Read more about Trading S&P 500 Futures with Cannon Trading Company here.

Trading S&P 500 futures with Cannon Trading Company is a straightforward process that involves a few key steps. This guide is a step-by-step breakdown of how to trade S&P 500 futures with Cannon Trading Company. By following these instructions, you will be able to start your S&P 500 futures trading journey. Let’s get started!

Step 1: Open an Account The first step is to open an account with Cannon Trading Company. Visit their website and navigate to the account opening section. Fill out the required information, including personal details, contact information, and any other requested documents. Once you have completed the application, submit it for review.

Step 2: Fund Your Account After your account is approved, you will need to fund it. Cannon Trading Company provides various funding options, such as wire transfers, electronic funds transfers, and check deposits. Choose the method that works best for you and transfer the desired amount to your trading account. Ensure that you comply with any minimum funding requirements specified by Cannon Trading Company.

Step 3: Choose a Trading Platform Cannon Trading Company offers advanced trading platforms to facilitate your S&P 500 futures trading. Explore the available platforms and choose the one that suits your preferences and trading needs. The platforms may include features such as real-time market data, customizable charts, technical analysis tools, and order types. Download and install the selected trading platform onto your computer or access the web-based platform if available.

Step 4: Familiarize Yourself with the Platform Before you start trading, take some time to familiarize yourself with the trading platform. Explore the different features and tools it offers. Learn how to navigate through the platform, access market data, analyze charts, and execute trades. Cannon Trading Company may provide tutorials, user guides, or webinars to assist you in understanding the platform’s functionality. Take advantage of these educational resources to gain confidence in using the trading platform.

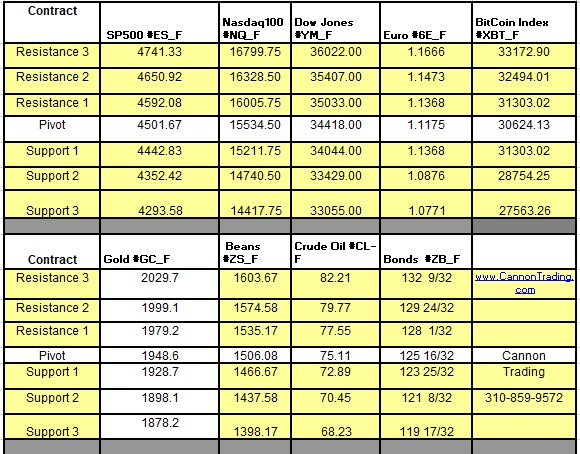

Step 5: Conduct Market Analysis Performing market analysis is essential to make informed trading decisions. Analyze the S&P 500 futures market using both fundamental and technical analysis. Fundamental analysis involves assessing economic indicators, corporate earnings reports, and news events that may impact the S&P 500 index. Technical analysis, on the other hand, focuses on analyzing price patterns, trends, and indicators to predict future price movements. Utilize the tools and resources provided by Cannon Trading Company, such as market reports and analysis, to enhance your understanding of the market.

Step 6: Develop a Trading Strategy Based on your market analysis, develop a trading strategy for S&P 500 futures. Determine your trading objectives, risk tolerance, and preferred trading style. Decide on the types of trades you will make, such as day trading, swing trading, or position trading. Define your entry and exit criteria, as well as your risk management rules. A well-defined trading strategy will help you make consistent and disciplined trading decisions.

Step 7: Place a Trade Once you have identified a trading opportunity based on your strategy, it’s time to place a trade. Open the trading platform provided by Cannon Trading Company and log in to your account. Select the S&P 500 futures contract you wish to trade. Specify the quantity (number of contracts) and the order type (market order, limit order, or stop order) based on your trading strategy. Double-check the details of your trade, including the contract specifications and order parameters, before submitting the trade.

Step 8: Monitor and Manage Your Trade After executing your trade, it is important to monitor it closely. Keep an eye on price movements, market conditions, and any news or events that may impact the S&P 500 futures market. Depending on your trading strategy, you may have predefined exit points or profit targets. If the market reaches your predetermined exit point or target, consider closing the trade. Alternatively, you may choose to adjust your stop-loss orders or take partial profits as the trade progresses.

Step 9: Review and Analyze Your Trades Regularly review and analyze your trading performance. Assess the outcomes of your trades, identify strengths and weaknesses in your strategy, and make any necessary adjustments. Learn from both successful and unsuccessful trades to improve your trading skills over time. Cannon Trading Company may provide trade history reports and performance analysis tools to assist you in evaluating your trades.

Step 10: Continuous Learning and Improvement Trading S&P 500 futures is an ongoing learning process. Stay updated with market news, economic releases, and changes in market conditions. Continuously educate yourself through books, articles, webinars, and other educational resources. Engage with the trading community to share insights and learn from experienced traders. Strive for continuous improvement in your trading skills and adapt to the ever-changing dynamics of the S&P 500 futures market.

Trading S&P 500 futures with Cannon Trading Company can be a rewarding endeavor if you approach it with the right mindset, knowledge, and discipline. By following these step-by-step instructions and incorporating sound trading principles, you will be on your way to becoming a successful S&P 500 futures trader. Remember to always trade responsibly and manage your risk effectively.

Ready to start trading futures? Call 1(800)454-9572 and speak to one of our experienced, Series-3 licensed futures brokers and start your futures trading journey with Cannon Trading Company today.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.