Coffee Anyone? Gold? Copper?

|

|

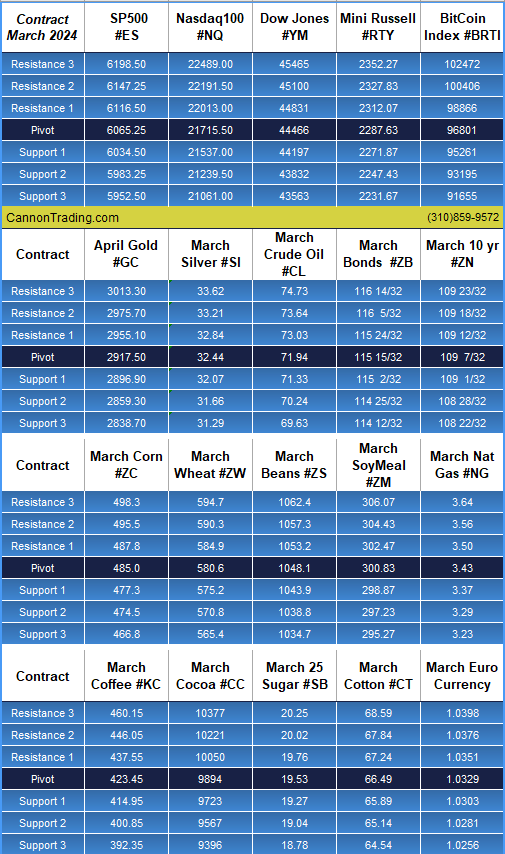

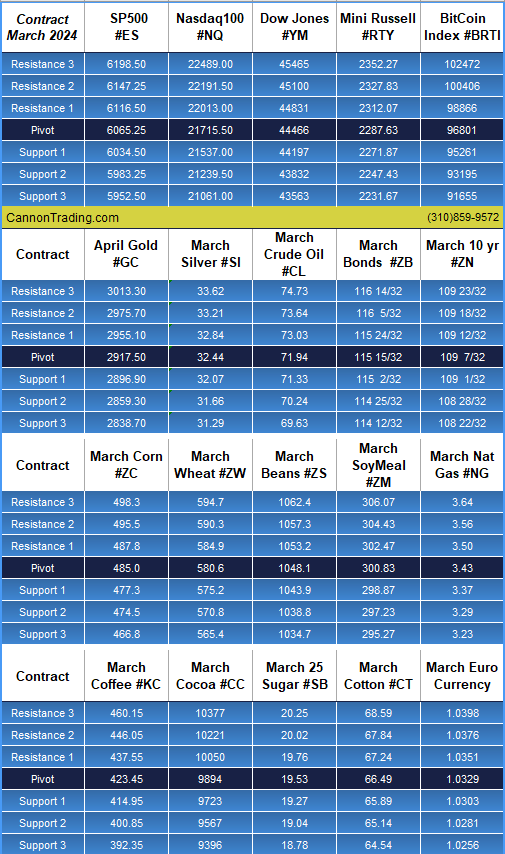

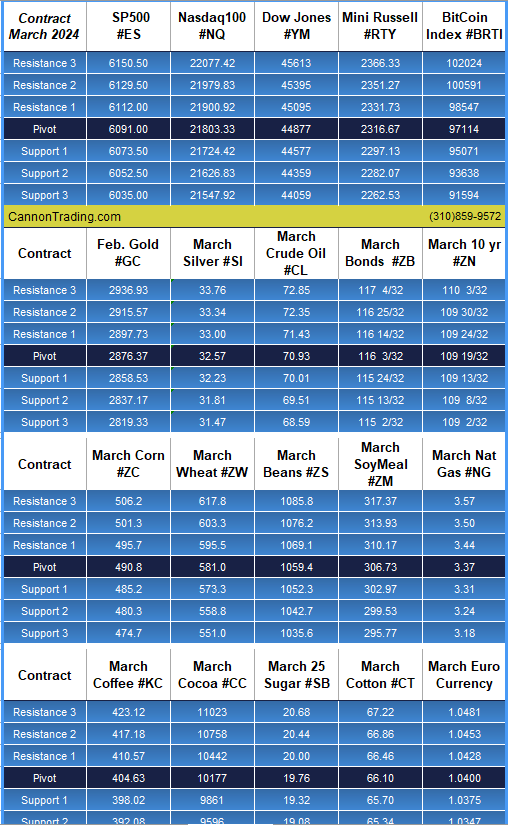

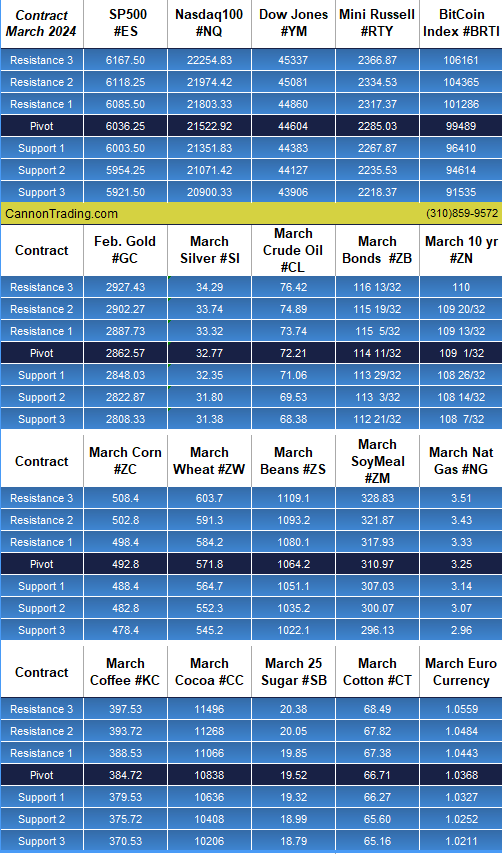

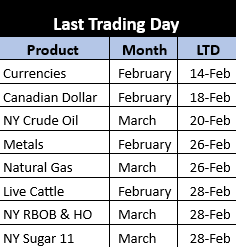

Daily Levels for February 11th, 2025

Economic Reports

provided by: ForexFactory.com

All times are Eastern Time ( New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

The futures market comprises mainly of two players, namely, the hedgers and the speculators. While the former use futures as a safety or protection blanket, the latter is a group of traders who handle the trading accounts of those investing in the futures.

Futures trading can be arisky business that can require guidance and consultancy. Whether you are an individual or a firm, you need to be well-versed with the rules of the game. Futures brokers are always there to help you with advice and help you in matters related to futures trading. A rule of futures trading is that one canonly use those funds that have been termed as risk capital.

We at Cannon Trading help your understanding of the big and small things about futures brokers and trading. Apart from that, we also aid you in making the most out of the market; and, no matter how volatile and risky it is we offer the best advice we possibly can on trading. Under this category of futures broker, we write about the latest and informative articles that you should read to get equipped on the recent events in the futures markets.

|

|

provided by: ForexFactory.com

All times are Eastern Time ( New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

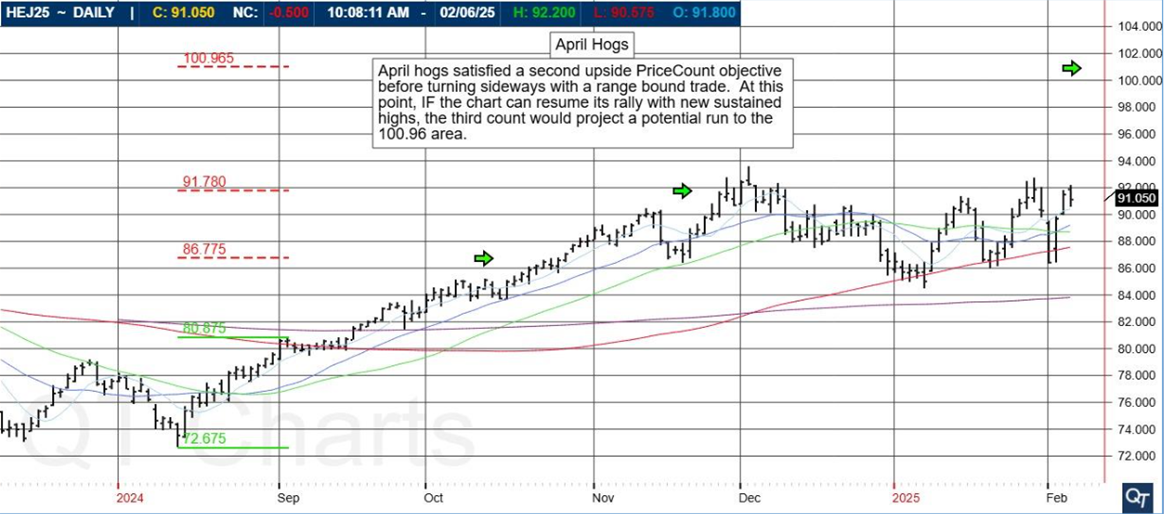

April Hogs satisfied a second upside PriceCount objective before turning sideways with a range bound trade. At this point, IF the chart can resume its rally with new sustained highs, the third count would project a potential run to the 100.96 area. |

provided by: ForexFactory.com

All times are Eastern Time ( New York)

|

||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||

|

|

|

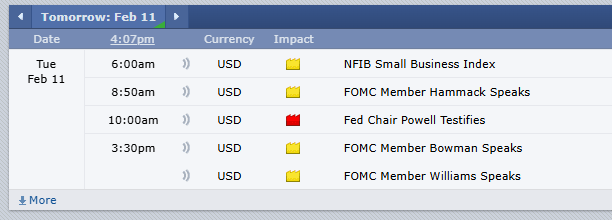

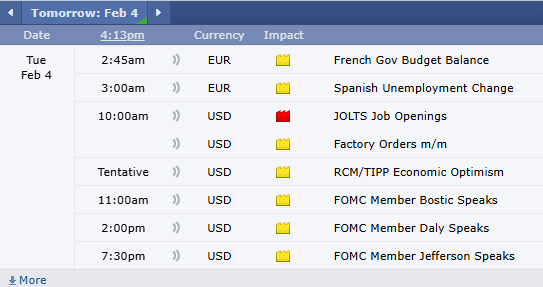

Economic Reports

provided by: ForexFactory.com

All times are Eastern Time ( New York)

|

|

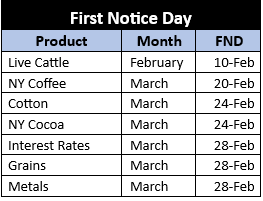

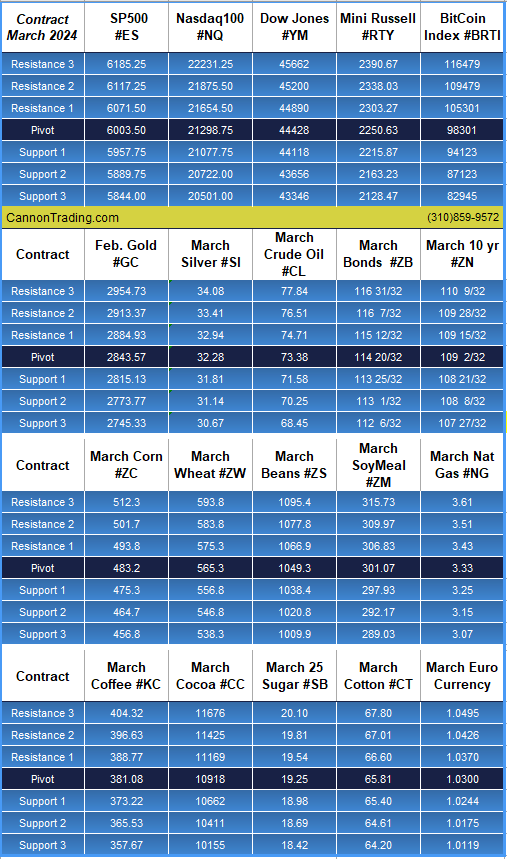

Please see below First Notice and Last Commodity Trading days for February! Make it a disciplined trading month.

Economic Reports

provided by: ForexFactory.com

All times are Eastern Time ( New York)

|

|

Gold has long been one of the most sought-after commodities, and its value as a trading instrument remains undisputed. Gold futures contracts, introduced as a way for traders to speculate on and hedge against price fluctuations, are pivotal in today’s financial markets. In this comprehensive exploration, we delve into the origins of gold futures contracts, key players behind their establishment, and their role in modern trading. Additionally, we examine potential price movements for natural gas futures in 2025 and assess why Cannon Trading Company is a leading choice for futures traders of all levels.

Gold trading has a history stretching back millennia, but the formalized trading of gold futures contracts began relatively recently. The Chicago Board of Trade (CBOT), established in 1848, is credited as a pioneer in the creation of futures contracts. Initially focused on agricultural products like wheat and corn, the CBOT laid the foundation for futures trading. The gold futures contract was introduced by the Commodity Exchange, Inc. (COMEX) in 1974. This move came in the wake of significant changes in the global gold market, including the U.S. abandoning the gold standard in 1971, allowing gold prices to float freely.

The introduction of gold futures allowed miners, jewelers, and speculators to protect themselves against price swings, leading to increased liquidity and price discovery in the gold market.

The price of gold futures is influenced by a combination of macroeconomic factors, geopolitical events, and supply-demand dynamics. Inflation expectations, interest rates, and currency movements—particularly the U.S. dollar—play critical roles in determining price trends.

Natural gas futures contracts are another critical component of the commodities market. As we move into 2025, traders are closely monitoring trends that could influence natural gas prices. Factors like global energy demand, geopolitical tensions, and weather patterns will play crucial roles.

A futures trader in January 2025 anticipates a harsh winter due to meteorological predictions. They buy natural gas futures at $4.50 per million British thermal units (MMBtu). As demand surges and prices reach $6.00 per MMBtu by February, the trader closes their position for a significant profit.

As of early 2025, the price of gold futures is hovering around $2,100 per ounce. This level reflects ongoing geopolitical uncertainties, concerns about inflation, and central bank actions. The Federal Reserve’s monetary policies, particularly its stance on interest rates, are likely to influence gold prices throughout the year. Traders should closely monitor economic data releases and geopolitical developments to adjust their strategies accordingly.

Cannon Trading Company has cemented its reputation as a premier choice for futures traders. Here’s why:

Mark, a mid-career investor, transitioned to futures trading in 2020. After struggling with platform inefficiencies at another brokerage, he switched to Cannon Trading. The firm’s support team guided him in setting up his first gold futures trade. Over two years, Mark’s portfolio grew by 35%, thanks to robust analytics tools and timely market insights provided by Cannon Trading.

Sarah, new to futures trading, joins Cannon Trading in 2025. She starts with a demo account on the TradingView platform, using educational resources to understand the dynamics of gold and natural gas futures. With personalized guidance from a Cannon Trading broker, Sarah transitions to live trading, steadily building her confidence and portfolio.

Gold futures contracts remain a cornerstone of the commodities market, offering traders unparalleled opportunities to hedge and speculate. The introduction of these contracts was a milestone, driven by visionaries who recognized the need for a structured market. In 2025, the outlook for gold futures prices is shaped by macroeconomic and geopolitical factors, while natural gas futures present unique opportunities for weather-driven trades.

For traders at all experience levels, Cannon Trading Company provides an ideal platform for futures contract trading. Its combination of cutting-edge tools, stellar reputation, and commitment to client success ensures a seamless trading experience. Whether you’re a seasoned futures trader or just starting, Cannon Trading offers the resources and support you need to thrive in the dynamic world of futures trading.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

|

|

|

|

|

|

|

|

|

|

|

Natural Gas (NG) futures have long captured the imagination of traders and investors worldwide, providing a unique blend of opportunity and volatility. Over the decades, natural gas evolved from a standard utility resource to a speculative commodity that drives significant activity in the futures markets. Understanding how this transition occurred, the factors influencing price movements, and the key figures involved in the rise of NG futures sheds light on their current prominence. Additionally, examining why Cannon Trading Company is a premier choice for trading futures contracts solidifies the importance of aligning with experienced brokers in navigating this dynamic market.

Natural gas, historically, was viewed as a straightforward energy resource—a reliable, abundant fuel for heating, electricity, and industrial uses. However, the deregulation of the energy markets in the late 20th century set the stage for its transformation into a speculative commodity. Before deregulation, natural gas prices were tightly controlled by government policies, ensuring stability but limiting market-driven price discovery. The Natural Gas Policy Act of 1978, followed by the full deregulation of wellhead prices in 1989, opened the floodgates for free-market dynamics.

As a result, natural gas began trading on commodity exchanges. The New York Mercantile Exchange (NYMEX) played a pivotal role, launching its first NG futures contracts in 1990. These contracts offered a standardized way to hedge and speculate on natural gas prices, providing transparency and liquidity to the market. Futures traders were drawn to the market’s volatility, driven by weather patterns, geopolitical events, and supply-demand dynamics.

These key players, alongside innovative traders and market makers, helped shape natural gas into the speculative powerhouse it is today.

Natural gas prices are notoriously volatile due to their sensitivity to supply-demand imbalances, weather conditions, and geopolitical developments. Traders in 2025 can expect this volatility to persist, driven by several key factors:

A futures trader anticipating a colder-than-usual winter might buy NG futures contracts in late summer when prices are typically lower. If severe weather materializes, driving up demand, the trader could sell the contracts at a premium. Conversely, if the forecast proves inaccurate, the trader could face losses. This scenario underscores the importance of market research and risk management.

In another scenario, a futures trader could analyze global LNG shipping trends and identify potential supply chain disruptions. By purchasing NG futures in anticipation of these disruptions, the trader positions themselves to capitalize on the resulting price increases.

One of the most notable cases in natural gas trading involves hedge fund Amaranth Advisors, which lost $6.6 billion in 2006 due to poorly managed NG futures bets. The firm’s trader, Brian Hunter, had taken large positions expecting a rise in natural gas prices that did not materialize. This cautionary tale emphasizes the inherent risks in futures trading and the need for disciplined strategies.

In contrast, savvy traders like John Arnold, a former Enron trader and founder of Centaurus Advisors, have successfully navigated the natural gas markets. Arnold’s ability to anticipate market trends and manage risk made him a legend in the energy trading world.

Another compelling example is the 2021 winter storm in Texas, which disrupted natural gas supply chains. Traders who had hedged their positions effectively managed to profit from the unforeseen supply shortages. This highlights the value of using NG futures to mitigate risk and capitalize on market opportunities.

For traders seeking to navigate the complexities of NG futures, partnering with a reputable broker is paramount. Cannon Trading Company stands out as a top choice for several reasons:

Natural gas futures have evolved into a vital component of the global energy markets, offering opportunities for hedging and speculation. The market’s journey from a regulated utility resource to a speculative commodity underscores the transformative power of deregulation and innovation. Traders entering the NG futures market in 2025 can expect continued volatility influenced by weather, global LNG trends, regulatory developments, and technological advancements.

For those looking to trade NG futures, Cannon Trading Company provides the tools, expertise, and trustworthiness needed to succeed. With its wide selection of trading platforms, decades of experience, and impeccable reputation, Cannon Trading is an ideal partner for navigating the dynamic world of futures trading.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572(International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

|

|

|

|