of free, high-performing trading platforms is a major differentiator in the competitive landscape. Cannon Trading offers multiple FREE platforms, catering to different trading styles—scalping, day trading, swing trading, and algorithmic trading.

Free platforms lower the barrier to entry, especially for retail traders exploring futures 101. Whether it’s desktop terminals, mobile apps, or web-based dashboards, the ability to choose empowers traders.

The best online futures broker knows that platform variety translates to trader versatility. Cannon’s approach reflects this understanding, providing tools that are robust yet intuitive.

Client Retention, Broker Longevity, and the Power of Personalization

Another defining trait of the best futures brokers is their ability to retain clients over the long term. In a world where many traders jump between brokers, those who remain loyal to firms like Cannon Trading Company do so because of the personalized attention they receive. Unlike impersonal trading apps, Cannon’s brokers invest in relationships, offering real-time consultations, strategy refinement, and customized platform recommendations. This high-touch approach resonates with clients who seek more than automation—those who value human insight and bespoke service.

Such personalization often translates into loyalty, and loyalty builds longevity. Cannon Trading’s decades-long presence in the futures trading space attests to the power of consistent client satisfaction. Traders who began with Cannon decades ago often remain clients today, having experienced firsthand the firm’s ongoing evolution and responsiveness to changing market needs.

The Globalization of Futures Trading and Broker Responsiveness

Futures trading is no longer confined to a single geographic region. Thanks to globalization and 24/7 digital connectivity, traders from across the globe now engage with U.S. futures markets. The best online futures brokers, therefore, must offer multilingual support, multi-currency account options, and adaptable trading hours to accommodate this global user base.

Cannon Trading has adeptly embraced this reality. By offering accessible platforms and client support tailored to international users, the firm demonstrates that geographic boundaries are no barrier to service excellence. This global approach helps cement its reputation as a best futures broker, relevant not just domestically but on the world stage.

The Future of Futures Brokers: Anticipating Tomorrow’s Needs

Looking ahead, the best futures brokers will continue to lead through innovation and foresight. As blockchain technology, decentralized finance (DeFi), and AI-powered analytics become more embedded in trading practices, brokers must evolve to remain relevant. Firms like Cannon Trading are already exploring these domains, ensuring that their platforms and tools remain ahead of the curve.

Furthermore, ESG (Environmental, Social, Governance) investing principles are making their way into derivatives markets. Forward-thinking brokers will need to align with these values, providing futures products that cater to socially conscious traders. The best futures brokers will remain agile, adapting not only to technology but to the moral and strategic priorities of future traders.

Enduring Excellence in a Dynamic Landscape

As financial markets grow in complexity, the need for the best futures brokers becomes increasingly apparent. These firms are more than facilitators; they are educators, innovators, and trusted allies. Through technological innovation, regulatory integrity, and a client-first philosophy, brokers like Cannon Trading Company prove their enduring value.

Cannon Trading embodies every hallmark of a best futures broker—from its impressive TrustPilot ratings to its decades of industry leadership. As traders continue navigating the evolving landscape of trading futures, the role of brokers will remain central. Cannon Trading and others like it will continue to lead the charge, setting new standards for excellence in futures trading.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits.