Dear Traders,

Get Real Time updates and more on our private FB group!

Written by John Thorpe, Senior Broker

Would you pay $700.00 for a one way airplane ticket between Chicago and Dallas? Economy? How about $650.00 one way between Oakland and Seattle in a middle seat? What if the price of your favorite coffee-chino increased by 50% or even 90%, how much will you be willing to pay to get that same fix? Or would you buy a lesser product? Is it rational we as consumers are forced to change our buying habits due to unexpected price increases?

A jeweler needs to buy resources (platinum, silver, gold, etc.) to make what he is going to sell, even when resources are sparse and costs are high. A farmer may be forced to sell his product when there is an abundance and prices are low. This doesn’t seem fair to the jeweler, who needs his supplies even when their costs skyrocket, or the farmer, who toils through a growing season and takes on the risks of weather, insects, and disease. These prices can fluctuate dramatically on the world market, and yet it is important for sellers to keep their prices a steady as possible to please their customer base. Perhaps where it is most apparent how important these fixed prices are is with your daily cup of coffee. A coffee roaster like Starbucks must try to control the cost of inputs even when the price for raw coffee bean fluctuates, sometimes dramatically, on the world market. If they couldn’t control the cost of the coffee, then you would not be able to depend on your daily $5.00 fix. Even Airlines are subjected to price variability in the form of costs for jet fuel. As fuel costs rise, the ticket price needs to cover the expense, and a rational increase in the price of a coach ticket should be expected; Budget prices no more. Irrational market price moves for the basic inputs of industry are long and storied throughout human history.

On a different topic, have you looked at some of our automated trading systems recently?

Good Trading

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

Futures Trading Levels

8-13-2021

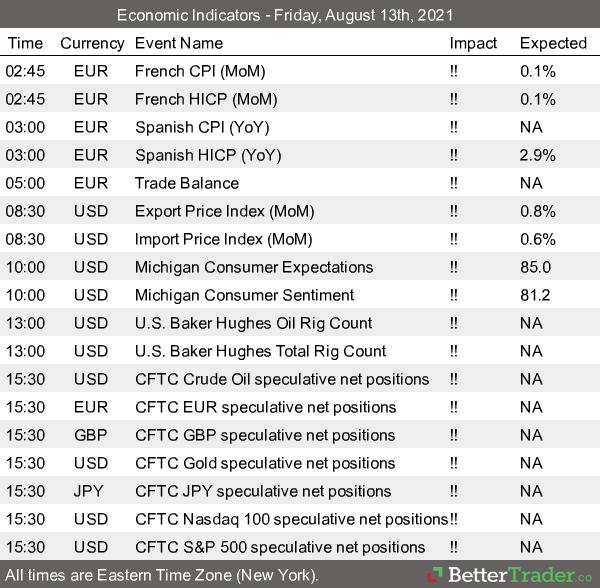

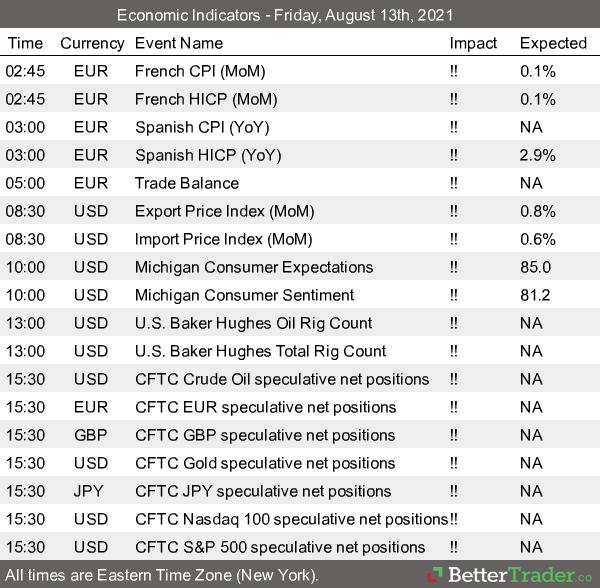

Economic Reports, source:

www.BetterTrader.co

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading as well as options on futures.