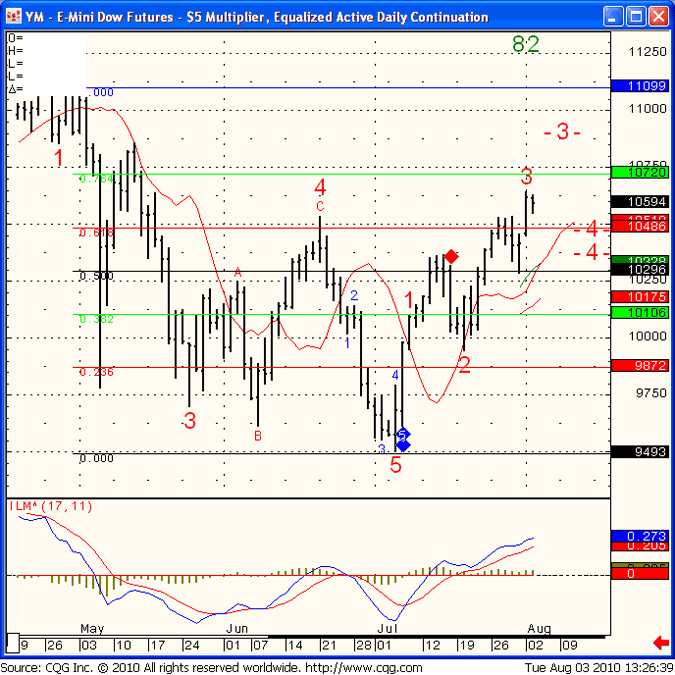

“We Met the Initial Target of 1049”

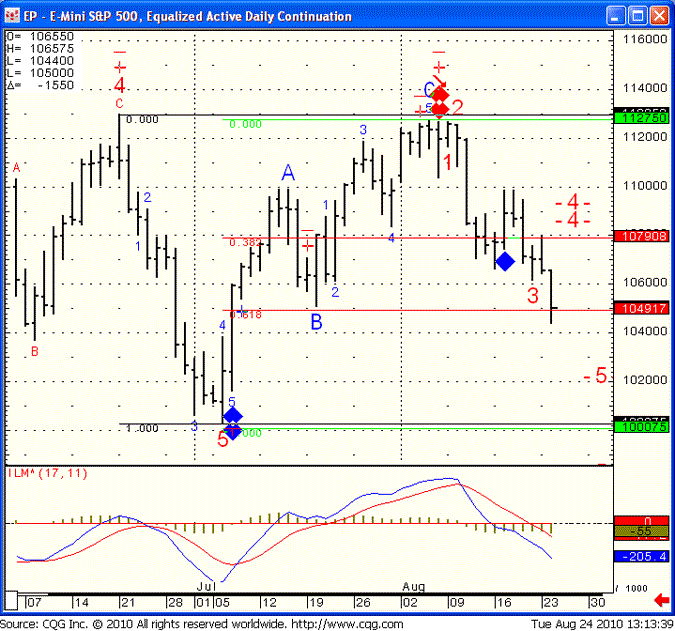

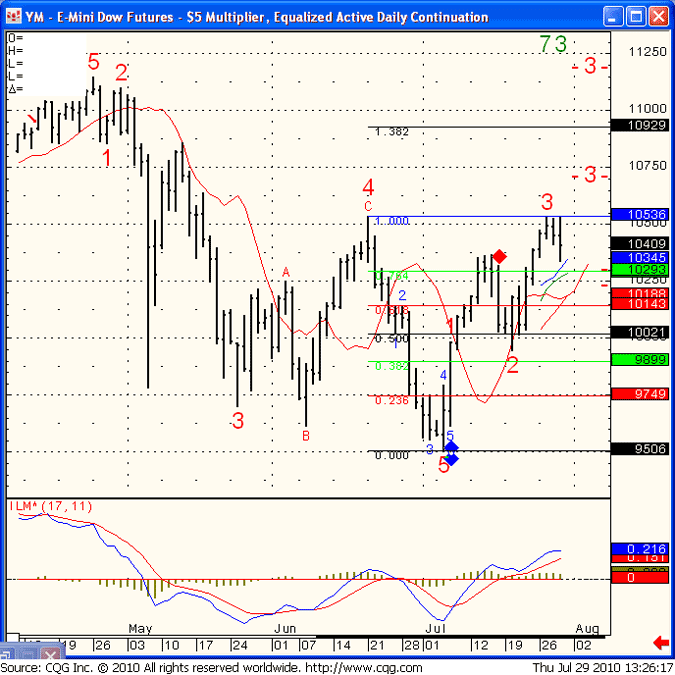

Yesterday I mentioned the following:

Daily chart of the mini Russell, which I consider the leader, for review below. Looks like we may get a test of previous lows and if and then the big question.. do we bounce or do we start a new leg lower:

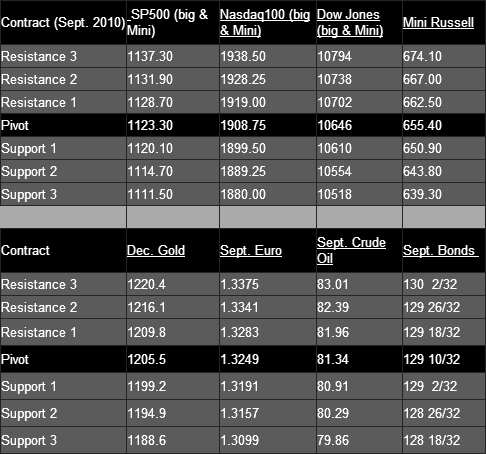

Well the big question for this point in time is here.. we met the initial target of 1049 and from a technical point of view we are looking at some wide bands. 1049 being pivot line, 1080 being resistance and 1000.75 being major support.

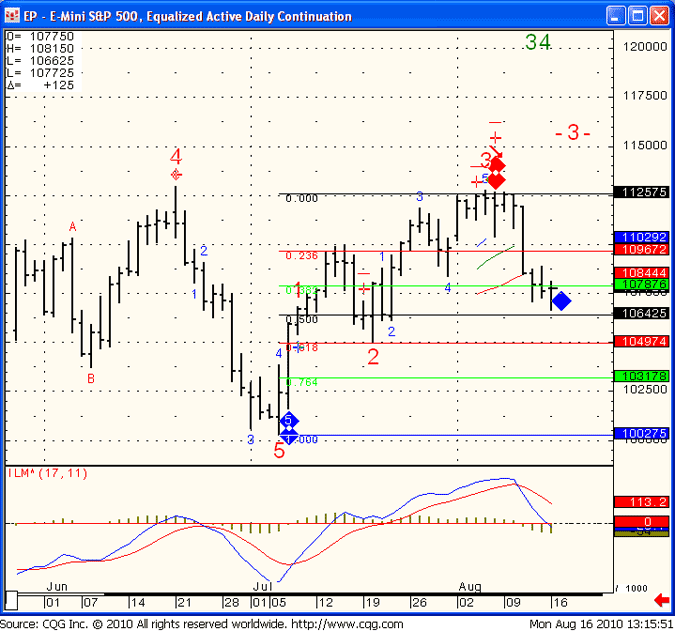

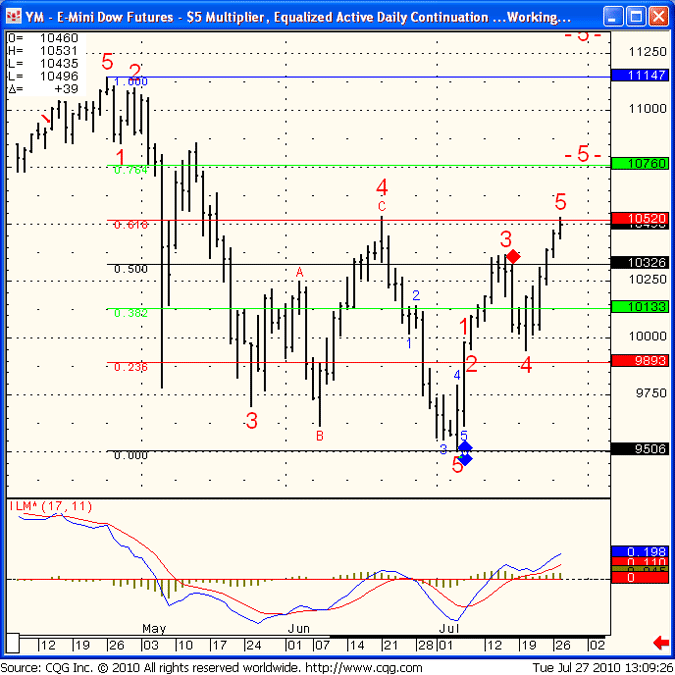

Today I am sharing daily chart of the mini SP 500 for review:

to sign for free trail, visit: https://www.cannontrading.com/tools/intraday-futures-trading-signals