Join our Private Facebook group

Subscribe to our YouTube Channel

Ahead of CPI and the Rest of the Week:

By Mark O’Brien, Senior Broker

Crypto:

Bitcoin futures open interest on the Chicago Mercantile Exchange hit a fresh all-time high, its nominal value reaching $5.4 billion as the Jan. contract traded within 200 points of $48,000 yesterday. The previous all-time high of $4.5 billion was recorded in November 2021 when the front month contract traded to its all-time high above $68,000.

Energy:

Concerns of slowing demand growth in the energy sector received additional fodder this morning when the Energy Information Agency (EIA) reported a surprise jump in U.S. crude stockpiles and a larger-than-expected jump in storage of both gasoline and distillates. Crude oil (basis Feb.) remains mired in the low $70 per barrel range with a few forays below $70 per barrel over the last month. Despite fears the Israel-Hamas war – now into its third month – could be a catalyst to supply disruption in the Middle East, crude oil is more that $10 per barrel (a $10,000 per contract move) lower since the beginning of the conflict, suggesting traders are more focused on global economic growth (slowing) than geopolitical risk, which seems to be increasing as events related to the war have spread, including attacks on U.S. bases in Iraq, U.S. strikes on Iranian-backed organizations in Syria and Yemen, Israeli attacks in Lebanon on Hezbollah, Yemeni-based Houthi attacks on vessels moving through the Bab al-Mandab Strait at the entrance to the Red Sea from the Gulf of Aden – a route that sees 10-12% of the world’s seagoing freight travel through it.

General:

Tomorrow we’ll be apprised yet again of the inflation situation here in the U.S. with the release of the Bureau of Labor Statistics’ Consumer Price Index Report, which measures the prices paid by consumers for a basket of consumer goods and services (7:30 A.M., Central Time). The reading plays an important role in shaping the Federal Reserve’s outlook on much-anticipated interest rate cuts this year.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

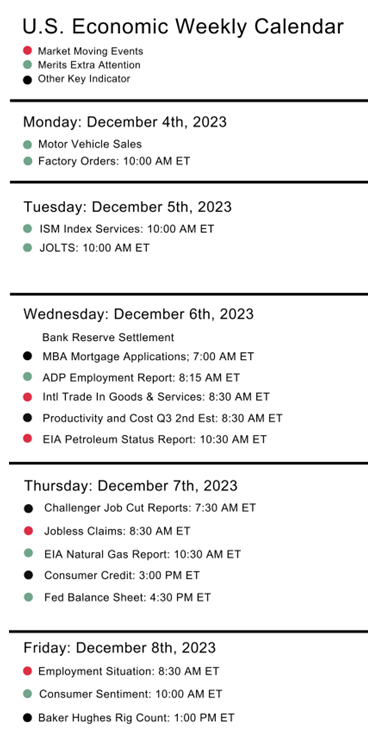

Futures Trading Levels

01-11-2024

Improve Your Trading Skills

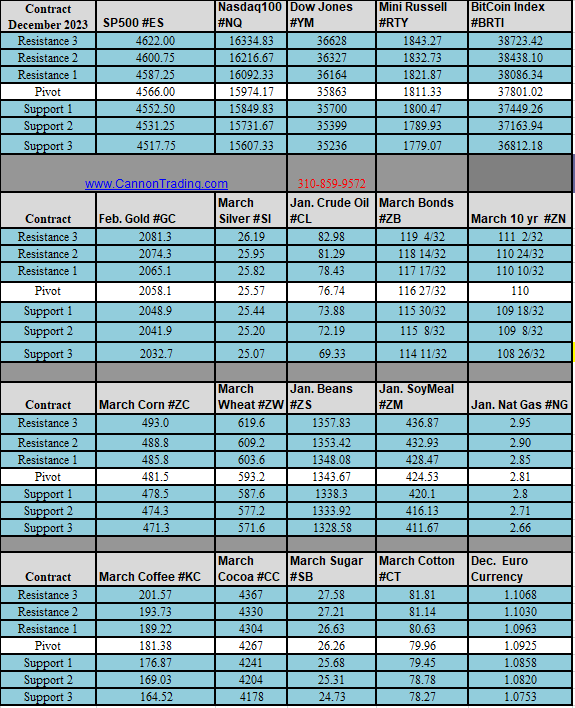

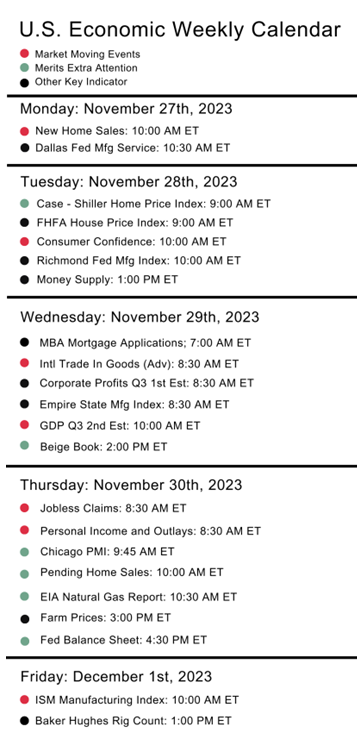

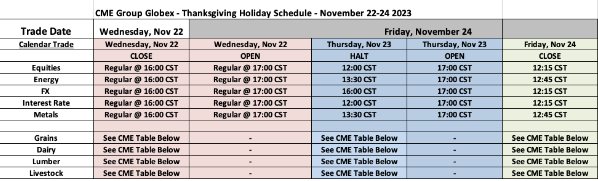

Economic Reports,

Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.