Connect with Us! Use Our Futures Trading Levels and Economic Reports RSS Feed.

![]()

![]()

![]()

![]()

![]()

![]()

1. Market Commentary

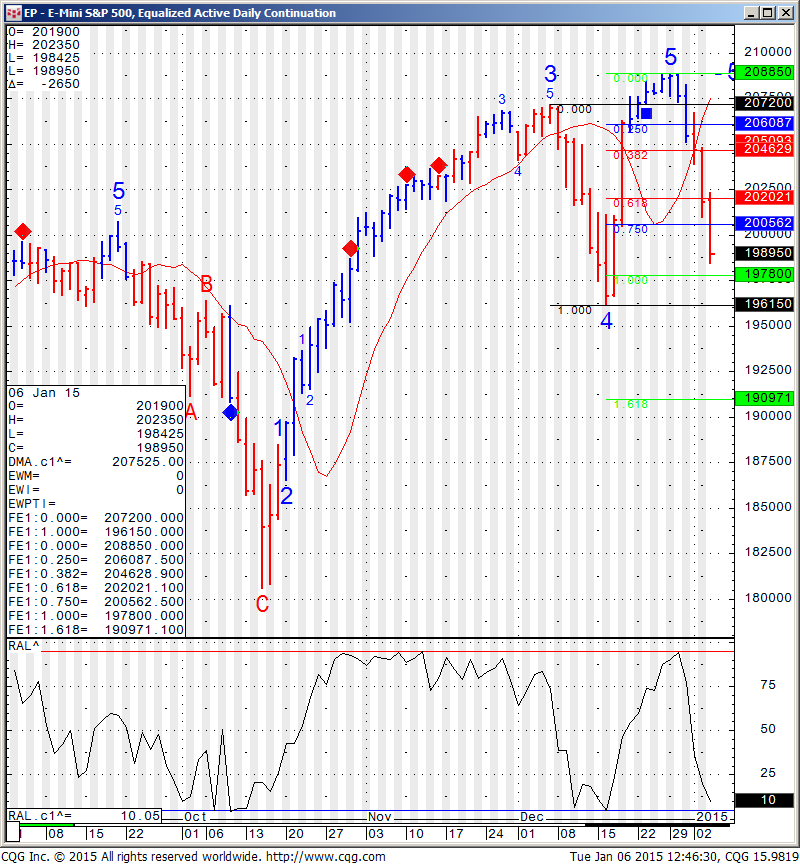

2. Futures Support and Resistance Levels – S&P, Nasdaq, Dow Jones, Russell 2000, Dollar Index

3. Commodities Support and Resistance Levels – Gold, Euro, Crude Oil, T-Bonds

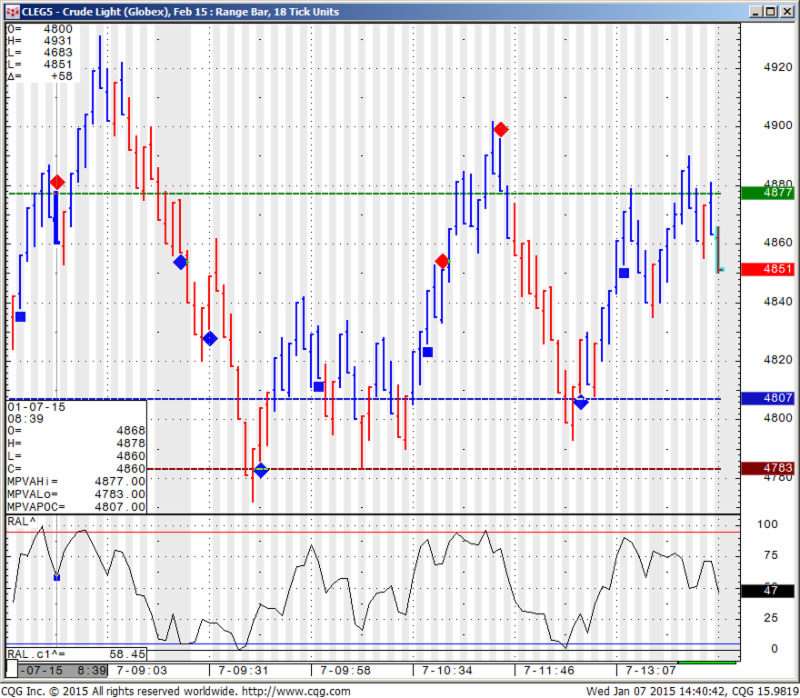

4. Commodities Support and Resistance Levels – Corn, Wheat, Beans, Silver

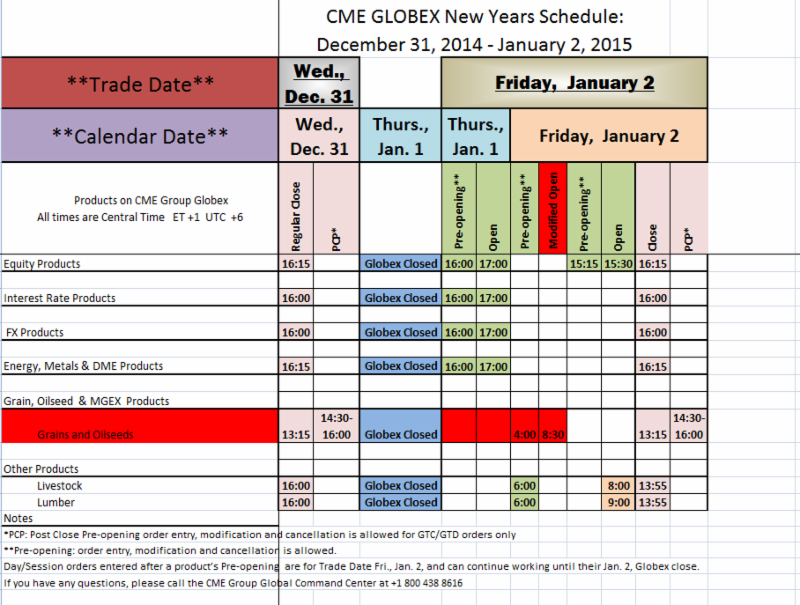

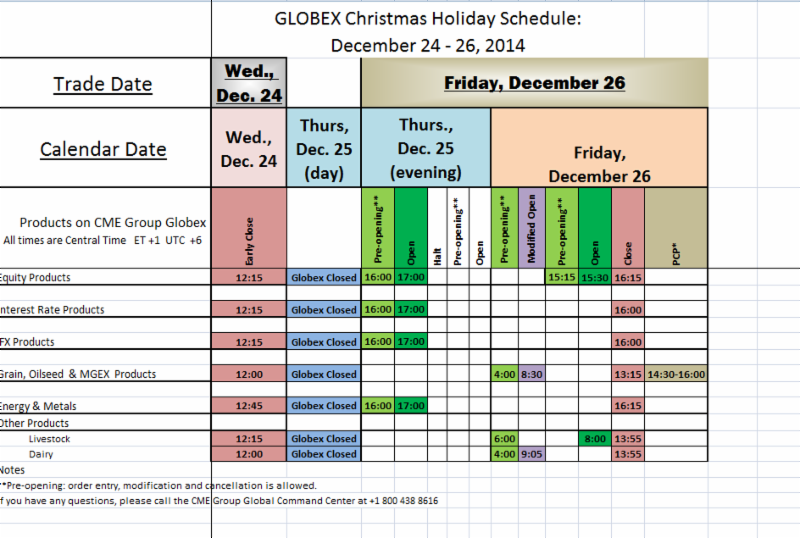

5. Futures Economic Reports for Tuesday January 13, 2015

Hello Traders,

For 2015 I would like to wish all of you discipline and patience in your trading!

TradeTheNews.com Weekly Market Update: Topsy-Turvy

Global equity markets were racked with volatility this week, as competing economic themes vied for dominance. Monday and Tuesday were dominated by concerns about the increasing risk of European deflation and the euro zone potentially unraveling over a renewed Greek crisis. The risk on tone was restored on Wednesday as Chancellor Merkel gave assurances that Germany wants Greece to stay in the euro. Mid-week sentiment was also helped by an Obama Administration announcement that the FHA would dramatically cut its mortgage insurance premiums in hopes of kick-starting the still anemic housing market. Fed policy minutes reinforced the stance of “patience,” while the new slate of dovish FOMC voters flexed their wings, highlighted by Chicago Fed President Evans who proclaimed that raising rates before 2016 would be a “catastrophe.” By Friday, deflation fears were setting in again, as Brent crude hit fresh 5-year lows and the US jobs data showed that last month’s signs of nascent wage inflation had evaporated. The US 10-year yield retreating back below 2% signaled increased investor anxiety as the week drew to a close. The DJIA notched five straight triple digit moves and for the week fell 0.5%, while the S&P500 dipped 0.6% and the Nasdaq lost 0.5%.

The headline US jobs data showed better than expected payroll gains and another tick down in unemployment to 5.6%, but dissection of the report focused chiefly on the disheartening hourly earnings component. The very healthy November gain in wages was cut in half by revisions (to +0.2% from the preliminary +0.4%), and December hourly earnings were -0.2% m/m. The data pulled the y/y growth rate to its lowest level in more than two years (+1.7%). Note that the Fed is on record with its desire to see wage growth accelerate to +3% y/y to help it achieve its 2% inflation target.

The FOMC minutes out on Wednesday confirmed that if the labor market continues to heal, then the Fed is likely to raise rates in the middle of the year even as they remain “patient” on hikes for now. Many analysts say higher rates are likely to happen even if there is little progress on inflation. The WSJ’s Hilsenrath argued that a case is to be made that lower long-term yields may even push the Fed to hike sooner, given they could be a sign of global funds flowing into the US economy and away from anemic overseas markets, potentially inflating various asset bubbles.

Continue reading “Economic Reports & Futures Levels 1.13.2015”