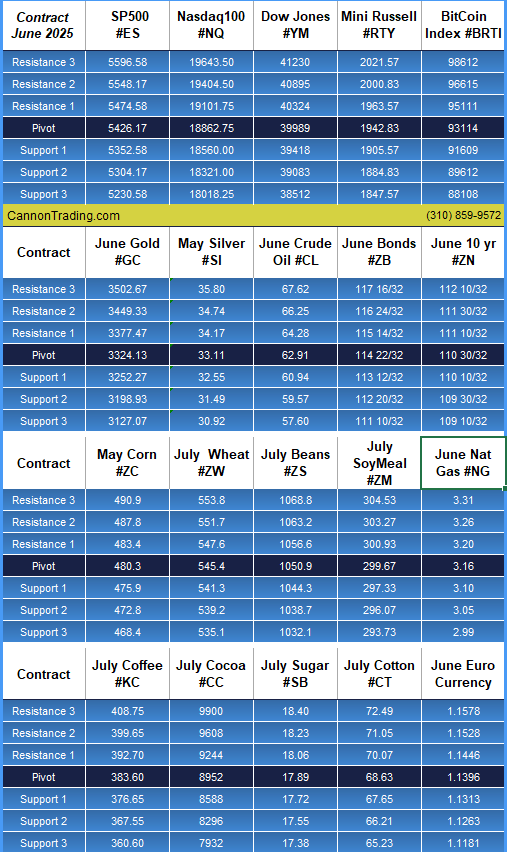

Post FOMC

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

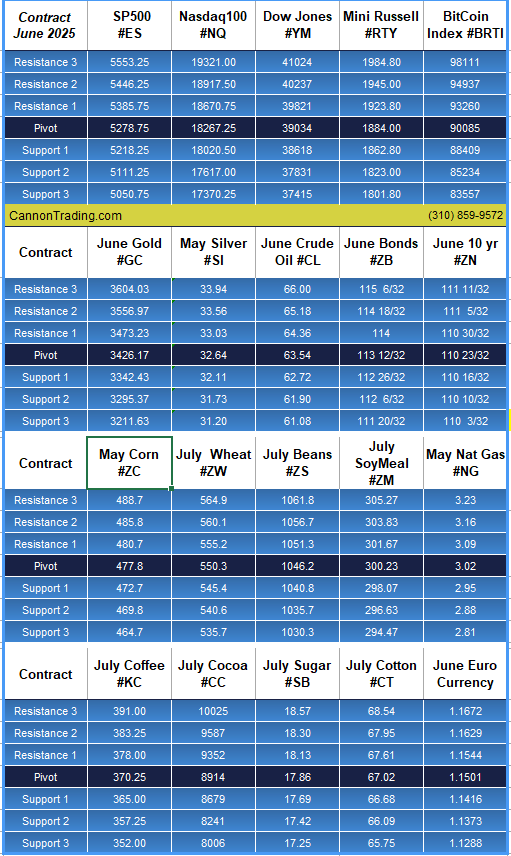

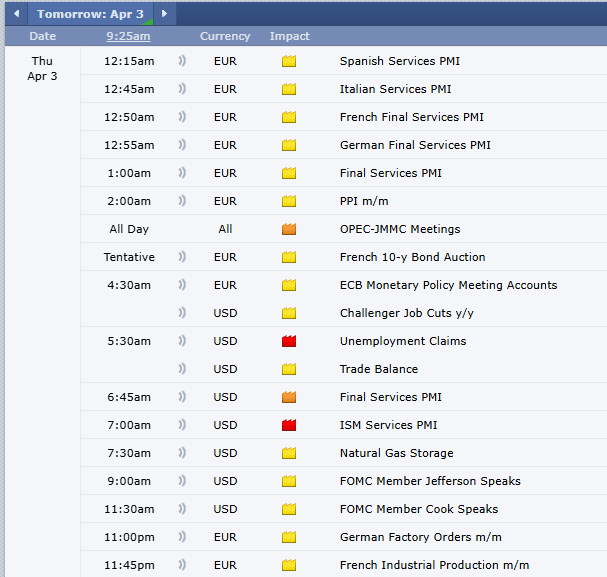

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

By John Thorpe, Senior Broker

|

|

|

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

|

|

|

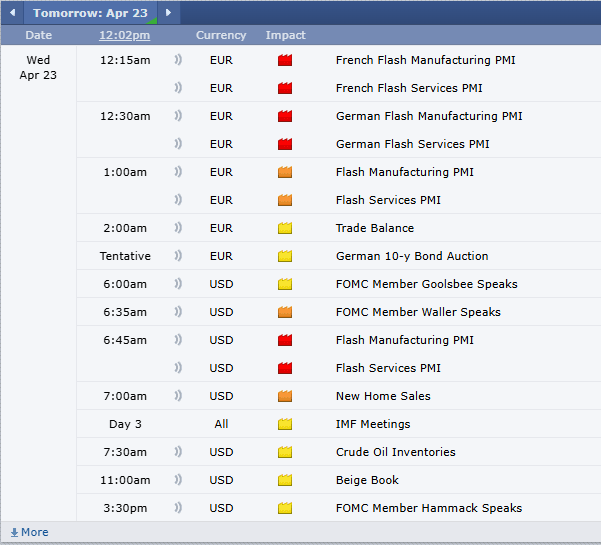

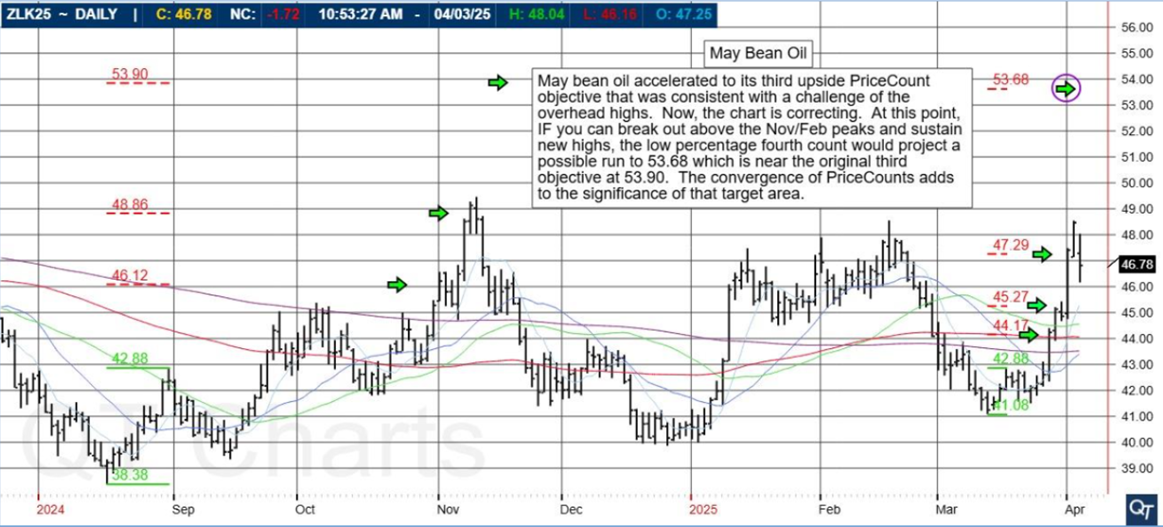

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

May bean oil accelerated to its third upside PriceCount objective that was consistent with a challenge of the overhead highs. Now, the chart is correcting.

At this point, IF you can break out above the Nov/Feb Peaks and sustain new highs, the low percentage fourth count would project a possible run to 53.68 which is near the original third objective at 53.90.

The convergence of PriceCounts adds to the significance of that target area.

|

|

|

|

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

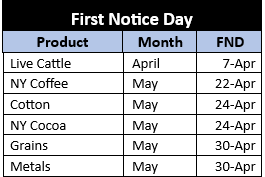

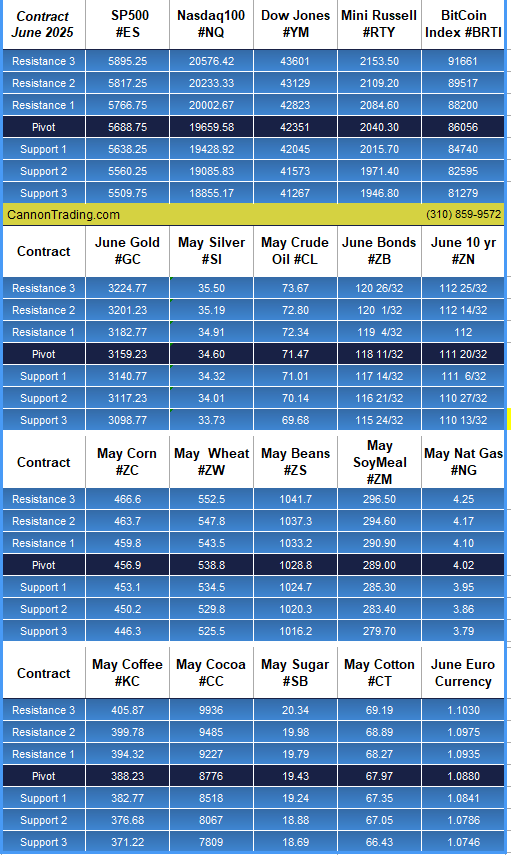

Below are the contracts which are entering

Be advised, for contracts that are deliverable, it is requested that all LONG positions be exited two days prior to First Notice and ALL positions be exited the day prior to Last Trading Day.

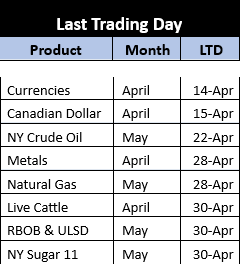

June 10 year treasury notes satisfied a first upside PriceCount objective last month and spent time consolidating with a sideways trade. Now, the chart is attempting to resume its rally where new sustained highs would project a possible run to the second count in the 113^26 area.

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

7 Powerful Reasons Crude Oil Futures Remain a Top Trading Opportunity

Crude oil plays a pivotal role in the global economy. It fuels transportation, powers industries, and supports the manufacture of countless products, from plastics to chemicals. Given its strategic importance, it’s no surprise that crude oil is one of the most actively traded commodities in the world. Trading crude oil futures has become an essential activity for hedgers, speculators, and institutional investors alike. This research paper delves into why crude oil futures are among the most coveted contracts in the futures market, their historical origins, evolution, risk assessments, and the benefits of using a reputable brokerage like Cannon Trading Company to engage in oil futures trading.

The crude oil futures contract as we know it today traces its origins back to the 1980s. Before this, crude oil was primarily traded via long-term physical contracts between producers and consumers. However, market volatility and geopolitical tensions in the 1970s, notably the oil embargo of 1973 and the Iranian Revolution of 1979, exposed the need for a more flexible pricing mechanism.

In response to these events, the New York Mercantile Exchange (NYMEX) introduced the first crude oil futures contract in 1983. This innovation provided market participants with a standardized, regulated mechanism to hedge against price volatility or speculate on price movements. The introduction of this oil futures contract was a watershed moment in the history of commodity trading, laying the groundwork for the sophisticated oil futures trading systems we see today.

Several factors contribute to the popularity of crude oil futures contracts:

Initially, the crude oil futures market was dominated by commercial players seeking to hedge their exposure. However, the landscape began to change in the late 1990s and early 2000s with the influx of hedge funds, institutional investors, and retail traders. Several factors contributed to this shift:

As a result, speculators now account for a significant portion of the open interest in crude oil futures markets, adding to both the liquidity and volatility of these contracts.

Each of these events has contributed to the continued popularity of trading crude oil futures by highlighting both the risks and rewards inherent in the market.

Trading crude oil futures involves significant risk, but it also offers considerable profit potential. Here is a breakdown of both:

Over the years, risk management tools such as stop-loss orders, advanced charting, algorithmic trading, and diversified portfolios have evolved, helping traders navigate the complexities of oil futures trading more effectively.

Trading crude oil futures involves several key steps:

The key to success in trading crude oil futures lies in education, discipline, and access to the right tools and information.

Cannon Trading Company stands out as a premier brokerage for trading crude oil futures for several compelling reasons:

These factors make Cannon Trading an excellent partner for anyone looking to explore or expand their oil futures trading activities. Whether you’re a novice wanting to learn how to trade oil futures or a seasoned investor seeking a better platform, Cannon Trading delivers on all fronts.

Trading crude oil futures has evolved into one of the most dynamic and potentially lucrative areas of the financial markets. From its origins in the 1980s to the speculative booms of the 21st century, the oil futures contract has proven its resilience and relevance. Despite inherent risks, the contract’s liquidity, volatility, and global importance continue to attract traders and investors from around the world.

Choosing the right broker can significantly enhance one’s oil futures trading experience. Cannon Trading Company, with its cutting-edge free trading platforms, exceptional customer service, and seasoned brokers, provides an optimal environment for trading crude oil futures successfully.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

7 Shocking Pitfalls of Ignoring Class 3 Milk Futures in Your Trading Strategy

In the dynamic and multifaceted world of commodities trading, class 3 milk futures stand out as a unique and critical financial instrument. Designed primarily for dairy producers, processors, and traders, these futures contracts are integral to hedging against price volatility in the dairy market. As the global dairy industry evolves with increasing complexity, understanding the nuances of class 3 milk futures becomes imperative for traders, commodity brokers, and institutional investors. This paper explores the foundational aspects of class 3 milk futures, distinguishes them from other dairy-related futures, provides projections for the next three trimesters of 2025, and examines why Cannon Trading Company and its state-of-the-art platform, CannonX, are leading choices for futures trading.

Class 3 milk futures are standardized financial contracts traded on the Chicago Mercantile Exchange (CME) that represent 200,000 pounds of milk, priced per hundredweight (cwt). These contracts are primarily utilized to hedge and speculate on the price movements of milk used in the production of cheese, which is why they are directly influenced by the supply and demand for cheese in the United States.

Milk is categorized into different classes based on its end-use. Class 3 milk pertains specifically to milk used in the manufacturing of hard cheeses such as cheddar. The price of class 3 milk is influenced by several factors including cheese prices, butterfat content, and protein values. Traders engaging in class 3 milk futures are essentially betting on the fluctuations of these key components within the dairy market.

The term “class 3” in futures contracts denotes the categorization established by the U.S. Department of Agriculture (USDA) under the Federal Milk Marketing Orders (FMMO). Milk is classified into four main categories:

Class 3 milk is particularly volatile due to the fluctuating demand and supply conditions in the cheese market. The futures contracts based on this class enable participants to manage risk associated with such volatility effectively.

Class 3 milk futures differ from other dairy futures contracts such as class 4 milk futures, nonfat dry milk futures, and butter futures in several key ways:

Historically, class 3 milk futures have demonstrated notable price swings tied closely to macroeconomic indicators and agricultural policies. Over the past decade, prices have fluctuated between lows of around $12/cwt to highs exceeding $24/cwt. This variability often correlates with shifts in feed costs, weather patterns, and international dairy demand.

The COVID-19 pandemic further exposed the volatility inherent in dairy markets. Disruptions in supply chains, changes in consumer behavior, and export inconsistencies led to sharp price adjustments. These historical lessons underscore the critical role class 3 milk futures play in providing price certainty and risk mitigation in commodities trading.

The global market exerts considerable influence on class 3 milk futures. Key international developments—such as EU dairy subsidies, New Zealand milk production, and Chinese import policies—can ripple through U.S. markets.

Managing risk is essential in futures trading, and class 3 milk futures offer an efficient tool for this purpose. Dairy producers use these contracts to lock in prices, securing future revenue and planning capital expenditures more accurately. Processors and distributors also hedge to stabilize their input costs.

Strategies commonly employed include:

These strategies allow participants to insulate themselves from adverse price movements, turning volatility into opportunity.

Seasonal trends suggest an increase in class 3 milk futures prices during the early months of the year due to winter production slowdowns and elevated holiday cheese demand. Weather conditions affecting feed quality may also contribute to reduced milk output, tightening supply.

Spring flush traditionally brings increased milk production, which could result in lower class 3 prices. However, if export demand for cheese rises, it may mitigate some downward pressure. Futures traders should monitor USDA reports and global cheese market dynamics during this period.

The lead-up to the holiday season often sees increased cheese demand, leading to higher class 3 milk prices. In 2025, with anticipated growth in foodservice and retail sectors, this trend may be more pronounced, presenting a bullish outlook for class 3 milk futures contracts.

Cannon Trading Company has cemented its reputation as a premier commodity broker through decades of exemplary service, advanced technology, and a client-first approach. Particularly for those involved in trading futures like class 3 milk futures, CannonX—the firm’s proprietary platform—offers unmatched capabilities.

As the commodities trading landscape continues to evolve, class 3 milk futures remain a vital tool for hedging and speculation in the dairy sector. Understanding their unique attributes, market dynamics, and forecasted trends for 2025 is crucial for effective trading. Cannon Trading Company, with its robust platform CannonX, emerges as a superior choice for both novice and seasoned traders. From expert brokers just a call away to unparalleled customer satisfaction and regulatory trust, Cannon sets the benchmark in futures trading.

In an increasingly complex market, success in commodities trading depends not only on knowledge and timing but also on the right platform and support system. For anyone looking to succeed in class 3 milk futures, Cannon Trading Company offers not just a trading platform, but a strategic partnership.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading(Instagram)

|

|

|

|

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

May cocoa completed its first downside PriceCount objective early this month and spent time trading sideways in a consolidation trade. Now, the chart is threatening to break down again where new sustained lows would project a possible slide to the second count in the 7130 area.

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

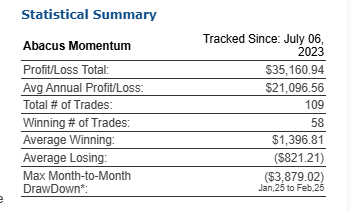

System Description

Market Sector: Stock Indexes

Markets Traded: ES ,

System Type: Day Trading

Risk per Trade: varies

Trading Rules: Not Disclosed

Suggested Capital: $19,500

System Description:

An ES day trading system currently traded by the developer who has 15+ years’ experience. The system seeks to catch significant intra-day moves (long or short) on days when market movement is expected to be above average.

Short positions trade one contract but long positions trade two contracts to reflect a lower risk/reward profile. Correlation to the S&P500 index is very low and the system is designed to perform in both bull and bear markets. The system is robust with simple logic and averages 5-6 trades a month without the risk of overnight positions.

Recommended Cannon Trading Starting Capital

$20,000

COST

Developer Fee per contract: $145.00 Monthly Subscription

Disclaimer The risk of trading can be substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not necessarily indicative of future results.

Futures Trading Disclaimer:

Transactions in securities futures, commodity and index futures and options on futures carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”. A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you.

You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position.

If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit.

Please read full disclaimer HERE.

|

|

|

|

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|