|

- Bitcoin Futures (114)

- Charts & Indicators (306)

- Commodity Brokers (589)

- Commodity Trading (845)

- Corn Futures (64)

- Crude Oil (229)

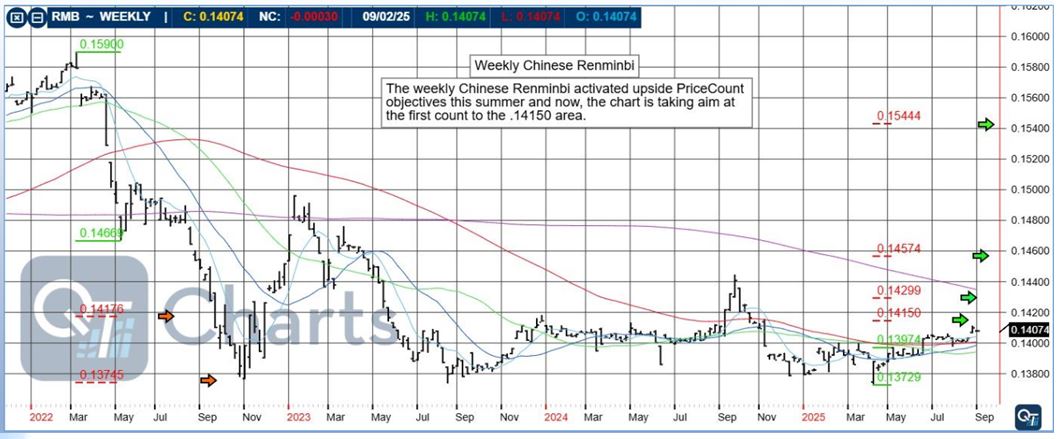

- Currency Futures (102)

- Day Trading (658)

- Day Trading Webinar (61)

- E-Mini Futures (163)

- Economic Trading (166)

- Energy Futures (127)

- Financial Futures (178)

- Future Trading News (3,159)

- Future Trading Platform (326)

- Futures Broker (665)

- Futures Exchange (347)

- Futures Trading (1,265)

- futures trading education (446)

- Gold Futures (111)

- Grain Futures (101)

- Index Futures (271)

- Indices (233)

- Metal Futures (140)

- Nasdaq (79)

- Natural Gas (40)

- Options Trading (191)

- S&P 500 (145)

- Trading Guide (429)

- Trading Webinar (60)

- Trading Wheat Futures (45)

- Uncategorized (26)

- Weekly Newsletter (222)

Category: Future Trading News

As a high risk trading type, futures trading is not for someone who is faint-hearted. Though there are a number of different ways of investing in futures , it is important to stick to what you know. Treading into unknown waters is not something that you should do when dealing in futures.

From managing margins to ordering trades to doing market analysis and more if you want to, you can do that all by yourself – but you may betaking double the risk. Therefore, when trading in futures, it may be better to seek advice from a professional trader.

Professional trading experts at Cannon Trading can help you with your futures trading. We are also there to keep you updated with the latest on futures trading and market news. All the news and latest articles on futures trading are published on our site under the category Archive Futures Trading News, which you are currently browsing through. Read more and the latest here and keep updated.

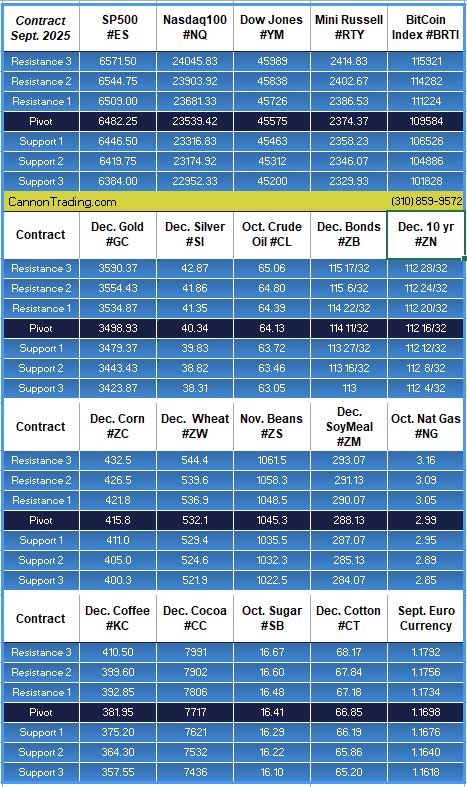

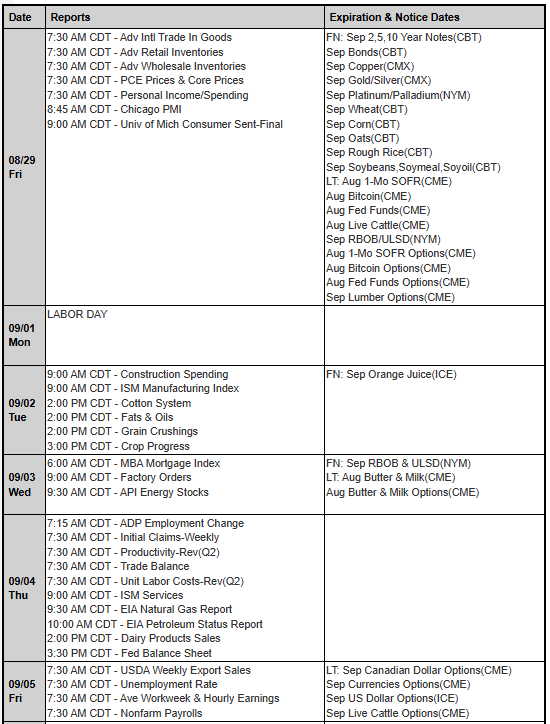

December Gold, September’s First Notice/Last Trading Day, Levels, Reports; Your 4 Important Need-To-Knows for Trading Futures on September 3rd, 2025

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

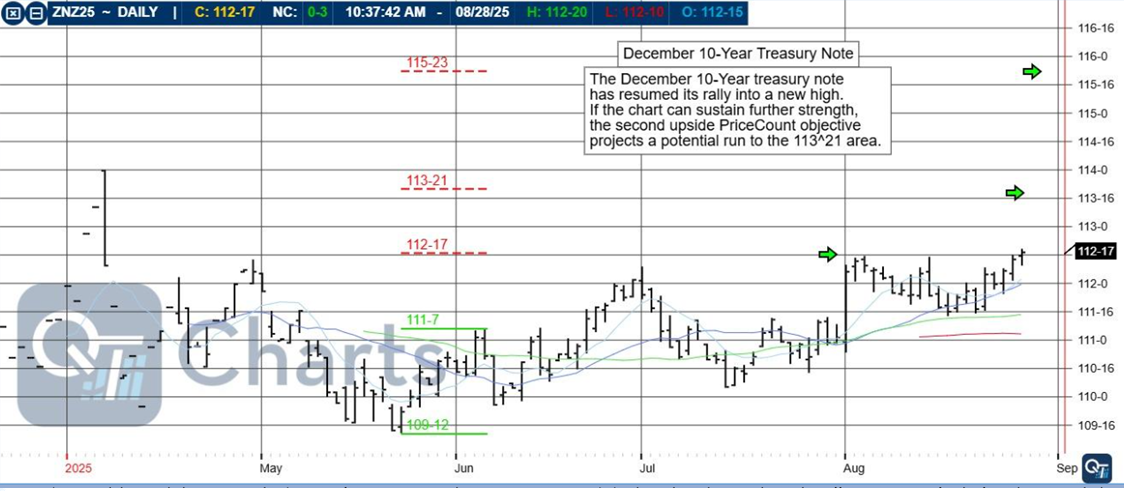

Labor Day Weekend 2025, Non Farm Payroll, December 10 Year Notes, Levels, Reports; Your 4 Important Must-Knows for Trading Futures the Week of September 1st, 2025

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

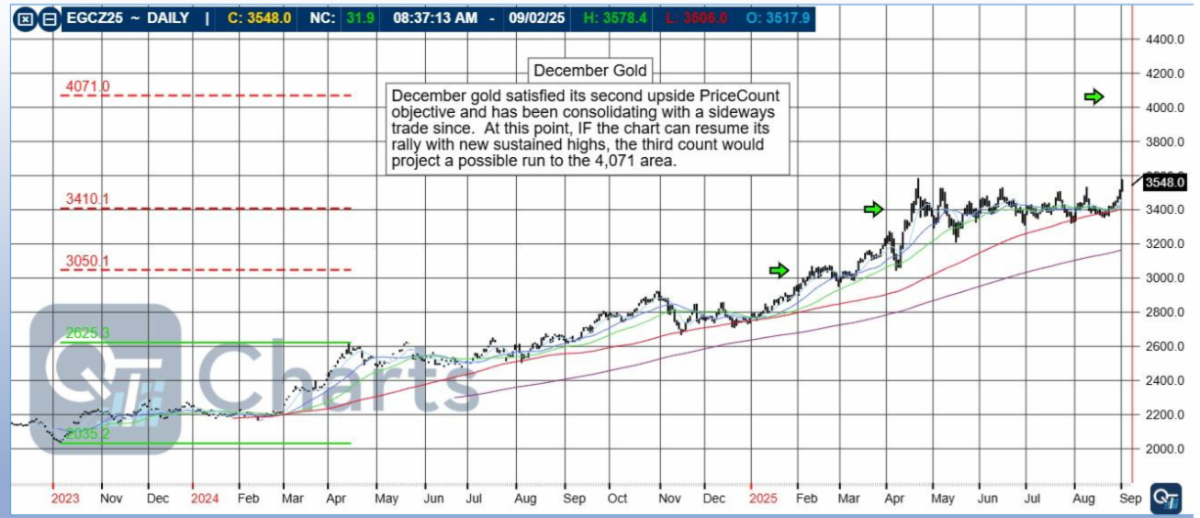

Gold Futures; Your 8 Important Need-To-Knows for Trading Gold Futures

Gold Futures

As the world shifts into the final half of 2025, investors and speculators alike are closely watching the gold futures market. Traditionally viewed as a hedge against inflation, economic instability, and geopolitical turbulence, gold continues to hold its place as a bedrock commodity in the global financial ecosystem. With the second and third trimesters of 2025 already underway, it’s crucial for traders to understand what might shape the gold futures price, what economic and geopolitical trends could drive volatility, and how trusted futures brokers—especially the seasoned professionals at Cannon Trading Company—can support your trading futures strategies.

This comprehensive analysis will provide a 360-degree look at the current and anticipated gold futures market conditions and offer a detailed case for why Cannon Trading Company, with its cannonx powered by cqg platform, reputation among futures brokers USA, and a deep bench of experienced advisors, is a powerful ally for anyone trading gold futures in the remaining months of 2025.

The Gold Futures Market in 2025: Context and Trends

- Economic Drivers of the Gold Futures Price

In 2025, the gold futures price has already shown considerable movement in response to multiple macroeconomic factors. As inflation remains persistent in both developed and emerging economies, central banks—particularly the Federal Reserve and the European Central Bank—are maintaining a cautious approach to rate cuts. This sustained inflationary pressure has continued to support bullish trends in the gold futures market.

Furthermore, global debt levels have hit historic highs. Sovereign debt in the U.S., Japan, and EU nations has led to renewed concern about long-term fiscal sustainability, pushing institutional investors to consider gold futures as a safer store of value. As we move through the last two trimesters of 2025, these factors are expected to remain critical in shaping the gold futures price.

- Geopolitical Uncertainty

With geopolitical hotspots persisting across the globe—from escalations in the Middle East to ongoing tensions in Eastern Europe and the South China Sea—safe-haven demand for gold remains elevated. The market has seen periods of rapid gold futures price spikes following geopolitical flare-ups, reflecting its continued appeal during crises.

Analysts predict that the next six months could feature more of the same: short bursts of volatility driven by global events, keeping the gold futures market lively and unpredictable.

- Central Bank Gold Buying

Central banks, particularly in emerging markets such as China, Russia, and India, have significantly increased their gold reserves in the first trimester of 2025. This trend is expected to continue through the end of the year, potentially tightening supply and providing upward momentum for the gold futures price.

Technical Forecasts: What Traders Can Expect in H2 2025

- Resistance and Support Levels

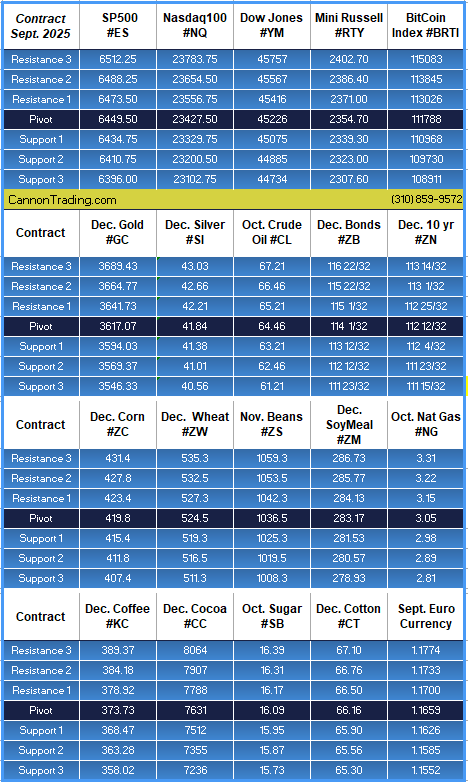

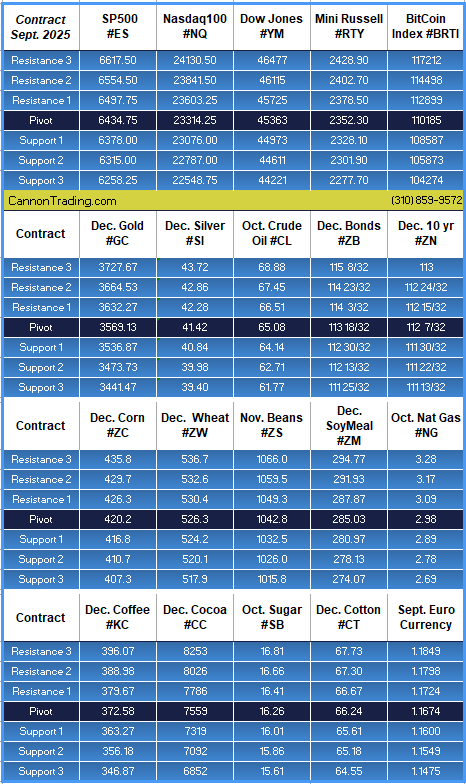

Based on current technical indicators and historical trends, analysts are watching key resistance levels near $3475.00 and $3550.00 per ounce. Strong support zones are holding near $3250.00 and $3300.00. As long as futures brokers see the gold market respecting these technical levels, range-bound trading strategies and momentum breakouts will likely remain viable.

- Market Sentiment Indicators

The Commitment of Traders (COT) report for July 2025 shows a growing net-long position among commercial hedgers, signaling increasing bullish sentiment. Retail traders are advised to pay close attention to these sentiment shifts, particularly as trading futures becomes more algorithmically driven.

- Volatility Expectations

As economic and political uncertainties mount, implied volatility for gold futures options has surged. This signals a potential for larger-than-average price swings, making risk management tools and broker expertise critical. Reliable future brokers can offer the analytics and risk control features necessary to navigate this environment.

Strategic Approaches to Gold Futures Trading in Late 2025

- Short-Term Speculation with High Liquidity Instruments

Instruments like the GC (COMEX Gold Futures) and MGC (Micro Gold Futures) offer high liquidity, making them ideal for intraday traders and swing traders. - Hedging Portfolio Risk

Asset managers and institutional investors often use gold futures to hedge equity exposure. As volatility persists in tech-heavy stock indexes, gold remains a preferred counterweight. - Long-Term Inflation Hedge

Investors betting on continued inflationary pressure may hold longer-dated gold futures contracts or use spreads to capture expected appreciation in gold prices over time. - Algorithmic and Quantitative Trading

With platforms like CannonX powered by CQG, quantitative traders can program and execute highly complex trading futures strategies for gold based on real-time analytics and back-tested models.

Why Cannon Trading Company is a Leading Choice for Gold Futures Traders

When evaluating futures brokers USA or anywhere else globally, several key criteria stand out: experience, platform diversity, regulatory integrity, and customer satisfaction. Cannon Trading Company meets and exceeds these benchmarks, making it a top choice among the best futures brokers for gold futures trading in 2025.

- Decades of Experience

Founded over 35 years ago, Cannon Trading has consistently maintained its position among the most trusted futures brokers in the United States. Their longevity speaks to their adaptability, insight, and client-first philosophy. In a world of ever-evolving market structures, having an experienced futures broker can be a game-changer.

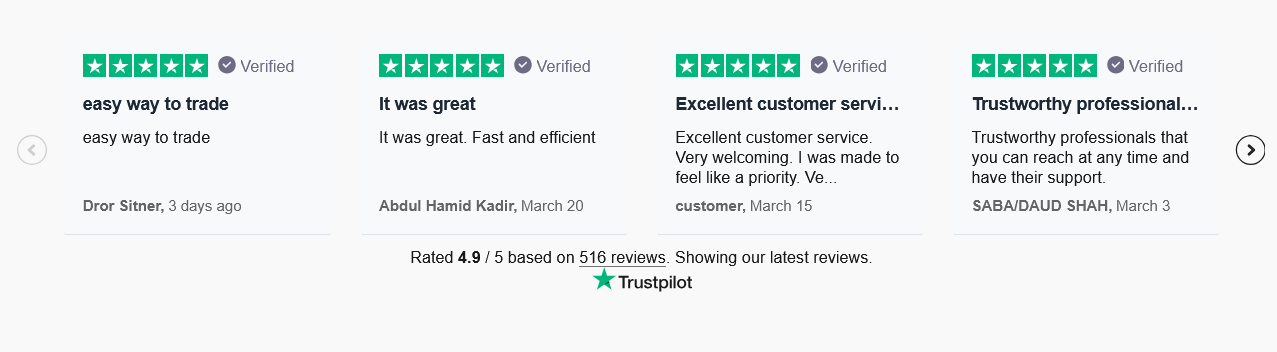

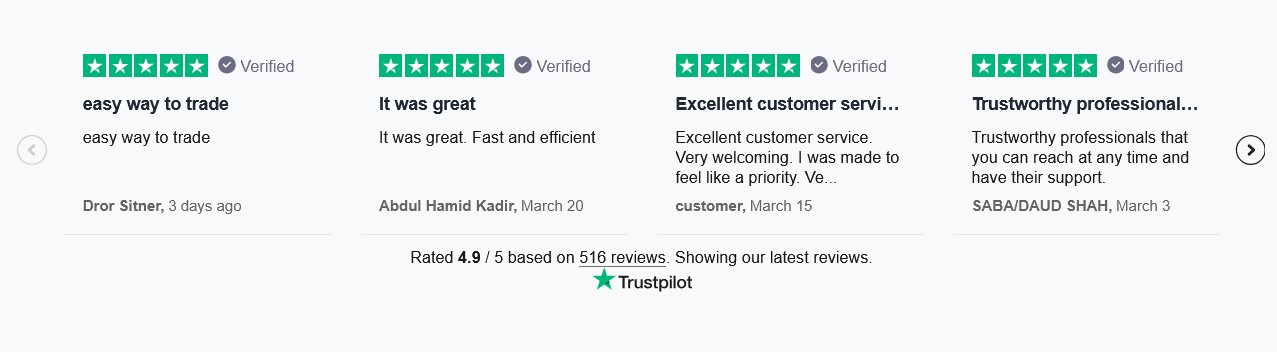

- 5-Star TrustPilot Ratings

Across the board, Cannon Trading boasts an impressive array of five out of five-star reviews on TrustPilot, with clients highlighting their quick response times, deep market knowledge, and outstanding support. This reflects a true commitment to the trader’s experience—an asset that cannot be overstated, especially when managing the complexities of trading futures like gold.

- Regulatory Reputation

Cannon Trading enjoys an exemplary standing with both federal and independent futures industry regulators. As a registered Introducing Broker with the CFTC and a member of the NFA, Cannon ensures that its practices are fully compliant, transparent, and centered on ethical trading. This reputation puts it in a league with only the best futures brokers.

The firm’s proprietary CannonX powered by CQG trading platform combines the power of CQG’s robust charting, execution, and data capabilities with Cannon’s tailored futures brokerage services. This platform is especially powerful for gold futures traders who need advanced tools for technical analysis, one-click execution, and seamless access to market data.

With CannonX, traders can also set up custom alerts, use multiple order types, and integrate their strategies with a wide variety of APIs. It’s built to serve everyone from the retail trader exploring gold futures for the first time to the institutional trader managing large-scale hedging operations.

- Wide Range of Trading Platforms

Beyond CannonX, Cannon Trading offers access to a suite of top-performing platforms including:

This level of platform diversity ensures that clients can tailor their trading futures experience to their exact preferences, strategy needs, and risk tolerance.

Gold Futures: Risk Management and the Broker Advantage

- Managing Leverage Effectively

One of the most critical factors in gold futures trading is leverage. While it allows for significant profit potential, it also increases the risk of outsized losses. Future brokers like Cannon Trading educate clients on proper margin usage, capital allocation, and stop-loss strategies.

- Access to Market Intelligence

Cannon’s clients benefit from daily market commentary, strategy webinars, and bespoke market research. This intelligence provides an edge in an environment where speed and information are critical.

- Personalized Broker Support

Unlike many large firms where traders are little more than account numbers, Cannon offers access to seasoned futures broker specialists who can guide clients through strategy execution, order placement, and risk mitigation. Whether you’re a newcomer or a seasoned professional, personalized support makes a tangible difference.

Gold Futures in H2 2025: Bullish or Bearish?

Based on the confluence of economic indicators, investor sentiment, and central bank behavior, the last two trimesters of 2025 are expected to lean bullish for gold futures. Key themes supporting this outlook include:

- Continued inflationary pressures

- Political instability in several regions

- Slower-than-expected rate cuts

- Aggressive central bank gold purchases

- Elevated market volatility driving demand for safe-haven assets

Still, traders must remain vigilant. The high level of volatility and frequent news-driven price shocks demand tight execution, robust risk management, and a reliable brokerage partner.

Cannon Trading Company—Your Best Ally in Gold Futures Trading

In a market as dynamic and consequential as gold futures, having the right partner is as important as having the right strategy. Cannon Trading Company is not just one of the best futures brokers—they are a full-spectrum solutions provider for those trading gold futures, offering:

- Decades of industry-leading experience

- Best-in-class platforms like CannonX powered by CQG

- Five-star client satisfaction ratings on TrustPilot

- Regulatory excellence

- A handpicked team of experienced futures brokers

- Unparalleled support and strategic insight

Whether you’re hedging, speculating, or diversifying, Cannon Trading Company is uniquely equipped to support your goals in the gold market. If you’re evaluating future brokers as we close out 2025, there’s simply no better choice.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

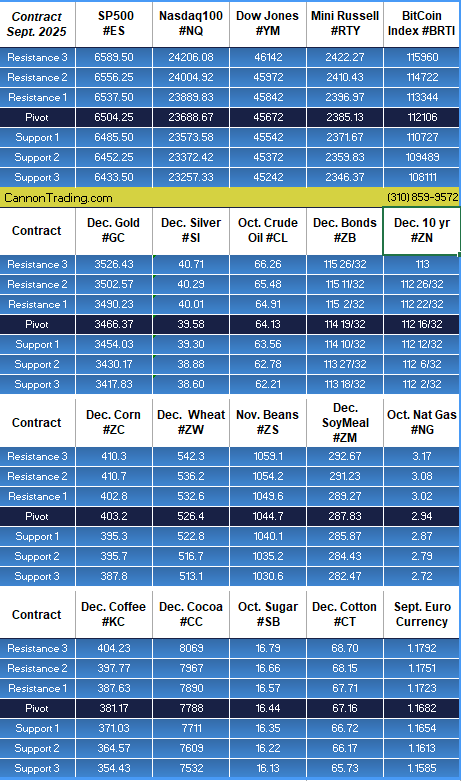

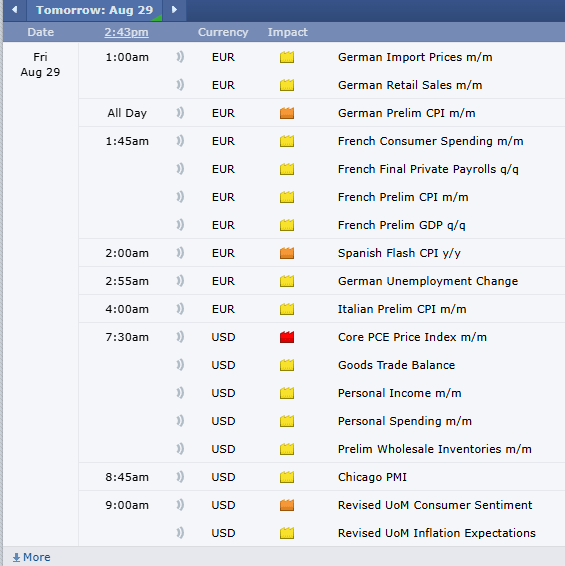

PCE Tomorrow, Labor Day Weekend Trading Hours, Levels, Reports; Your 5 Important Need-To-Knows for Trading Futures on August 29th, 2025

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Silver Futures Contract; Your 6 Important Need-To-Knows for Trading Silver Futures Contracts

Silver Futures Contract

The silver futures contract is a powerful instrument for investors and speculators seeking exposure to the silver market without directly owning the physical metal. As we move into the final two trimesters of 2025, the silver market stands at a critical juncture influenced by macroeconomic shifts, industrial demand, and investor sentiment. In this detailed analysis, we’ll explore the expected trajectory of silver futures prices, key drivers shaping the market, and how reputable firms like Cannon Trading Company provide a robust foundation for trading success.

With decades of experience, 5-star TrustPilot ratings, and a reputation for excellence with both federal and independent regulators, Cannon Trading Company is one of the best futures brokers for navigating the complexities of trading futures—particularly in volatile markets like silver.

The Role and Mechanics of a Silver Futures Contract

A silver futures contract is a legally binding agreement to buy or sell a specific quantity of silver (typically 5,000 troy ounces) at a predetermined price and date in the future. These contracts are traded on commodities exchanges like the CME Group and are used for hedging, speculation, and price discovery.

Key Features

- Standardization: Contracts are standardized, ensuring uniformity in terms of quantity and quality of silver.

- Leverage: Futures trading allows traders to control large amounts of silver with a relatively small amount of capital.

- Liquidity: Silver futures are among the most actively traded contracts, providing high liquidity.

Whether you’re hedging against inflation or speculating on silver futures prices, this instrument offers a level of flexibility and exposure that spot silver simply cannot match.

Macroeconomic Landscape: What Lies Ahead for Silver Futures Contracts in 2025?

As we enter the second half of 2025, several critical factors are shaping the outlook for silver future prices.

- Monetary Policy and Interest Rates

The Federal Reserve’s trajectory in the latter half of 2025 is expected to shift slightly dovish after a series of rate hikes between late 2024 and early 2025. A cooling labor market and slowing inflation have raised the possibility of modest rate cuts. This could benefit precious metals, particularly silver, which tends to thrive in low-interest-rate environments.

Silver futures are inversely correlated with real interest rates. As yields decline, the opportunity cost of holding non-yielding assets like silver diminishes, potentially driving up silver futures prices.

- Geopolitical Uncertainty

Escalating tensions in Eastern Europe and disruptions in global trade routes have increased the appeal of safe-haven assets. Investors traditionally turn to gold, but silver, being both a precious and industrial metal, sees dual inflows from risk-averse and opportunistic investors.

These geopolitical developments could lead to increased volatility in the silver futures contract market, attracting traders looking for profitable price swings.

- Industrial Demand Boom

Silver’s unique properties make it indispensable for several high-growth industries:

- Green Energy: Solar panels use large quantities of silver. With global solar deployment expected to hit record levels in late 2025, demand will rise.

- EV Manufacturing: Electric vehicles utilize silver in batteries, wiring, and semiconductors.

- Electronics: 5G infrastructure and AI server farms require significant silver input.

As industrial usage rises, silver future prices may experience strong upward pressure, especially during Q3 and Q4 when many factories ramp up production ahead of the holiday and fiscal year-end cycles.

Silver Futures Price Forecast for the Final Trimesters of 2025

Q3 2025: Moderate Bullish Outlook

- Expected range: $33.00 – $42.00 per ounce

- Drivers:

- Rate cut expectations from the Federal Reserve

- Strong Q2 earnings in renewable energy and EV sectors

- Ongoing geopolitical instability

Market participants may see silver futures prices move steadily upward in Q3, but not without periods of pullbacks and profit-taking.

Q4 2025: High Volatility with Bullish Tilt

- Expected range: $33.50 – $40.00 per ounce

- Drivers:

- End-of-year fund reallocations

- Strong holiday season demand for electronics

- Potential short-covering rallies

Q4 may witness explosive moves in silver futures, driven by institutional repositioning and tight physical supply constraints. Traders should be prepared for sudden price swings, making risk management crucial.

Why Cannon Trading Company Is a Leading Futures Brokerage for Silver Traders

Navigating the nuanced world of trading futures, especially something as volatile as silver, requires expertise, reliable tools, and exceptional client support. That’s exactly what Cannon Trading Company delivers.

- Decades of Experience

Established in 1988, Cannon Trading Company has weathered every major market storm, from the Dot-Com Bubble to the 2008 financial crisis to the COVID-19 crash. Their longevity is a testament to their deep knowledge of futures trading and their ability to adapt to new challenges.

When dealing with complex instruments like the silver futures contract, experience is everything.

- Exceptional Regulatory Reputation

Cannon Trading maintains an exemplary standing with both federal regulators (such as the CFTC and NFA) and independent industry watchdogs. This ensures clients operate in a secure, compliant, and transparent trading environment.

Among futures brokers USA, very few match the regulatory track record of Cannon Trading Company.

- TrustPilot Reviews: A Testament to Client Satisfaction

Cannon boasts numerous 5 out of 5-star ratings on TrustPilot, an independent consumer review platform. Clients routinely praise their responsiveness, personalized service, and the quality of their trading insights. This makes them a strong contender among the best futures brokers in the world.

“Knowledgeable brokers and amazing service. Always willing to help. Highly recommend!” – Verified TrustPilot Reviewer

- Wide Selection of Top-Tier Trading Platforms

Whether you’re a scalper, swing trader, or long-term investor in silver futures, Cannon Trading provides access to powerful trading platforms:

- CannonX powered by CQG: A premium platform known for lightning-fast execution and detailed market data. Ideal for traders who require precision and speed.

- MultiCharts and RTrader Pro: Advanced platforms offering robust charting and risk management tools.

Having access to multiple platforms allows traders to customize their strategy, which is essential when dealing with unpredictable silver future prices.

CannonX Powered by CQG: The Game-Changer

Among the various platforms offered, CannonX powered by CQG stands out. Built on one of the most reliable infrastructures in the industry, this platform enables:

- Real-time quotes for silver futures contracts

- Depth-of-market views to analyze order flow

- Risk management tools tailored for trading futures

- Mobile and desktop compatibility

For traders focused on silver futures prices, speed, accuracy, and low latency can mean the difference between a gain and a missed opportunity. CannonX delivers all three with finesse.

Futures Brokers vs. Best Futures Brokers: Why Cannon Leads

The difference between ordinary futures brokers and the best futures brokers lies in the details:

| Criteria | Average Brokers | Cannon Trading Company |

| Years in Business | 5–10 | 35+ |

| Platform Variety | 1–2 | 10+ |

| Regulatory Standing | Mixed | Exceptional |

| TrustPilot Ratings | 3.5–4.0 stars | 5 out of 5 stars |

| Client Support Hours | Limited | Extended (phone/email/chat) |

| Educational Resources | Basic | Extensive (blogs, webinars, 1-on-1 coaching) |

Traders seeking the best futures brokers for silver contracts will find that Cannon offers unmatched value in service and tools.

Educational Support: Equipping Traders for Success

Beyond just account management, Cannon Trading believes in empowering its clients. Their suite of educational materials includes:

- Webinars on silver futures contract trading

- Daily market commentaries

- Technical and fundamental analysis

- One-on-one mentorship sessions

This commitment to client growth distinguishes them from many future brokers who focus solely on transactional relationships.

Risk Management Strategies for Silver Futures Contracts

Trading silver futures contracts involves inherent risks due to leverage and market volatility. Here are some essential strategies Cannon brokers recommend:

- Set Stop-Loss Orders

To prevent catastrophic losses during rapid price reversals, use stop-loss levels based on technical indicators or volatility bands.

- Use Hedging Techniques

For portfolio managers, hedging with silver futures can protect against price fluctuations in physical holdings or ETFs.

- Stay Informed

Track economic indicators like interest rates, GDP data, and industrial production. These elements directly impact silver futures prices.

Cannon Trading supports these efforts by offering real-time market updates and personalized trading alerts, making it one of the most responsive futures brokers USA has to offer.

Silver Futures Contracts in the Global Context

It’s essential to remember that silver futures prices are influenced not just by domestic trends but by global events. Key international factors include:

- Chinese industrial output: China is the largest consumer of silver in manufacturing.

- Latin American mining supply: Peru and Mexico supply a significant portion of global silver.

- Currency volatility: A weakening dollar generally supports higher silver future prices.

Cannon Trading provides global insights through its research desk, ensuring clients stay ahead of international trends affecting silver futures.

The silver futures contract continues to be one of the most dynamic and rewarding financial instruments available to modern traders. With the final two trimesters of 2025 promising high volatility and potential bullish momentum, now is a pivotal time to get involved. Whether you’re a seasoned veteran or new to trading futures, choosing the right brokerage partner is crucial.

Cannon Trading Company stands out among futures brokers USA thanks to its:

- Decades of market expertise

- Top-tier platforms like CannonX powered by CQG

- 5-star TrustPilot reputation

- Commitment to education and client success

- Strong standing with federal and independent regulators

When evaluating futures brokers, there’s a clear distinction between average and elite. Cannon belongs in the upper echelon of best futures brokers, delivering consistent value, integrity, and results.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

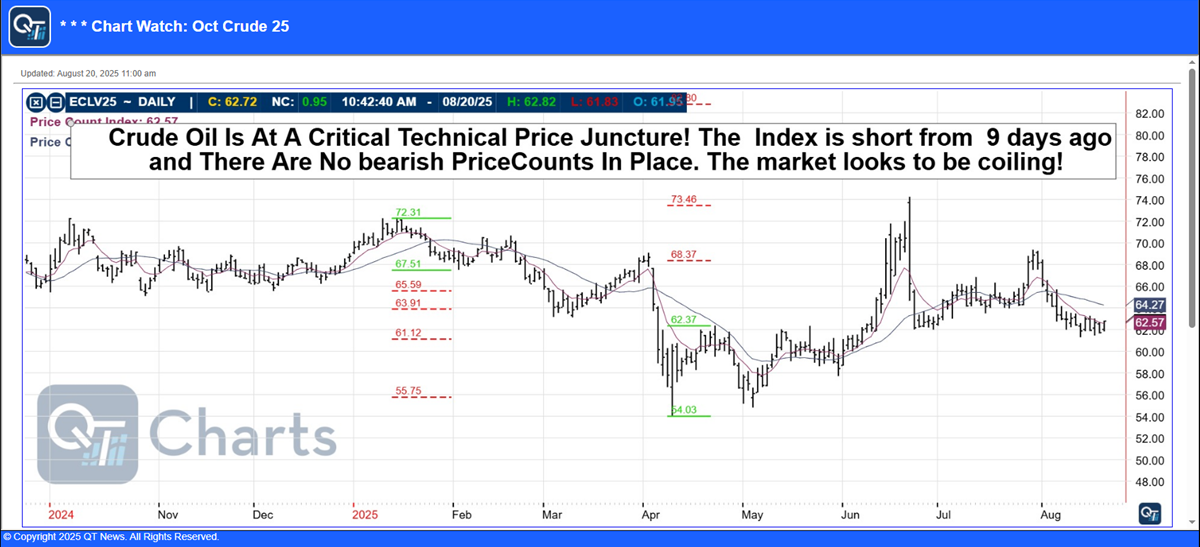

Cattle, Crude Oil, Levels, Reports, Highlights; Your 5 Important Need-To-Knows for Trading Futures on August 28th, 2025

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

Futures on S&P 500; Your 8 Important Need-To-Knows for Trading S&P 500 Futures

Futures on S&P 500

Futures on S&P 500 are among the most actively traded and influential derivatives in the global financial markets. Representing a contract to buy or sell the Standard and Poor’s 500 Index at a predetermined price at a future date, these instruments serve as vital tools for both institutional and retail traders seeking exposure to the broader U.S. equity market. With global attention focused on macroeconomic shifts, interest rate policies, inflationary trends, and geopolitical developments, understanding how the S&P 500 futures contract may perform in the second half of 2025 is critical.

This article takes a deep dive into what traders can expect from futures on S&P 500 during the final two trimesters of 2025, supported by market insights, historical patterns, and economic data. It also explores how Cannon Trading Company stands out as a top-tier partner for navigating this complex landscape, backed by decades of experience, regulatory recognition, and a stellar reputation as one of the best futures brokers in the U.S.

Understanding the Futures on S&P 500 Landscape

Before looking ahead, it is essential to grasp the foundational nature of these contracts. The S and P 500 futures contract is based on the Standard & Poor’s 500 Index, a benchmark representing 500 leading publicly traded companies in the United States. These futures offer traders the ability to speculate on or hedge against broad market moves without directly holding any of the index’s components.

Because of their deep liquidity, transparency, and nearly 24-hour trading cycle, standard and poor’s 500 futures are indispensable for professional traders, portfolio managers, and retail participants alike. They serve as barometers of market sentiment and provide efficient ways to manage risk.

The S&P 500 index futures chart is frequently used by traders to identify key support and resistance levels, determine long-term trends, and develop algorithmic or discretionary trading strategies.

2025 Market Context: The Stage Is Set

The first half of 2025 was marked by moderation in inflation, a potential shift in interest rate policy from the Federal Reserve, and a rebound in tech and energy sectors. Now, as we look into the third and fourth trimesters (Q3 and Q4), several themes are expected to define the market outlook for futures on S&P 500:

- Federal Reserve Policy Shift

The Fed’s likely pivot from a tightening to a more neutral or even accommodative stance will be crucial. If inflation continues to trend lower, a rate cut or a pause may inject optimism into equities. Traders can expect the standard & poor’s 500 index futures to respond favorably in such a scenario, reflecting anticipated corporate growth and lower borrowing costs.

- Corporate Earnings Stabilization

Many companies, particularly in the tech, health, and energy sectors, are projected to report stable or rising earnings in H2 2025. Traders using s and p 500 futures contracts will likely watch quarterly earnings releases closely, as positive surprises could spark strong rallies. Conversely, earnings misses may trigger short-selling opportunities through futures.

- Presidential Election Volatility

With the 2024 U.S. Presidential election concluded and the new administration entering its first full year, policy direction will influence investor sentiment. Markets typically display increased volatility in the year after an election as fiscal policy priorities become clearer. Futures brokers are already preparing for increased volume and volatility as traders leverage standard and poor’s 500 futures to express their macroeconomic outlook.

- Global Market Influences

China’s economic recovery, European Central Bank policy, and ongoing geopolitical tensions will also feed into risk-on/risk-off dynamics. Futures brokers USA are advising clients to watch international developments that could push the s&p 500 index futures chart into breakout or breakdown territory.

Q3 & Q4 2025 Forecast: Key Scenarios

Bullish Scenario

- Fed begins gradual rate cuts in Q3 2025

- Inflation falls to 2% target

- Corporate earnings grow at 8–10% YoY

- Geopolitical tensions ease

Expected Result:

The standard & poor’s 500 index futures may reach record highs, with breakout patterns forming on the S&P 500 index futures chart. Trading futures will be characterized by bullish momentum, with increasing participation from hedge funds and retail investors.

Bearish Scenario

- Inflation remains sticky

- The Fed delays rate cuts

- Global tensions escalate

- U.S. debt ceiling debates cause market dislocation

Expected Result:

Futures on S&P 500 could face sharp pullbacks, and traders may turn to short positions or options strategies. A downtrend in the S&P 500 index futures chart may drive increased volatility and lower liquidity, particularly in overnight trading sessions.

Neutral Scenario

- Economic growth slows but avoids recession

- Fed adopts wait-and-see approach

- Corporate earnings meet expectations

Expected Result:

Markets may trade in a range-bound manner. Futures brokers will focus on technical strategies, exploiting short-term volatility within support/resistance zones on the s and p 500 futures contract.

Cannon Trading Company: A Strategic Partner for S&P 500 Futures Traders

Cannon Trading Company stands out among future brokers by offering comprehensive support and sophisticated tools to help traders succeed with s&p 500 index futures contracts. Here’s how:

- Decades of Experience in the Futures Industry

With over three decades of expertise, Cannon Trading has been a pioneer in helping clients navigate the dynamic world of trading futures. This experience is vital in interpreting macroeconomic shifts and applying them to actionable strategies involving standard and poor’s 500 futures.

Whether you are new to the market or a seasoned professional, working with one of the best futures brokers can dramatically improve your performance by offering insights rooted in market history and institutional-grade analytics.

Cannon Trading Company enjoys numerous 5 out of 5-star ratings on TrustPilot, a testament to their client-first philosophy. Reviews often highlight their personalized service, fast execution, and helpful educational resources—attributes rarely found among typical futures brokers USA.

Traders looking to maximize their edge in futures on s&p 500 trading will find Cannon’s client satisfaction record reassuring.

- Regulatory Reputation and Transparency

Few firms in the futures industry can claim such a pristine reputation with both federal regulators (such as the Commodity Futures Trading Commission) and independent regulatory bodies like the National Futures Association. This level of compliance reinforces trust, especially in an environment where due diligence is paramount for traders using high-leverage instruments like standard & poor’s 500 index futures.

Cannon Trading consistently operates with full transparency, making them a preferred partner among institutional investors and self-directed traders alike.

- Wide Array of Trading Platforms

Cannon offers access to a wide selection of high-performance trading platforms tailored to meet different needs. These include platforms known for advanced charting, low-latency execution, and support for automated strategies.

Platforms with detailed S&P 500 index futures chart functionality help traders execute breakout, scalping, or mean-reversion strategies more effectively. By offering choices like CQG, Rithmic, TradingView, and others such as CannonX powered by CQG, Cannon provides flexibility that only the best futures brokers can match.

- Dedicated Futures Broker Support

Whether you are trading futures intraday, using swing strategies, or deploying long-term hedging techniques, having access to a dedicated futures broker makes all the difference. Cannon’s brokers provide market insights, platform guidance, and risk management consultation—all tailored to your strategy in the s and p 500 futures contract space.

This level of service is what separates average futures brokers from industry leaders.

Why Partnering with the Best Futures Brokers Matters

The S&P 500 market is both an opportunity and a challenge. Rapid movements, macroeconomic sensitivity, and technical complexity mean traders require not just good platforms but seasoned guidance.

Cannon Trading Company consistently ranks among the best futures brokers due to:

- Real-time support from professional futures brokers

- Rich educational resources tailored to s and p 500 futures contract strategies

- Unbiased platform recommendations

- Cutting-edge tools and analytics for evaluating the S&P 500 index futures chart

- Transparent fee structures and competitive commissions

In 2025, with expected volatility in standard & poor’s 500 index futures and increased volume across global exchanges, choosing a trusted partner is non-negotiable. Cannon Trading Company meets this demand better than nearly any other futures brokers USA has to offer.

Practical Tips for Trading Futures on S&P 500 in H2 2025

- Follow the Fed

Monitor every FOMC meeting and speech for forward guidance. Futures contracts will often price in expectations weeks in advance.

- Leverage Technical Patterns

Use the S&P 500 index futures chart to identify breakouts, moving average crossovers, or volume spikes. These signals can form the backbone of an effective strategy.

- Utilize Futures Broker Tools

Work with future brokers who offer options chains, volume profiles, and multi-timeframe indicators for better decision-making.

- Mind the Macroeconomic Calendar

Watch out for NFP reports, CPI releases, and quarterly GDP data. These reports are catalysts for major moves in standard and poor’s 500 futures.

- Deploy Risk Management Systems

Cannon Trading Company offers several tools and broker consultations to help traders manage downside risk—an essential feature when trading leveraged instruments.

The final two trimesters of 2025 present both risks and opportunities for those engaged in trading futures on the S&P 500. With monetary policy, earnings season, and geopolitical uncertainty shaping market sentiment, the ability to adapt quickly is crucial.

Futures brokers play an indispensable role in supporting this adaptability. Cannon Trading Company, with its impeccable ratings, institutional reputation, and diverse platform access, positions itself as one of the best futures brokers for navigating the volatility of standard & poor’s 500 index futures.

Whether you are analyzing a S&P 500 index futures chart for day-trading setups or holding positions based on macro trends, partnering with a high-caliber futures broker like Cannon can be the edge that defines your success.

Ready to start trading futures? Call us at 1(800)454-9572 (US) or (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

NVDIA, December Corn, Levels, Reports – even Kelce/Swift! Your 5 Important News for Trading Futures on August 27th, 2025

|

|

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

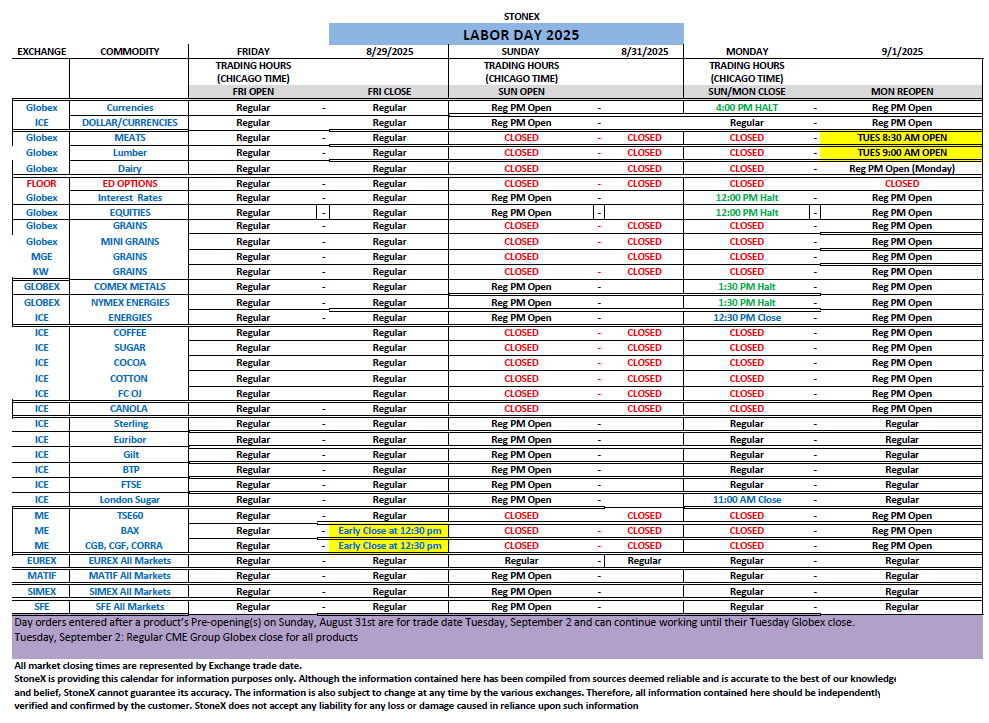

Labor Day 2025; Your Important Trading Calendar for the 3-Day Weekend

Labor Day 2025 FULL SCHEDULE

|

|

|

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010