|

|

As a high risk trading type, futures trading is not for someone who is faint-hearted. Though there are a number of different ways of investing in futures , it is important to stick to what you know. Treading into unknown waters is not something that you should do when dealing in futures.

From managing margins to ordering trades to doing market analysis and more if you want to, you can do that all by yourself – but you may betaking double the risk. Therefore, when trading in futures, it may be better to seek advice from a professional trader.

Professional trading experts at Cannon Trading can help you with your futures trading. We are also there to keep you updated with the latest on futures trading and market news. All the news and latest articles on futures trading are published on our site under the category Archive Futures Trading News, which you are currently browsing through. Read more and the latest here and keep updated.

|

|

|

|

|

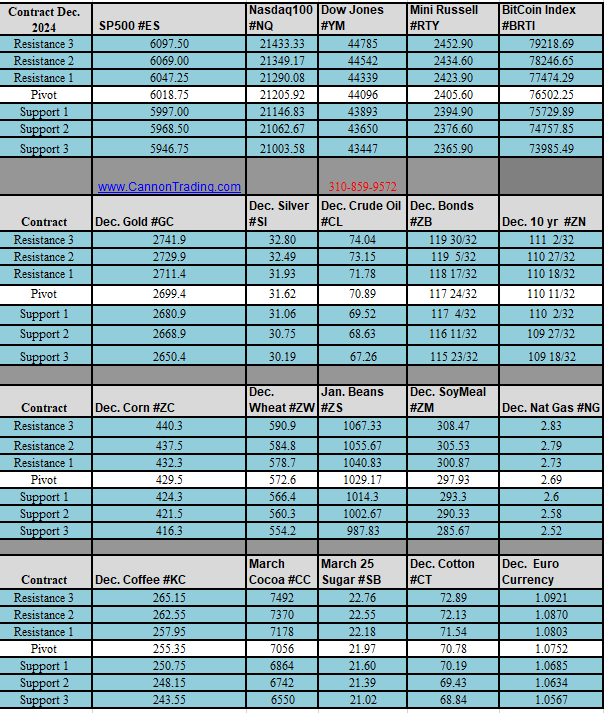

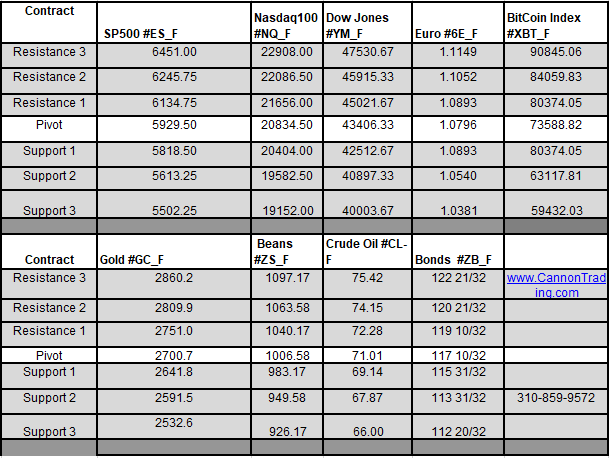

In this issue:

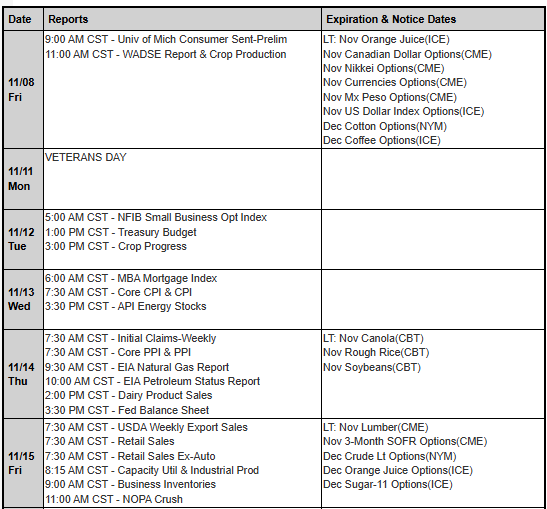

Important Notices – Next Week Highlights:

The Week Ahead

By John Thorpe, Senior Broker

|

|

|

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

July -Dec Corn Spread

The July – Dec corn spread satisfied its second upside PriceCount objective early last month and corrected. Now, the chart is poised to resume its rally where new sustained highs would project a possible run to the 11.75 area.

PriceCounts – Not about where we’ve been , but where we might be going next!

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

DaGGoR Rider M1C NQ

PRODUCT

NQ – Mini NASDAQ

SYSTEM TYPE

Swing Trading

Recommended Cannon Trading Starting Capital

$40,000

COST

USD 150 / monthly

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

|

|

The oil market is one of the most significant and dynamic global markets, with crude oil futures representing one of the most actively traded commodities worldwide. For both new and experienced traders, understanding how to trade oil futures is key to gaining exposure to the oil market, which is impacted by a multitude of factors, from geopolitics to technological advancements. In this guide, we’ll explore the history of crude oil futures trading, why they are so popular, and the advantages and disadvantages for various types of traders, including retail traders, institutional traders, and hedgers. We’ll conclude with an analysis of oil price forecasts for the end of the year, addressing relevant factors that may impact these predictions.

Oil, often referred to as “black gold,” has been a critical resource in the global economy since its discovery as a fuel source. The journey of oil from its early use to becoming a dominant global commodity on the futures trading market is complex. Originally, oil was traded in physical markets, where buyers and sellers would negotiate contracts for delivery. However, as global energy demand grew, especially in the 20th century, oil became an essential commodity, fueling industries, economies, and transport systems worldwide.

To facilitate oil trading and address the volatility in oil prices, crude oil futures were introduced in the 1980s, allowing for price stabilization and hedging. The New York Mercantile Exchange (NYMEX) launched the first crude oil futures contract in 1983, followed by similar offerings from the Intercontinental Exchange (ICE) and other exchanges. These contracts allowed market participants to buy or sell oil at a predetermined price on a future date, bringing a significant degree of predictability and security to the volatile oil market.

Crude oil futures are among the most popular futures contracts, and there are several reasons why traders are drawn to crude oil futures trading:

To successfully engage in crude oil futures trading, traders should familiarize themselves with the trading process, understand market terminology, and stay informed on global events. Below are key steps for how trade oil futures:

Advantages:

Disadvantages:

Advantages:

Disadvantages:

Advantages:

Disadvantages:

The price of crude oil futures heading into the end of the year is likely to be influenced by several critical factors, including global demand recovery, OPEC+ production decisions, and geopolitical issues.

Based on current market conditions, analysts predict that oil prices could remain relatively high through the end of the year, with potential spikes if any supply disruptions occur. Crude oil futures may see increased buying pressure, but price sensitivity to unforeseen disruptions could cause fluctuations. Retail and institutional traders, as well as hedgers, should remain vigilant, monitoring relevant indicators and adjusting their strategies accordingly. Given these factors, how to trade oil futures effectively will require a close watch on economic reports, OPEC announcements, and geopolitical developments.

Understanding how to trade oil futures requires a grasp of market mechanics, key influences, and the reasons behind the popularity of crude oil futures trading. With high liquidity, volatility, and a strong influence from global factors, oil futures present unique opportunities and risks for traders of all kinds. For retail traders, the potential for high returns is met with significant risk. Institutional traders benefit from data and scale, but face regulatory challenges, while hedgers achieve price stability at the cost of flexibility.

The outlook for crude oil futures remains complex, with oil prices predicted to face various pressures that may drive prices higher or, conversely, cause corrections. As oil remains essential to the global economy, futures trading in this sector will continue to be a focal point for market participants. For anyone engaging in crude oil futures trading, maintaining a strategic approach and staying informed of global events are essential for navigating the unpredictable and profitable world of oil futures.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

|

The E-Mini S&P 500, a futures contract for the S&P 500 index, has grown to become one of the most popular financial products in the world for futures trading. From retail traders to institutional investors and hedgers, the E-Mini S&P offers a flexible, accessible way to participate in the stock market, speculate on price movements, and hedge against risks. Brokers play a crucial role in facilitating these trades, providing guidance, resources, and a robust platform for responsible futures trading. This article explores why indices like the S&P 500 are so popular, the importance of experienced brokers, and common mistakes that new traders should avoid when entering the complex world of futures trading.

The S&P 500, also known as the Standard and Poor’s 500 Index, represents 500 of the largest publicly traded companies in the United States. This index has become a barometer of the U.S. economy, and its futures contracts, like the E-Mini S&P 500, have become a popular choice for traders. But what makes these futures so attractive?

Brokers are essential in the stock index trading ecosystem. They provide traders with the necessary infrastructure, resources, and guidance to navigate the markets. Their services are tailored to cater to various types of traders, from retail investors to institutional clients and hedgers. Here’s how they assist each group:

For retail traders, brokers offer a user-friendly platform, educational resources, and customer support to make trading more accessible. Brokers help retail traders in the following ways:

Institutional traders, such as hedge funds, asset managers, and pension funds, have larger capital bases and are typically more sophisticated in their trading strategies. Brokers offer these traders advanced tools and services to meet their complex needs:

Hedgers, such as companies with large stock portfolios or those affected by economic cycles, use the E-Mini S&P 500 and other index futures to offset risks. Brokers assist hedgers with specific services:

New traders often face a steep learning curve when entering the futures markets, and the S&P 500 futures are no exception. Here are some rookie mistakes that traders should avoid:

Experienced brokers help traders avoid these pitfalls by providing educational resources, effective trading tools, and disciplined practices. Here’s how they can make a difference:

Choosing a broker with a solid reputation and strong regulatory standing is vital for futures traders. Here’s why a broker with 5-star ratings on TrustPilot and Google, along with a robust regulatory history, matters:

Legacy futures brokers—those who have been around for decades—offer a wealth of knowledge, experience, and insight that newer brokers may lack. Here are some characteristics that set them apart:

The E-Mini S&P 500 futures contract has cemented its place as one of the most widely traded financial instruments, appealing to a diverse range of market participants. Stock indices like the S&P 500 offer traders access to broad market exposure, high liquidity, and efficient hedging opportunities. Brokers play an instrumental role in facilitating these trades, providing support, education, and the necessary tools to help traders succeed.

For retail traders, institutional investors, and hedgers alike, choosing a broker with a solid reputation and a strong regulatory background is essential. Avoiding rookie mistakes and understanding risk management are crucial for anyone looking to trade S&P 500 futures. Ultimately, a broker with experience, high ratings, and regulatory trust offers an invaluable foundation for responsible, successful futures trading. With the right broker by their side, traders can confidently navigate the opportunities and challenges of the S&P 500 index futures market.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

|

|

|