Learn more about hedging futures with Cannon Trading Company here.

In the volatile world of financial and commodity markets, where price fluctuations can spell success or disaster for individuals and businesses alike, a prudent strategy known as futures hedging emerges as a powerful tool for risk mitigation. Hedging involves the use of financial instruments, such as futures contracts and options, to protect against potential losses stemming from adverse price movements. This proactive approach helps safeguard investments, maintain profitability, and provide stability in an unpredictable environment.

Candidates for Hedging on Futures and Commodity Markets

Various entities can benefit from futures hedging, each with their unique exposure to price volatility. These candidates include:

- Commodity Producers and Consumers: Businesses engaged in producing or consuming commodities like crude oil, natural gas, agricultural products, and metals are directly exposed to fluctuations in commodity prices. Producers can hedge against price declines, while consumers can hedge against price increases.

- Manufacturers: Companies that rely on raw materials or components, the prices of which are subject to fluctuations, can use futures hedging to stabilize their input costs and secure profit margins.

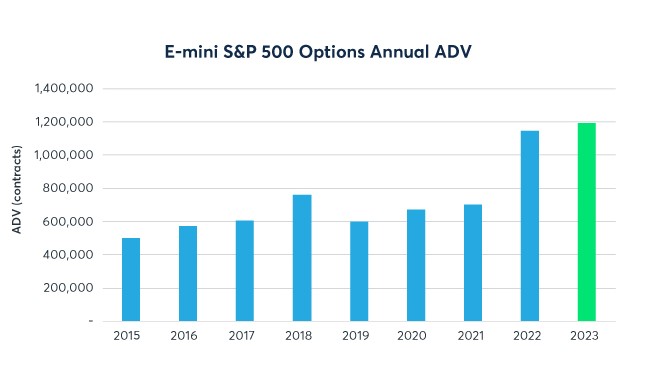

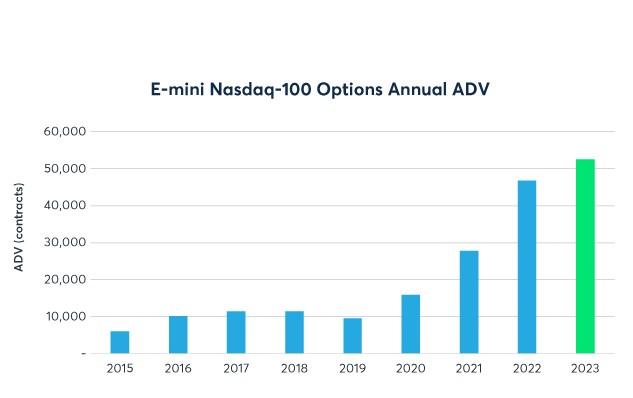

- Investors: Portfolio managers and individual investors can use futures contracts to hedge their equity portfolios against market downturns. Stock index futures allow them to offset potential losses in the stock market.

- Importers and Exporters: Businesses involved in international trade can be significantly affected by currency fluctuations. Currency futures can be employed to hedge against exchange rate risk.

- Financial Institutions: Banks and financial institutions often use interest rate futures to hedge against changes in interest rates that can impact their lending and borrowing activities.

Hedging Techniques with Futures

The core concept of futures hedging involves taking an offsetting position in the futures market to counterbalance the risk of an existing exposure. A long hedge involves buying futures contracts to protect against a potential price increase, while a short hedge involves selling futures contracts to guard against a potential price decrease. For instance:

Crude Oil Hedgers: Imagine an oil producer concerned about falling crude oil prices. They can enter into a futures contract to sell oil at a predetermined price, effectively locking in the current higher price. If prices fall, the losses in the cash market are offset by gains in the futures market.

Agricultural Hedgers: Farmers concerned about price drops for their crops can take a long position in the futures market. If prices fall, their futures contracts will appreciate in value, counteracting the losses on the actual crop sales.

Stocks Hedging through Futures Indices: Investors who own a diversified stock portfolio can use stock index futures to protect against a market-wide decline. By taking a short position in stock index futures, they can offset potential losses in their equity holdings if the market drops.

Hedging Techniques with Options

Options are another powerful instrument for hedging that provide flexibility beyond the limitations of futures contracts. An option gives the holder the right, but not the obligation, to buy (call option) or sell (put option) an underlying asset at a predetermined price within a specified time frame. Hedging techniques using options include:

Protective Put: An investor holding a stock can buy a put option to limit potential losses. If the stock’s price falls, the put option’s value increases, offsetting the decline in the stock’s value.

Covered Call: Investors owning an asset can sell a call option against it. If the price of the asset remains relatively stable or decreases, the premium from the call option provides a cushion against potential losses.

Markets Typically Hedged in the Futures Markets

A wide range of markets are commonly hedged using futures contracts:

- Commodity Markets: As mentioned earlier, commodities such as oil, gas, metals, and agricultural products are prime candidates for futures hedging due to their inherent price volatility.

- Financial Markets: Interest rate futures are widely used to manage interest rate risk. Currency futures help mitigate the effects of fluctuating exchange rates.

- Equity Markets: Stock index futures and options allow investors and portfolio managers to hedge against downturns in the stock market.

The Role of Cannon Trading Company in Hedging

Cannon Trading Company stands out as a reliable partner for individuals and businesses seeking to implement effective hedging strategies. With years of experience in the futures brokerage industry, Cannon Trading Company offers a suite of services and resources tailored to assist hedgers in navigating the complexities of the financial and commodity markets.

TrustPilot Ranking: 4.9 out of 5 Stars

One striking testament to the credibility and competence of Cannon Trading Company is its exceptional TrustPilot ranking of 4.9 out of 5 stars. TrustPilot, a trusted platform for customer reviews, reflects the experiences and opinions of real clients. Such a high rating underscores Cannon Trading Company’s commitment to providing quality service, personalized guidance, and dependable execution to its clients.

This remarkable rating can be attributed to several key factors:

- Expertise: Cannon Trading Company boasts a team of experienced professionals with in-depth knowledge of futures markets, hedging strategies, and risk management. Clients benefit from their expert insights and guidance.

- Customer-Centric Approach: The company’s focus on understanding clients’ unique needs and tailoring solutions accordingly demonstrates a commitment to personalized service that fosters trust and loyalty.

- Technology and Resources: Cannon Trading Company provides cutting-edge trading platforms, real-time market data, and a wealth of educational resources. This empowers clients to make informed decisions and execute hedging strategies effectively.

- Transparency: Transparent pricing, timely execution, and clear communication contribute to clients’ confidence in the company’s operations.

Futures hedging stands as a crucial mechanism for mitigating risk in both financial and commodity markets. Whether it’s crude oil producers, agricultural businesses, investors, or financial institutions, various candidates can benefit from hedging strategies tailored to their unique exposures. By utilizing techniques involving futures contracts and options, these candidates can safeguard their interests against the uncertainties of market fluctuations. Cannon Trading Company’s reputation as a trustworthy partner, as evidenced by its exceptional TrustPilot ranking, positions it as a valuable resource for hedgers looking to navigate these markets effectively and with confidence.

Ready to start trading futures? Call 1(800)454-9572 and speak to one of our experienced, Series-3 licensed futures brokers and start your futures trading journey with Cannon Trading Company today.

Disclaimer – Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. Past performance is not indicative of future results. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.