Dear Traders,

Get Real Time updates and more on our private FB group!

No commentary today but feel free to join our private FB group and gain access to daily, morning insight into the markets for the day ahead with commentary such as below which our members had access to hours before the open:

10.13.21 Wednesday insight:

XX = STOP

SCO = STOP CLOSE ONLY

MA= MOVING AVERAGE

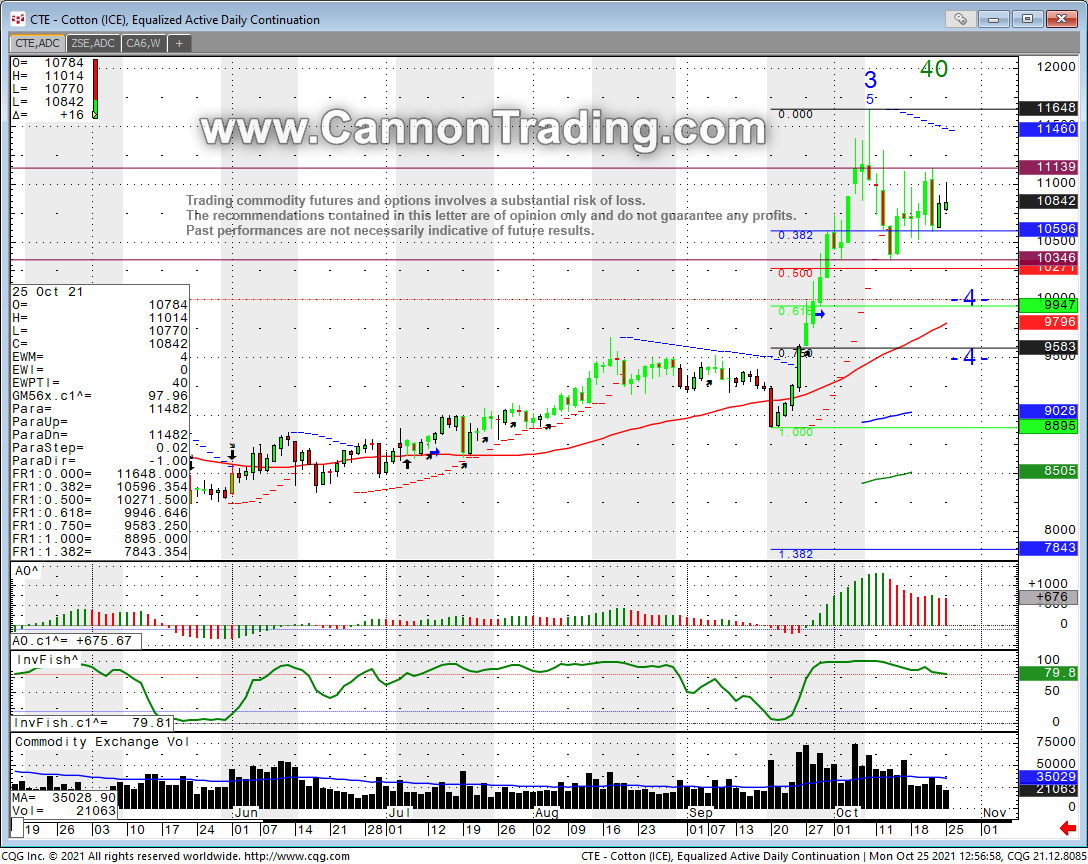

FIBO’S = Fibonacci Retracements

Z S&P JUST FINISHED A 4TH WAVE UP

3 DAYS AGO @ 4421.50 ON V 07th

A CLOSE BELOW THE 3rd WAVE @ 4260.00

FROM V 01st TRIGGERS THE 5th WAVE

DOWN TO 4080.00

X CRUDE

UPSIDE OBJECTIVE $85.00

GOOD MORNING.

10.13.21 Wednesday

CPI 7:30

Real Earnings 7:30

API Energy Stocks 3:30

Z S&P

4250.00 OBJECTIVE UNTIL

A CLOSE ABOVE 4387.25

4348.50 CRITICAL MA

RESISTANCE

50% FIBO 4343.75

Z NASDAQ

14,450 OBJECTIVE UNTIL

A CLOSE ABOVE 14,753.25

14,753.25

CRITICAL MA

KEY RESISTANCE

Z US$

7th DAY IN A ROW!

LOW YESTERDAY 94.235 *

ALGO’S SUPPORT 94.25*

ALGO IS LONG

BEARISH FOR S&P’S

Z US$ CLOSED @ 94.519 +0.193

ALGO SUPPORT:

94.35 *

94.26 Sell SCO

94.15

Z S&P:

BEAR BIAS.

4373.25 KEY RESISTANCE

U 03rd HIGH 4539.50

K 13th LOW 4028.25

FIBO’S:

38.2% = 4343.75

50.0% = 4283.50 / 4th DAY

61.8% = 4223.25

4373 25

KEY MA

MAJOR SWING AREA!

KEY RESISTANCE

4421.75

KEY TRANSITIONING MA

MASSIVE RESISTANCE

4387.00

MASSIVE MA

KEY RESISTANCE

4348.50

CRITICAL MA

MASSIVE SUPPORT

4157.50

LAST MA SUPPORT / MUST HOLD!

ALGO IS NEUTRAL

ALGO RESISTANCE:

4466.50

4439.25 Buy SCO

4416.00

Z S&P Closed 4340.75 -10.25

ALGO SUPPORT:

4339.00

4321.25 Sell SCO

4300.50 / Selling pressure

Z NASDAQ:

U 07th HIGH 15,702.25

K 13th LOW 12,915.00

FIBO’S:

38.2% = 14,637.75

50.0% = 14,309.75 ***

61.8% = 13,981.75

14,939.75

KEY MA

15,159.25

KEY TRANSITIONING MA

KEY RESISTANCE

14,988.25

MASSIVE MA

KEY RESISTANCE

14,753.50

CRITICAL MA

KEY RESISTANCE

LAST MA SUPPORT

14,033.50

ALGO IS SHORT

ALGO RESISTANCE:

15,736.50

15,685.75 Buy SCO

Z NASDAQ

Closed 14,653.25 -47.25

ALGO SUPPORT:

14,630.75 / Selling PRESSURE

X CRUDE:

ALGO IS LONG

X CRUDE Closed $80.64 +0.12

ALGO SUPPORT:

78.82

78.36 Sell SCO **

77.85

75.52

KEY MA

KEY SUPPORT

71.74

KEY TRANSITIONING MA

70.70

MASSIVE MA

70.00

CRITICAL MA

63.66

LAST MA SUPPORT / MUST HOLD!

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

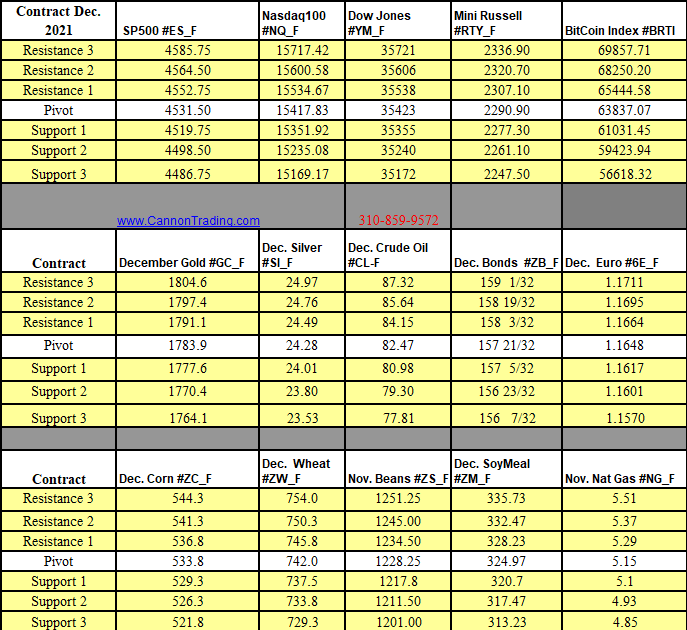

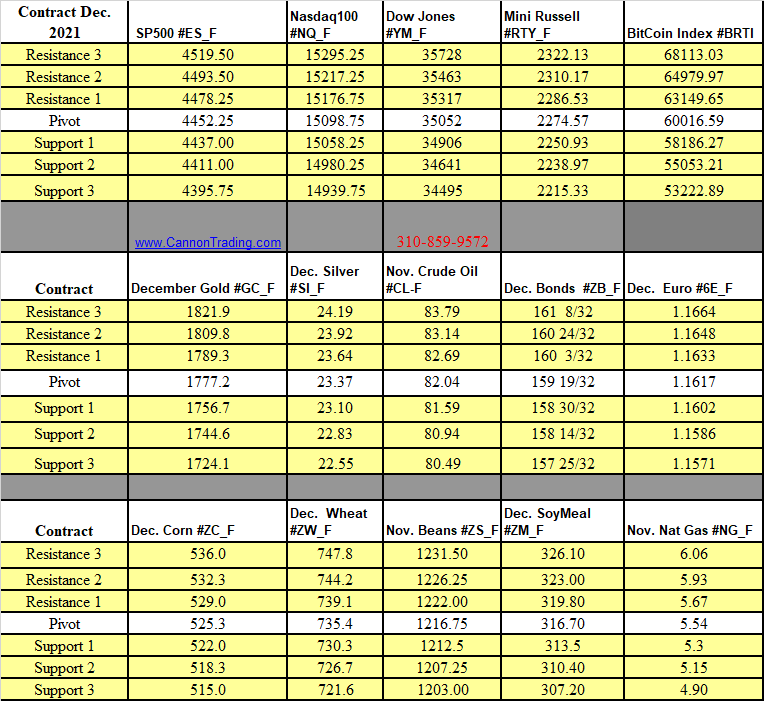

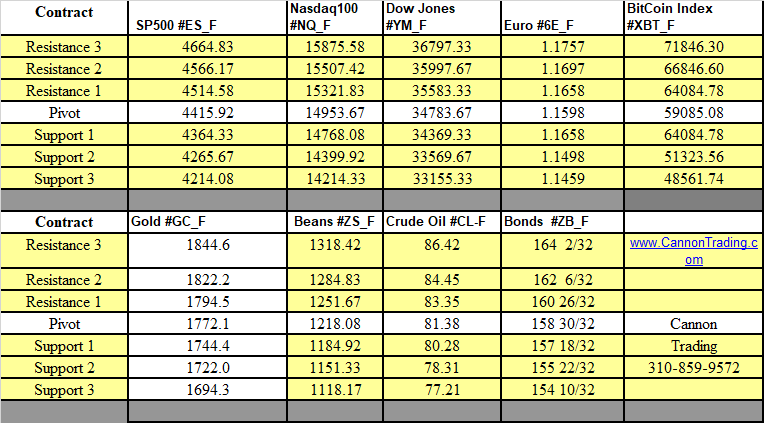

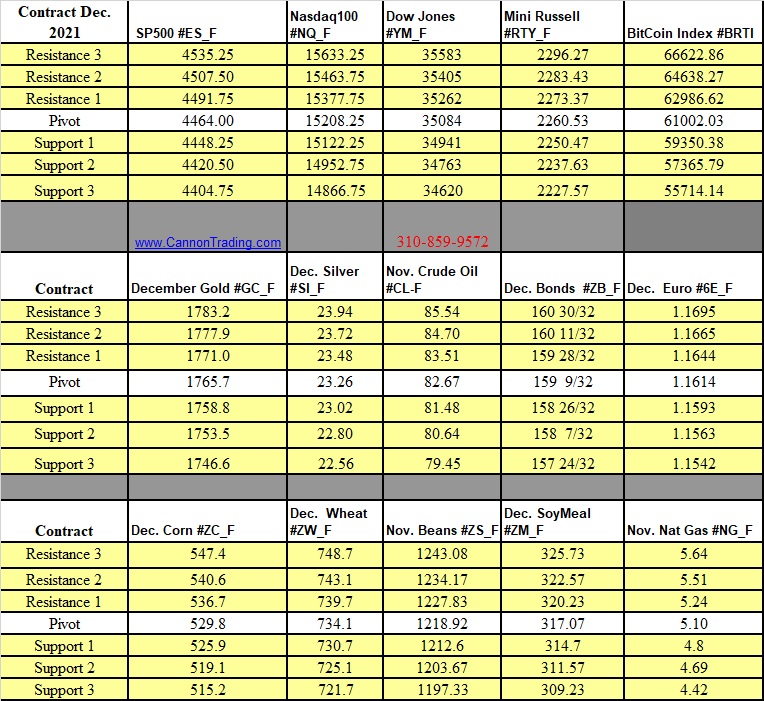

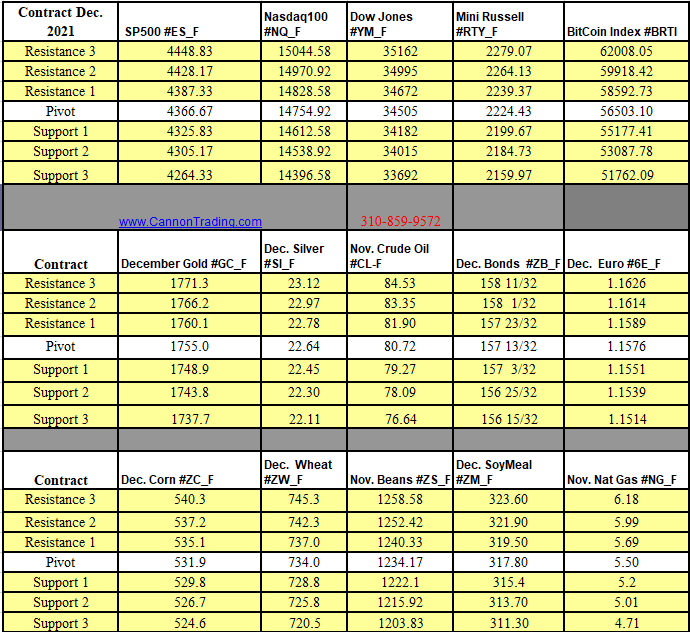

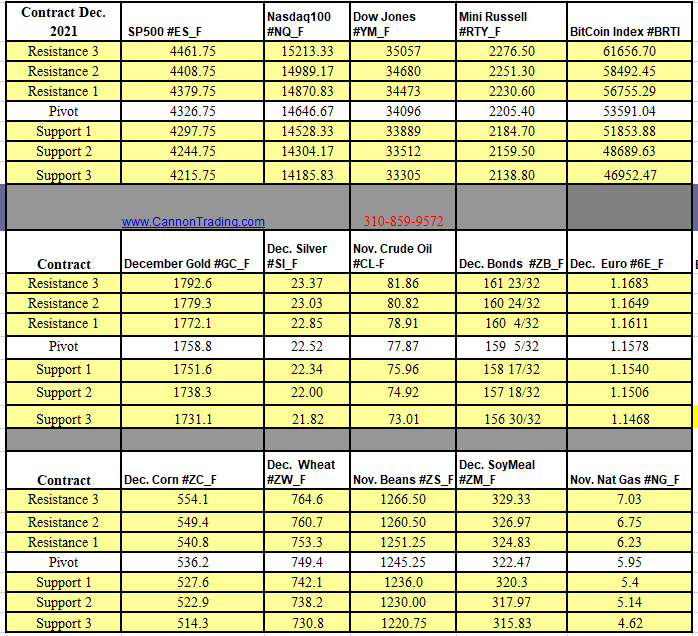

Futures Trading Levels

10-14-2020

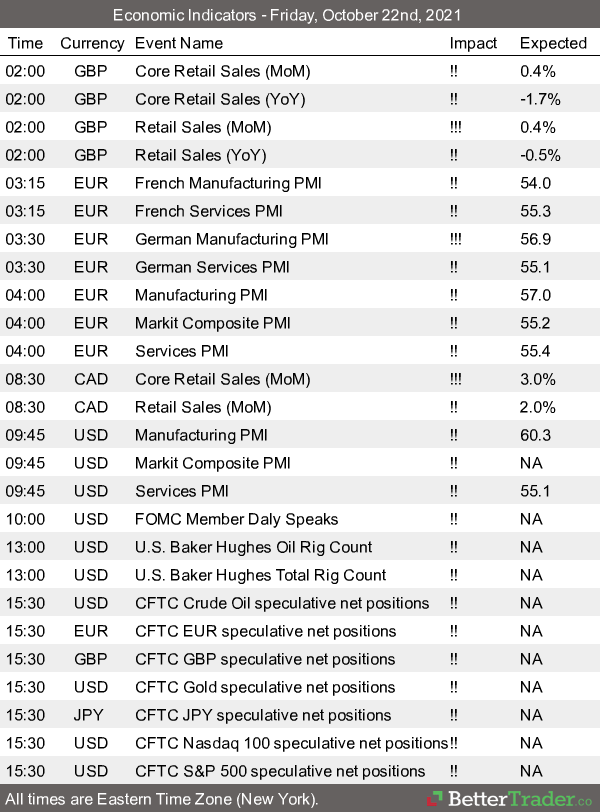

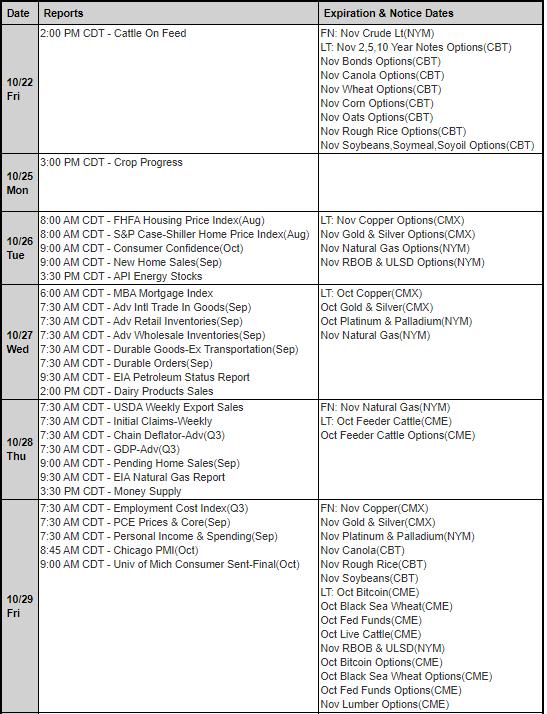

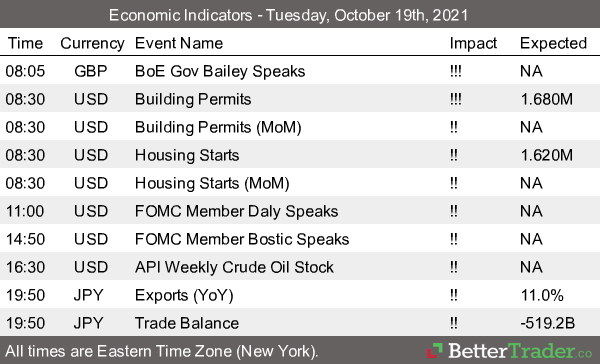

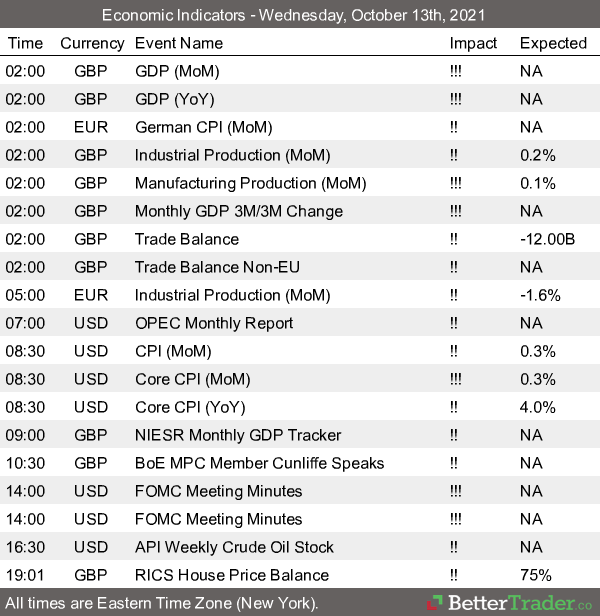

Economic Reports, source:

https://bettertrader.co/

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.