January 6, 2017 - Issue #857

In This Issue

1. Simple Day Trading Approach

2. Hot Market report: U.S. T-Bond Bulls Showing Some Strength

3. Economic Calendar

1. Simple Day Trading Approach

Cannon Trading is pleased to present a FREE 3 week trial to a simple day trading concept you can learn, evaluate and implement on all major futures contracts.

The trial includes a 23 page PDF that outlines our concept for daytrading, how to use the two main indicators/ ALGOS, money management rules and much more. Interested clients and qualified prospects will be able to set up two different 15 minutes desktop sharing sessions to review from the conceptual stage to the implementation page, as we walk you through the set up on your own machine and provide feedback as we assist you through the learning curve.

What's Included?

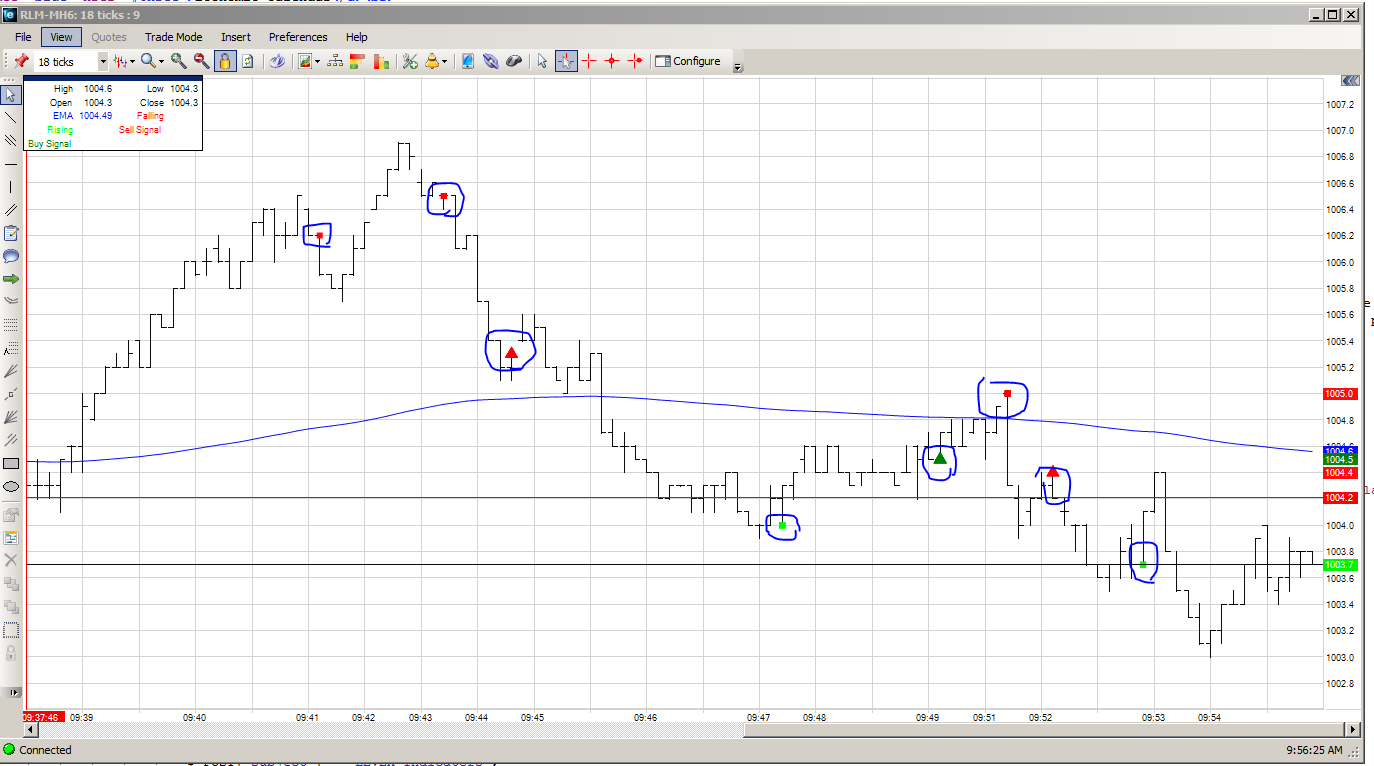

Free demo that includes the charts along the indicators below: (Diamonds and Arrows)

23 page PDF booklet with examples, explanations and more…

Live remote session during market hours to review the model with realtime price action

Diamonds:

DIAMONDS is an algorithm that was created while designing different trading systems. It is a proprietary algorithm that tries to measure exhaustion in selling or buying and possible chance of short term reversal.

The ALGO calculates recent highs/lows, consecutive highs/lows, RSI, volatility and then the formula outputs; a number that either meet certain criteria or not. RED diamonds suggest possible short term top. GREEN or BLUE diamonds suggest possible short term bottoms.

The term “suggested” is used because like any other indicator or trading strategy, the future for the next few minutes or sometimes seconds cannot be predicted.

ILM: ILM produces arrows on the charts that signal potential start of a trend. ILM is based on moving average, volatility system and proprietary calculations.

Simply review the information, fill out the form below to instantly download our trading platform, and start your FREE trial with the indicators on the charts.

Don't wait... limited time free trial. Sign up NOW!

LEVEX - Trading Concept & Indicators

Cannon Trading respects your privacy and will never give this information to a 3rd party.2. U.S. T-Bond Bulls Showing Some Strength

From our friend Jim Wyckoff at JimWyckoff.com

Click on image below to enlarge

The March U.S. Treasury bond futures market saw prices hit a four-week high late this week. Prices have been trending higher for three weeks.

Short covering has been featured. Bears still have the overall near-term technical advantage.

However, if prices can close at or near the weekly high on Friday, that would be an early technical clue that the bond market has put in at least a near-term bottom. Make 2017 a great year!!

The March U.S. Treasury bond futures market saw prices hit a four-week high late this week. Prices have been trending higher for three weeks.

Short covering has been featured. Bears still have the overall near-term technical advantage.

However, if prices can close at or near the weekly high on Friday, that would be an early technical clue that the bond market has put in at least a near-term bottom. Make 2017 a great year!!

3. Economic Calendar

Source: Moore Research Center, Inc.

| Date | Reports | Expiration & Notice Dates |

|---|---|---|

| 01/06 Fri |

7:30 AM CST - USDA Weekly Export Sales

7:30 AM CST - Nonfarm Payrolls(Dec) 7:30 AM CST - Unemployment Rate(Dec) 7:30 AM CST - Ave Workweek & Hourly Earnings(Dec) 7:30 AM CST - Trade Balance(Nov) 9:00 AM CST - Factory Orders(Nov) |

LT: Jan Canadian Dollar Options(CME)

Jan Currencies Options(CME) Jan Live Cattle Options(CME) Jan Mx Peso Options(CME) Jan US Dollar Options(ICE) Feb Cocoa Options(ICE) |

| 01/09 Mon |

2:00 PM CST - Consumer Credit(Nov)

|

|

| 01/10 Tue |

9:00 AM CST - Wholesale Inventories(Nov)

3:30 PM CST - API Energy Stocks |

LT: Jan Orange Juice(ICE)

|

| 01/11 Wed |

6:00 AM CST - MBA Mortgage Applications Index

9:30 AM CST - EIA Petroleum Status Report 2:00 PM CST - Dairy Products Sales |

|

| 01/12 Thu |

7:30 AM CST - USDA Weekly Export Sales

7:30 AM CST - Initial Claims-Weekly 7:30 AM CST - Export(ex-ag) & Import(ex-oil) Prices(Dec) 9:30 AM CST - EIA Natural Gas Report 11:00 AM CST - WASDE Report & Crop Production(& Annual) 11:00 AM CST - Grain Stocks 11:00 AM CST - Winter Wheat Seedlings 3:30 PM CST - Money Supply |

|

| 01/13 Fri |

7:30 AM CST - Core PPI & PPI(Dec)

7:30 AM CST - Retail Sales(Dec) 7:30 AM CST - Retail Sales Ex-Auto(Dec) 9:00 AM CST - Business Inventories(Nov) 9:00 AM CST - Mich Sentiment(Jan) |

LT: Jan Canola(CBT)

Jan Rough Rice(CBT) Jan Soybeans,Soymeal,Soyoil(CBT) Jan Mx Peso(CME) Jan Lumber(CME) Jan Eurodollar Options(CME) Feb Coffee Options(ICE) |

| 01/16 Mon |

MARTIN LUTHER KING, JR. DAY

|

LT: Jan Eurodollar(CME)

|

| 01/17 Tue |

11:00 AM CST - NOPA Crush

|

FN: Jan Lumber(CME)

LT: Feb Crude Lt Options(NYM) Feb Sugar-11 Options(ICE) |

| 01/18 Wed |

6:00 AM CST - MBA Mortgage Purchase Index

7:30 AM CST - Core CPI & CPI(Dec) 8:15 AM CST - Capacity Util & Industrial Prod(Dec) 1:00 PM CST - Fed's Beige Book(Jan) 3:00 PM CST - Net Long-Term TIC Flows(Jan) 3:30 PM CST - API Energy Stocks |

LT: Feb Platinum Options(NYM)

Feb Palladium Options(NYM) |

| 01/19 Thu |

7:30 AM CST - Initial Claims-Weekly

7:30 AM CST - Building Permits & Housing Starts(Dec) 7:30 AM CST - Philadelphia Fed(Jan) 9:30 AM CST - EIA Natural Gas Report 10:00 AM CST - EIA Petroleum Status Report 2:00 PM CST - Dairy Products Sales |

|

| FN=First Notice, OE=Option Expiration, LT=Last Trade | ||

* Please note that the information contained in this letter is intended for clients, prospective clients, and audiences who have a basic understanding, familiarity, and interest in the futures markets.

** The material contained in this letter is of opinion only and does not guarantee any profits. These are risky markets and only risk capital should be used. Past performances are not necessarily indicative of future results.

*** This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts herein contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgment in trading!