Will AI be a gold mine or a money pit?

21 October 2024

By GalTrades.com

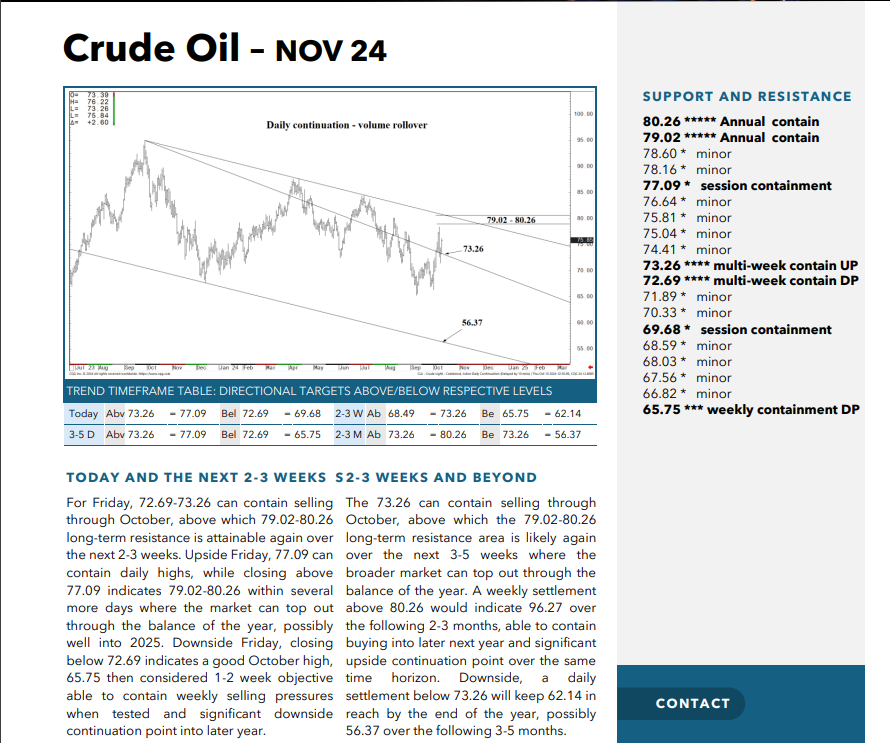

Oil went below $70 concern of commodity inflation receded somewhat

Markets are a little stretched on the upside SPX up for 6 weeks, investor sentiment is in favor of the bulls. Small caps appear to be playing catch-up Russell closed at a two-year high Wednesday, which may help sustain the recent uptrend. Next week the economic calendar is light so the focus will be on Q3 earnings, which have been strong so far. The path of least resistance still seems to be trending higher. If the benign earnings momentum doesn’t continue throughout next week perhaps this could provide enough of an excuse for investors to take profits, resulting in a modest pullback in stocks.

What happens with the FED what’s the next move? As long as data continues to validate the soft/no-landing thesis it seems that the bias will continue to remain higher.

Deutsche bank posted that 5-year inflation swaps spiked to the highest level since March 2023. Can we see another spike in inflation that can affect the fed’s next move?

At some point the huge debt levels that we’re running suppress growth and increase interest rates and that leads to higher inflation. The market is pricing in 6 rate cuts of 150 basis points and full-on expectations of $275 of earnings. What if any of the Mag 7 miss earnings? Last quarter they all delivered good earnings and were sold off, we saw profit taking. ASML missed and semies went down this past week. Then we saw positive earnings from Taiwan Semiconductor Manufacturing (TSM), the largest chipmaker in the world. TSM reported a 54% climb in annual profit, better than analysts had expected, driven by accelerating AI demand. I understood it as AI semies demand is there.

Piper Sandler said, “the S&P is overvalued by 8% but so what”.

Stifel said this week “we’re goanna go up another 8 to 10% and then we’re goanna crash 25% sometime next year”.

Bottom line anything is plausible but what’s actionable is now.

Nuclear energy: Mega companies are investing in energy to power their AI infrastructure. AMZN announced it has signed an agreement with Dominion Energy, Virginia’s utility company, to invest more than $500 million to develop small modular reactors. Stocks in nuclear energy space – CEG, VST, D, TLN, LEU, BWXT, OKLO, SMR.

We received solid earnings from Goldman Sachs (GS), Bank of America (BAC), and Citigroup (C). Another newsmaker was UnitedHealth (UNH), which saw shares drop sharply after the company shaved the top end of its guidance amid rising costs. It was the first outlook miss in years for the giant health company.

Treasury yields fell as inflation concerns eased amid sliding crude oil prices on media reports that Israel doesn’t plan to target Iran’s oil sector. Odds of a 25-basis-point Federal Reserve rate cut next month climbed in futures trading Tuesday.

The Russell 2000® Index (RUT) pushed above technical resistance intraday at the July peak near 2,260, though it settled below that. Strength there likely reflects the slight dip in Treasury yields that also lent support to “defensive” and yield-sensitive sectors including real estate, utilities, and consumer staples. The financial sector strength related to strong bank earnings also helps the RUT, which is heavily weighted toward that sector.

Walgreens Boots Alliance jumped more than 15% after the company said it will shut 1,200 stores over the next three years. The company’s earnings beat Wall Street’s estimates. Shares were down about 70% year to date.

Data-wise, October New York Fed Empire State Manufacturing, which provides insight into New York’s manufacturing climate, was much worse than expected at –11.9, with anything under zero indicating contraction. Analysts had expected a reading of 3.6, down from 11.5 a month ago. On a positive note, the report’s six-month outlook rose to its highest in three years, and employment numbers looked strong.

On Thursday we had retail sales. They climbed 0.4%, compared with the 0.2% consensus and 0.1% in August. Excluding autos, one very strong category in retail sales was restaurants and bars, which saw a 1.05% monthly increase.

Retail sales figures indicate consumers are still doing well and spending, which means gross domestic product growth is likely to be in the 3% plus region again.

Ongoing softness in manufacturing and falling commodity prices—reducing inflation expectations, Lower crude prices can help company margins across many industries and keep a lid on inflation.

Before retail sales, the thinking was that the Fed would cut rates 25 basis points in November but consider pausing in December if data remained strong. It’s unclear if a massive jobs report, a warm Consumer Price Index(CPI) and now a very hot retail sales report, would be enough for the Fed to think about a pause at either of its remaining meetings this year. Markets have lowered expectations about the number and size of rate cuts in 2024 due to the strength in the economic data.

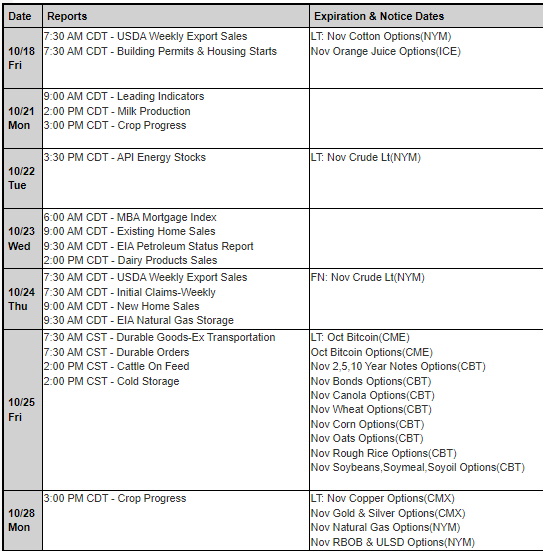

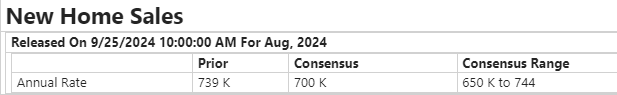

It will be a pretty light week of economic data. However, there are two major updates on the state of the housing market, with September’s existing home sales out on Wednesday and September’s new home sales out on Thursday. Housing is a key watch item for investors and the Federal Reserve because it represents a large, unavoidable cost for most Americans, and it’s proven to be a sticky source of inflation. Last week, September housing starts were slightly better than expected, though they were down month over month. We’re unlikely to see a sustained material improvement in the housing market until bond yields come down, which will help pull mortgage rates lower and, in turn, make monthly payments more affordable.

Bonds:

Expect the sideways churning in the bond market to continue until there is a catalyst for the next move. Credit spreads will likely remain tight. The U.S. dollar, having rebounded again from the low end of its two-year trading range, looks like it has some room to move higher as weakness in global growth relative to the United States keeps it firm.

Currently, Bloomberg probabilities suggest a 92% chance of a 25-basis point cut at the November FOMC versus 89% last Friday. Through 2025, the probabilities are suggesting 150 basis points of cuts, which is consistent with the September dot plots from the Fed.

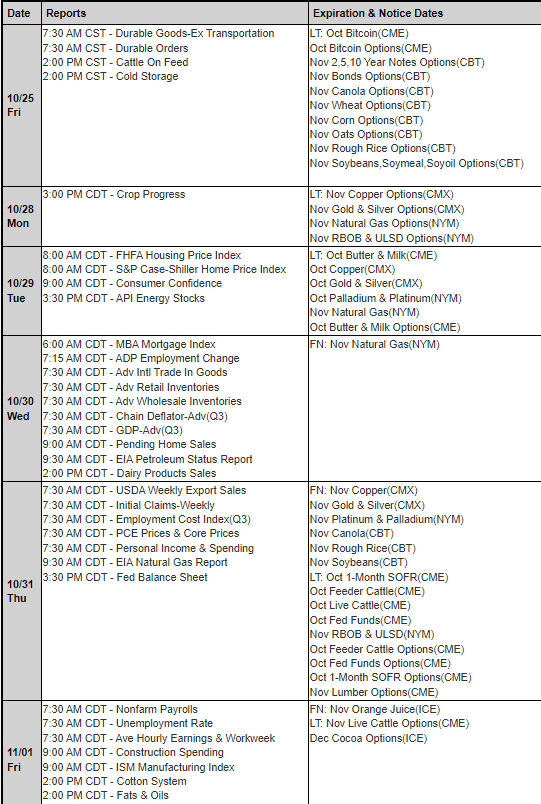

Before the next Federal Reserve meeting November 6–7, key data include September’s Personal Consumption Expenditures (PCE) price index on October 31 and October nonfarm payrolls on November 1.

The European Central Bank (ECB) cut rates 25 basis points for the third time this year.

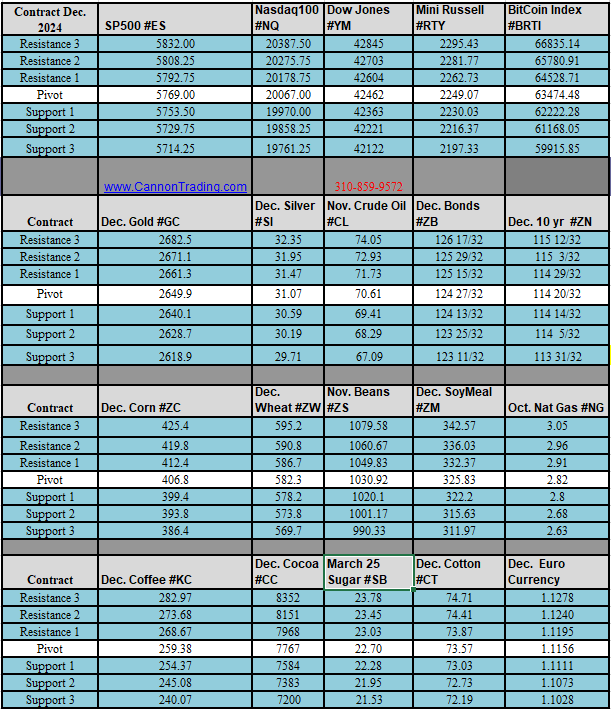

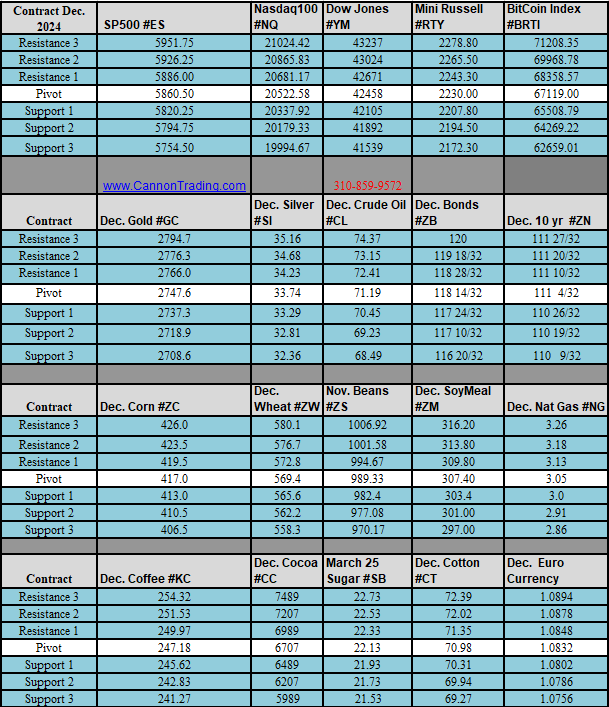

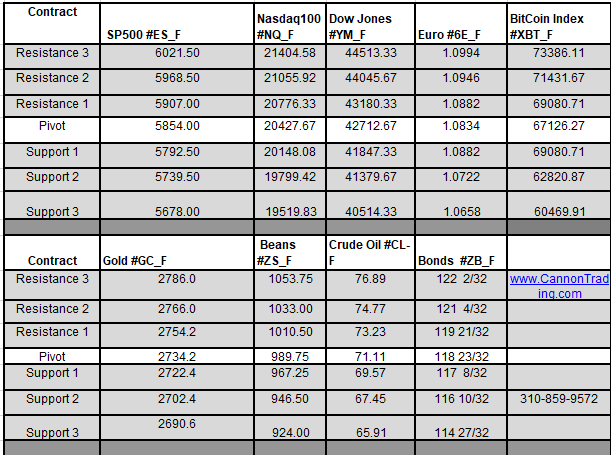

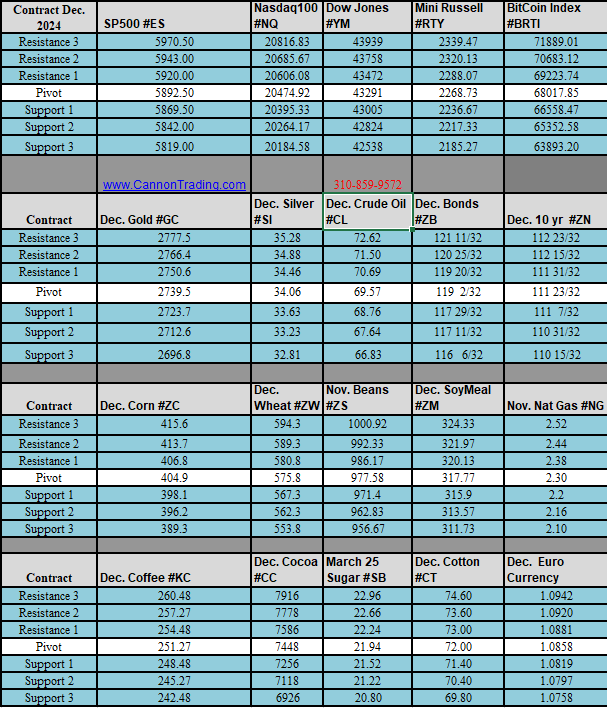

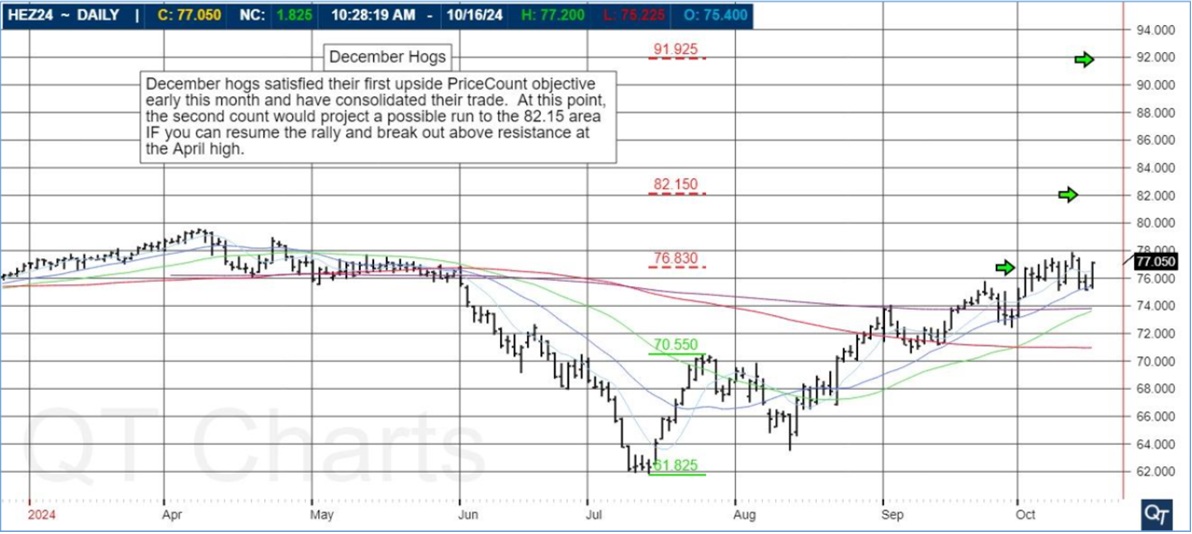

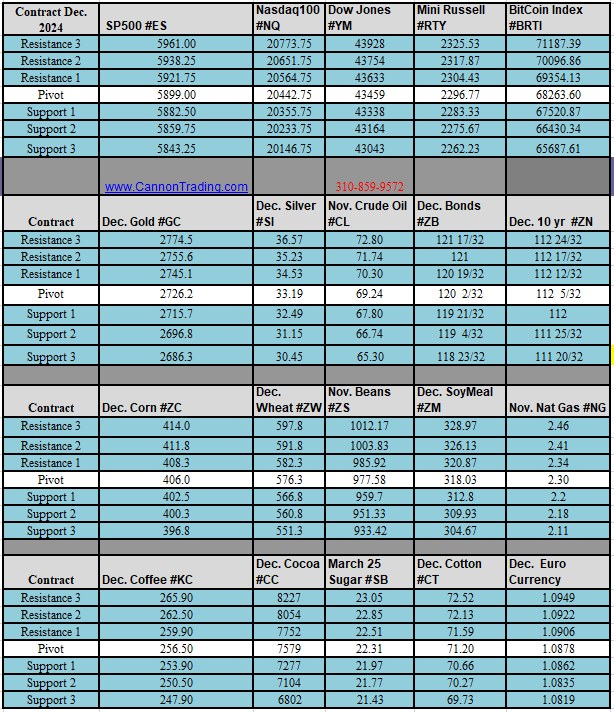

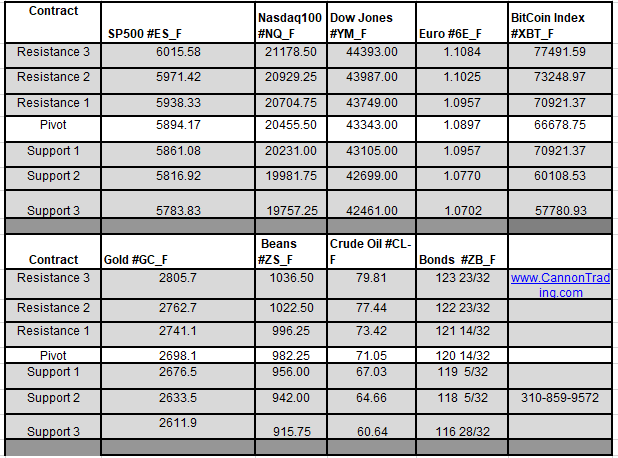

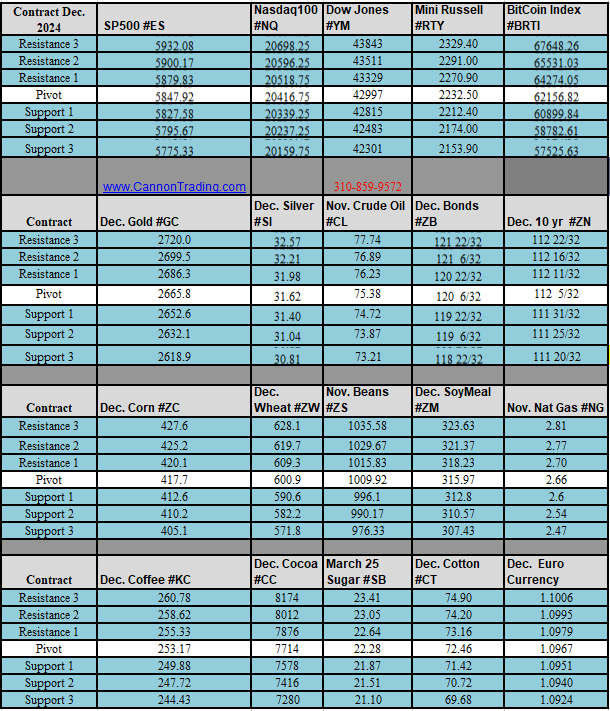

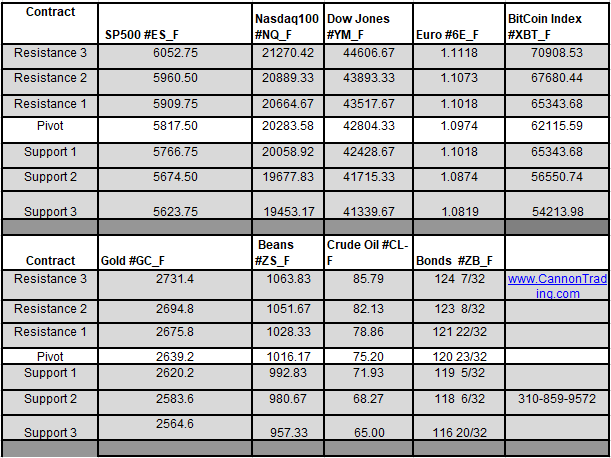

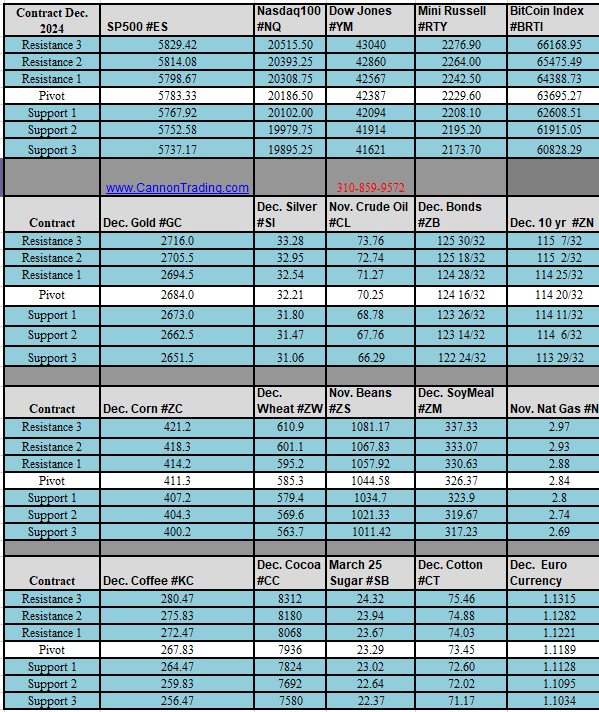

Futures:

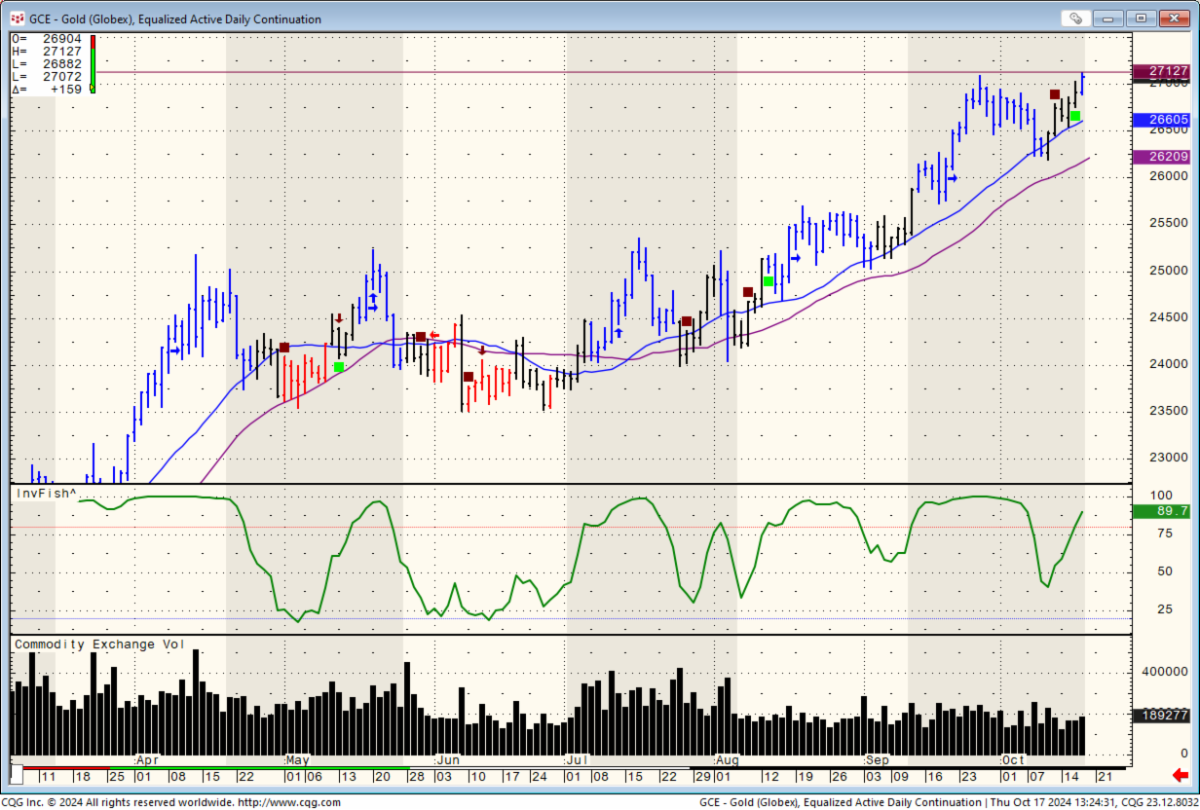

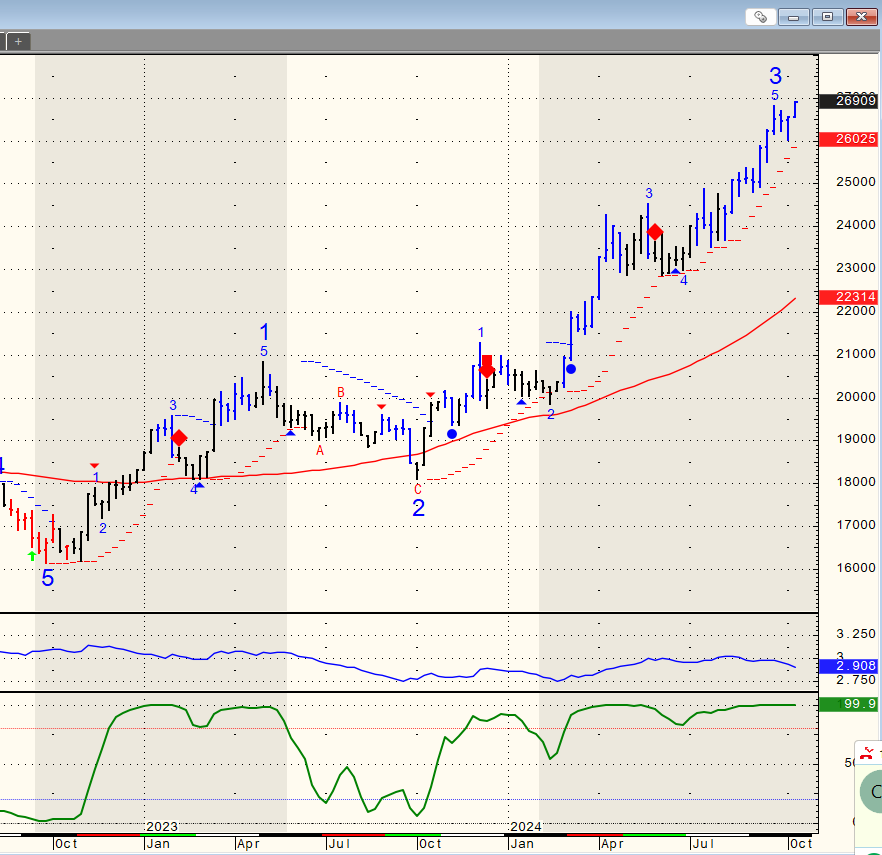

#SLV highest since November 2012. #GLD continues its record run.

As of Tuesday, looking at the daily chart for the Gold Futures December 2024 (/GCZ24) contract we can see significant buying pressure as the contract climbed to new all-time highs. The contract has consistently traded off the 20-Day Simple Moving Average which was tested yesterday on below average volume. /GCZ24 is currently trading well above the 50-Day and 200-Day SMA price points.

According to the CFTC Commitment of Traders report released October 8th managed money traders have decreased their long position by -20,271 contracts and increased their short position by +132 contracts. Managed money traders are net long 194,059 contracts. The 14-Day Relative Strength Index at 59.17% indicates more buyers than sellers.

Chinese stocks are under pressure lately, with declines this month eroding gains from the massive rally sparked by China’s stimulus announcement in September.

Investors appear to have lost faith that the government’s stimulus will be the answer to that economy’s problems,” Yardeni Research said in its Wednesday briefing note. “The quick knee-jerk rally in Chinese equities already looks like it’s getting a leg cramp.”

China’s third-quarter GDP rose 4.6% on an annual basis between July and September, inching just above the Reuters consensus view of 4.5%. Retail sales also climbed more than analyst had expected. Chinese stocks popped more than 3.5% Friday on stimulus hopes despite GDP falling sequentially from 4.7% in the second quarter.

European and Asian stocks mostly climbed this week, and Japan saw inflation dip, which could ease concerns about another rate hike there.

Conclusion from this week:

The decline in oil and solid retail sales this past week point to an economy with moderating inflation and resilient growth.

discipline mandates that we consider lightening up our stock exposure in an overbought market. We’re not there yet but still close.

You need a catalyst for the sector and stock that you’re trading to move higher. The markets were missing a catalyst this week for further upside. Some of the economic reports this week suggest that the FED may slow down further cuts. SPX price-to-earnings (P/E) ratio of nearly 22 remains historically elevated.

Earnings:

- Monday (10/21): Sandy Springs Bancorp Inc. (SASR), SAP SE (SAP), Nucor Corp. (NUE), WR Berkley Corp. (WRB), Alexandria Real Estate Equities Inc. (ARE), AGNC Investment Corp. (AGNC), Zions Bancorp (ZION). Logitech (LOGI).

- Tuesday (10/22): GE Aerospace (GE), Danaher Corp. (DHR), Verizon Communications (VZ), Philip Morris International Inc. (PM), RTX Corp. (RTX), Lockheed Martin Corp. (LMT), Texas Instruments (TXN), Baker Hughes Co. (BKR), Seagate Technology Holdings (STX), Enphase Energy (ENPH), Norfolk Southern Corp. (NSC), General Motors (GM), Freeport-McMoRan (FCX), 3M (MMM),

- Wednesday (10/23): Coca-Cola Co. (KO), Thermo Fisher Scientific Inc. (TMO), Nextera Energy Inc. (NEE), AT&T Inc. (T), Boeing Co. (BA), General Dynamics Corp. (GD), Tesla (TSLA), T-Mobile US (TMUS), International Business Machines Corp. (IBM), ServiceNow Inc. (NOW), Lam Research Corp. (LRCX)

- Thursday (10/24): S&P Global Inc. (SPGI), Union Pacific Corp. (UNP), Honeywell International Inc. (HON), United Parcel Services Inc. (UPS), Northrop Grumman Corp. (NOC), Carrier Global Corp. (CARR), Capital One Financial Corp. (COF), Digital Realty Trust Inc. (DLR)

- Friday (10/25): Sanofi SA (SNY), HCA Healthcare Inc. (HCA), Colgate-Palmolive Co. (CL), AON PLC (AON), Centene Corp. (CNC)

Technical Analysis:

NDX is less than 2% away from it’s all time high 20,675. NDX remains in an uptrend and price has been converging over the past two months in triangle trend. mega-cap tech earnings, which we’ll get the week after next, will likely determine whether we can make new all-time highs or not.

Russell appears to be forming a bull flag formation on the charts. This bullish pattern would be confirmed if the index closes above the upper trendline of the flag, or some technicians look for a close above the top of the flagpole which is at Wednesday’s 2,286 close.

KWEB ETF China, retraced 50% according to Fibonacci numbers.

Memoirs of a trader:

For the past two years I added trading options as opposed to just trading stocks. Trading options is very risky we’re paying for time value (every day that passes on your option without the option moving in the direction of your trade, the option loses time value). And if the stocks you’re trading aren’t moving, trading the options is a losing bet. Another thing that caught my attention, 20 years ago options premiums were much cheaper than they are today, The only options trade that worked for me this week was selling a put, taking the other side of the trade (which can be very risky) but works when the underlying stock doesn’t move or moves in your direction. Conclusion stick to trading stocks when the stock isn’t moving you aren’t losing and add options only once the volatility gets going.

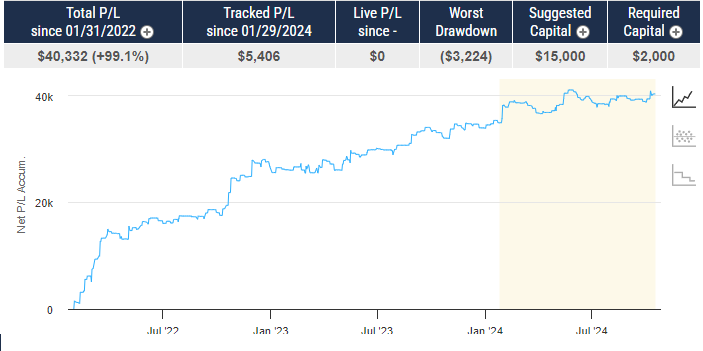

Trading stocks, commodity futures and options involves a substantial risk of loss. The information here is of opinion only and do not guarantee any profits. Past performances are not necessarily indicative of future results. |

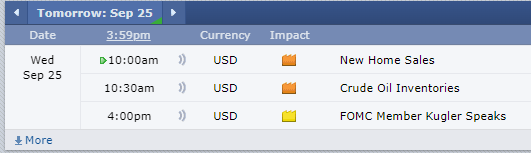

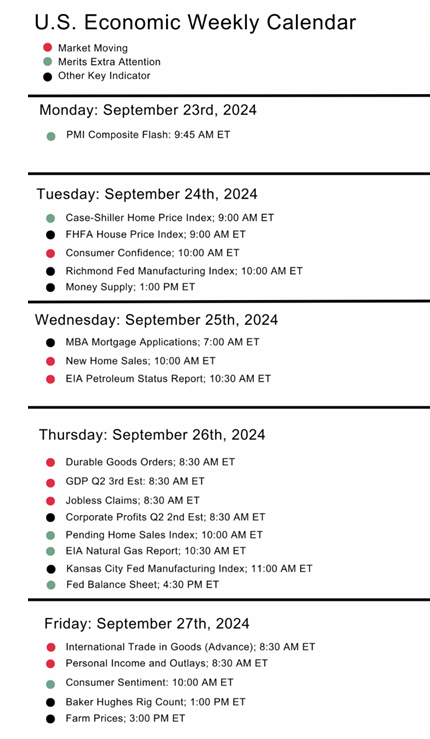

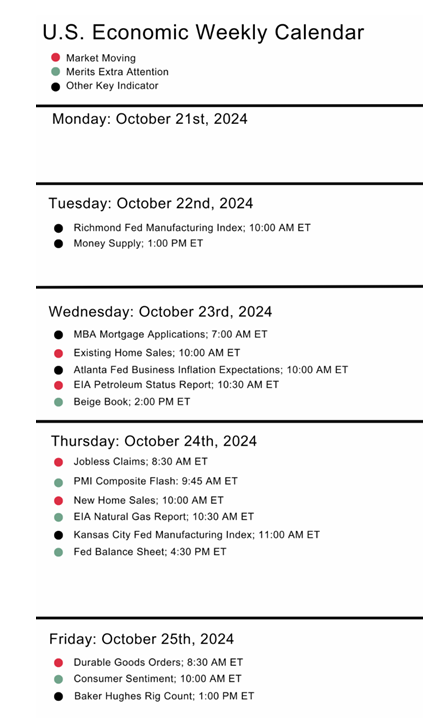

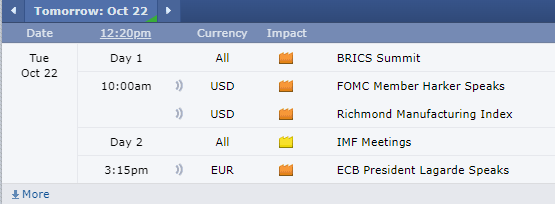

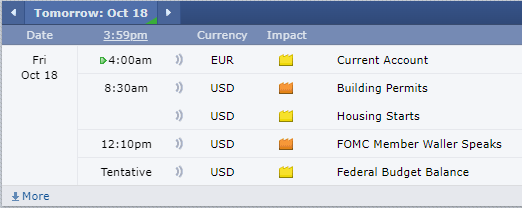

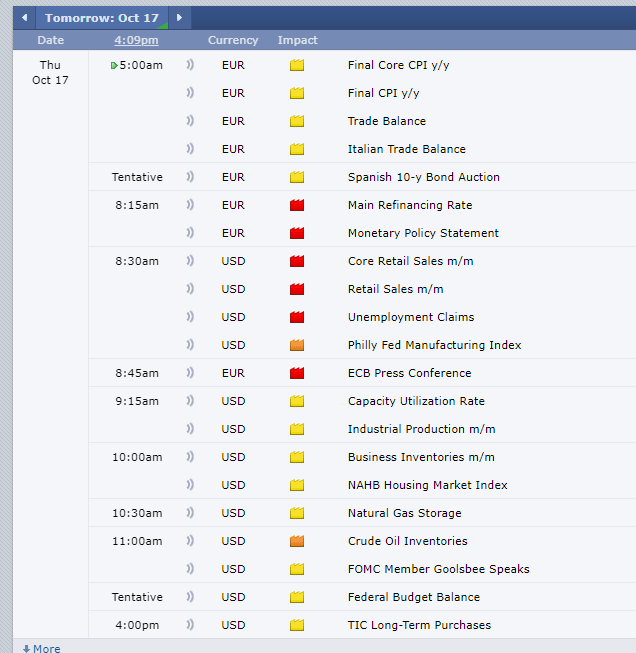

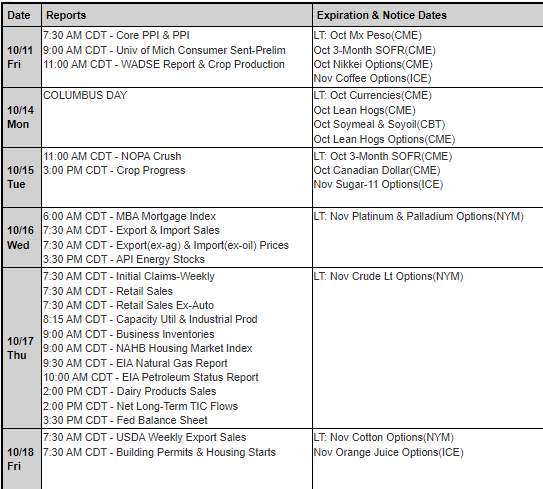

Economic Reports

provided by:

Economic Reports

provided by:

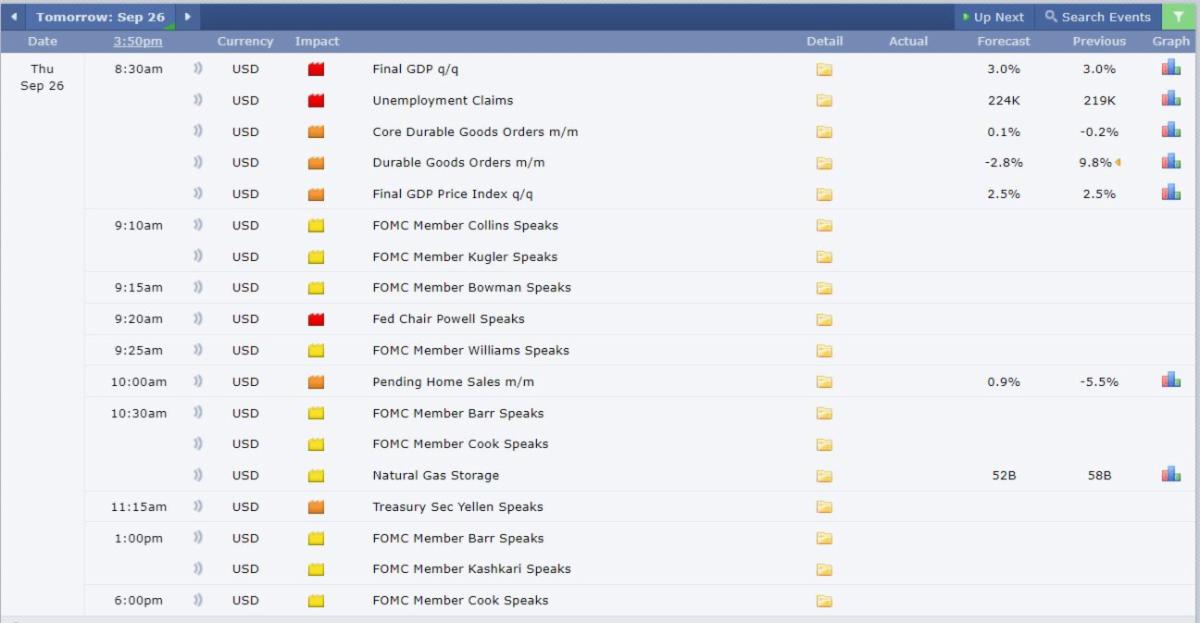

US new home sales data for June will be updated Wednesday morning at 9:00 am CT. Analysts expect new home sales month-to-month at a 0.640 mln unit annualized pace, up +3.4%. The prior month’s sales were -11.3% at 0.619 mln unit annual rate. Micron Technology reports after the close

US new home sales data for June will be updated Wednesday morning at 9:00 am CT. Analysts expect new home sales month-to-month at a 0.640 mln unit annualized pace, up +3.4%. The prior month’s sales were -11.3% at 0.619 mln unit annual rate. Micron Technology reports after the close