Silver futures contracts have long been a cornerstone of futures trading, offering traders, investors, and hedgers a powerful instrument to capitalize on silver price movements. Whether you’re an experienced futures trader or just starting your journey into future trading, understanding the intricacies of silver futures is essential for maximizing profits while managing risk. This comprehensive guide explores silver futures contracts, including ten obscure facts, real-life case studies, potential risks, and why Cannon Trading Company is an excellent choice for traders at all levels.

The Silver Futures Contract

A silver futures contract is an agreement to buy or sell a specified amount of silver at a predetermined price on a future date. These contracts are traded on major exchanges, such as the COMEX division of the Chicago Mercantile Exchange (CME). Trading futures in silver offers numerous advantages, such as liquidity, leverage, and the ability to hedge against inflation or price fluctuations in the physical silver market.

Key Specifications of Silver Futures Contracts

- Contract Size: Typically 5,000 troy ounces per contract

- Tick Size: $0.005 per ounce, equating to $25 per contract

- Margin Requirements: Varies by broker but generally ranges between 5-10% of the contract’s value

- Expiration Months: March, May, July, September, and December

- Settlement: Physical delivery or cash settlement

With this foundation, let’s dive into ten obscure facts about silver futures contracts that many traders may not be aware of.

10 Obscure Facts About the Silver Futures Contract

- The Hunt Brothers’ Silver Manipulation Scandal (1979-1980)

One of the most notorious events in silver futures trading occurred when Nelson and William Hunt attempted to corner the silver market in the late 1970s. By amassing a substantial silver position using futures contracts, they drove silver prices from $6 per ounce to nearly $50 in early 1980. However, when the COMEX changed margin requirements, their heavily leveraged positions collapsed, resulting in a historic crash. This case underscores the importance of understanding margin requirements and regulatory intervention in commodity brokerage.

- Silver Futures Used as a Hedge by Electronics Manufacturers

Silver isn’t just a precious metal; it’s an industrial commodity heavily used in electronics, solar panels, and medical equipment. Companies in these sectors use silver futures contracts to hedge against price volatility, ensuring stable production costs. While hedging is common in energy commodities, fewer traders realize how integral it is to the silver industry.

- E-mini Silver Futures Contracts Exist, But Few Trade Them

Much like E-mini futures for the S&P 500, there are E-mini silver futures, which are one-fifth the size of standard contracts (1,000 ounces). However, due to their lower liquidity, most futures traders opt for standard silver contracts. This lack of liquidity can lead to wider bid-ask spreads, making them less attractive for short-term traders.

- The ‘Contango’ and ‘Backwardation’ Phenomena in Silver

In future trading, contango occurs when silver’s futures price is higher than the current spot price, often due to storage costs. Conversely, backwardation happens when the futures price is lower than the spot price, typically due to supply shortages. Understanding these market conditions can help traders time entries and exits effectively.

- Silver’s Seasonal Price Trends Favor Specific Trading Strategies

Historical data suggests that silver prices tend to rise between December and February, aligning with increased industrial demand and holiday jewelry sales. Savvy traders use seasonal trends to adjust their strategies, particularly those who incorporate statistical arbitrage into their futures trading.

- The Impact of Gold-Silver Ratio Trading

The gold-silver ratio (GSR) measures how many ounces of silver are required to buy one ounce of gold. When the GSR is abnormally high, some futures traders go long on silver while shorting gold, betting on a reversion to historical averages. This strategy is popular among spread traders looking to capitalize on mean reversion.

- The Role of Algorithmic Trading in Silver Futures Markets

Many commodity brokerage firms and hedge funds use algorithmic trading strategies to exploit micro-second inefficiencies in the silver futures market. These high-frequency trading (HFT) strategies can create artificial liquidity but may also contribute to flash crashes.

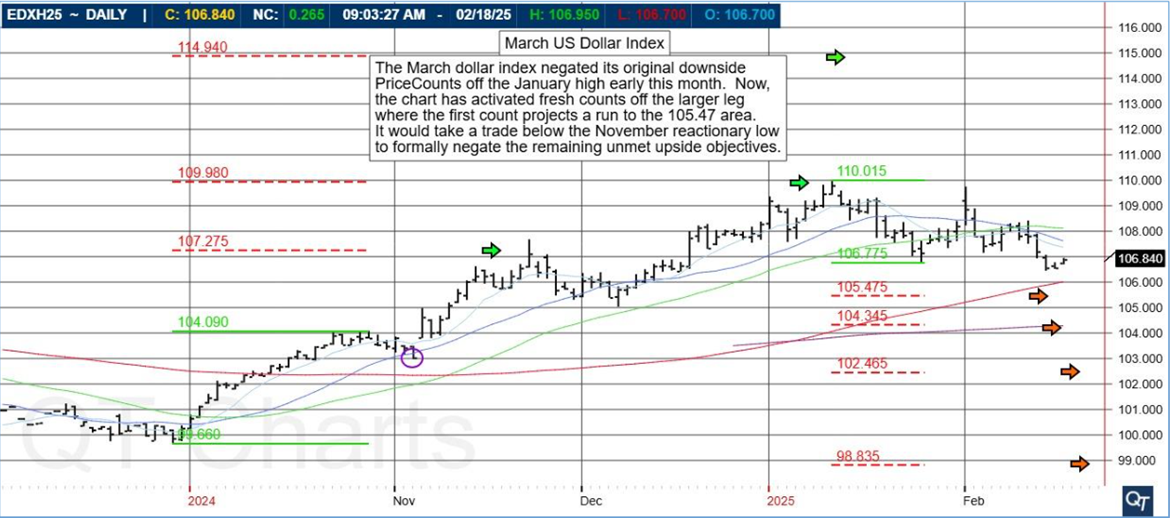

- Silver Futures Are Heavily Influenced by Currency Movements

Unlike many commodities, silver prices have a strong inverse correlation with the U.S. dollar. When the dollar weakens, silver prices tend to rise. Futures traders often monitor forex trends to predict potential silver price movements.

- The Unique ‘Crack Spread’ Hedging Technique in Precious Metals

Similar to energy futures traders who use crack spreads in oil markets, some silver futures traders hedge positions using platinum and palladium spreads. Since these metals have overlapping industrial uses, their price movements often follow related trends.

- Silver’s Sensitivity to Interest Rates and Inflation Hedges

Silver is often viewed as an inflation hedge, similar to gold. However, silver’s higher volatility and industrial demand create a unique dynamic where interest rate hikes can have a more significant impact compared to gold.

Real-Life Silver Futures Trading Case Studies

Case Study 1: A Hedge Fund’s Short Squeeze in 2021

In early 2021, a group of retail traders on Reddit attempted to orchestrate a short squeeze in silver futures, similar to what happened with GameStop (GME). While the attempt didn’t achieve the same magnitude, silver futures spiked briefly before institutions countered the move with increased liquidity.

Case Study 2: A Large Producer’s Strategic Hedge in 2015

In 2015, a major mining company used silver futures contracts to hedge against declining silver prices. By locking in future sales at favorable prices, the company stabilized its revenue despite falling spot prices.

Risk Factors in Silver Futures Trading

Despite its opportunities, trading silver futures comes with risks:

- Leverage Risk: High leverage can lead to significant losses.

- Market Volatility: Silver’s price swings can trigger margin calls.

- Liquidity Risk: Less liquid contracts may have unfavorable spreads.

- Regulatory Changes: Government policies can impact market conditions.

Why Trade Silver Futures with Cannon Trading Company?

Cannon Trading Company stands out as a premier futures broker due to:

- Diverse Trading Platforms: Access to top-tier platforms like CQG, Rithmic, and TradeStation.

- Outstanding Reputation: Rated 5 out of 5 stars on TrustPilot.

- Decades of Experience: Trusted since 1988.

- Regulatory Excellence: Full compliance with NFA and CFTC regulations.

For traders seeking a reliable commodity brokerage firm with top-tier tools and unparalleled expertise, Cannon Trading Company is the go-to choice.

For more information, click here.

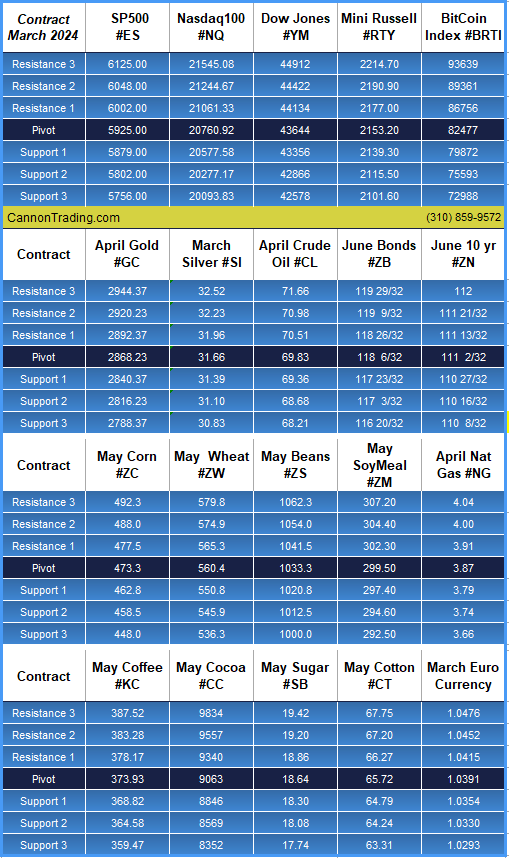

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.