In this post:

1. Market Commentary

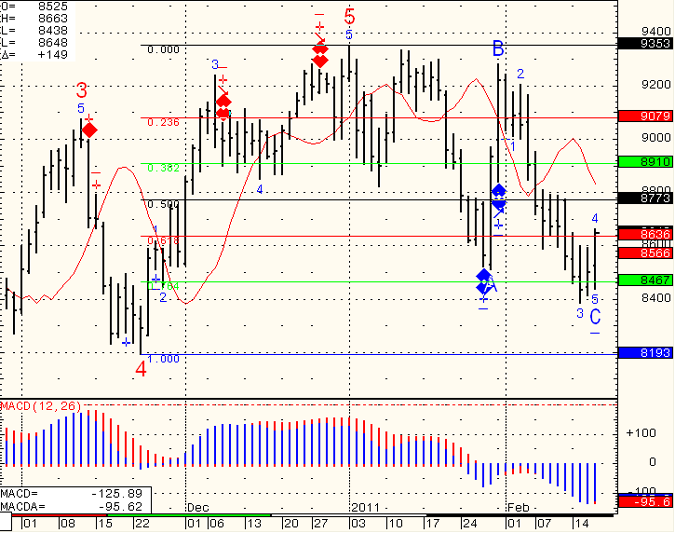

2. Daily Futures Chart for Mini S&P 500

3. Support and Resistance Levels

4. Economic Reports

5. Highlighted Earnings Releases

1. Market Commentary

Monthly unemployment is sure to move the market tomorrow morning…the big question is which way and to be honest , I have no idea…..

i am getting mixed signals from the chart perspective and there is a case both for the bulls and the bears.

The bulls need to hold above 1183.00 and break above 1215.75

The bears need to break below 1183.00 to have a shot at the 1142.50 level.

I am sure we can see wild and wide swings when the report comes out tomorrow morning before cash open and through out the trading session as large traders will try to square their positions ahead of the long, Labor day weekend.

When is doubt, stay out until you have a clearer picture of what you think the market will do.

See the Labor Day Holiday Trading Hours at our weekly newsletter.

2. Support and Resistance Levels!

| Contract (Sept. 2011) | SP500 (big & Mini) | Nasdaq100 (big & Mini) | Dow Jones (big & Mini) | Mini Russell |

| Resistance 3 | 1246.43 | 2300.75 | 11865 | 758.03 |

| Resistance 2 | 1237.22 | 2282.25 | 11785 | 746.57 |

| Resistance 1 | 1220.73 | 2252.50 | 11635 | 728.53 |

| Pivot | 1211.52 | 2234.00 | 11555 | 717.07 |

| Support 1 | 1195.03 | 2204.25 | 11405 | 699.03 |

| Support 2 | 1185.82 | 2185.75 | 11325 | 687.57 |

| Support 3 | 1169.33 | 2156.00 | 11175 | 669.53 |

| Contract | Dec. Gold | Sept. Euro | Oct. Crude Oil | Dec. Bonds |

| Resistance 3 | 1853.5 | 1.4510 | 91.43 | 140 25/32 |

| Resistance 2 | 1843.5 | 1.4444 | 90.66 | 139 4/32 |

| Resistance 1 | 1835.4 | 1.4356 | 89.74 | 138 11/32 |

| Pivot | 1825.4 | 1.4290 | 88.97 | 136 22/32 |

| Support 1 | 1817.3 | 1.4202 | 88.05 | 135 29/32 |

| Support 2 | 1807.3 | 1.4136 | 87.28 | 134 8/32 |

| Support 3 | 1799.2 | 1.4048 | 86.36 | 133 15/32 |

Continue reading “Monthly Job Report May Move the Markets | Support and Resistance Levels”