|

- Bitcoin Futures (114)

- Charts & Indicators (306)

- Commodity Brokers (589)

- Commodity Trading (845)

- Corn Futures (64)

- Crude Oil (229)

- Currency Futures (102)

- Day Trading (658)

- Day Trading Webinar (61)

- E-Mini Futures (163)

- Economic Trading (166)

- Energy Futures (127)

- Financial Futures (178)

- Future Trading News (3,159)

- Future Trading Platform (326)

- Futures Broker (665)

- Futures Exchange (347)

- Futures Trading (1,265)

- futures trading education (446)

- Gold Futures (111)

- Grain Futures (101)

- Index Futures (271)

- Indices (233)

- Metal Futures (140)

- Nasdaq (79)

- Natural Gas (40)

- Options Trading (191)

- S&P 500 (145)

- Trading Guide (429)

- Trading Webinar (60)

- Trading Wheat Futures (45)

- Uncategorized (26)

- Weekly Newsletter (223)

Category: Future Trading News

As a high risk trading type, futures trading is not for someone who is faint-hearted. Though there are a number of different ways of investing in futures , it is important to stick to what you know. Treading into unknown waters is not something that you should do when dealing in futures.

From managing margins to ordering trades to doing market analysis and more if you want to, you can do that all by yourself – but you may betaking double the risk. Therefore, when trading in futures, it may be better to seek advice from a professional trader.

Professional trading experts at Cannon Trading can help you with your futures trading. We are also there to keep you updated with the latest on futures trading and market news. All the news and latest articles on futures trading are published on our site under the category Archive Futures Trading News, which you are currently browsing through. Read more and the latest here and keep updated.

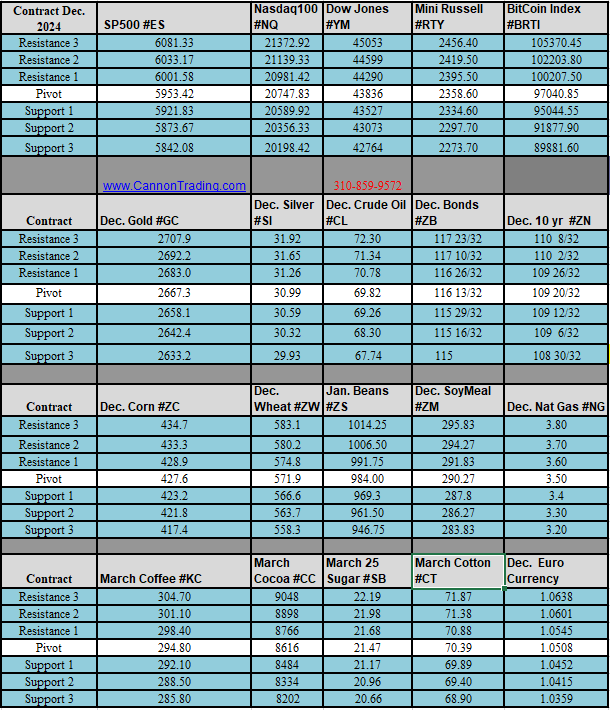

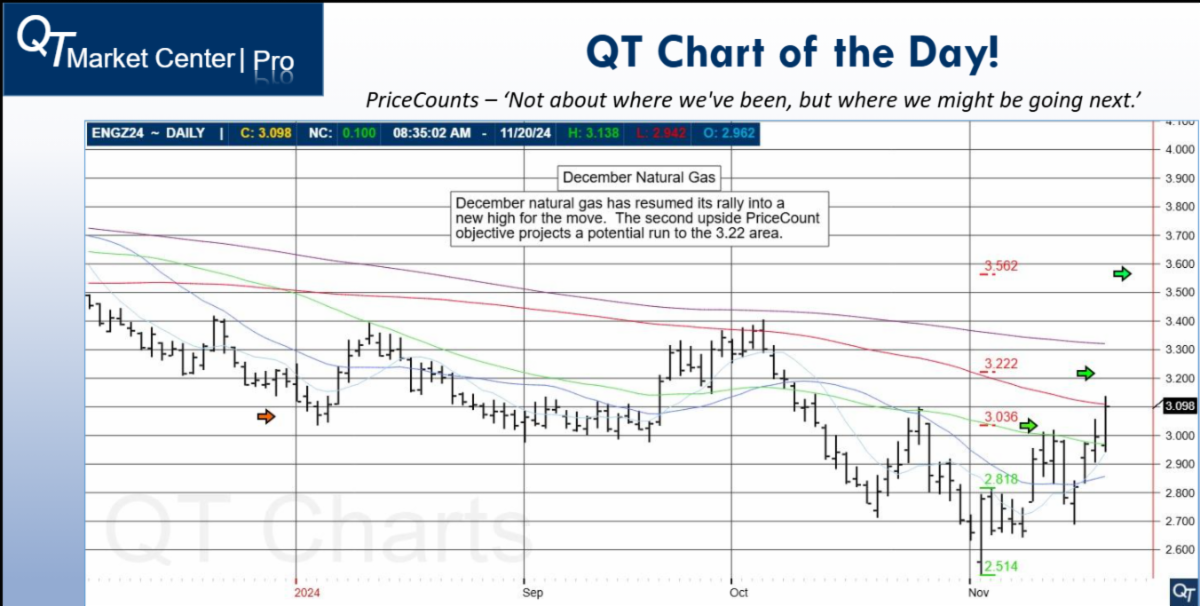

Dec Natural Gas Chart & Trading Levels 11.21.2024

|

|

Movers and Shakers: Geopolitical Tensions, Fed Insights, and NVIDIA Earnings Ahead

|

Bitcoin Futures vs. Nano Bitcoin Futures: Exploring Opportunities for Every Trader

|

|

DJIA Index Futures

The Dow Jones Industrial Average (DJIA), commonly known as the Dow, has long served as a benchmark for American stock market performance, capturing the movement of 30 prominent U.S. companies across various sectors. Since the inception of DJIA Index Futures, often referred to as Dow futures or Dow Jones futures, traders have had unique opportunities to speculate on the index’s movements, providing a way to manage risk and potentially earn profits based on the future value of the Dow. As the futures market evolved, DJIA Index Futures established themselves as some of the most versatile tools in a trader’s portfolio.

This article explores why DJIA Index Futures have remained a mainstay in the futures market, the key players involved in the development of the Dow Jones futures contract, and why Cannon Trading Company is an excellent brokerage for trading these futures contracts. With decades of expertise in futures trading and a reputation for exceptional customer service, Cannon Trading Company has earned its place as a premier option for traders looking to invest in DJIA Index Futures and emini Dow futures.

The Versatility of DJIA Index Futures for Futures Traders

DJIA Index Futures have demonstrated remarkable versatility since their introduction to the market. This versatility stems from several key factors:

- Hedging Opportunities: One of the primary uses of DJIA Index Futures is to hedge against potential losses in the stock market. Institutional investors and portfolio managers use Dow futures to manage risk. For example, if a fund holds a large portfolio of U.S. stocks, a decline in the Dow could lead to losses. By holding short positions in DJIA Index Futures, fund managers can offset these losses, thereby protecting their assets and minimizing risk.

- Leverage Potential: Futures contracts are highly leveraged instruments, allowing traders to control large amounts of underlying assets with a relatively small amount of capital. This characteristic makes DJIA Index Futures particularly attractive to traders who want to maximize their returns. Since futures leverage can amplify both gains and losses, traders are advised to approach it with caution and employ risk management strategies.

- Speculative Opportunities: Beyond hedging, DJIA Index Futures offer substantial potential for speculation. By accurately predicting the direction of the Dow Jones Industrial Average, traders can capitalize on price movements. This is particularly valuable for day traders who look to profit from intraday volatility, as well as swing traders who seek to capture longer-term trends.

- Liquidity and Market Access: DJIA Index Futures are among the most actively traded futures contracts globally, providing deep liquidity for traders. High liquidity enables traders to enter and exit positions quickly, with minimal slippage, enhancing the efficiency of trading strategies. The popularity of emini Dow futures, a miniaturized version of the standard contract, has further increased market accessibility, allowing smaller retail traders to participate in Dow futures trading.

- Flexibility in Trading Hours: The DJIA Index Futures market operates nearly 24 hours a day, offering traders more flexibility than the traditional stock market. This round-the-clock trading access allows traders to react instantly to geopolitical events, economic data releases, or other market-moving factors. Thus, the ability to trade Dow Jones futures outside standard stock market hours makes them ideal for managing global events’ impact on U.S. markets.

The Inception of DJIA Index Futures

The idea of creating futures contracts based on major stock indices emerged in response to increased demand for risk management tools in the 1980s. The Chicago Board of Trade (CBOT) was instrumental in bringing this concept to life. The late Leo Melamed, a visionary in financial futures and a key figure at the Chicago Mercantile Exchange (CME), recognized the potential of introducing futures on financial indices. Working alongside industry pioneers, Melamed helped to popularize index futures as a way for investors to protect their portfolios from adverse movements in stock prices.

The initial success of the S&P 500 futures contract set the stage for further innovation in the market. The creation of DJIA Index Futures was a natural progression. In 1997, the CBOT launched the DJIA Index Futures contract, providing investors a means to speculate or hedge on the movements of one of the most well-known indices in the world. This product allowed for a diversified approach to futures trading, as it reflected the performance of the Dow Jones Industrial Average, a cornerstone of American financial markets.

While Melamed was a pivotal figure, the development and launch of DJIA Index Futures were collaborative efforts that involved input from regulators, financial institutions, and industry experts. Their goal was to create a futures product that mirrored the Dow Jones index and offered accessible, transparent, and efficient trading for institutions and retail investors alike.

Cannon Trading Company: An Ideal Partner for Trading DJIA Index Futures

With its reputation for excellence and over three decades of experience in futures trading, Cannon Trading Company has become a trusted broker for traders interested in DJIA Index Futures. Known for its high ratings on platforms like TrustPilot, where it maintains a 5-star rating, Cannon Trading Company has earned a solid reputation for customer service and reliability. Here’s why Cannon Trading Company is a standout choice for trading DJIA Index Futures and other futures contracts.

- Expertise and Experience: Cannon Trading Company has specialized in futures markets for over 30 years, gaining expertise in navigating the complexities of futures trading. The brokerage’s deep industry knowledge is invaluable to traders, especially those trading Dow futures, who may require guidance on market trends, trading strategies, or risk management techniques.

- Regulatory Compliance and Reputation: Cannon Trading Company adheres to strict regulatory standards, holding an excellent reputation with industry regulatory bodies. Compliance with industry regulations ensures that Cannon Trading Company maintains transparency, accountability, and protection of client funds—critical factors when choosing a brokerage for Dow Jones futures trading.

- High-Quality Customer Service: Cannon Trading Company’s customer service team receives high praise for responsiveness, knowledge, and reliability. The brokerage’s dedication to client support, combined with its stellar TrustPilot ratings, reflects its commitment to providing a seamless trading experience. Whether traders need technical assistance, market insights, or guidance on emini Dow futures, Cannon’s customer service team is equipped to offer prompt and expert support.

- Advanced Trading Platforms: Cannon Trading Company offers advanced trading platforms designed to meet the diverse needs of futures traders. From sophisticated charting tools to real-time data feeds, Cannon provides the resources necessary for traders to make informed decisions when trading DJIA Index Futures. Many of these platforms are customizable, allowing traders to tailor their trading interface to their unique preferences.

- Educational Resources: For traders looking to improve their futures trading skills, Cannon Trading Company offers educational resources that cover a wide range of topics, including Dow Jones futures trading, emini Dow trading strategies, and risk management principles. This focus on education helps both novice and experienced traders make well-informed decisions when trading DJIA Index Futures.

Emini Dow Futures: A Popular Choice for Retail Traders

In addition to standard DJIA Index Futures, the introduction of emini Dow futures has expanded accessibility for retail traders. These miniaturized contracts represent a fraction of the size of traditional Dow futures, allowing traders with smaller capital to participate in Dow Jones futures trading. Emini Dow futures retain many of the features of standard contracts, including liquidity, leverage, and round-the-clock trading. Cannon Trading Company provides access to emini Dow futures, enabling retail traders to benefit from the versatility of Dow Jones futures without the large financial commitment of full-sized contracts.

Why Choose DJIA Index Futures?

As a futures trading instrument, DJIA Index Futures offer several advantages that make them popular among traders worldwide:

- Diversification and Exposure to U.S. Markets: DJIA Index Futures offer exposure to 30 major U.S. companies, providing a diversified entry point into the U.S. stock market. For international traders, Dow futures present an efficient way to gain exposure to the American economy.

- Adaptability to Different Trading Strategies: DJIA Index Futures can be used in various trading strategies, including hedging, speculation, and arbitrage. This adaptability makes them suitable for both institutional and retail traders, regardless of their investment objectives.

- Ease of Trading During Market Downturns: Unlike traditional stock trading, which is challenging in declining markets, futures traders can easily take short positions in DJIA Index Futures, enabling them to profit from downward price movements.

- Low Transaction Costs: Futures trading, including trading DJIA Index Futures, often has lower transaction costs compared to other types of financial instruments. Lower costs mean traders can focus more on their strategies without worrying as much about high commissions or fees.

- Transparency and Standardization: DJIA Index Futures contracts are standardized, meaning that contract specifications, including expiration dates and contract sizes, are set by the exchange. This standardization provides transparency and simplifies the trading process for participants.

Since their inception, DJIA Index Futures have proven to be a valuable asset in the futures trading landscape. These contracts offer traders a unique combination of leverage, liquidity, and flexibility, making them suitable for a wide range of strategies, including hedging, speculation, and arbitrage. The versatility of Dow futures, combined with their close association with the U.S. stock market, has made them a go-to choice for traders seeking exposure to the American economy.

Cannon Trading Company’s dedication to providing a top-tier trading experience, combined with its 5-star TrustPilot rating, extensive experience, and regulatory compliance, makes it a highly recommended broker for trading DJIA Index Futures. With access to advanced trading platforms, educational resources, and high-quality customer service, Cannon Trading Company empowers traders to capitalize on opportunities in DJIA Index Futures and emini Dow futures with confidence.

Whether you’re a seasoned futures trader or just starting your journey with Dow Jones futures, the support and expertise offered by Cannon Trading Company make it a trustworthy partner for achieving your trading goals. DJIA Index Futures, with their unique attributes and market appeal, remain an indispensable tool for futures traders worldwide.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

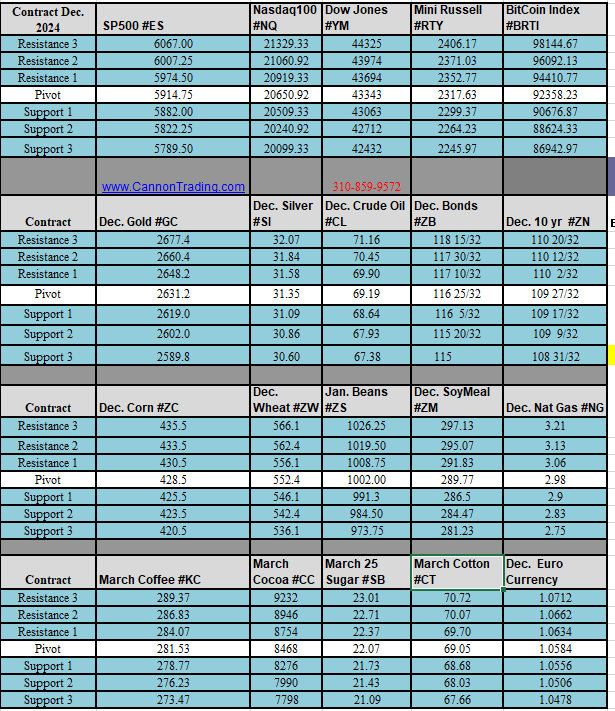

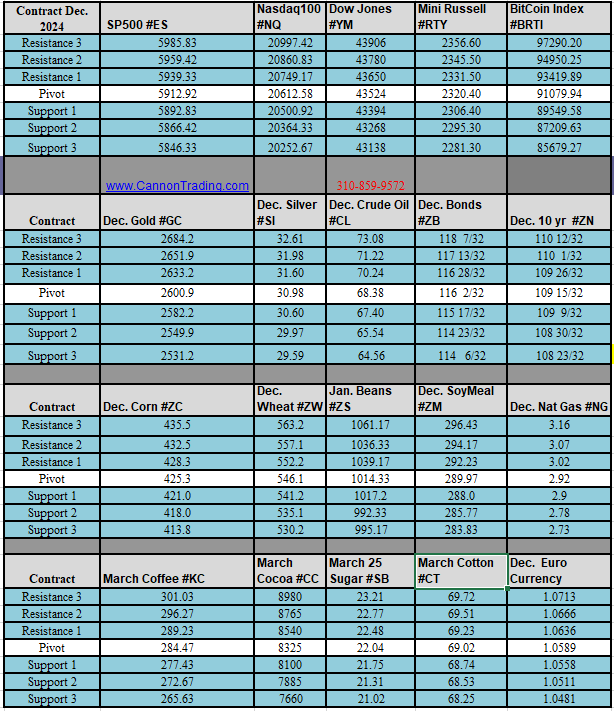

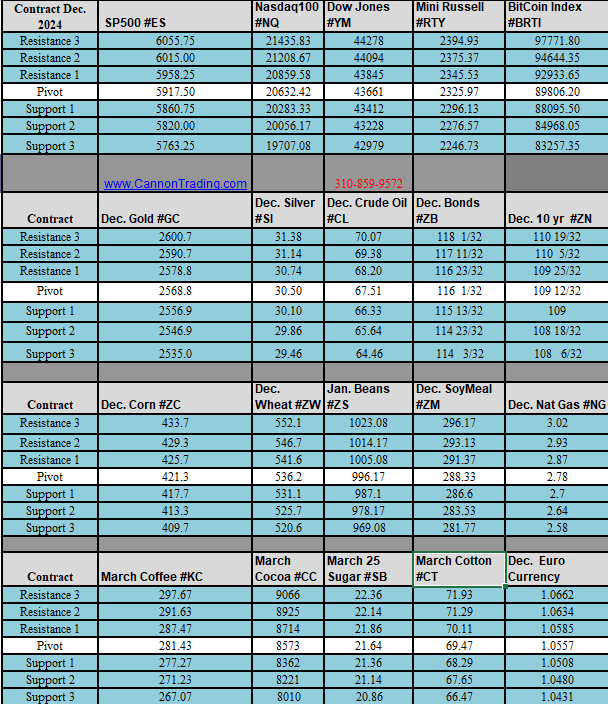

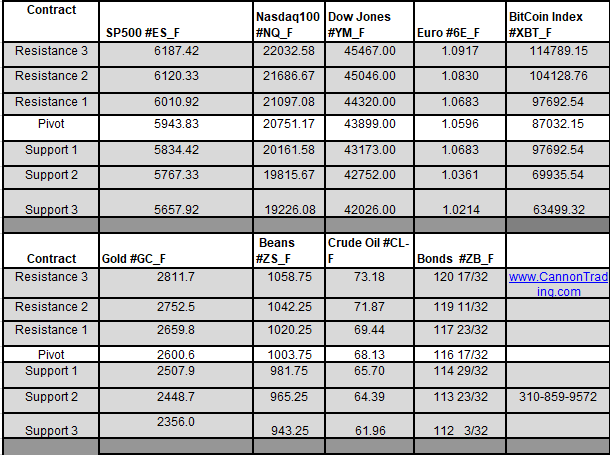

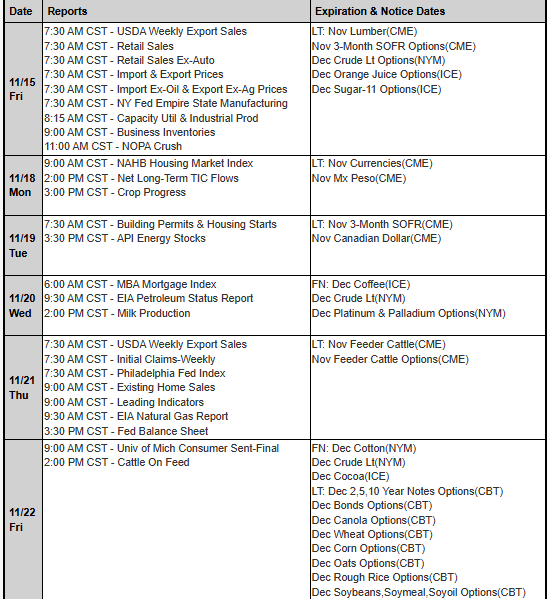

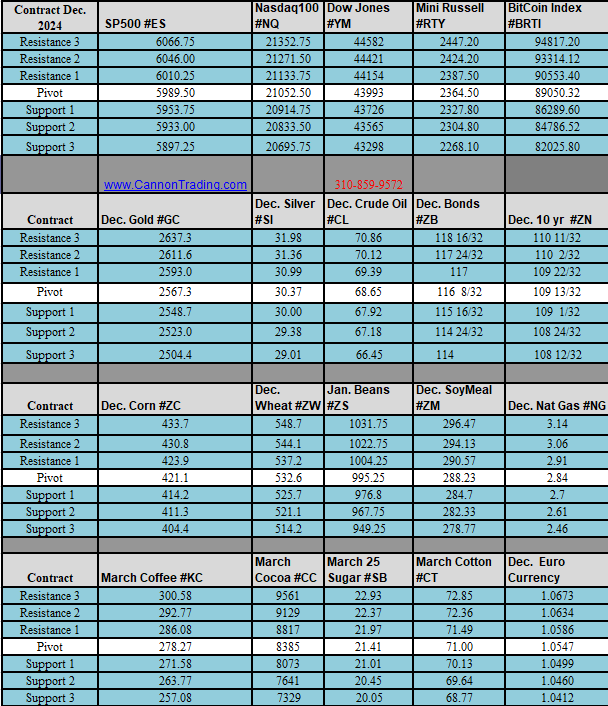

The Week Ahead in Futures Trading + Trading Levels for Nov. 18th

Cannon Futures Weekly Letter Issue # 1217

|

|

|

|

|

Futures Trader

A futures trader is a professional who buys and sells futures contracts on commodities, financial instruments, and other assets in order to profit from fluctuations in their price. Engaging in futures trading involves significant risk and complexity, but when done right, it can yield considerable rewards. However, to maintain a long-term career in futures trading, a trader must adhere to a set of core principles that promote sustainable growth and risk management. Key principles for longevity in this field include emotional control, adherence to trading plans, disciplined risk management, and an understanding of how to balance opportunity with caution. Futures trading is a demanding profession, and those who approach it without a structured approach often find themselves struggling to maintain consistency.

Emotional Control: The Backbone of Successful Futures Trading

One of the most critical principles for any futures trader is emotional control. The fast-paced nature of trading futures, coupled with the significant leverage available, can make it easy to fall into the traps of fear and greed. Emotional control allows traders to respond to market movements calmly rather than react impulsively, which is essential in avoiding irrational decisions that can lead to losses.

For instance, a futures trader may be tempted to double down on a losing position out of frustration or stubbornness, hoping to recoup losses. However, experienced traders know that emotional decisions are rarely profitable in the long term. Instead, successful futures traders have the discipline to cut losses when needed and avoid revenge trading — the tendency to try and “win back” losses through risky moves. Achieving emotional control is often about creating a mindset that recognizes that losses are a natural part of trading in futures and can be managed with a clear strategy.

While emotional control is vital, it can also conflict with the excitement of seizing opportunities. The futures market often presents fast-moving opportunities, and a futures trader may feel an impulse to “catch the wave” of a sudden price move. However, seasoned traders understand that making emotionally driven decisions rarely yields consistent profits. They approach each opportunity with a clear mind and refrain from overtrading, no matter how tempting it may feel in the moment.

The Role of a Trading Plan: Consistency and Structure

A trading plan is a carefully crafted roadmap that outlines a trader’s strategy, including entry and exit points, stop-loss levels, position sizes, and risk tolerance. For a futures trader, adhering to a trading plan is crucial for maintaining consistency in an environment known for its volatility. A trading plan helps remove the emotional component from decision-making, as it provides clear guidelines on how to react under different market conditions.

One of the most significant challenges that futures traders face is resisting the urge to deviate from their trading plans in pursuit of short-term gains. Trading in futures can sometimes feel unpredictable, and an unexpected market shift may lead traders to stray from their plan to try to capitalize on a sudden price movement. While the allure of quick profits can be strong, a successful futures trader recognizes the importance of sticking to the plan and avoiding impulsive trades that do not align with their long-term objectives.

For example, let’s say a futures trader sees an unexpected market rally that they did not anticipate in their plan. Jumping in impulsively could expose them to excessive risk and result in a significant loss if the market reverses. Instead, a disciplined futures trader will assess the situation and determine if the opportunity aligns with their trading criteria. If not, they will patiently wait for a setup that fits their plan. This adherence to a structured approach not only minimizes unnecessary risks but also helps in building a consistent track record over time.

Risk Management: Avoiding Overleveraging in Futures Trading

Risk management is arguably one of the most important principles for anyone involved in futures trading. Unlike other forms of trading, futures contracts are highly leveraged, allowing a futures trader to control large positions with a relatively small amount of capital. While this leverage can magnify profits, it also significantly increases the potential for losses. Proper risk management involves understanding the potential downside of each trade and implementing safeguards to protect capital.

One of the main ways to manage risk is by avoiding overleveraging. Overleveraging occurs when a trader takes on too large a position relative to their account size, which can lead to substantial losses if the market moves unfavorably. Many futures traders are tempted to overleverage in an attempt to maximize profits, but this approach often leads to a quick depletion of their capital. Instead, experienced traders limit their leverage to a level that allows them to weather market volatility without risking catastrophic losses.

Resisting overleveraging is critical, but it sometimes conflicts with a trader’s desire to take advantage of an attractive opportunity. For instance, if a futures trader identifies what they perceive as a high-probability trade, they may feel compelled to increase their leverage to maximize their gains. However, seasoned traders understand that any single trade carries risk, and overextending oneself on one trade can lead to financial trouble. The most successful futures traders balance their enthusiasm for opportunity with a disciplined approach to leverage, ensuring that they have enough capital to remain in the market for the long haul.

Choosing the Right Broker: The Value of Support and Expertise

While discipline and skill are essential, selecting a reliable futures broker is also a crucial decision for any futures trader. The right broker provides a foundation of support, from trade execution to customer service and technical troubleshooting. Cannon Trading Company, for instance, is known for its decades of experience in the futures markets, and with a 5 out of 5-star rating on TrustPilot, it has established a reputation for reliability and client satisfaction.

Working with a broker like Cannon Trading offers multiple advantages for futures traders trading futures. First, their extensive experience in the futures markets means they understand the nuances and challenges traders face daily. This insight allows them to provide valuable guidance and support, which can be especially beneficial for newer traders who are still learning the complexities of trading futures. Additionally, their high customer service ratings indicate a strong commitment to assisting clients promptly, which can be essential in the fast-paced world of futures trading where platform issues or trade execution delays can have financial consequences.

Cannon Trading’s dedication to customer service and troubleshooting helps traders focus on their strategies without the added stress of technical issues. In futures trading, having a broker who can resolve issues efficiently and provide ongoing support can be the difference between a successful trade and a missed opportunity. Cannon Trading’s ratings reflect their reliability in providing broker assistance, which is invaluable for futures traders who rely on quick access to information and a seamless trading experience.

Continuous Learning and Adaptability in Futures Trading

The futures markets are constantly evolving, with new technologies, strategies, and market conditions emerging regularly. For a futures trader to succeed over the long term, a commitment to continuous learning is essential. This could involve studying market trends, understanding new regulations, or refining trading strategies based on past experiences. A willingness to adapt and evolve as a trader ensures that one remains competitive and avoids becoming complacent.

Additionally, the support of a knowledgeable broker like Cannon Trading Company can aid in this learning process. With their years of experience, they can offer educational resources, insights, and market analysis that are beneficial to traders at all skill levels. Leveraging the resources provided by an experienced broker can help traders stay informed and make more educated decisions.

Balancing Discipline and Opportunity in Futures Trading

The life of a futures trader is a delicate balance between seizing opportunities and maintaining discipline. The desire to capitalize on favorable market conditions is natural, but without the guiding principles of emotional control, adherence to a trading plan, and disciplined risk management, traders may fall into habits that undermine their long-term success. Resisting the temptation to overleverage and choosing a trustworthy broker like Cannon Trading Company can further support a sustainable approach.

Futures trading is not a career suited to impulsive decision-making or excessive risk-taking. Traders who respect the markets, remain vigilant, and continuously refine their strategies have the best chances of success. The journey of a futures trader is marked by patience, adaptability, and a focus on consistent, incremental gains rather than high-stakes risks. By adhering to these core principles and leveraging the support of an experienced broker, traders can pursue a rewarding and sustainable career in the dynamic world of futures trading.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

S and P 500 Futures Contract

The S and P 500 futures contract, commonly referred to as SPX index futures, is one of the most popular and actively traded stock market index futures. It represents a standardized agreement to buy or sell the value of the S&P 500 Index at a future date. With a focus on the performance of 500 large-cap U.S. companies, the SPX index futures contract serves as a barometer for the broader U.S. economy and is widely used by traders and investors to hedge portfolios or speculate on market direction. In this article, we’ll delve into the significance of the U.S. Presidential election on the S&P 500 futures contract, assess the impact of Trump’s hypothetical win on these futures, and explore the advantages of using a highly rated brokerage firm, Cannon Trading Company, for trading futures.

What Does the U.S. Presidential Election Mean for the S&P 500 Futures Contract?

U.S. Presidential elections significantly impact financial markets, with the S&P 500 and SPX index futures being among the most affected instruments. This is due to the perceived influence that presidential policies can have on the broader economy, specific sectors, and individual corporations. SPX index futures, representing the S&P 500 Index, are particularly sensitive to factors like economic stimulus, corporate taxation, regulatory policies, and trade relations—policies that can shift dramatically depending on which candidate wins the White House.

When a candidate from a business-friendly background, such as Trump, wins an election, it can lead to initial optimism in the stock market and a subsequent rally in S&P 500 futures. This optimism is often fueled by expectations of corporate tax cuts, deregulation, and pro-business policies that could directly boost corporate earnings and drive stock prices higher. On the other hand, uncertainty around foreign policy and global trade dynamics can introduce volatility, impacting SPX index futures as traders try to anticipate the broader implications for multinational corporations.

Historically, a Republican victory has often led to an initial bullish outlook on the SPX index futures due to the traditional pro-business stance associated with the party. However, this impact can vary depending on the incumbent’s unique policy mix, as seen with Trump’s focus on “America First” policies. A win for Trump in the 2024 election, for instance, would likely continue influencing investor sentiment, particularly in industries like manufacturing, energy, and defense, as well as in sectors that rely on reduced regulations.

Pros and Cons of S and P 500 Futures Contracts with Trump’s Victory

Trump’s victory could bring both advantages and disadvantages for S&P 500 futures contracts, creating both opportunities and risks for traders. Here’s a closer look at some potential pros and cons.

Pros

- Potential for Corporate Tax Cuts and Deregulation: One of the most prominent benefits seen from Trump’s previous presidency was his emphasis on reducing corporate taxes and loosening regulatory requirements for businesses. A win for Trump would likely signal similar intentions, potentially boosting the profitability of U.S.-based companies. With higher earnings, stock valuations tend to rise, making SPX index futures attractive to traders who anticipate a bullish market.

- Infrastructure Spending and Job Growth: Trump’s previous initiatives often included ambitious infrastructure spending plans, which he posited would lead to job growth and increased consumer spending. If Trump returns to office, a renewed focus on infrastructure could drive demand across multiple sectors, from construction to technology. This increased economic activity might provide a strong backdrop for the S&P 500 index, pushing SPX index futures higher.

- Market Volatility and Trading Opportunities: Trump’s leadership style has historically brought volatility to financial markets. For active traders in S&P 500 futures contracts, such volatility can present a plethora of trading opportunities, as frequent market swings allow traders to capitalize on both upward and downward movements in SPX index futures.

Cons

- Potential Trade Conflicts and Global Tensions: Trump’s previous term was marked by trade tensions, particularly with China. Renewed trade wars or heightened tariffs could negatively affect multinational companies, especially in sectors like technology, manufacturing, and agriculture. This uncertainty might cause sharp swings in SPX index futures, making it more challenging for traders to accurately predict market directions.

- Uncertain Economic Policies and Fiscal Discipline: The potential for an expansionary fiscal policy focused on government spending might also increase concerns about the national debt. Increased federal spending and potential inflation concerns could contribute to volatility in the bond market, which can trickle into the S&P 500 and SPX index futures. Traders may need to exercise caution in response to fiscal policy announcements and inflation indicators.

- Social and Political Instability: A win for Trump could also bring about societal polarization and potential civil unrest, which may have repercussions in the financial markets. Uncertainty in the political landscape often translates to market volatility, which could create unexpected swings in SPX index futures, challenging risk management for traders.

Why Choose Cannon Trading Company for Trading Futures?

For traders looking to capitalize on SPX index futures, selecting the right brokerage is essential. Cannon Trading Company, with decades of experience in the futures market and a reputation for excellence, has become a go-to option for both novice and seasoned traders. Here are several reasons why Cannon Trading Company stands out as a top choice for trading futures, especially S&P 500 futures contracts.

- Unparalleled Expertise and Experience: Cannon Trading Company has a long-standing history in the futures market, with a team of professionals who understand the intricacies of SPX index futures and other stock market index futures. Their expertise enables them to provide valuable insights, helping traders make informed decisions based on real-time market data, technical analysis, and macroeconomic trends.

- Exceptional Customer Ratings and Trustworthiness: With a perfect 5-star rating on TrustPilot, Cannon Trading has built a solid reputation for client satisfaction. Traders appreciate the company’s transparent and ethical practices, as evidenced by its regulatory compliance record. This trustworthiness is critical for futures traders who need confidence in their broker, especially when trading high-stakes instruments like SPX index futures.

- Advanced Trading Platforms and Resources: Cannon Trading Company offers a wide array of trading platforms that cater to various trading styles and experience levels. Their platforms come equipped with sophisticated charting tools, analytical resources, and real-time data, allowing traders to stay updated on the performance of SPX index futures and other contracts. For example, their trading platforms offer advanced risk management features, allowing traders to set parameters that help protect against unexpected market swings.

- Personalized Support and Education: The brokerage’s team goes above and beyond to support its clients, offering personalized guidance tailored to each trader’s goals and risk tolerance. For traders new to SPX index futures, Cannon Trading provides educational resources and training, helping them develop strategies suited to their trading style. This level of support can make a significant difference, especially during volatile periods.

- Wide Range of Trading Instruments: Besides SPX index futures, Cannon Trading offers access to a variety of other stock market index futures, commodities, and options. This wide range enables traders to diversify their portfolios and explore different sectors, all while enjoying the convenience of trading with a single brokerage.

The Importance of SPX Index Futures for Traders

SPX index futures play a crucial role in financial markets by providing a way for traders to hedge against or speculate on the future direction of the S&P 500. These futures contracts enable traders to take advantage of market movements without needing to own individual stocks. This feature is particularly beneficial during periods of political uncertainty or economic volatility, as traders can quickly pivot their positions in response to changing market conditions.

Trading futures like the SPX index futures also offers advantages in terms of leverage, as traders only need to deposit a fraction of the contract’s value as collateral. This leverage allows traders to magnify their potential returns, though it also increases the risk, underscoring the importance of proper risk management and using a reputable brokerage like Cannon Trading Company.

The outcome of the U.S. Presidential election can have a profound impact on financial markets, especially on instruments like the S&P 500 futures contract, or SPX index futures. A Trump victory would likely bring renewed attention to pro-business policies, but it could also introduce additional volatility stemming from trade tensions, fiscal policy shifts, and political polarization. For traders, these dynamics underscore the importance of choosing a reliable and experienced brokerage.

Cannon Trading Company, with its decades of experience, high customer ratings on TrustPilot, and robust regulatory reputation, stands out as a top choice for trading futures. With personalized support, advanced trading platforms, and a commitment to transparency, Cannon Trading empowers traders to navigate the complex world of SPX index futures. For those looking to capitalize on the opportunities within the S&P 500 futures contract, a trusted brokerage like Cannon Trading can make all the difference in achieving trading success.

In a dynamic market landscape influenced by political events, having a solid foundation in SPX index futures and a supportive brokerage like Cannon Trading Company can provide traders with the tools and insights needed to make informed and strategic trades.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

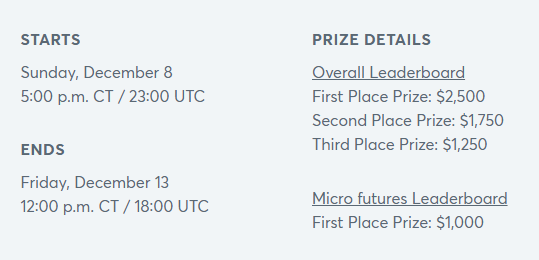

Face the Pros: Test Your Skills in a Simulated Trading Challenge

|

|

Futures Trading

Futures trading has become a popular avenue for investors looking to speculate on price movements in various markets, including commodities, currencies, indices, and interest rates. Futures contracts are standardized agreements to buy or sell an asset at a predetermined price on a future date, making them versatile tools for both speculation and hedging. As markets grow increasingly volatile and interconnected, many investors are drawn to trading in futures not only to potentially earn profits from price swings but also to hedge against adverse market movements. This article delves into the fundamentals of trading with futures, explores how it can responsibly hedge other investments, discusses the role of futures brokers, and highlights Cannon Trading Company as a highly regarded brokerage option.

Futures Trading

Trading with futures involves the buying and selling of contracts that obligate the holder to transact an asset at a specific price on a predetermined date in the future. These contracts are standardized in terms of quantity, quality, and delivery specifics, which facilitates easy trading on exchanges. Key participants in futures trading include speculators, who aim to profit from price fluctuations, and hedgers, who seek to protect themselves against potential losses in other investments.

Trading in futures can span a range of underlying assets, including:

- Commodities: such as crude oil, natural gas, gold, and agricultural products.

- Currencies: such as the U.S. Dollar, Euro, Yen, and emerging market currencies.

- Indices: including stock market indices like the S&P 500 and NASDAQ.

- Interest Rates: such as treasury bonds and other fixed-income instruments.

Using Futures Trading to Hedge Other Investments Responsibly

One of the key applications of trading with futures is as a hedging tool. Investors and businesses can use futures contracts to lock in prices or protect against fluctuations in other assets. This process, known as hedging, is fundamental to managing risk, especially in volatile markets, and can be particularly healthy for your trading future.

- Hedging Commodities Exposure – For companies involved in commodities (e.g., oil, agriculture), futures can provide a reliable hedge against price volatility. For example, an airline company that requires large quantities of jet fuel may use fuel futures contracts to lock in current prices and shield itself from the risk of rising oil prices. This hedging strategy helps the company forecast costs more accurately, ensuring smoother operations and financial planning for your trading future.

- Protecting Stock Portfolio with Index Futures – Investors with significant equity holdings can use index futures to hedge against declines in the broader market. For instance, if an investor holds a large portfolio of stocks but anticipates a market downturn, they could sell futures contracts on a market index like the S&P 500. If the market does indeed decline, losses in the stock portfolio could be offset by gains from the short futures position.

- Currency Hedging for International Investments – Trading futures is also instrumental in managing currency risk for companies and investors exposed to foreign exchange fluctuations. A U.S.-based investor with holdings in European stocks may wish to hedge against fluctuations in the Euro-to-Dollar exchange rate. By entering into futures contracts on the EUR/USD currency pair, the investor can lock in favorable exchange rates, mitigating potential losses from adverse currency movements in your trading future.

- Interest Rate Hedging for Fixed-Income Portfolios – Bond investors and corporations with debt obligations can use interest rate futures to protect against the risk of rising rates. For example, a company planning to issue debt in the near future might buy interest rate futures to lock in current borrowing rates. This strategy provides a safeguard against the financial impact of future rate hikes, which could otherwise increase their interest expenses.

Responsible Hedging Practices in Futures Trading

While trading in futures can be a powerful hedging tool, it’s essential to approach it responsibly. Over-hedging, or using excessively large futures positions, can lead to unintended risks, such as missing out on favorable price movements or incurring losses if the hedge doesn’t correlate closely with the underlying exposure. Responsible hedging with futures involves:

- Position Sizing: Ensuring that the size of the futures position aligns closely with the size of the asset being hedged.

- Understanding Correlation: Selecting futures contracts with strong correlation to the underlying asset, which minimizes basis risk (the risk that the futures price and the spot price move differently).

- Setting Limits: Implementing stop-loss orders and risk management limits to prevent potential overexposure to futures positions.

How Futures Brokers Assist Traders in Futures Trading

Trading futures requires access to exchanges, expert analysis, and the technical infrastructure necessary to execute trades quickly. Futures brokers play a pivotal role in providing these resources and services, making trading more accessible, efficient, and informed for retail and institutional investors alike.

- Trade Execution and Access to Markets – Futures brokers provide traders with direct access to various futures exchanges, such as the Chicago Mercantile Exchange (CME) and Intercontinental Exchange (ICE). Brokers facilitate quick, efficient trade execution and ensure traders can access real-time market data, price quotes, and order routing systems.

- Research and Market Analysis – Most reputable futures brokers offer a wealth of research and market analysis resources. They may provide daily market updates, trading insights, technical analysis, and economic data that help traders make informed decisions. Some brokers even offer specialized analysis for different futures markets, including commodities, financials, and currencies, allowing traders to tailor their strategies according to specific markets.

- Risk Management Tools and Support – Effective risk management is crucial for any trader, particularly in the high-stakes futures market. Brokers can provide tools like margin monitoring, stop-loss orders, and options for leverage management. Many brokers also offer educational resources to help traders develop a deeper understanding of risk management techniques, which is invaluable for both new and seasoned traders.

- Trading Platforms and Technology – In today’s fast-paced markets, the technology a broker offers can make a significant difference. Futures brokers typically provide platforms with advanced charting tools, customizable order types, and integrated news feeds to help traders keep pace with the market. Some brokers even offer proprietary software with specialized features for futures trading, such as options chains, advanced technical analysis tools, and real-time risk assessments.

- Education and Training – Trading futures can be complex, and education is key to developing the skills necessary to succeed. Many brokers offer resources ranging from online tutorials and webinars to one-on-one coaching and seminars. These educational resources enable traders to deepen their understanding of markets, strategies, and trading platforms.

Why Cannon Trading Company is a Top Choice for Futures Trading

For those seeking a reliable futures broker, Cannon Trading Company stands out as a premier choice. With decades of experience, a strong regulatory record, and consistently high customer ratings, Cannon Trading Company has earned a reputation as a trustworthy and knowledgeable broker in the industry. Here’s why Cannon Trading is widely regarded as a top-tier option for futures traders.

- Decades of Industry Experience – Founded in 1988, Cannon Trading has been serving futures traders for over three decades. This longevity not only speaks to the firm’s reliability but also indicates a deep understanding of the futures markets. Cannon Trading’s experienced brokers can provide insights and guidance to help clients navigate market complexities and develop effective strategies.

- Exceptional Customer Ratings on TrustPilot – With a 5 out of 5-star rating on TrustPilot, Cannon Trading has consistently demonstrated its commitment to excellent service. Positive customer feedback highlights the firm’s attentive and knowledgeable support, responsiveness, and user-friendly platform. TrustPilot reviews provide potential clients with insight into the broker’s client-first approach, affirming Cannon Trading’s reputation as a reliable and client-focused broker.

- Stellar Regulatory Record – Regulatory compliance is essential in the financial industry, and Cannon Trading maintains a strong regulatory record. The firm is a registered Futures Commission Merchant (FCM) with the Commodity Futures Trading Commission (CFTC) and a member of the National Futures Association (NFA). This affiliation underscores Cannon Trading’s adherence to high ethical and operational standards, giving traders peace of mind regarding the firm’s integrity and professionalism.

- Advanced Trading Platforms – Cannon Trading offers a range of sophisticated trading platforms to meet the needs of different traders. Whether clients require a powerful platform for advanced technical analysis or an easy-to-navigate interface for beginners, Cannon Trading has options suited to various levels of experience. Some of the platforms available include CannonPro, OEC Trader, and FireTip, all of which provide real-time data, advanced charting capabilities, and customizable tools.

- Wide Range of Market Access and Instruments – Cannon Trading provides access to a diverse selection of futures markets, from commodities like oil and precious metals to financial instruments such as stock indices and foreign currencies. This wide range allows traders to diversify their portfolios and take advantage of opportunities across multiple asset classes.

- Dedicated Customer Support and Broker Assistance – Cannon Trading’s team of experienced brokers is available to assist clients with everything from account setup to advanced trading strategies. The firm prides itself on its hands-on approach, providing dedicated support to help clients achieve their trading goals. Cannon Trading’s brokers can offer personalized guidance, helping traders navigate the complexities of futures markets with confidence.

- Education and Resources for Traders – Cannon Trading places a strong emphasis on trader education. The firm offers a range of resources, including market commentary, educational articles, webinars, and daily analysis to keep clients informed about market developments. Whether clients are new to futures trading or experienced professionals, Cannon Trading’s educational offerings can help them improve their knowledge and refine their trading strategies.

- Futures Trading and Choosing the Right Brokerage – Futures trading offers investors unique opportunities to manage risk, capitalize on market volatility, and hedge other investments. By responsibly using futures contracts, investors and companies can lock in prices, protect against adverse market movements, and better forecast their financial outcomes. Futures brokers play a crucial role in this process by providing access to markets, offering research and analysis, and delivering technology and support that enable traders to execute their strategies effectively.

Cannon Trading Company stands out as an excellent choice for traders seeking a reliable, experienced, and client-focused futures broker. With its decades of industry experience, high customer ratings on TrustPilot, and strong regulatory compliance, Cannon Trading offers traders a trustworthy partner in navigating the complexities of the futures markets. For those interested in futures trading, working with a reputable brokerage like Cannon Trading can provide the tools, resources, and support needed to make informed and strategic trading decisions. Whether one is hedging risk, seeking profits, or diversifying a portfolio, futures trading with the right broker can be a powerful addition to an investment strategy.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010