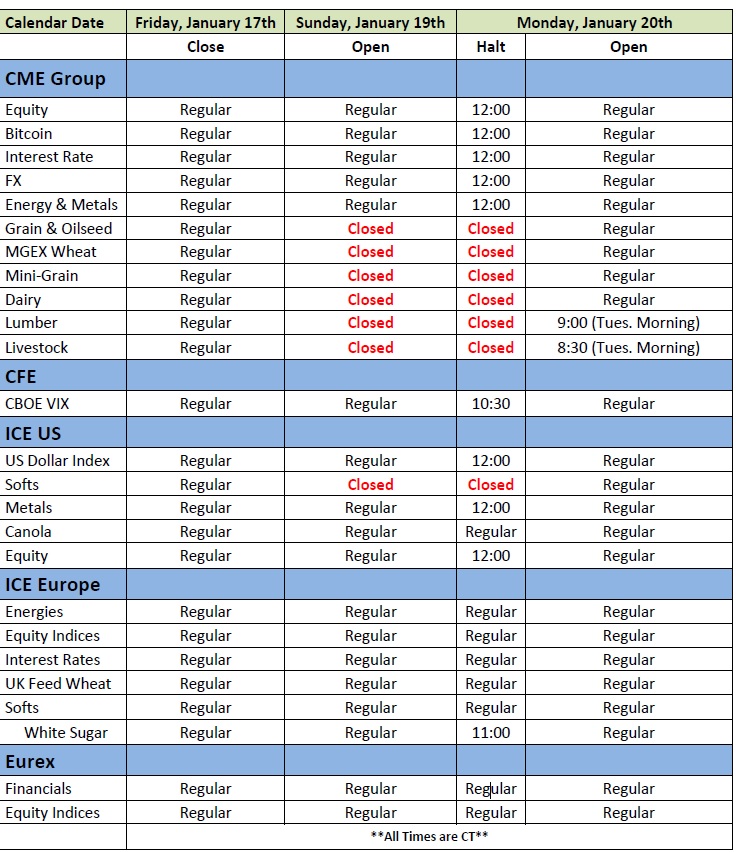

Commodities, especially agricultural commodities, are used by each of us every day. Agricultural commodities are broken into several categories: grains and oilseeds, livestock, dairy, lumber, softs, biofuels, and more. These commodities, from the food on your plate to the gas in your car, are all around us every day and almost impossible to avoid. For these reasons, futures trading is extremely common in the agricultural industry. From a small drought to a large storm, these commodities can be significantly impacted by just one instance of unfavorable weather. Agricultural futures trading allows farmers and consumers alike a way to protect their investment from the rise and fall of their product’s value in this volatile industry.

How to Get Started with Agricultural Futures Trading

Agricultural commodities are within the category of soft commodities. The term soft commodity refers to a commodity that is grown and then harvested such as grain, cotton, and coffee, as well as livestock like cattle and pork. While the majority of these commodities are used directly as a food source, some are used industrially such as rubber and latex from trees, as well as several other users in the clothing, and skin care industries. With their myriad of functions, it is more common that these products will be used for very similar purposes. As such, when getting started with agricultural futures trading, it is an essential step to choose your asset, and research it extensively.

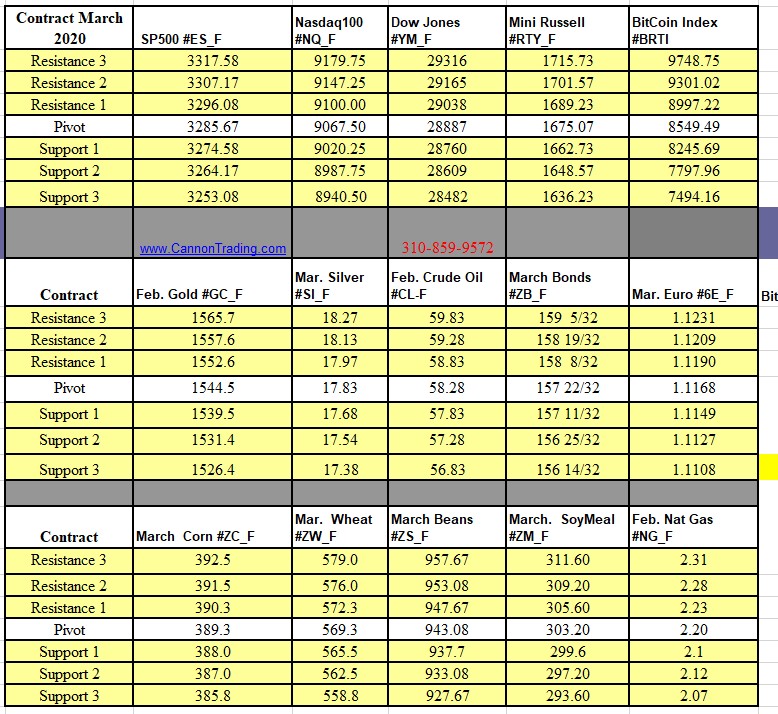

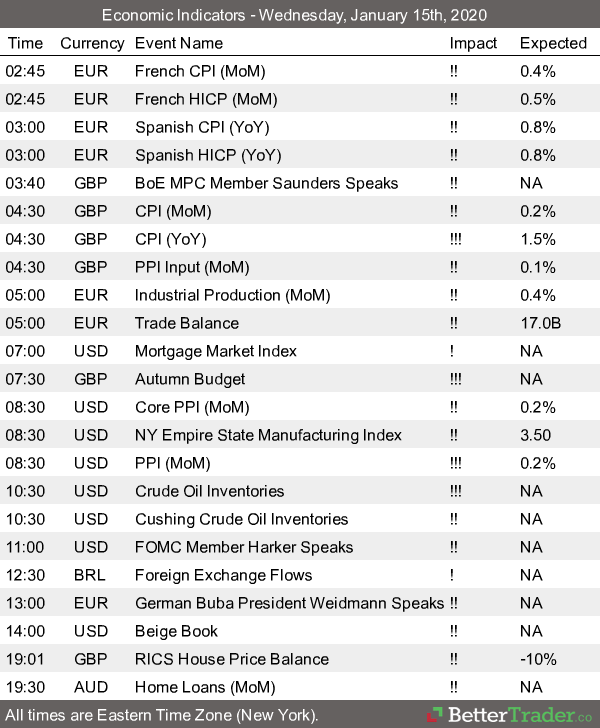

Begin by asking yourself: What will my commodity’s price relationship be like with other commodities? What outside factors like the weather is my commodity at risk of? What types of markets will I be selling my commodity to? By asking these questions, you will begin to understand the supply and demand that you will be operating with. We then suggest you watch the market while trying to predict price ebbs and flows. Were your predictions correct? Once you feel that you have a comfortable grasp on your commodity’s volatility, it is time to partner with a professional.

Agricultural Futures Trading Best Practices

Agricultural commodities can be used as the physical goods themselves, or as a powerful investment vehicle. These commodities are integrated into almost every industry imaginable, and will, therefore, need to purchase them constantly. As a business owner, you will want to lock in a set price that is safe from supply and demand — this is where futures trading comes in.

Hedging is a common risk management strategy, given the high volatility of agricultural commodities. This strategy is built to minimize losses by locking in a fixed price to buy and sell your commodity at a later date. Futures trading is particularly useful in the agricultural industry as the quantity of these products can be difficult to predict due to weather, low fertility, and other factors. The inconsistency within these markets will sometimes cause discrepancy, opening the door for the more profitable technique: commodity arbitrage.

Commodity arbitrage is a process in which a commodity is simultaneously bought and sold in two separate markets in order to take advantage of a said price discrepancy. For example, one may buy crops in a state where the harvest is large and thus the supply is high with low demand, pay the shipping cost, and still profit from selling in a state with a lesser bounty and thus an inverse supply and demand.

Finally, there is speculation. This process is popular with traders who are looking to make a profit in agriculture. When speculating, the user is never physically handling the commodity, only the contracts. By carefully watching the market, users can predict rises and fall in prices across several regions to buy and sell accordingly.

Risks Involved

Naturally, there is a large risk involved when agricultural futures trading on the commodities market. Operating in this space is inherently based on prediction alone, with missteps leading to an overabundance of assets, a shortage of assets, or losing more money than you initially invested. Cannon Trading will help you to get started by partnering you with a professional futures broker. Our professional team members will help to advise you on a strategy that is right for you to help get you started investing in the agricultural commodities market based on your net income, and experience level. We will help to advise you on an investment vehicle that is right for you and help with all of your trading needs and questions when they arise with our extensive background and knowledge of the agricultural futures market. Don’t go it alone, start your commodities trading journey with expert assistance from Cannon Trading.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources.