Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

What’s Included?

As a high risk trading type, futures trading is not for someone who is faint-hearted. Though there are a number of different ways of investing in futures , it is important to stick to what you know. Treading into unknown waters is not something that you should do when dealing in futures.

From managing margins to ordering trades to doing market analysis and more if you want to, you can do that all by yourself – but you may betaking double the risk. Therefore, when trading in futures, it may be better to seek advice from a professional trader.

Professional trading experts at Cannon Trading can help you with your futures trading. We are also there to keep you updated with the latest on futures trading and market news. All the news and latest articles on futures trading are published on our site under the category Archive Futures Trading News, which you are currently browsing through. Read more and the latest here and keep updated.

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

|

Friday, January 6th

US December Non-Farm Payroll Report

|

|

Friday 08:30 EST /13:30GMT (US) Dec Change in Non-farm Payrolls

|

|

What the News Desk Says www.TradeTheNews.com

Last month the November unemployment rate fell to a nine-year low of 4.6% and underemployment also dropped to a pre-crisis low. The pace of payroll gains was in line with expectations at a healthy 178K, enough to support the Fed decision to raise rates in December.

This Friday’s data is expected to show unemployment ticked up to 4.7% and another 175K net job gains. That should keep expectations on track for more Fed rate hikes later this year and continue to support the strengthening trend in the US dollar. For a FREE TRIAL of TradeTheNews live audio feed, click here. |

** Please vote! the competition ends January 31st and you can vote every day, even if you voted before.

Continue reading “Non Farm Payrolls Tomorrow To Move the Markets!! 1.06.2017”

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

^^^

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program.

One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does no involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results

Continue reading “Futures Trading Indicators – Free Trial 1.05.2017”

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

Dear Traders,

* Wishing all of you the best in 2017 – Trading wise, health and all that you wish for! *** To start the new year, a look at a different approach to futures trading ( I highly recommend to speak with one of our brokers before attempting to take any action with a strategy you are NOT familiar with):

|

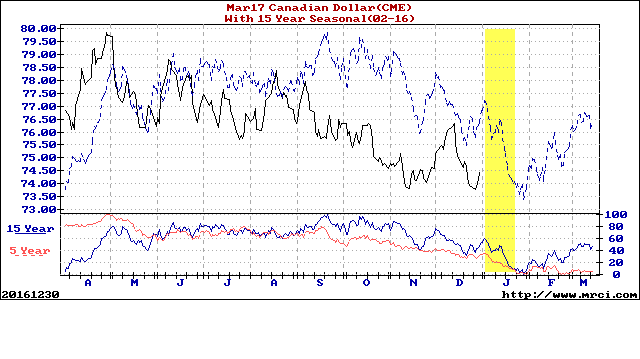

Moore Research Center, Inc.

Free Futures Trading Strategy Of The Month

|

||||||||

|

Seasonal

Strategy |

Entry

Date |

Exit

Date |

Win

Pct |

Win

Years |

Loss

Years |

Total

Years |

Average

Profit |

Average Profit

Per Day |

|

Sell Mar Canadian Dollar(CME)-CDH7

|

01/03/2017

|

01/22/2017

|

87

|

13

|

2

|

15

|

1395

|

70/20

|

|

Seasonal tendencies are a composite of some of the more consistent commodity futures seasonals that have occurred over the past 15 years. There are usually underlying fundamental circumstances that occur annually that tend to cause the futures markets to react in a similar directional manner during a certain calendar period of the year. Even if a seasonal tendency occurs in the future, it may not result in a profitable transaction as fees, and the timing of the entry and liquidation may impact on the results. No representation is being made that any account has in the past or will in the future achieve profits utilizing these strategies. No representation is being made that price patterns will recur in the future. Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk in actual trading. For example, the ability to withstand losses or adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all of which can adversely affect actual trading results. Results not adjusted for commission and slippage.

*** Please vote! the competition ends January 31st and you can vote every day, even if you voted before. ****

Continue reading “Seasonal Trade Idea to start 2017! 1.04.2017”

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

Dear Traders,

* Sometimes our biggest challenge when trading is simply NOT TO GET INTO A TRADE….One of my client said: “I am getting paid to wait”…

** This week and next week, crude oil numbers come out Thursday at 10 AM central since the markets were closed Monday.

Learning to be selective and controlling to urge to just get into a trade because otherwise “you feel you are not doing your job” is not easy but this is definitely one of the steps you as a trader must master in order to be part of the very small percentage of traders who actually make it….

New Year’s 2017 Day Holiday Schedule for CME / Globex and ICE Exchanges

Equity, Interest Rate, FX, Energy, Metals & DME Products

Friday, Dec 30

1600 CT / 1700 ET / 2200 UTC – Regular close

Monday, Jan 2

New Years Observed – Globex closed

Monday, Jan 2

1700 CT / 1800 ET / 2300 UTC – Regular open for trade date Tuesday, Jan 3

Tuesday, Jan 3

1600 CT / 1700 ET / 2200 UTC – Regular close

Grain, Oilseed & MGEX Products

Friday, Dec 30

Regular close – Per each product schedule

Monday, Jan 2

New Year’s Observed – Globex closed

Monday, Jan 2

1900 CT / 2000 ET / 0100 UTC – Open for trade date Tuesday, Jan 3

Tuesday, Jan 3

0700 CT / 0800 ET / 1300 UTC – MGEX Apple Juice open

0800 CT / 0900 ET / 1400 UTC – Grain, Oilseed & MGEX products pre-open

0830 CT / 0930 ET / 1430 UTC – Grain, Oilseed & MGEX products reopen

Regular close – Per each product schedule

Livestock, Dairy & Lumber Products

Friday, Dec 30

Regular Close – Per each Product

Monday, Jan 2

New Years Observed – Globex closed

Monday, Jan 2

1700 CT / 1800 ET / 2300 UTC – Dairy – Regular open for trade date Tuesday, Jan 3

Tuesday, Jan 3

830 CT / 930 ET / 1430 UTC – Livestock markets open

900 CT / 1000 ET / 1500 UTC – Lumber market open

Regular close – Per each product schedule

Globex® New Year’s 2017 Holiday Schedule

More details at: http://www.cmegroup.com/tools-information/holiday-calendar/files/2017-new-years-holiday-schedule.pdf

If you have any questions, please call the CME Global Command Center at +1 800 438 8616, in Europe

at +44 800 898 013 or in Asia at +65 6532 5010

Ice Futures New Year’s 2017 Holiday Trading Schedule

Detailed holiday hours: https://www.theice.com/holiday-hours

The above sources were compiled from sources believed to be reliable. Cannon Trading assumes no responsibility for any errors or omissions. It is meant as an alert to events that may affect trading strategies and is not necessarily complete. The closing times for certain contracts may have been rescheduled.

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

* 25 Proven Strategies for Trading Options

If you are currently trading options on futures or are interested in exploring them further, check out our newly updated trading guide, featuring 25 commonly used options strategies, including butterflies, straddles, strangles, backspreads and conversions. Each strategy includes an illustration demonstrating the effect of time decay on the total option premium involved in the position.

Options on futures rank among our most versatile risk management tools, and are offered on most of our products. Whether you trade options for purposes of hedging or speculating, you can limit your risk to the amount you paid up-front for the option while maintaining your exposure to beneficial price movements. Download PDF here

****

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

* Check out Cannon Trading’s interview with well-known market technician, Carolyn Boroden, the Fibonacci Queen.

** Christmas Trading Schedule

****

Continue reading “Futures Holiday Trading Schedule 12.21.2016”

Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

* Check out Cannon Trading’s interview with well-known market technician, Carolyn Boroden, the Fibonacci Queen.

**Check out our top performing trading systems!

Live results. Explore different systems by different developers and if interested, have these systems “auto trade”.

Please contact your broker or just call us at +310 859 9572.

****

Continue reading “Trader’s interview with the Fibonacci Queen! – Carolyn Boroden 12.20.2016”