Dow Jones Industrial Index Futures, often referred to as Dow Futures, represent a contract that allows traders and investors to speculate or hedge on the future price movement of the Dow Jones Industrial Average (DJIA). The DJIA, established in 1896, is a stock market index that tracks 30 large publicly-owned companies listed on the New York Stock Exchange (NYSE) and NASDAQ. It is one of the most recognized and tracked stock indices globally, serving as a benchmark for the performance of the U.S. economy.

What are Dow Futures?

Dow Jones Industrial Index Futures are derivative contracts that mirror the price movement of the DJIA but are traded on futures exchanges like the Chicago Mercantile Exchange (CME). These contracts offer investors the ability to speculate on the future value of the index, either profiting from upward price movement (long positions) or downward movement (short positions). The primary contract size is often referred to as the “E-mini Dow Futures” and “Micro Dow Futures,” providing varying levels of leverage for traders.

How Does One Make Money Trading Dow Futures?

Making money trading Dow Jones Industrial Index Futures (or Dow Futures) involves understanding the dynamics of futures markets, price movements, and leveraging timing to one’s advantage. There are several approaches traders can take:

- Speculation: Traders can buy (go long) or sell (go short) Dow Jones futures based on their expectation of the index’s movement. If a trader believes the Dow Jones index will rise, they may go long on Dow futures, and profit if the index rises above the entry price. Conversely, if they anticipate a decline, they may short the futures contract and profit if the index falls.

- Hedging: Institutional investors and portfolio managers use Dow Jones futures as a hedging tool to protect against adverse movements in the stock market. For example, a fund heavily invested in large-cap stocks might hedge against potential market downturns by selling Dow Jones Industrial Index futures. If the stock market declines, the losses in the stock portfolio would be partially or wholly offset by gains in the futures position.

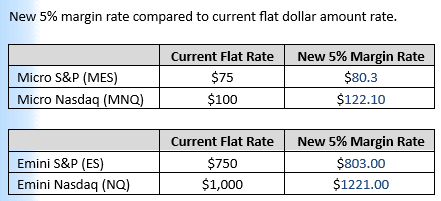

- Leverage: One of the attractive features of futures trading is leverage. Futures contracts allow traders to control a large amount of the underlying asset (in this case, the Dow Jones index) with a relatively small margin deposit. This increases potential returns but also magnifies risk, which is something traders must manage carefully.

- Arbitrage: Some sophisticated traders employ arbitrage strategies to exploit price discrepancies between the Dow Jones index, futures contracts, and other related instruments. This involves simultaneous buying and selling of assets to profit from temporary differences in price.

History of Dow Jones Futures and How the Contract Came to Be Traded

The introduction of Dow Jones Industrial Index Futures on the futures markets is part of a broader historical evolution of financial futures. Stock index futures, including Dow futures, began trading in the 1980s, largely due to an increasing demand for instruments that allowed institutions and traders to hedge and speculate on market-wide price movements rather than individual stocks.

The launch of futures contracts tied to the Dow Jones Industrial Average, such as the E-mini Dow and later the Micro Dow, allowed traders to efficiently gain exposure to the broader market, enabling smaller investors to participate due to the more accessible contract sizes. The Chicago Board of Trade (CBOT), which later became part of the CME Group, introduced Dow futures contracts to provide more liquidity and flexibility to traders looking for exposure to the U.S. stock market in a standardized, regulated, and transparent marketplace.

The growing demand for diversified trading tools, combined with the need to manage portfolio risks, further cemented the popularity of Dow Jones Industrial Index futures. The role of Dow futures expanded beyond just speculative trading and became an integral part of risk management for institutional investors, portfolio managers, and corporations.

Advantages and Disadvantages of Trading Dow Jones Futures

Both retail traders and institutional investors participate in Dow Jones futures, but they approach these markets differently, each facing distinct advantages and disadvantages.

For Retail Traders:

- Advantages:

- Access to Leverage: Dow futures provide retail traders the ability to control large positions with a relatively small capital outlay, amplifying potential returns. For instance, the E-mini Dow and Micro Dow contracts offer different levels of exposure, allowing traders to tailor their risk.

- 24-Hour Market: Unlike the underlying stock index, Dow Jones futures trade nearly 24 hours a day, allowing traders to react to global events that may affect market sentiment. This is especially valuable in periods of high volatility.

- Diversification: Retail traders can diversify their portfolios by trading Dow Jones futures alongside individual stocks, commodities, and other financial instruments.

-

Disadvantages

:

- High Risk Due to Leverage: While leverage can multiply profits, it also increases potential losses. Retail traders need to be cautious and have a risk management strategy, such as using stop-loss orders.

- Complexity: Futures trading can be complex and may require a steep learning curve, particularly for beginners. The volatility of index futures can lead to rapid price changes, making it difficult to manage positions without significant experience.

- Margin Calls: If the market moves against a trader’s position, they may face margin calls, requiring additional funds to maintain their position, potentially leading to forced liquidation.

For Institutional Traders:

- Advantages:

- Efficient Hedging: Institutional investors, such as pension funds or mutual funds, can use Dow Jones futures to hedge their large equity portfolios, providing protection against adverse market moves without the need to sell their underlying stocks.

- Liquidity: The Dow Jones futures market is highly liquid, allowing institutional traders to enter and exit large positions without significant price slippage. This is a critical factor when managing multi-million or even billion-dollar portfolios.

- Arbitrage Opportunities: Institutional traders with sophisticated systems can exploit inefficiencies between cash markets, Dow Jones futures, and other related instruments, generating profits from small price discrepancies.

- Disadvantages:

- Market Volatility: While institutional traders are well-equipped to handle market volatility, sharp and sudden price movements can still cause disruptions in carefully hedged positions. Moreover, volatility spikes can make it more expensive to maintain hedges.

- Complexity and Transaction Costs: Institutional traders must account for transaction costs and fees associated with trading large futures positions, which can erode profits, particularly when trading frequently.

For Hedgers:

- Advantages:

- Risk Management: Hedgers, such as corporations with significant exposure to the equity markets, can use Dow futures to manage risk effectively, locking in future prices and reducing exposure to adverse market movements.

- Flexibility: Dow Jones futures allow for the flexible adjustment of hedging positions in response to market changes, providing a cost-effective way to manage portfolio risk.

- Disadvantages:

- Opportunity Costs: While hedging with Dow futures can protect against losses, it can also limit upside potential if the market moves favorably. Hedgers must weigh the benefits of protection against the potential opportunity costs of missed gains.

Why is Cannon Trading Company a Great Choice for Trading Dow Jones Futures?

Cannon Trading Company has built a reputation as a leading broker in the futures trading industry, providing superior services to both retail and institutional traders. Here are several reasons why Cannon Trading is an excellent choice for trading Dow Jones Industrial Index Futures:

- Expertise and Experience: Cannon Trading has been a prominent player in the futures trading world for over three decades. Their team of experienced brokers is well-versed in the intricacies of Dow Jones futures and can offer tailored advice and trading strategies to clients.

- Advanced Trading Platforms: Cannon Trading provides access to top-tier trading platforms designed for both retail and institutional clients. These platforms offer fast execution speeds, advanced charting tools, and the flexibility to trade Dow futures efficiently. This is particularly important for Dow Jones Industrial Futures traders who require timely access to markets and data.

- Competitive Commission Structure: For those trading Dow Jones futures, Cannon Trading offers competitive commission rates, allowing traders to maximize their returns without being weighed down by excessive fees. This is particularly beneficial for high-frequency traders and institutional investors managing large portfolios.

- Personalized Service: Cannon Trading stands out for its personalized approach, offering one-on-one support to traders of all levels. Whether a client is a retail trader new to Dow Jones futures or an institutional hedger managing large sums, Cannon’s team provides direct and knowledgeable assistance, ensuring that trading decisions align with the client’s goals.

- Risk Management Tools: For those trading leveraged instruments like Dow futures, risk management is crucial. Cannon Trading offers various risk management tools, such as stop-loss orders and sophisticated platform features, enabling traders to protect their capital in volatile markets.

- Education and Resources: Cannon Trading also invests in client education, providing access to market research, webinars, and other educational resources. This commitment to educating clients ensures that they are well-equipped to navigate the complexities of trading Dow Jones Industrial Index Futures.

Trading Dow Jones futures offers a range of opportunities for both retail and institutional investors, providing access to leverage, diversification, and risk management tools. However, these benefits come with significant risks, especially for retail traders who must carefully manage leverage and market volatility. For institutional traders and hedgers, Dow futures offer efficient means of portfolio management and risk mitigation. Cannon Trading Company, with its long history, advanced platforms, personalized service, and commitment to education, stands as an excellent choice for those looking to trade Dow Jones Industrial Index Futures. Whether speculating on market trends or hedging against potential downturns, Dow Jones futures remain a critical tool in the modern trading landscape.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572(International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading