FOMC Takeaways

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

If one has to define financial futures, it is pretty simple. A financial future is basically a futures contract agreed upon on a short term or long term rate of interest. There are a number of representative financial futures contracts. Financial futures trading also requires you to understand some typical financial terms and terminology. Most popular are the treasury bonds futures in this category. Under this category archive, you will be able to learn and understand the different aspects of financial futures, through the write-ups we have listed for the readers.

Cannon Trading can provide assistance. We can provide you with professional advice and help. Whether you approach us for consultation on day trading, crude oil trading or for advice on financial futures, we can give you the answers and solutions that qualify us as one of the best. Another resource that we help you out with is information and knowledge based category archives. This particular category of blogs features extensive and exclusive information on financial futures. Read about it and equip yourself!

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Futures trading has evolved dramatically in recent years with the rise of intuitive, real-time platforms that offer retail and professional traders powerful tools. Among them, TradingView has surged in popularity thanks to its dynamic charting, robust analytical tools, and social community features. In this article, we explore why the TradingView Futures Trading Platform stands out as a premier online futures trading platform and why Cannon Trading Company is a top-tier partner for those looking to take advantage of everything TradingView has to offer.

What Is the TradingView Futures Trading Platform?

The TradingView Futures Trading Platform is a sophisticated yet user-friendly online futures trading platform that delivers live charting, in-depth analytics, and direct broker connectivity for active traders. Available through the TradingView download, TradingView app, and TradingView Desktop, it provides access to global futures markets with a seamless trading experience.

With the TradingView free version offering basic capabilities and premium upgrades unlocking institutional-level tools, TradingView caters to both novice and professional traders. The platform is particularly well-known for its TradingView chart interface, which allows real-time visualization of market data and technical indicators, including TradingView chart live feeds from major exchanges.

Key Features of TradingView for Futures Trading

When it comes to futures trading, specific platform features can make all the difference. Here are the most important features of the TradingView Futures Trading Platform that set it apart:

The combination of precision and flexibility in the TradingView chart tool enables futures traders to analyze trends and execute strategies efficiently.

While the platform is critical, your choice of broker is equally important in determining your success in the futures markets. That’s where Cannon Trading Company truly shines. Here’s why they make an ideal partner for those using TradingView for futures trading:

Established in 1988, Cannon Trading Company has over 35 years of futures industry experience. Their team includes brokers with backgrounds in institutional trading, risk management, and commodity trading. This depth of expertise helps clients make informed decisions and leverage the full potential of tools like the TradingView chart.

Cannon Trading is a registered member of the National Futures Association (NFA) and operates under the strict oversight of the Commodity Futures Trading Commission (CFTC). Their spotless compliance record demonstrates an unwavering commitment to transparency and ethical standards in all client dealings.

This makes them a trusted partner when integrating a robust online futures trading platform like TradingView.

Cannon Trading has earned numerous 5 out of 5-star ratings on TrustPilot. Clients consistently praise their excellent customer service, fast execution speeds, and educational support. These accolades reflect their client-first philosophy and ensure a smooth TradingView app experience when connected to Cannon.

While TradingView is a premier choice, Cannon provides access to a broad array of trading software at no cost, including:

Unlike many large brokerage firms, Cannon Trading provides personalized service. You can speak to experienced professionals who will walk you through connecting your account to TradingView Desktop or help you troubleshoot features like TradingView chart live.

They also provide insights into using TradingView indicators and settings tailored to your risk tolerance and market goals.

Getting started is simple. Follow these steps to launch your journey with one of the best online futures trading platforms:

This partnership brings together the best of both worlds:

Whether you’re trading energy futures, metals, interest rate products, or indices, the TradingView and Cannon combo gives you the insight, control, and speed needed to succeed.

The TradingView Futures Trading Platform has revolutionized how traders approach the markets, offering intuitive tools like TradingView chart, TradingView chart live, and multi-device access through the TradingView app, TradingView Desktop, and TradingView free editions.

But pairing this cutting-edge platform with a highly rated, industry-respected broker like Cannon Trading Company takes your trading to the next level. With their decades of futures expertise, free platform offerings, personalized broker assistance, and a sterling reputation among regulators and clients, Cannon is a trusted name in futures trading.

Whether you’re just beginning or are a seasoned trader seeking to optimize your setup, leveraging TradingView through Cannon Trading is one of the smartest moves you can make in today’s futures landscape.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

In the dynamic world of online futures trading platforms, few names stand out as boldly as MotiveWave. As technology continues to evolve, traders demand more robust, analytical, and user-friendly tools. The MotiveWave Futures Trading Platform meets these demands head-on, delivering a comprehensive suite of features that elevate the trading experience for both novice and professional futures traders alike.

This article provides a deep dive into the MotiveWave trading environment, highlights key features that make it a premier choice for futures trading, and explores why Cannon Trading Company is the ultimate partner for leveraging MotiveWave’s power.

What is MotiveWave?

MotiveWave is a professional-grade futures trading platform known for its advanced charting tools, algorithmic trading capabilities, and comprehensive market analysis features. Initially gaining traction among forex and equity traders, MotiveWave has carved a prominent space within the online futures trading platform sector due to its reliability and feature-rich design.

Whether you’re focused on short-term scalping or long-term market trend analysis, MotiveWave trading tools are tailored to adapt to your trading style. From MotiveWave mobile access to full desktop integration via MotiveWave download, the platform ensures seamless continuity for traders on the move. Additionally, it supports custom workspaces and scripting with Java-based extensions, further enhancing the functionality for sophisticated trading needs.

Most Important Features for Futures Trading on MotiveWave

Accessing your trading environment is easy with the MotiveWave login process. The interface is secured with two-factor authentication, ensuring your data and trading activities are protected. Users can customize their workspace upon login, allowing for a personalized experience that matches individual trading preferences.

The MotiveWave download is available directly from the official website. Installation is straightforward, with support available for Windows, macOS, and Linux operating systems. Regular updates ensure the platform remains secure and compatible with the latest system features.

A common query among new users is: Is MotiveWave free? While MotiveWave offers a free trial version, its full capabilities are unlocked through tiered pricing plans. This freemium model allows users to test the interface and decide on the best plan that suits their trading needs. Considering its robust toolset, the MotiveWave price offers excellent value compared to competitors.

There are also occasional promotions through partners like Cannon Trading, which may include extended trial periods or discounted subscriptions. This makes testing the MotiveWave trading experience even more accessible.

Choosing the right brokerage is as crucial as selecting the right futures trading platform. Cannon Trading Company excels in this regard. Here’s why:

MotiveWave Review Summary

The feedback from users paints a highly favorable MotiveWave review. Traders cite the platform’s depth of analysis, customizability, and professional-grade tools as reasons for their loyalty. Whether evaluating MotiveWave software for the first time or switching from another futures trading platform, users consistently highlight its seamless performance and insightful analytics.

Professional traders appreciate how MotiveWave trading aligns with institutional tools, while new users benefit from the clear documentation and visual guides. This inclusivity ensures a smoother learning curve, especially when paired with educational materials from Cannon Trading.

Furthermore, the synergy between MotiveWave and Cannon Trading amplifies the platform’s benefits. Combining advanced technology with decades of industry expertise creates a powerful trading environment that is both innovative and secure.

The MotiveWave Futures Trading Platform stands out in a crowded marketplace by offering unparalleled features, powerful analytical tools, and wide-ranging compatibility. The repeated queries of MotiveWave login, MotiveWave price, and MotiveWave download are justified by the platform’s capabilities and reliability. While MotiveWave mobile ensures traders are never disconnected, the question “Is MotiveWave free” is best answered by its generous trial options and value-packed pricing tiers.

When partnered with a top-tier brokerage like Cannon Trading Company, traders gain access to world-class tools, unbeatable service, and a trusted advisor in their futures trading journey. If you’re looking to elevate your futures trading game, MotiveWave combined with Cannon Trading is a combination worth serious consideration.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

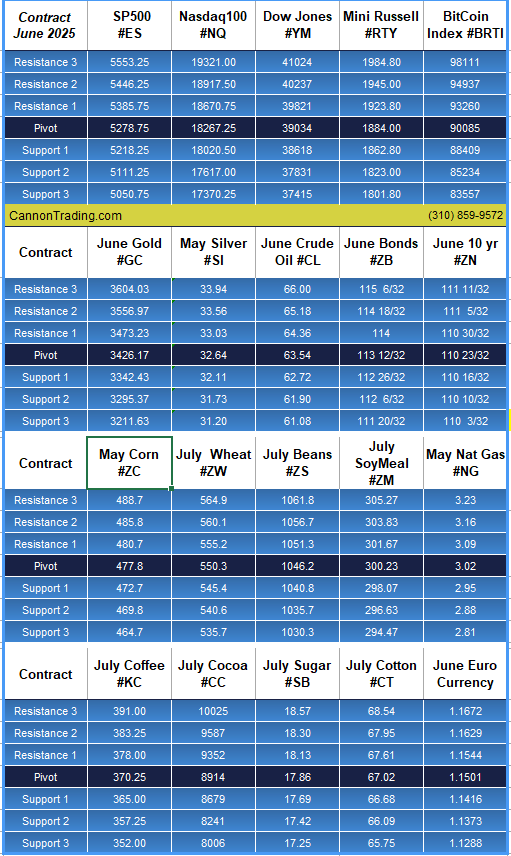

However, with volatility, you need to double check the status daily at:

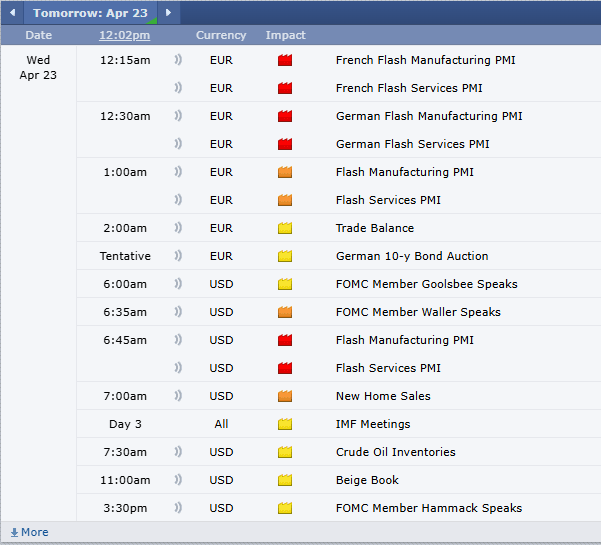

We have a full day tomorrow! Reports, earnings and more global news in general.

Below you will see a quick video on how to set and utilize the bracket orders feature on the StoneX futures platform/ CQG desktop

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Sierra Charts is widely regarded as one of the best futures trading platforms available today. Known for its depth, precision, and robust customization, Sierra Chart software is built for traders who value speed, stability, and flexibility in their charting and order execution. Whether you’re a new entrant exploring the world of trading futures or a seasoned institutional trader looking for a powerful toolset, Sierra Charts is designed to meet your needs with professional-grade features.

Cannon Trading Company stands out as the ideal brokerage partner for users of Sierra Charts, offering decades of experience, unmatched client support, and a suite of benefits that enhance every trader’s workflow.

Sierra Chart software is a high-performance, low-latency platform tailored for futures trading. It delivers a comprehensive solution with advanced technical analysis tools, real-time market data, and support for automated trading systems. Developed with an emphasis on efficiency and control, Sierra Charts is not only an institutional trading platform but also accessible to independent traders who demand performance.

Key Advantages:

With support for multiple data providers and brokers, Sierra Charts positions itself as a true institutional trading platform with appeal across the professional spectrum.

Cannon Trading Company is uniquely positioned to support Sierra Charts users for several compelling reasons:

✅ Decades of Experience

With over 35 years in the industry, Cannon Trading is one of the most trusted names in futures trading. Their deep expertise ensures clients receive insightful guidance for both platform use and market strategies.

✅ Stellar Reputation

The firm boasts a near-perfect TrustPilot rating, with many reviews applauding its fast support and knowledgeable brokers—ideal for trading futures confidently.

✅ Regulatory Excellence

Cannon Trading has maintained an exemplary record with regulators, giving traders peace of mind that they are working with a reliable and transparent partner.

✅ Diverse Platform Suite

In addition to Sierra Chart software, Cannon Trading provides access to a top-tier selection of platforms including CTS T4, Firetip, Rithmic, and more—cementing its reputation as a leader in best futures trading platform solutions.

Whether you’re a short-term scalper or a long-term trend trader, Sierra Charts delivers a versatile, robust, and high-performance experience that meets the demands of modern futures trading. When paired with the trusted, experienced team at Cannon Trading Company, you gain not only the tools but also the support to take your trading futures journey to the next level.

From institutional-grade features to tailored service, the synergy between Sierra Chart software and Cannon Trading is unmatched in the industry.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

By John Thorpe, Senior Broker

|

|

|

provided by: ForexFactory.com

All times are Eastern Time (New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

Futures trading, a cornerstone of global financial markets, demands precision, foresight, and agility. In this high-stakes arena, the best futures brokers serve as indispensable allies for retail and institutional traders alike. These brokers facilitate access to markets, provide vital data and analysis tools, offer risk management solutions, and help ensure compliance with complex regulatory frameworks. In the 2020s, the criteria for what constitutes the best futures broker have evolved, shaped by technological advances, user expectations, and heightened competition.

This paper will assess the evolving role of the best futures brokers, the innovations that streamline trading futures, and the defining features that make firms like Cannon Trading Company industry leaders. Special emphasis will be placed on how brokers have consistently met the shifting demands of traders, serving as both enablers and educators in an increasingly complex market environment.

To understand the appeal and necessity of the best futures brokers, it is essential to define the criteria by which they are judged. Traders today demand more than simple execution services; they expect comprehensive support, from educational resources to advanced trading platforms.

Key characteristics of the best futures brokers include:

These features define not only competence but resilience and versatility—qualities essential for enduring success in futures trading.

The 2020s have seen an explosion in fintech innovations that reshape the futures trading landscape. Technologies like artificial intelligence (AI), algorithmic trading, cloud-based platforms, and mobile accessibility have significantly enhanced both the trader’s and broker’s capabilities.

The best futures brokers leverage these technologies not just as features but as integral components of the client experience, transforming how traders interact with global futures markets.

As futures trading attracts a new wave of retail participants, education becomes a crucial broker responsibility. Futures 101 resources—ranging from video tutorials to live webinars and downloadable guides—are now standard offerings among the best online futures brokers.

These educational tools serve dual purposes:

A best futures broker doesn’t just execute trades; it mentors. With futures 101 content, traders are better equipped to understand contracts, margin requirements, rollover processes, and technical indicators.

Founded in Los Angeles, California, Cannon Trading Company exemplifies what it means to be a best futures broker. With decades of experience and an unwavering commitment to client satisfaction, Cannon Trading seamlessly combines old-school integrity with modern innovation.

Through its commitment to education, support, and technology, Cannon Trading has proven itself one of the best online futures brokers time and time again.

A critical element that separates a best futures broker from mediocre alternatives is regulatory compliance. Futures trading is governed by organizations such as the Commodity Futures Trading Commission (CFTC) and the National Futures Association (NFA). These bodies ensure that brokers uphold financial solvency, ethical conduct, and client transparency.

Cannon Trading Company’s spotless record and industry acknowledgment affirm its role as a regulatory role model. In an industry where even minor infractions can erode trust, Cannon’s adherence to stringent compliance is a major reason it remains a best futures broker in both reputation and results.

Traders today are increasingly guided by peer reviews and public ratings. Sites like TrustPilot offer transparent assessments of broker performance. Cannon Trading’s consistent 5-star ratings indicate more than just satisfaction—they signal reliability, accessibility, and ethical business practices.

These reviews often cite attributes such as:

These features not only satisfy user expectations but elevate Cannon Trading into the echelon of best futures brokers recognized globally.

The provision of free, high-performing trading platforms is a major differentiator in the competitive landscape. Cannon Trading offers multiple FREE platforms, catering to different trading styles—scalping, day trading, swing trading, and algorithmic trading.

Free platforms lower the barrier to entry, especially for retail traders exploring futures 101. Whether it’s desktop terminals, mobile apps, or web-based dashboards, the ability to choose empowers traders.

The best online futures broker knows that platform variety translates to trader versatility. Cannon’s approach reflects this understanding, providing tools that are robust yet intuitive.

Another defining trait of the best futures brokers is their ability to retain clients over the long term. In a world where many traders jump between brokers, those who remain loyal to firms like Cannon Trading Company do so because of the personalized attention they receive. Unlike impersonal trading apps, Cannon’s brokers invest in relationships, offering real-time consultations, strategy refinement, and customized platform recommendations. This high-touch approach resonates with clients who seek more than automation—those who value human insight and bespoke service.

Such personalization often translates into loyalty, and loyalty builds longevity. Cannon Trading’s decades-long presence in the futures trading space attests to the power of consistent client satisfaction. Traders who began with Cannon decades ago often remain clients today, having experienced firsthand the firm’s ongoing evolution and responsiveness to changing market needs.

Futures trading is no longer confined to a single geographic region. Thanks to globalization and 24/7 digital connectivity, traders from across the globe now engage with U.S. futures markets. The best online futures brokers, therefore, must offer multilingual support, multi-currency account options, and adaptable trading hours to accommodate this global user base.

Cannon Trading has adeptly embraced this reality. By offering accessible platforms and client support tailored to international users, the firm demonstrates that geographic boundaries are no barrier to service excellence. This global approach helps cement its reputation as a best futures broker, relevant not just domestically but on the world stage.

Looking ahead, the best futures brokers will continue to lead through innovation and foresight. As blockchain technology, decentralized finance (DeFi), and AI-powered analytics become more embedded in trading practices, brokers must evolve to remain relevant. Firms like Cannon Trading are already exploring these domains, ensuring that their platforms and tools remain ahead of the curve.

Furthermore, ESG (Environmental, Social, Governance) investing principles are making their way into derivatives markets. Forward-thinking brokers will need to align with these values, providing futures products that cater to socially conscious traders. The best futures brokers will remain agile, adapting not only to technology but to the moral and strategic priorities of future traders.

As financial markets grow in complexity, the need for the best futures brokers becomes increasingly apparent. These firms are more than facilitators; they are educators, innovators, and trusted allies. Through technological innovation, regulatory integrity, and a client-first philosophy, brokers like Cannon Trading Company prove their enduring value.

Cannon Trading embodies every hallmark of a best futures broker—from its impressive TrustPilot ratings to its decades of industry leadership. As traders continue navigating the evolving landscape of trading futures, the role of brokers will remain central. Cannon Trading and others like it will continue to lead the charge, setting new standards for excellence in futures trading.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits.