The Standard and Poor’s 500 Futures (commonly referred to as S&P 500 Futures Contracts) are among the most heavily traded derivatives in global markets. As a vital tool for hedging, speculation, and portfolio diversification, these contracts allow traders to take positions on the Standard & Poor’s 500 Index Futures before market opening and even when traditional stock exchanges are closed.

Traders and financial news consumers know the basics of futures on S&P 500, but there are many obscure facts, forgotten trading techniques, and historical trades that can enrich one’s understanding. Below, we delve into ten lesser-known facts about SPX Index Futures, examine real-world case studies, discuss risk potential, and explain why Cannon Trading Company is an exceptional brokerage for futures traders of all experience levels.

10 Obscure Facts About Standard and Poor’s 500 Futures

- The First S&P 500 Futures Contract Had a Different Underlying

The S&P 500 Future was first launched on April 21, 1982, by the Chicago Mercantile Exchange (CME). However, the early contracts were not directly based on the S&P 500 Index but instead on a related basket of stocks. Over time, adjustments were made to better reflect the actual futures on S&P 500.

- The Notorious 1987 Crash and Circuit Breakers

On October 19, 1987—Black Monday—the Standard & Poor’s 500 Index Futures played a pivotal role in accelerating the crash. The market saw a 22.6% drop in one day, leading to the introduction of circuit breakers—automatic halts in futures trading e-mini futures to prevent catastrophic sell-offs.

- Trading Pit Hand Signals Still Exist

While most of the trading today happens electronically, remnants of the old commodity brokerage system remain. Some veteran traders in Chicago and New York still use outdated hand signals to communicate, despite trading via electronic platforms.

- The “Fair Value” Calculation is a Game Changer

SPX Index Futures prices do not always align with the underlying index due to interest rates, dividends, and arbitrage opportunities. Institutional traders monitor the fair value of the futures on S&P 500 to make strategic moves before market openings.

- Micro E-mini Futures Changed the Game

The introduction of micros futures in 2019 made it easier for retail traders to enter the futures trading e-mini futures market. With contracts one-tenth the size of standard S&P 500 Futures Contracts, these new instruments opened up risk-managed access to one of the most liquid markets in the world.

- Hedging with Futures Prevented a 2008 Collapse

During the 2008 financial crisis, firms that effectively used futures on S&P 500 for hedging avoided catastrophic losses. Goldman Sachs, for example, managed to mitigate stock losses by shorting S&P 500 Futures Contracts, preserving billions in value.

- The Dark Side of Market Manipulation

In 2010, the Flash Crash occurred due to high-frequency trading and manipulation of SPX Index Futures. A single trader, Navinder Singh Sarao, used a technique called “spoofing” to move markets with fake orders, temporarily crashing major indices.

- The Expiration of Futures Contracts Can Cause Mini Flash Crashes

S&P 500 Futures Contracts expire quarterly, leading to heightened volatility known as “quadruple witching” when options and futures on indices and stocks all expire simultaneously.

- The Role of the VIX in Trading Futures SP500

The CBOE Volatility Index (VIX), also known as the “fear gauge,” directly influences futures on S&P 500. Traders use the VIX to predict upcoming market swings and hedge against downside risks.

- Historical Anomalies Can Repeat

Market behavior during futures trading e-mini futures often follows historical patterns. Studying past crashes and recoveries in SPX Index Futures can provide traders with predictive insights, such as the dramatic rebounds after the COVID-19 crash in 2020.

Risk Potential in Trading Standard & Poor’s 500 Index Futures

While trading futures can be highly rewarding, it is also fraught with risk. Below are some of the key dangers:

- Leverage Risk: Futures trading involves substantial leverage, meaning that small price movements can result in massive gains or catastrophic losses.

- Liquidity Risk: Although S&P 500 Futures Contracts are highly liquid, unexpected geopolitical events can cause slippage, making execution difficult.

- Overnight Exposure: Unlike stocks, SPX Index Futures trade 24/5, making traders susceptible to overnight movements and global events.

- Margin Calls: Traders using excessive margin in futures trading e-mini futures can face unexpected liquidation.

- Psychological Pressure: Trading S&P 500 Futures Contracts requires discipline, as impulsive decisions in volatile conditions can wipe out accounts.

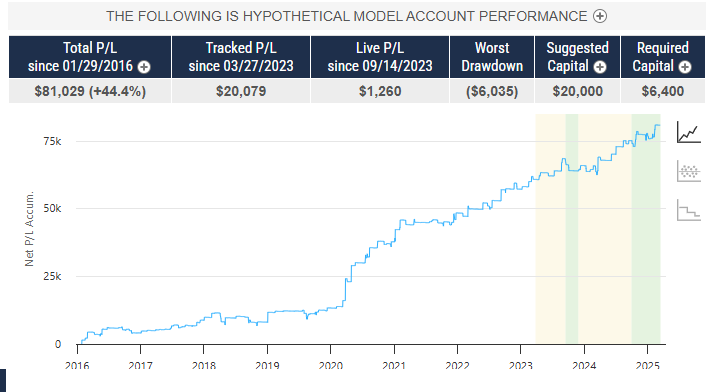

Why Cannon Trading Company is a Great Brokerage for S&P 500 Future Trading

With decades of expertise in commodity brokerage, Cannon Trading Company is a premier destination for traders seeking top-tier platforms and support. Here’s why:

- Unparalleled Trading Platforms: Cannon Trading offers a selection of the industry’s best platforms for trading futures, including NinjaTrader, TradeStation, and MultiCharts.

- Regulatory Excellence: The firm has an exemplary reputation with regulatory bodies such as the National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC).

- 5-Star Ratings on TrustPilot: With consistent top ratings, traders trust Cannon Trading for its reliability and customer service.

- Education for All Levels: Whether you’re a novice learning what is futures trading or a professional seeking futures broker support, Cannon provides extensive training materials.

- Micro Futures Accessibility: With micro futures trading e-mini futures, traders can enter the market at lower capital thresholds while maintaining strong risk management.

Understanding Standard and Poor’s 500 Futures requires more than just technical knowledge. Traders who grasp the market’s historical anomalies, obscure trading techniques, and risk factors can navigate volatility with confidence.

By trading with a top-tier futures broker like Cannon Trading Company, traders gain access to elite platforms, regulatory protection, and expert guidance. Whether you’re trading standard S&P 500 Futures Contracts or experimenting with micros futures, Cannon Trading ensures that traders of all levels are equipped for success.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading