The Russell 2000 Futures contract is a cornerstone of the futures trading world, providing traders with a robust tool to speculate on or hedge against movements in small-cap equity markets. Since its inception, the Russell 2000 Futures, often abbreviated as RUT 2000 Futures, has undergone significant evolution, becoming a vital component of modern futures trading. This piece explores its origins, development, and role in the market, while highlighting why trading futures with Cannon Trading Company is an exceptional choice for traders at all experience levels.

The Birth of the Russell 2000 Futures Contract

The Russell 2000 Index, launched in 1984 by the Frank Russell Company, tracks the performance of the smallest 2,000 stocks within the Russell 3000 Index, representing U.S. small-cap companies. The introduction of the Russell 2000 Futures Contract followed shortly after, in response to increasing demand for products enabling investors to trade on the performance of small-cap stocks in a standardized, liquid manner.

The Key Figures Behind the Inception

Several financial pioneers were instrumental in bringing the Russell 2000 Futures to life. William F. Sharpe, a Nobel laureate and consultant to the Frank Russell Company, helped refine the methodology for index construction. His contributions ensured that the Russell indices offered an accurate reflection of market segments.

The Chicago Mercantile Exchange (CME), a leading futures exchange, played a central role in facilitating the trading of these contracts. Key figures at CME, such as Leo Melamed, known as the “father of financial futures,” were advocates for innovation in derivatives markets. Under Melamed’s leadership, the CME expanded its offerings, including equity index futures like the RUT 2000 Futures.

Early Trading Anecdotes and Challenges

When trading began, many small-cap companies featured in the Russell 2000 were relatively unknown. Traders found the RUT 2000 Futures offered an efficient way to manage exposure to this high-risk, high-reward market segment. Anecdotes from early trading sessions illustrate the volatility of small-cap stocks and the corresponding opportunities in the futures market. For instance, a trader who identified a trend in burgeoning tech startups in the early 1990s could leverage RUT 2000 Futures to magnify returns or hedge against broader market risks.

One notable early trade occurred during the dot-com boom. A hedge fund manager, anticipating a bubble in small-cap tech stocks, used Russell 2000 Futures contracts to short the index. When the bubble burst, this strategic use of futures resulted in substantial profits for the fund, solidifying the contract’s reputation as a powerful tool for both speculation and risk management.

Evolution and Modern-Day Use

Over the decades, the Russell 2000 Futures have evolved in terms of accessibility, technology, and utility. Originally traded in open-outcry pits, the advent of electronic trading platforms revolutionized futures trading. CME’s Globex platform, introduced in 1992, allowed traders worldwide to access RUT 2000 Futures, increasing liquidity and efficiency.

Contract Specifications

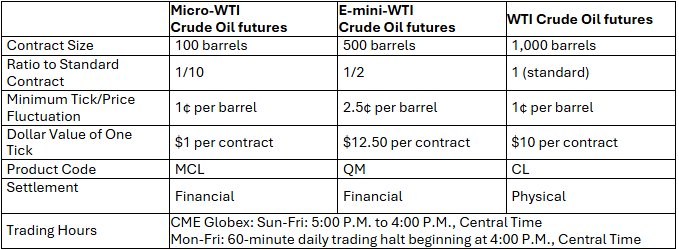

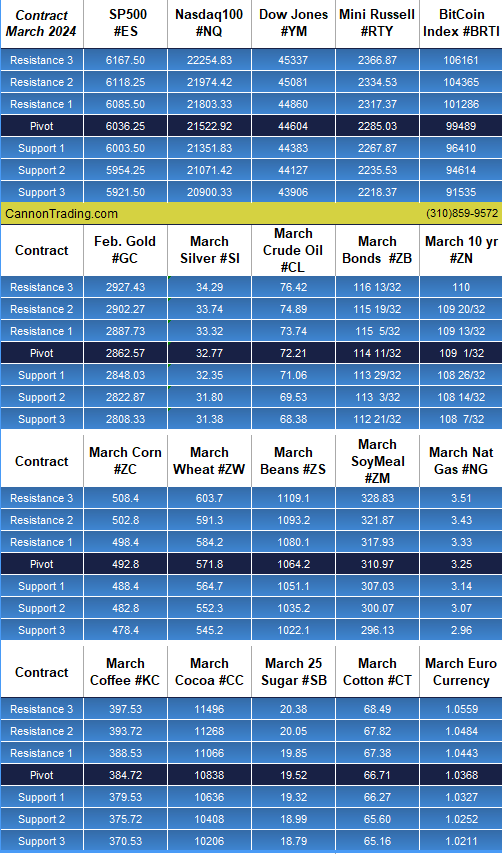

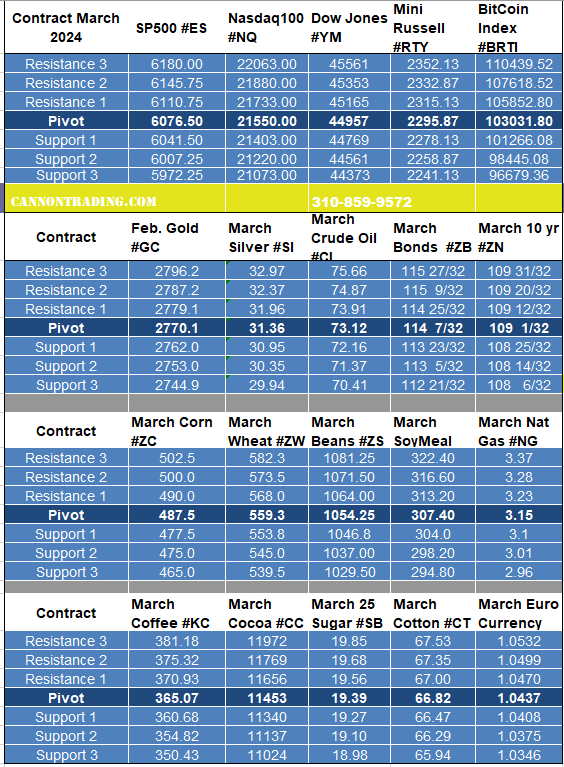

The modern Russell 2000 Futures contract has standardized terms that make it attractive to a broad range of traders. Key specifications include:

- Contract Size: $50 times the Russell 2000 Index value.

- Tick Size: 0.10 index points, equivalent to $5 per tick.

- Settlement: Cash-settled to the final index value.

These attributes make it suitable for individual traders and institutional investors alike. Additionally, the introduction of E-mini and Micro E-mini RUT Futures has lowered barriers to entry, enabling smaller traders to participate without excessive capital requirements.

Hypothetical Trading Scenario

Consider a trader bullish on small-cap stocks due to favorable economic conditions. With the Russell 2000 Index trading at 1,800 points, the trader buys two RUT 2000 Futures contracts at this level. Each contract’s notional value is $90,000 ($50 × 1,800), requiring a margin deposit of roughly $6,000 per contract.

The index rises to 1,850, yielding a gain of 50 points. For two contracts, the profit is $5,000 ($50 × 50 points × 2 contracts). This example demonstrates how RUT 2000 Futures enable traders to amplify returns with minimal upfront capital, though the risks of leveraged losses must also be acknowledged.

The Role of Futures Brokers

The evolution of futures trading platforms and brokerage services has been crucial in shaping the market. Futures brokers serve as the backbone of trading, offering access to platforms, market data, and educational resources.

Cannon Trading Company: A Premier Futures Broker

Cannon Trading Company has established itself as a top-tier futures broker, earning 5-star ratings on TrustPilot and accolades for its decades of experience. Here’s why Cannon Trading is a standout choice for trading futures contracts:

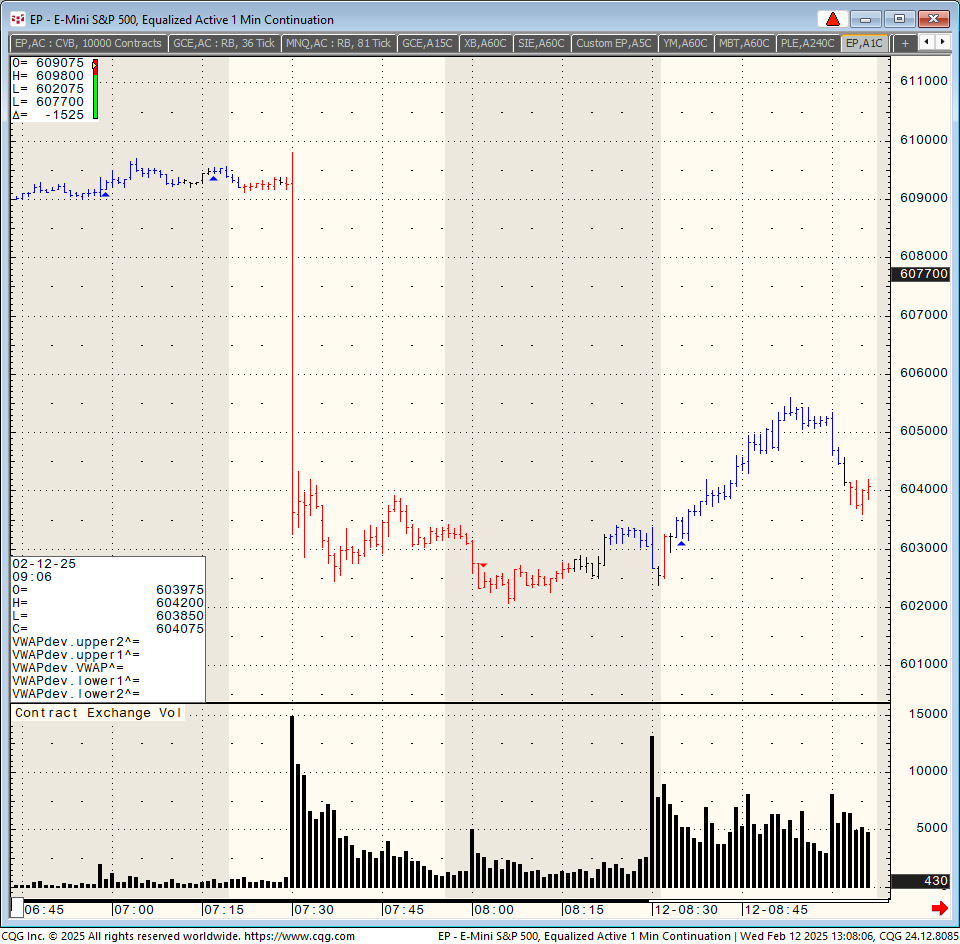

- Diverse Platform Selection: Cannon Trading provides access to industry-leading platforms such as NinjaTrader, TradeStation, and CQG. Each platform is tailored to different trading styles, ensuring both novice and seasoned traders have the tools they need.

- Educational Resources: Cannon Trading offers extensive resources for futures traders, including market analysis, webinars, and trading guides. This focus on education empowers clients to make informed decisions.

- Regulatory Excellence: With a stellar reputation among regulatory bodies like the NFA and CFTC, Cannon Trading emphasizes transparency and compliance, giving traders peace of mind.

- Personalized Service: Unlike generic online brokers, Cannon Trading provides personalized service, pairing clients with experienced brokers who understand their unique needs.

Real-Life Case Studies

Case Study 1: Hedging Risk with RUT 2000 Futures

In 2020, a small-cap mutual fund manager faced uncertainty amid the COVID-19 pandemic. Concerned about potential market downturns, they used RUT 2000 Futures to hedge their portfolio. By selling futures contracts, the manager mitigated losses as the index fell, demonstrating the contracts’ value for risk management.

Case Study 2: Leveraged Gains

An individual futures trader, recognizing strong earnings growth in small-cap companies in 2021, decided to go long on E-mini RUT Futures. With precise entry and exit strategies, the trader achieved a 25% return on initial margin, highlighting the profit potential of leveraged futures trading.

The Future of Russell 2000 Futures Trading

As technology advances, the Russell 2000 Futures market will continue to grow. Innovations like AI-driven trading algorithms and blockchain-based clearing systems promise to enhance efficiency and transparency. Moreover, the increasing globalization of markets means more traders from diverse backgrounds will access RUT 2000 Futures, further boosting liquidity.

The Russell 2000 Futures contract has evolved from a niche product into a vital instrument for traders worldwide. With its origins rooted in the vision of financial pioneers, the RUT 2000 Futures now serve as a powerful tool for hedging and speculation in the small-cap equity market. For traders seeking an exceptional futures broker, Cannon Trading Company stands out for its unparalleled platform selection, regulatory excellence, and client-focused approach. Whether you are a novice futures trader or an experienced market participant, Cannon Trading provides the resources and support necessary to succeed in the dynamic world of futures trading.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.