In a world that never stops shifting, futures trading has remained a core pillar of modern financial markets. With increased geopolitical uncertainties, ongoing economic upheavals, and recent shifts in U.S. trade policy, professional traders have turned to sophisticated strategies to adapt, survive, and thrive.

At the heart of these strategies is the use of futures contracts, leveraged financial instruments that allow traders to speculate on the direction of prices for commodities, currencies, indices, and interest rates. Today’s article not only highlights 10 expert trading techniques used during market volatility but also explains how your futures broker plays a critical role in facilitating these trades while managing risk. Special attention is given to the ripple effects of tariffs imposed by President Donald Trump and their lingering influence on futures markets. Finally, we’ll spotlight Cannon Trading Company, one of the best futures brokers in the business, exploring how it has built and maintained its impressive legacy.

- Trend Following with Adaptive Moving Averages

Technique Overview: Trend following involves identifying and riding the direction of market trends. By using adaptive moving averages like the Kaufman Adaptive Moving Average (KAMA), traders can smooth out noise and act only when significant movements occur.Risk Assessment: Medium risk. This technique can perform poorly in sideways markets, leading to false signals.Broker Facilitation: Your futures broker can provide robust charting tools, backtesting environments, and automated trade execution to support this strategy.

- Contrarian Trading Based on Sentiment Indicators

Technique Overview: Contrarian traders go against prevailing market sentiment when it reaches extremes. Tools like the Commitment of Traders (COT) report help gauge market positioning.Risk Assessment: High risk. Being early can mean substantial drawdowns before reversal.Broker Facilitation: Access to real-time sentiment data and professional market insights is crucial—services Cannon Trading Company offers in abundance.

- Spread Trading (Inter-Commodity and Intra-Commodity)

Technique Overview: This strategy involves buying one contract and selling another to profit from the price difference between related instruments.Risk Assessment: Low to medium risk. Spreads tend to be more stable than outright positions.Broker Facilitation: Cannon’s platforms allow advanced spread execution and margin efficiencies that are essential for this method.

- Volatility Breakout Systems

Technique Overview: This method capitalizes on price breakouts following periods of low volatility. Traders use tools like Bollinger Bands to set breakout triggers.Risk Assessment: Medium to high risk. False breakouts can occur in choppy markets.Broker Facilitation: Fast, reliable execution and customizable alerts are key services provided by top futures brokers like Cannon.

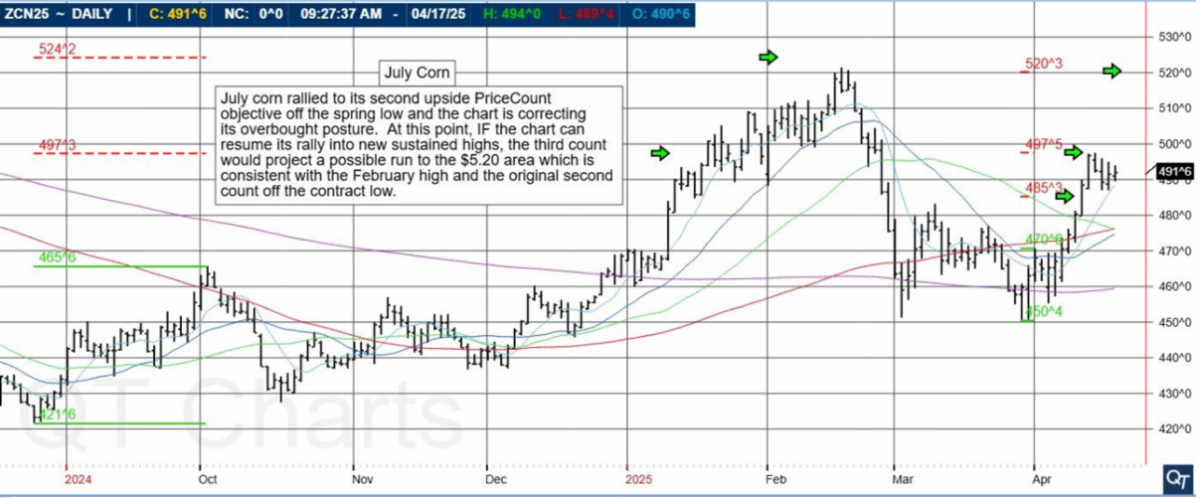

- Seasonal Pattern Recognition

Technique Overview: Certain markets, like agriculture and energy, follow predictable seasonal patterns. Professional traders use historical data to anticipate moves.Risk Assessment: Medium risk. Weather and political developments can override seasonal trends.

- Hedging with Index Futures

Technique Overview: Institutional and retail traders use index futures to hedge their portfolios during turbulent periods.Risk Assessment: Low risk if used correctly. Misjudging beta correlations can reduce hedge effectiveness.Broker Facilitation: Cannon Trading Company offers personalized broker consultations to calculate hedge ratios and recommend appropriate instruments.

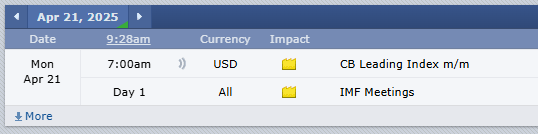

- Event-Driven Futures Trading

Technique Overview: Traders capitalize on events like interest rate decisions, employment reports, and geopolitical crises.Risk Assessment: High risk due to the unpredictability of outcomes and market reactions.Broker Facilitation: Speed, expert commentary, and real-time news feeds are services only elite futures trading firms provide.

- Quantitative Algorithmic Strategies

Technique Overview: These involve using mathematical models to generate trading signals. Common models include mean reversion, arbitrage, and momentum-based strategies.Risk Assessment: Varies depending on model complexity. High for poorly tested models.Broker Facilitation: Cannon supports various platforms ideal for algorithmic trading futures, such as MultiCharts and SierraChart.

- Using Options on Futures for Risk Management

Technique Overview: Options offer a way to control risk with predefined loss levels while maintaining upside potential.Risk Assessment: Low to medium, depending on the strategy (e.g., straddles, strangles, vertical spreads).Broker Facilitation: Experienced brokers like those at Cannon can tailor options strategies to the trader’s risk profile.

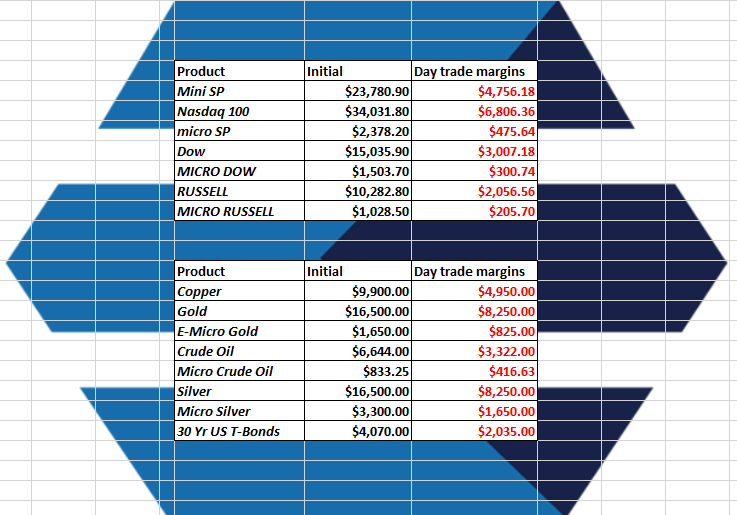

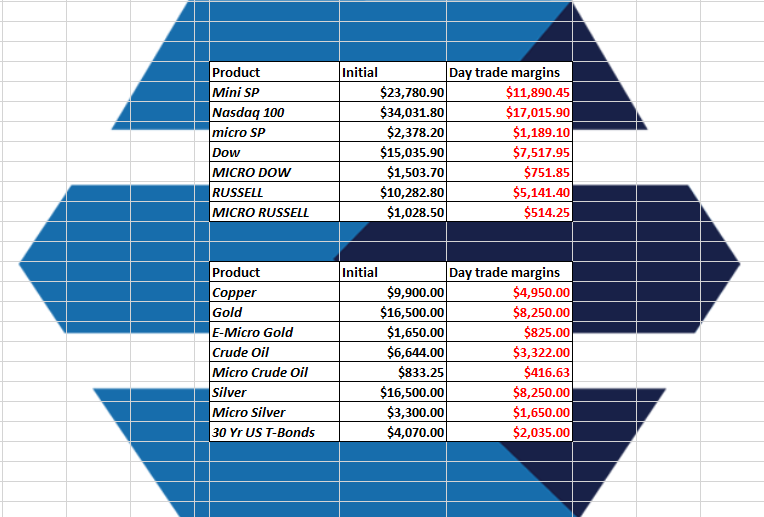

- Micro Futures for Scalping

Technique Overview: Micro futures allow for smaller trade sizes, ideal for scalping strategies that require frequent entries and exits.Risk Assessment: Low risk per trade, but potentially high due to cumulative effects of frequent trading.Broker Facilitation: Low commissions and fast execution—standard offerings at Cannon—are crucial for scalpers.

Tariffs and the Futures Markets: The Trump Effect

The tariffs President Trump’s administration imposed—especially on steel, aluminum, and Chinese goods—continue to affect futures markets today. These policies have reshaped global supply chains and introduced lasting price distortions in key commodities like soybeans, crude oil, and industrial metals.

Lingering Impacts Include:

- Increased volatility in agriculture futures due to disrupted export channels.

- Supply bottlenecks in metals, inflating futures prices.

- Continued geopolitical risk premiums priced into energy markets.

As a result, professional futures trading strategies must now incorporate macroeconomic forecasting and geopolitical analysis to remain effective.

Why Cannon Trading Company is Among the Best Futures Brokers

For more than three decades, Cannon Trading Company has been synonymous with excellence in futures trading. Here’s why traders—from beginners to professionals—consider it among the best futures brokers in the industry:

Unparalleled Customer Service

No automated voice systems. At Cannon, real brokers—many with over 20 years of experience—are a call away. This direct human connection ensures that your trades and concerns receive immediate attention.

Wide Array of Free Trading Platforms

Whether you prefer technical analysis, fast execution, or automated strategies, Cannon offers FREE access to leading platforms like:

- SierraChart

- MultiCharts

- TradingView

- CQG

- TT (Trading Technologies)

These platforms empower futures traders with speed, precision, and customization.

Trust and Transparency

Boasting numerous 5-star reviews on TrustPilot, Cannon Trading is recognized for its ethical practices and reliability. With a clean regulatory track record and transparent fee structures, clients know they’re in safe hands.

Legacy and Stability

Founded in 1988, Cannon has weathered every market storm from the dot-com bubble to the COVID-19 pandemic. Its endurance is a testament to strong leadership, financial prudence, and client-centric philosophy.

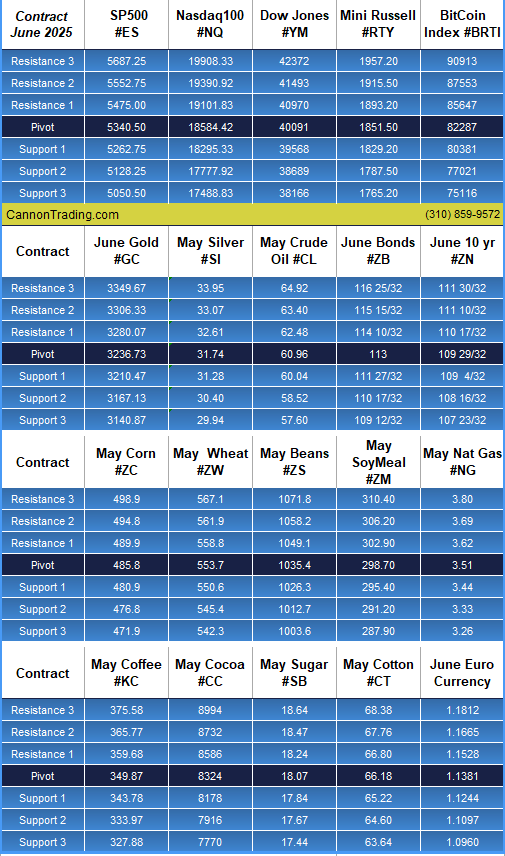

Global Market Access

From grains to cryptocurrencies, Cannon supports trading across a broad spectrum of futures contracts, offering both diversity and specialization.

Regulatory Excellence

Cannon maintains stellar standing with industry regulators such as the NFA and CFTC. This instills trust and peace of mind for clients around the globe.

The Road Ahead

In volatile markets, survival depends on precision, discipline, and the right partnerships. Advanced trading techniques are only as good as the tools and guidance behind them. A seasoned futures broker not only facilitates trades but also acts as a strategic ally.

In this ever-evolving landscape, trading futures remains both a science and an art. And with Cannon Trading Company by your side, you gain not just a service provider, but a legacy partner committed to your success.

For more information, click here.

Ready to start trading futures? Call us at1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading