USDA

Cannon Futures Weekly Letter

In Today’s Issue #1236

- The Week Ahead – Non-Farm Payroll, Prospective Plantings and Fed Chair Powell

- Futures 102 – Intro to Crude Oil Futures

- Hot Market of the Week – Bloomberg Commodity (CRB) Index

- Broker’s Trading System of the Week – Combo Breakout Swing System

- Trading Levels for Next Week

- Trading Reports for Next Week

|

|

Non Farm Payroll Friday!

June gold is front month!

|

|

Important Notices: The Week Ahead

By John Thorpe, Senior Broker

USDA, Non Farm Payroll, Prospective Plantings and Fed Chair Powell?

USDA

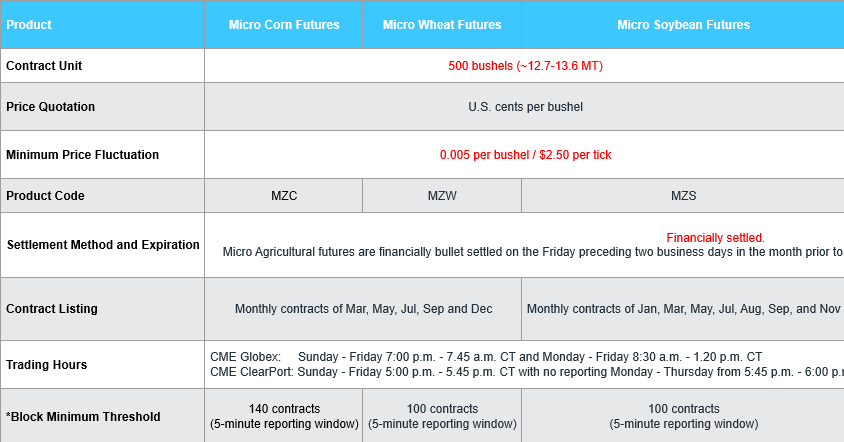

One of the most impactful Agricultural reports of the year will be released Monday at 11:00 am CDT. The Prospective Plantings report and Grain Stocks released by the USDA will offer a needed insight into prospective acreage plantings for grains and oilseeds.

I have included commentary from The Progressive Farmers’ DTN top analyst for your review: DTN Pre-Report analysis

More volatility to come as next week all markets will be reacting, as they have been, to the Global Tariff talk.

Non Farm Payroll

Highlights next week will include the aforementioned Grain report. Non farm Payroll (NFP) Friday followed by Fed Chair J. Powell and other Fed Speakers. This may be the final Q4 2024 Earnings guidance as we will see a mere 67 releases the entire week.

USDA, Non Farm Payroll

Earnings Next Week:

- Mon. Quiet

- Tue. Quiet

- Wed. Quiet

- Thu. Conagra, Constellation Brands

- Fri. Quiet

FED SPEECHES:

- Mon. Bostic 12:45 CDT, Barr 2:10 CDT,

- Tues. Kugler 7:40 CDT, Williams 8:05 CDT ,

- Wed. Kugler 3:30 CDT

- Thu. Jefferson 11:30 CDT, Cook 1:30 CDT

- Fri. Fed Chair J. Powell 10:25 CDT, Barr 11:00 CDT, Waller 11:45 CDT

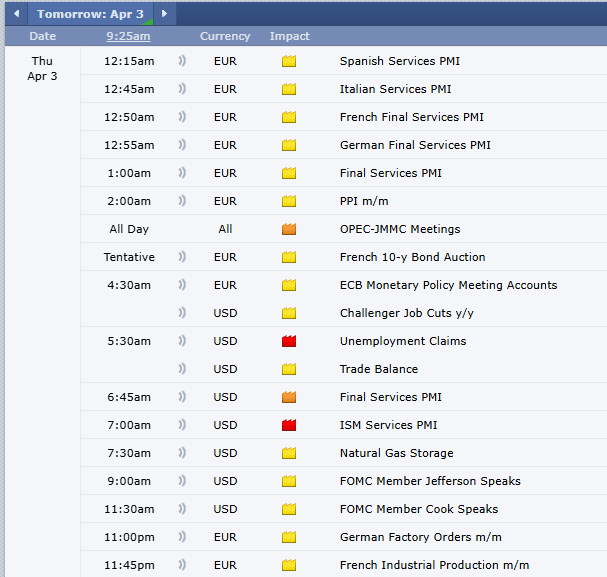

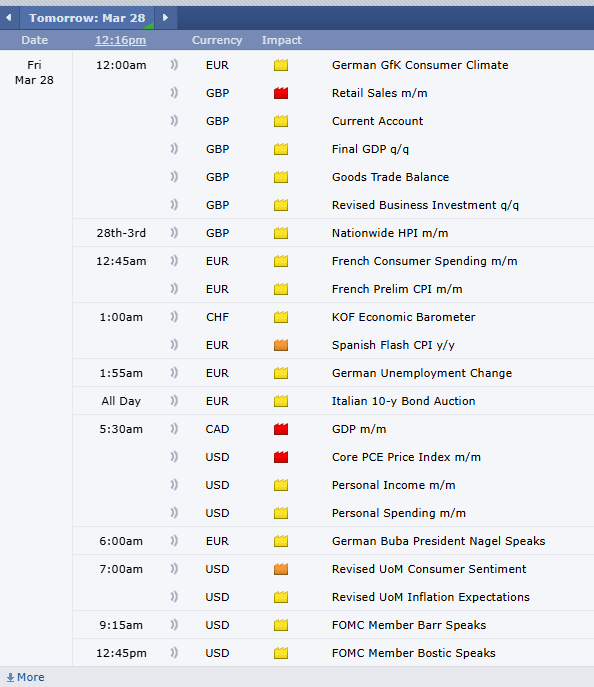

Economic Data week:

- Mon. Chicago PMI, Dallas Fed, USDA Prospecting Plantings and Grain Stocks

- Tue. Redbook, ISM Mfg. Final, JOLTS, Dallas Fed.,

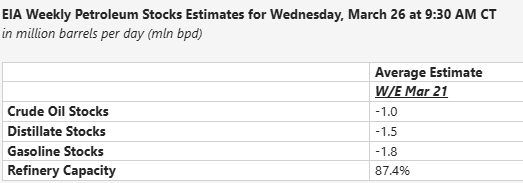

- Wed. EIA Crude Stocks, ADP, Factory Orders

- Thur. Initial Jobless Claims, ISM Svcs Final, EIA Nat Gas

- Fri. Non-Farm Payroll

USDA, Non Farm Payroll

|

|

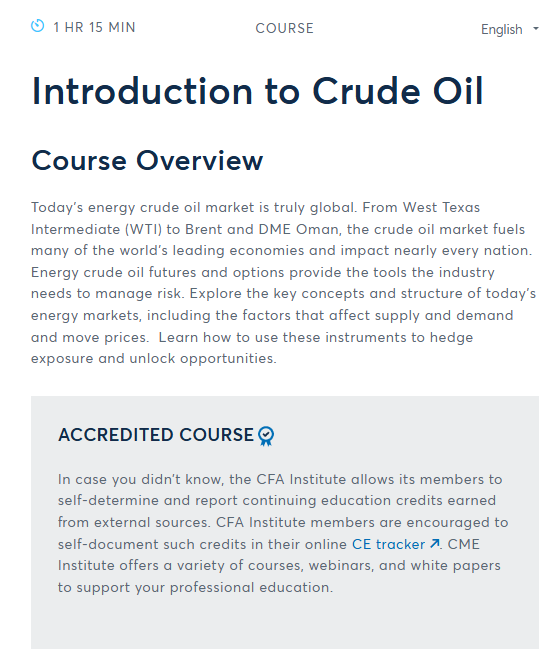

Futures 102: Introduction to Crude Oil futures

Course overview

Today’s energy crude oil market is truly global. From West Texas Intermediate (WTI) to Brent and DME Oman, the crude oil market fuels many of the world’s leading economies and impact nearly every nation. Energy crude oil futures and options provide the tools the industry needs to manage risk.

Explore the key concepts and structure of today’s energy markets, including the factors that affect supply and demand and move prices. Learn how to use these instruments to hedge exposure and unlock opportunities.

USDA, Non Farm Payroll

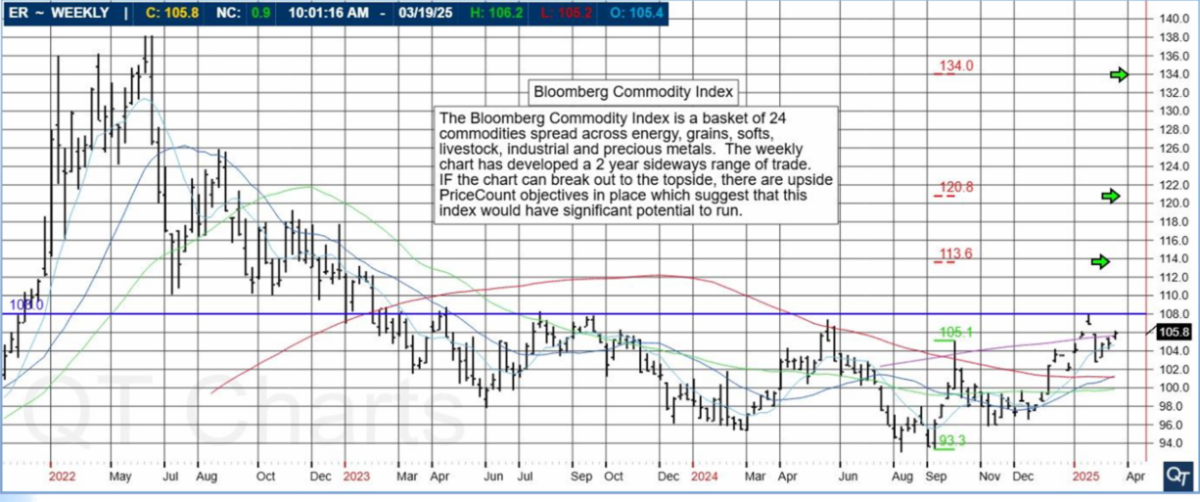

Hot Market of the Week

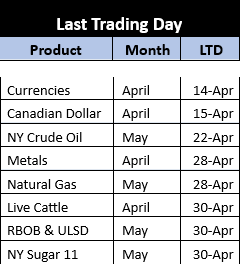

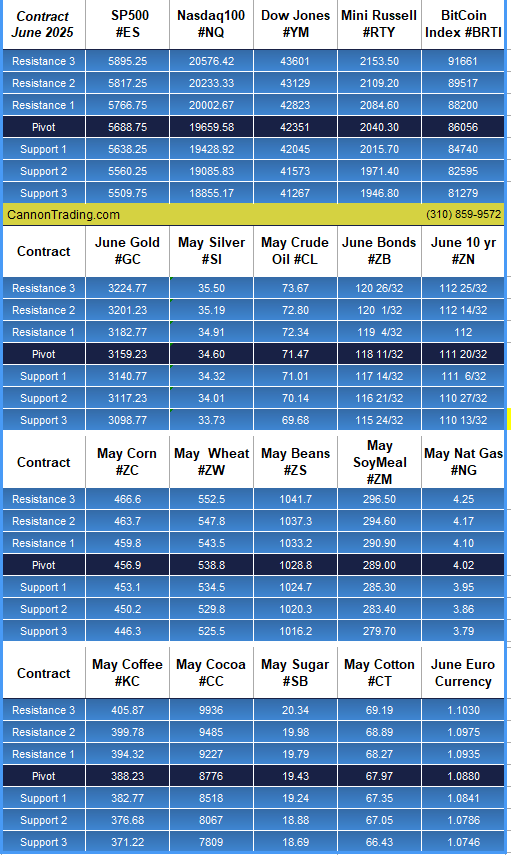

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

Bloomberg Commodity Index

The Bloomberg Commodity Index is a basket of 24 commodities spread across energy, grains, softs, livestock, industrial and precious metals. The weekly chart has developed a 2-year sideways range of trade. IF the chart can break out to the topside, there are upside PriceCount objectives in place which suggest that this index would have significant potential to run.

The PriceCount study is a tool that can help to project the distance of a move in price. The counts are not intended to be an ‘exact’ science but rather offer a target area for the four objectives which are based off the first leg of a move with each subsequent count having a smaller percentage of being achieved.

It is normal for the chart to react by correcting or consolidating at an objective and then either resuming its move or reversing trend. Best utilized in conjunction with other technical tools, PriceCounts offer one more way to analyze charts and help to manage your positions and risk. Learn more at www.qtchartoftheday.com

Trading in futures, options, securities, derivatives or OTC products entails significant risks which must be understood prior to trading and may not be appropriate for all investors. Past performance of actual trades or strategies is not necessarily indicative of future results.

USDA, Non Farm Payroll

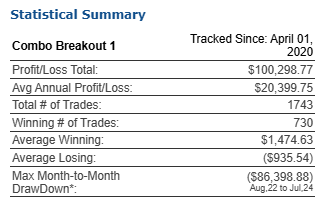

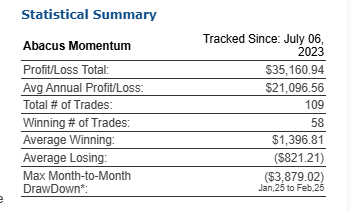

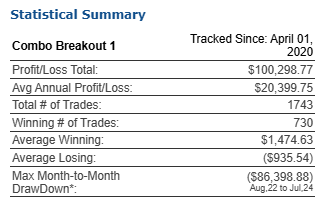

Brokers Trading System of the Week

Combo Breakout 1 Trading System

Market Sector: Diversified / Multiple

Markets Traded: C , KW , S , W , CL , HO , NG , RB , KC , SB , FGBL , TU , FV , BP , EC , JY , SF , DX , FESX , GC , EMD , NQ , RTY , ES , YM ,

System Type: Swing Trading

Risk per Trade: varies

Trading Rules: Partially Disclosed

Suggested Capital: $50,000

Developer Fee per contract: $200.00 Monthly Subscription

System Description:

Portfolio Combo Breakout I consists of 5-6 daytrade and swing strategies using different symbols, timeframes, and session templates. All strategies are developed by simple, structured, and proven breakout models based on strong fundamental logics.

All strategies are fully robustness tested as well as stress tested with no position sizing, more contracts can be traded. The 5-6 strategies have very low correlations (Less than 0.1) in order to achieve smoother portfolio equity curve.

Combo Breakout I is specially designed to trade with Combo Breakout II and Combo Breakout III for their low correlations in the portfolio level.

USDA, Non Farm Payroll

Disclaimer: The risk of trading can be substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not necessarily indicative of future results.

Futures Trading Disclaimer:

Transactions in securities futures, commodity and index futures and options on futures carry a high degree of risk. The amount of initial margin is small relative to the value of the futures contract, meaning that transactions are heavily “leveraged”.

A relatively small market movement will have a proportionately larger impact on the funds you have deposited or will have to deposit: this may work against you as well as for you.

You may sustain a total loss of initial margin funds and any additional funds deposited with the clearing firm to maintain your position. If the market moves against your position or margin levels are increased, you may be called upon to pay substantial additional funds on short notice to maintain your position.

If you fail to comply with a request for additional funds within the time prescribed, your position may be liquidated at a loss and you will be liable for any resulting deficit. Please read full disclaimer HERE.

| Would you like to get weekly updates on real-time, results of systems mentioned above? |

|

|

|

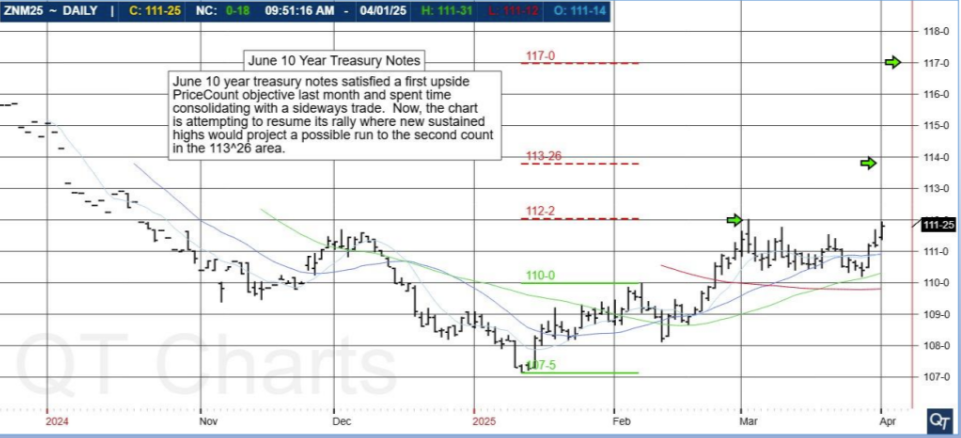

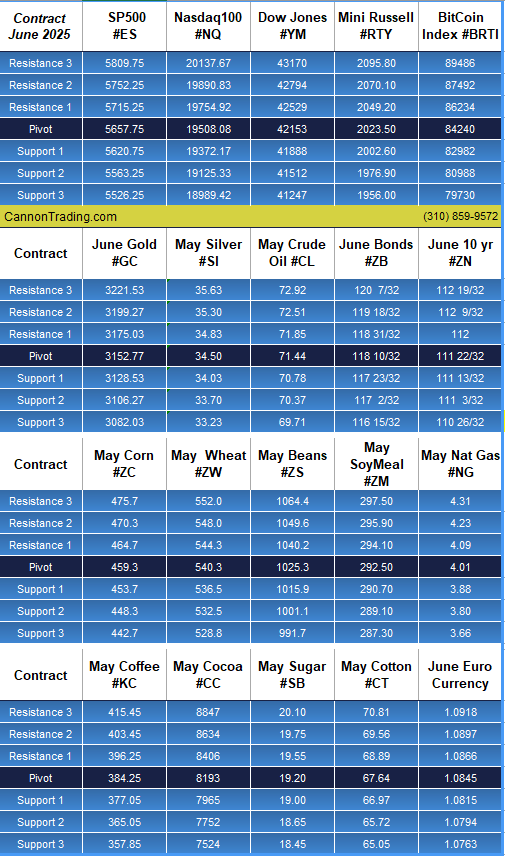

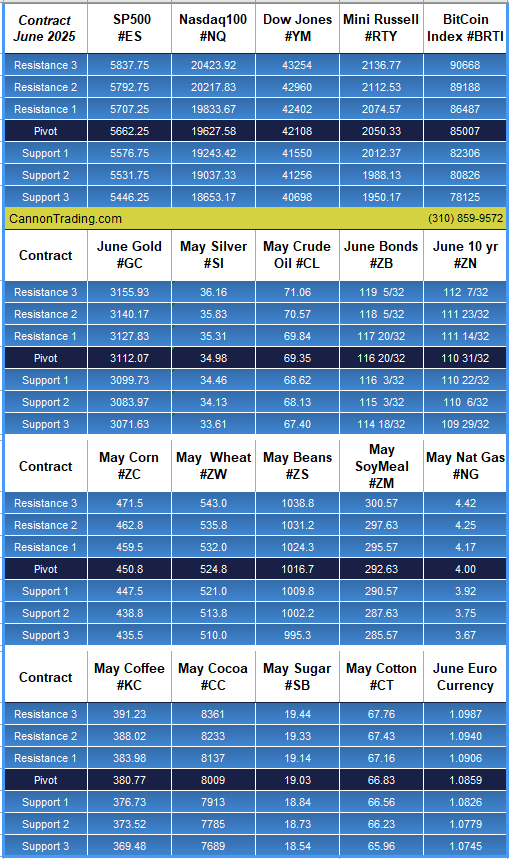

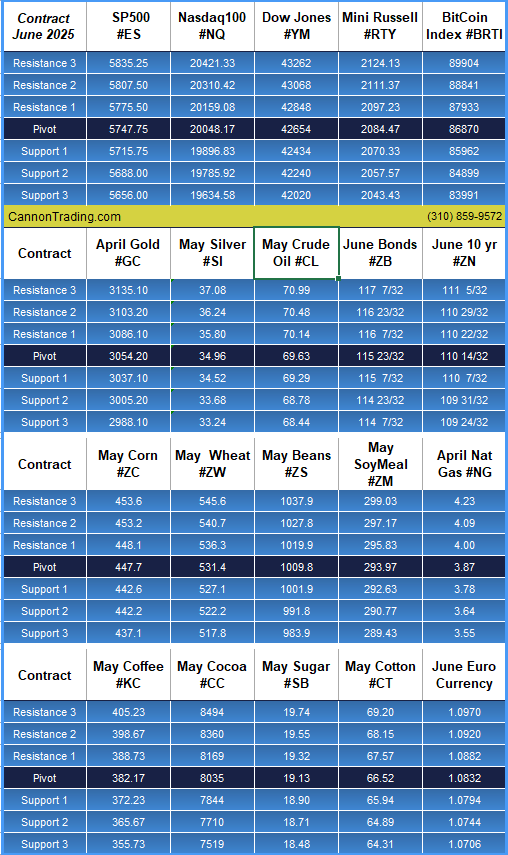

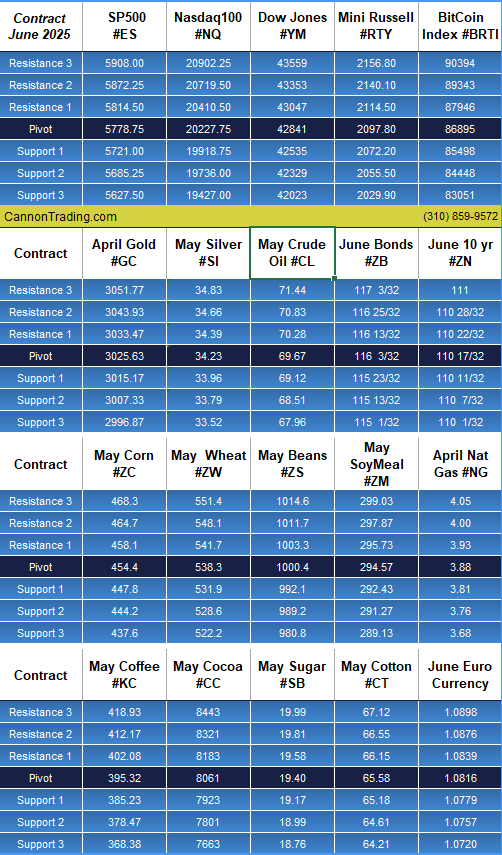

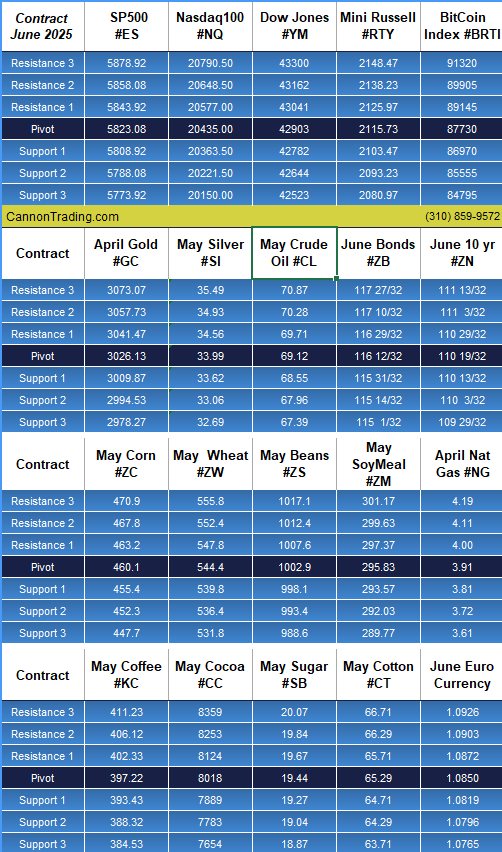

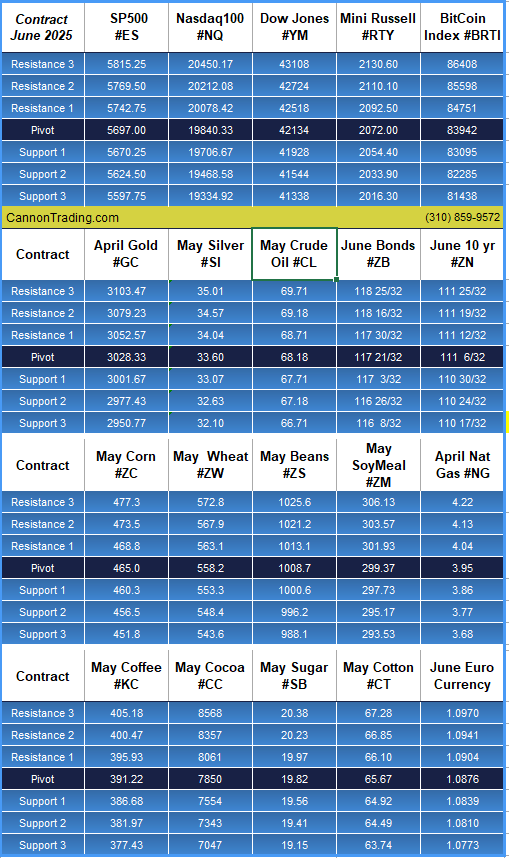

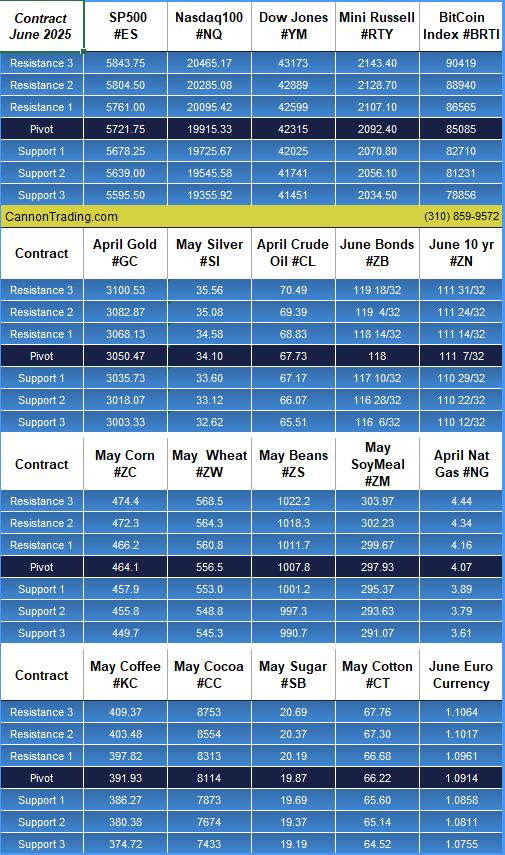

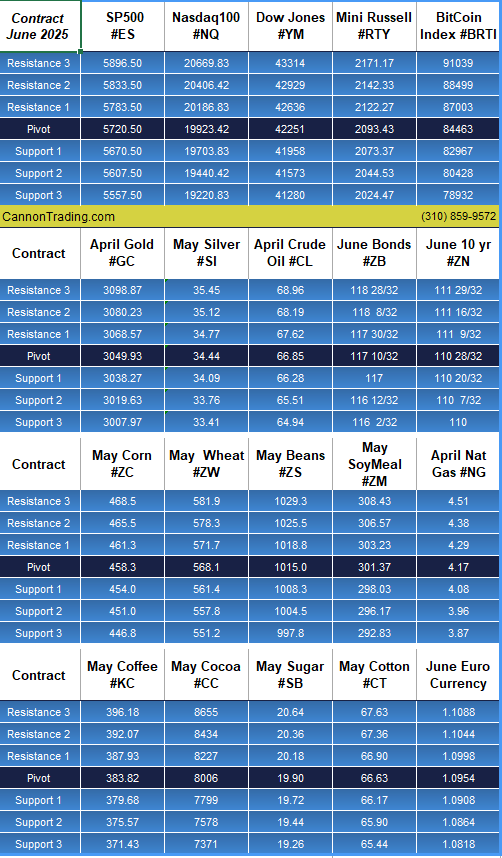

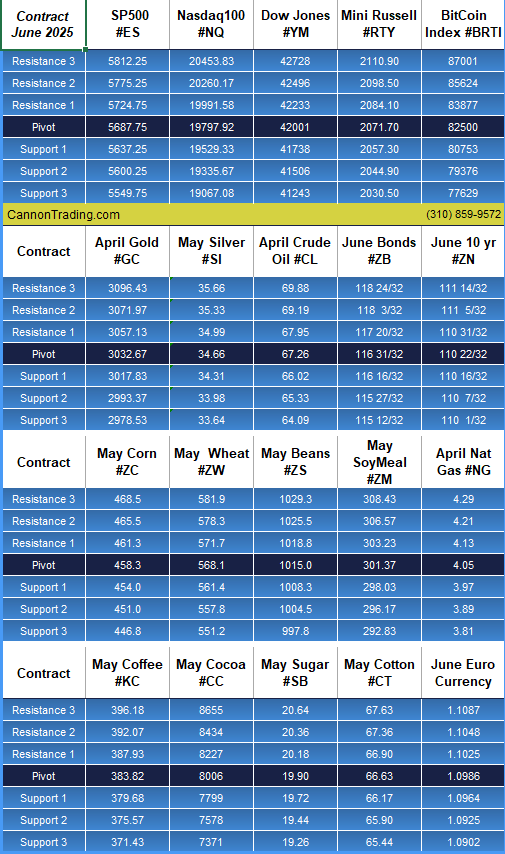

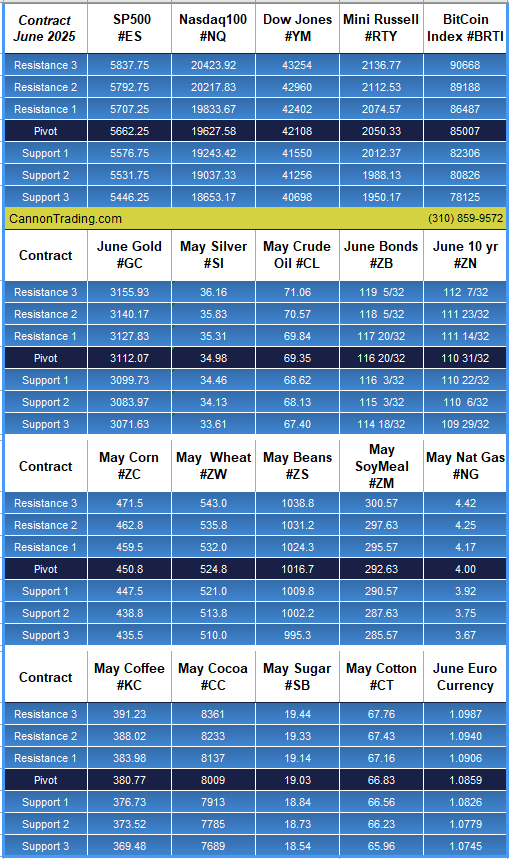

Trading Levels for Next Week

Daily Levels for March 31st, 2025

|

|

| Would you like to receive daily support & resistance levels? |

|

|

|

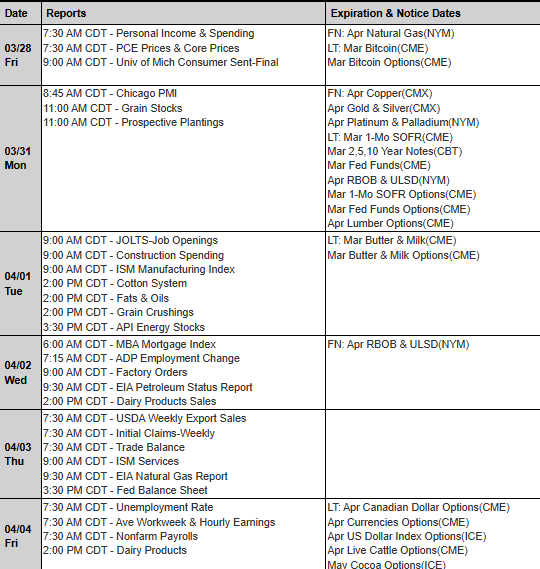

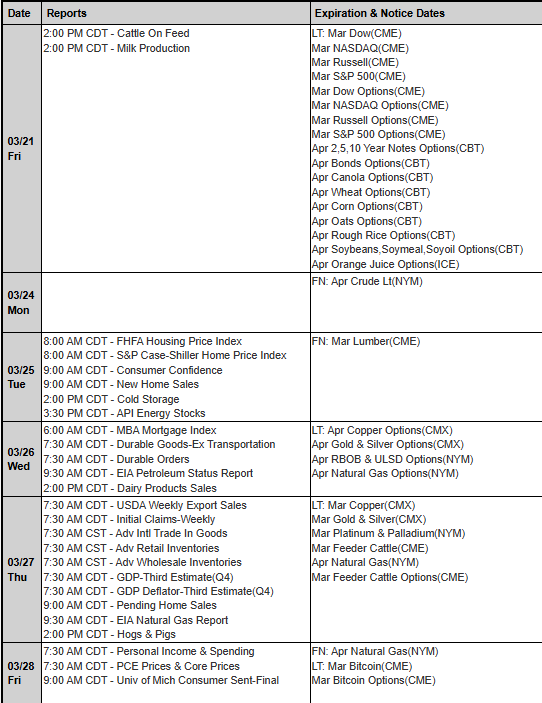

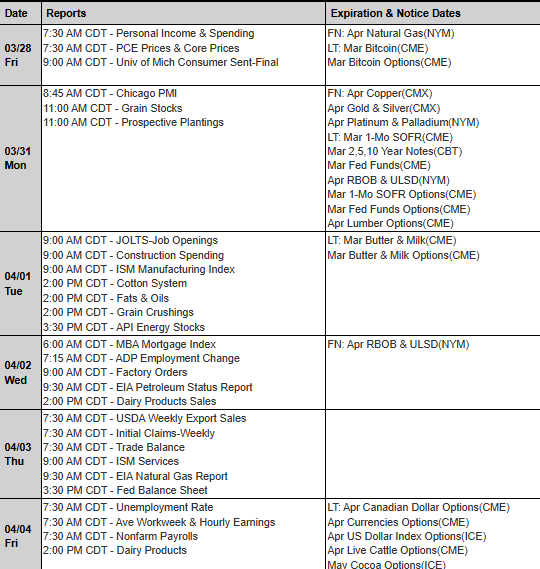

Trading Reports for Next Week

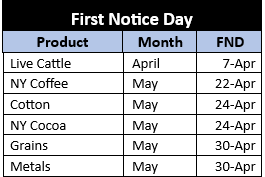

First Notice (FN), Last trading (LT) Days for the Week:

www.mrci.com

|

|

|

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors.

You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources.

You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

|

|

|

|

|

|

|