|

- Bitcoin Futures (114)

- Charts & Indicators (306)

- Commodity Brokers (589)

- Commodity Trading (845)

- Corn Futures (64)

- Crude Oil (229)

- Currency Futures (102)

- Day Trading (658)

- Day Trading Webinar (61)

- E-Mini Futures (163)

- Economic Trading (166)

- Energy Futures (127)

- Financial Futures (178)

- Future Trading News (3,159)

- Future Trading Platform (326)

- Futures Broker (665)

- Futures Exchange (347)

- Futures Trading (1,265)

- futures trading education (446)

- Gold Futures (111)

- Grain Futures (101)

- Index Futures (271)

- Indices (233)

- Metal Futures (140)

- Nasdaq (79)

- Natural Gas (40)

- Options Trading (191)

- S&P 500 (145)

- Trading Guide (429)

- Trading Webinar (60)

- Trading Wheat Futures (45)

- Uncategorized (26)

- Weekly Newsletter (223)

Category: Futures Trading

Futures trading is done by two main parties, one of which is the hedger and the other one is the speculator. Where a speculator is there to trade for either their own accounts or that of their clients, a hedger always uses futures as a possible protection from losses. Hedgers can also be described as individuals or business owners who are more risk averse. Speculators and hedgers are likely to benefit from futures trading if the trader has a strong ability to analyze the markets and understands that future behavior. Though futures can behigh risk, they offer an equally high return and are thus very tempting.

In case you are new to futures trading you need to understand how things work. We at Cannon Trading are there to help with your understanding of all the elements of futures trading and also counsel and advise you with the same. Our knowledge base featured on our website, is a store house of information. In order to know every aspect of futures trading, you must read through these articles that have been listed in this category archive. Go through it and get better informed!

Inflation Uptick and Bitcoin’s Surge: Navigating New Highs in Crypto and CPI

|

|

Bull Market Pause: Equity Stalls, Crypto Surges with Presidential Boost

|

Election Highs and Market Surprises: Navigating the 2024 Bull Run

|

|

Weekly Newsletter: The Week Ahead in Futures Trading + Trading Levels for Nov. 11th

Cannon Futures Weekly Letter Issue # 1216

In this issue:

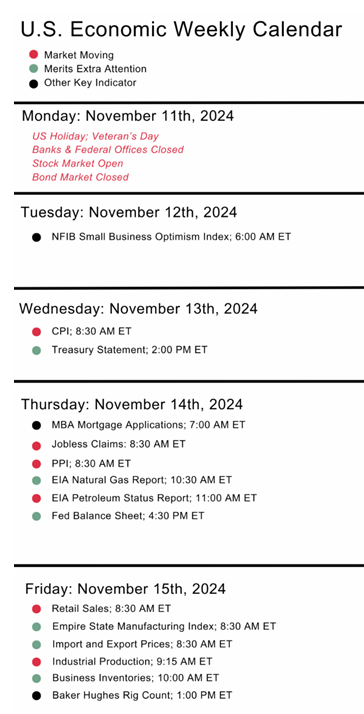

- Important Notices – Veteran’s Day, CPI, PPI

- Futures 102 – Trading Contest – REAL CASH Prizes

- Hot Market of the Week – July-Dec. Corn Spread

- Broker’s Trading System of the Week – Nikkei 225 Swing System

- Trading Levels for Next Week

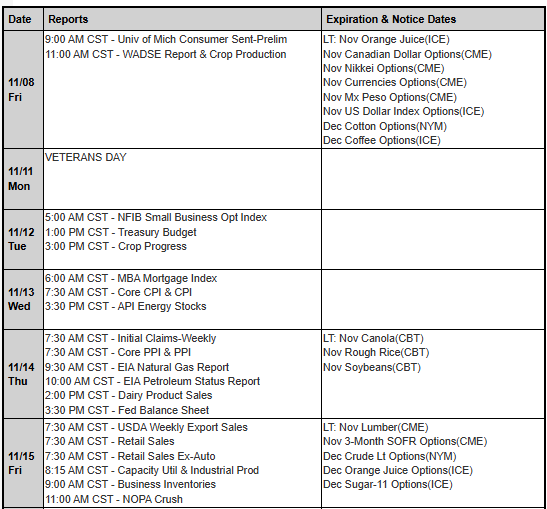

- Trading Reports for Next Week

Important Notices – Next Week Highlights:

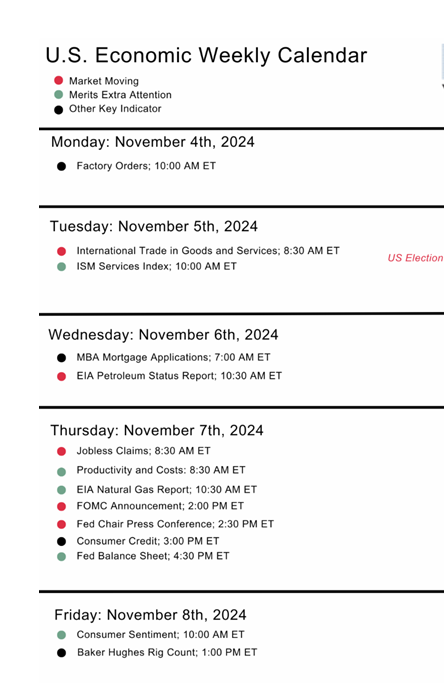

The Week Ahead

By John Thorpe, Senior Broker

- Veterans Day Monday the Banks, Bond market and Federal officers are closed,

- 13 Fed Speakers Powell on Thursday!

- 821 earnings

- CPI Wed, PPI Thursday!

|

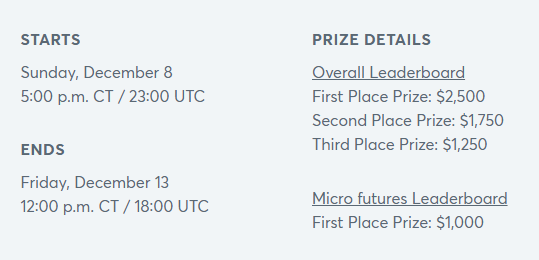

Futures 102: Trading Contest – Trade Against the Pro!

|

|

-

- Hot Market of the Week – July -Dec Corn Spread

Hot market of the week is provided by QT Market Center, A Swiss army knife charting package that’s not just for Hedgers, Cooperatives and Farmers alike but also for Spread traders, Swing traders and shorter time frame application for intraday traders with a unique proprietary indicator that can be applied to your specific trading needs.

July -Dec Corn Spread

The July – Dec corn spread satisfied its second upside PriceCount objective early last month and corrected. Now, the chart is poised to resume its rally where new sustained highs would project a possible run to the 11.75 area.

PriceCounts – Not about where we’ve been , but where we might be going next!

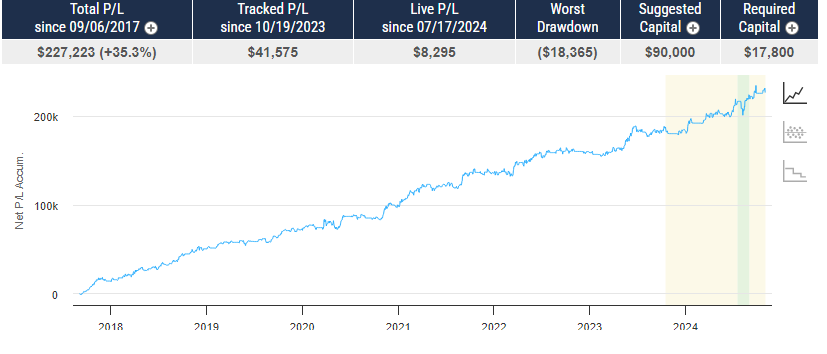

Broker’s Trading System of the Week

With algorithmic trading systems becoming more prevalent in portfolio diversification, the following system has been selected as the broker’s choice for this month.

DaGGoR Rider M1C NQ

PRODUCT

NQ – Mini NASDAQ

SYSTEM TYPE

Swing Trading

Recommended Cannon Trading Starting Capital

$40,000

COST

USD 150 / monthly

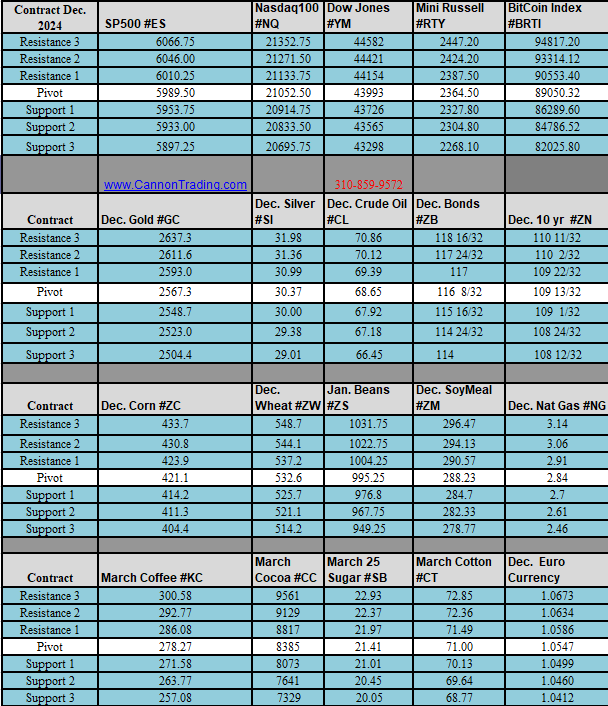

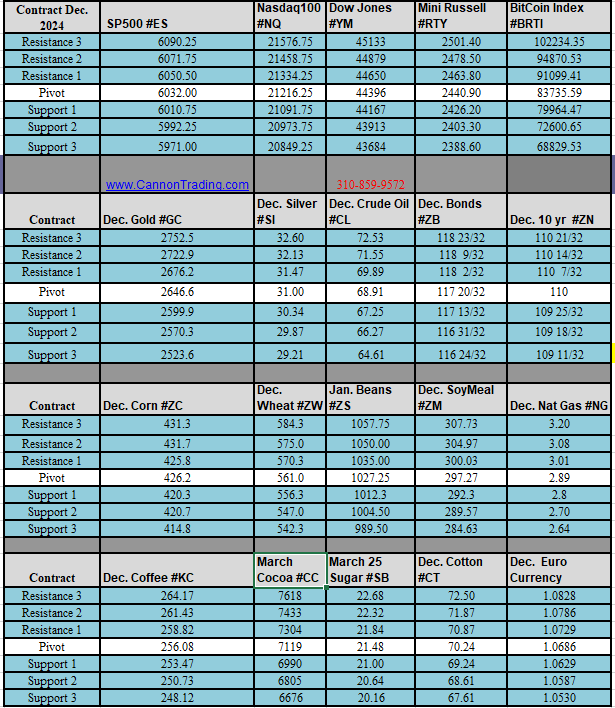

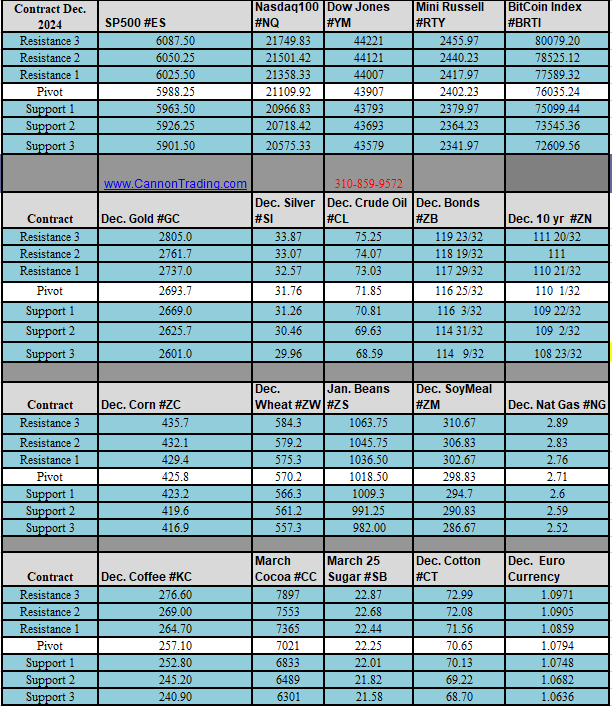

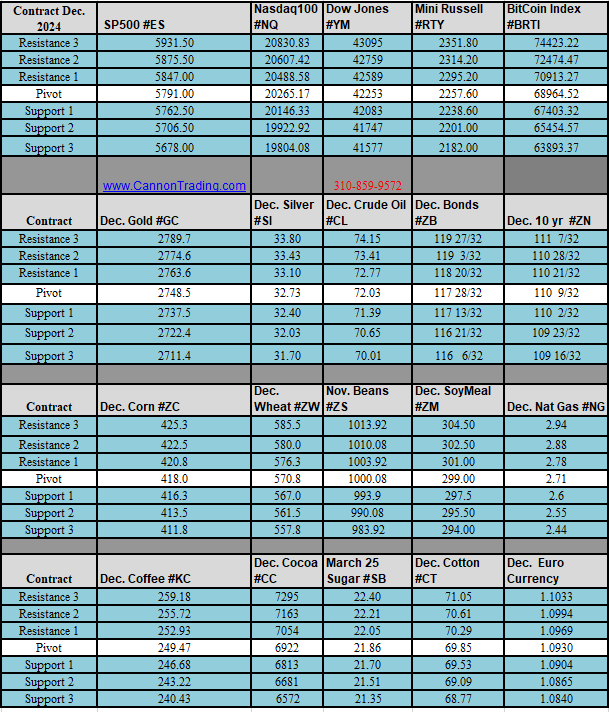

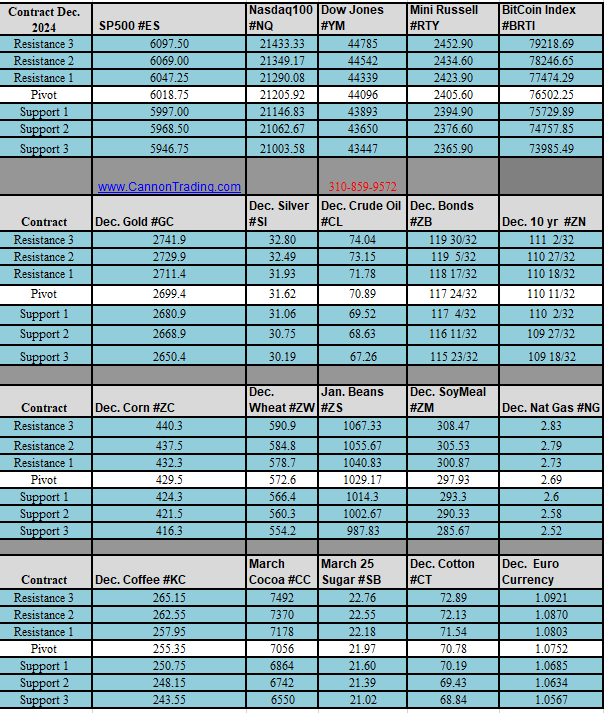

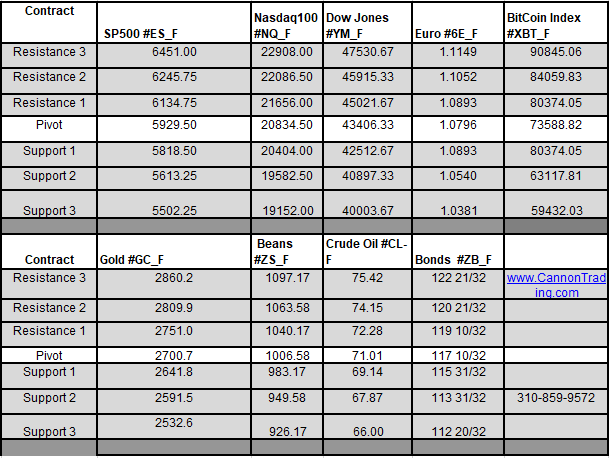

Daily Levels for November 11th, 2024

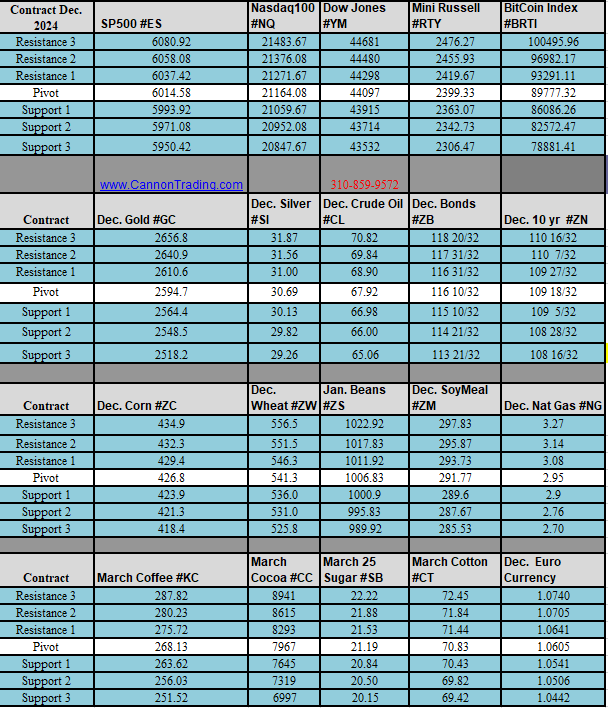

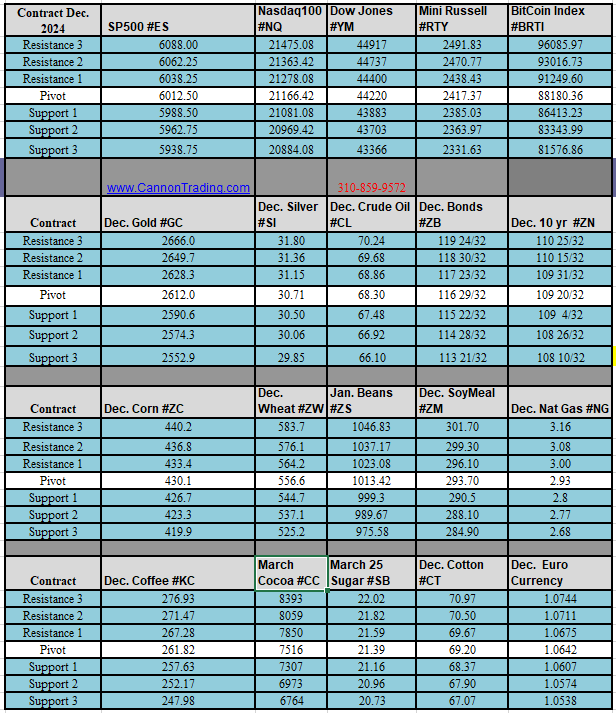

Weekly Levels for the week of November 11th, 2024

Improve Your Trading Skills

Get access to proprietary indicators and trading methods, consult with an experienced broker at 1-800-454-9572.

Explore trading methods. Register Here

* This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.

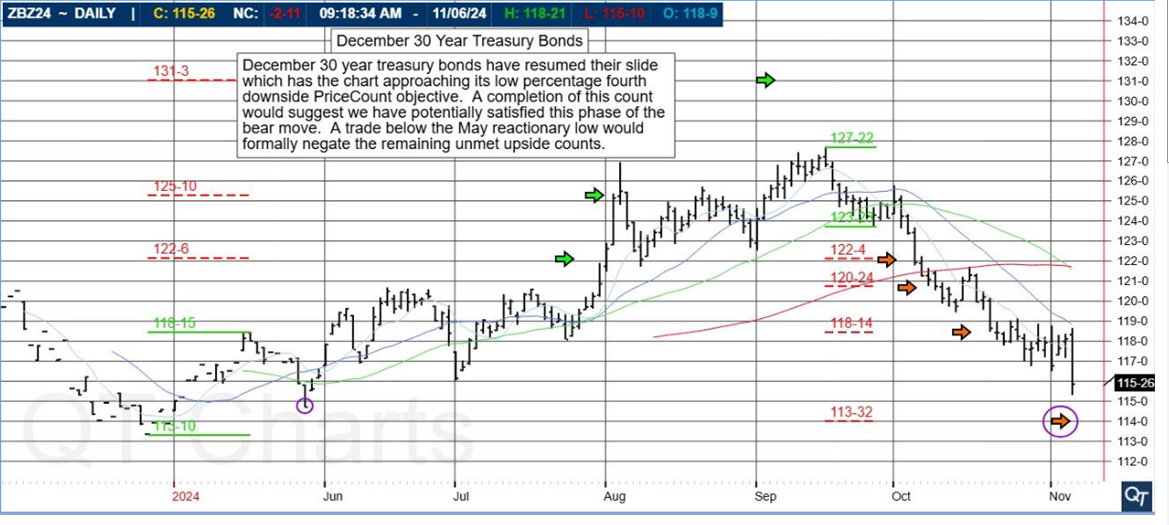

Why Trade Bitcoin Futures? Ask a Broker & 30 Year Treasury Bond Review

|

|

How Trade Oil Futures

The oil market is one of the most significant and dynamic global markets, with crude oil futures representing one of the most actively traded commodities worldwide. For both new and experienced traders, understanding how to trade oil futures is key to gaining exposure to the oil market, which is impacted by a multitude of factors, from geopolitics to technological advancements. In this guide, we’ll explore the history of crude oil futures trading, why they are so popular, and the advantages and disadvantages for various types of traders, including retail traders, institutional traders, and hedgers. We’ll conclude with an analysis of oil price forecasts for the end of the year, addressing relevant factors that may impact these predictions.

The Origins of Oil as a Tradable Commodity

Oil, often referred to as “black gold,” has been a critical resource in the global economy since its discovery as a fuel source. The journey of oil from its early use to becoming a dominant global commodity on the futures trading market is complex. Originally, oil was traded in physical markets, where buyers and sellers would negotiate contracts for delivery. However, as global energy demand grew, especially in the 20th century, oil became an essential commodity, fueling industries, economies, and transport systems worldwide.

To facilitate oil trading and address the volatility in oil prices, crude oil futures were introduced in the 1980s, allowing for price stabilization and hedging. The New York Mercantile Exchange (NYMEX) launched the first crude oil futures contract in 1983, followed by similar offerings from the Intercontinental Exchange (ICE) and other exchanges. These contracts allowed market participants to buy or sell oil at a predetermined price on a future date, bringing a significant degree of predictability and security to the volatile oil market.

Why Crude Oil Futures are Popular

Crude oil futures are among the most popular futures contracts, and there are several reasons why traders are drawn to crude oil futures trading:

- Liquidity: The oil futures market is one of the most liquid markets globally. High liquidity means that there is always a buyer or seller at any given time, making it easier for traders to enter and exit positions.

- Volatility: Oil prices are highly sensitive to changes in supply, demand, geopolitical tensions, and economic shifts. This volatility presents opportunities for traders to profit from price movements, whether they are upward or downward.

- Transparency: Unlike other markets, where information may not always be easily accessible, the oil market is relatively transparent, with data on supply, demand, inventory levels, and geopolitical developments widely available.

- Global Significance: Oil is essential for transportation, manufacturing, and energy production, making it a critical commodity globally. Consequently, oil futures are a popular contract for speculation and risk management, given the reliance of the world economy on oil.

How Trade Oil Futures

To successfully engage in crude oil futures trading, traders should familiarize themselves with the trading process, understand market terminology, and stay informed on global events. Below are key steps for how trade oil futures:

- Choosing a Brokerage: Selecting the right brokerage is the first step. Brokers that offer crude oil futures trading, such as E-Futures.com or Cannon Trading, provide platforms, tools, and guidance specifically tailored for futures traders.

- Understanding Contracts: The most widely traded crude oil futures contracts are West Texas Intermediate (WTI) on the NYMEX and Brent crude oil on the ICE. These contracts specify the quantity (typically 1,000 barrels) and the quality of oil to be delivered, along with the future delivery date.

- Leverage and Margin Requirements: Oil futures are leveraged products, meaning that a trader only needs to put down a fraction of the contract’s value (margin). While leverage can amplify profits, it also increases risk, as even a slight price movement against a trader’s position can result in significant losses.

- Strategies: Some common trading strategies include day trading, swing trading, and position trading. Day trading involves capitalizing on intraday price fluctuations, while swing trading captures short-term trends over several days. Position trading, on the other hand, is suitable for those looking at long-term trends.

- Monitoring Influences: Global events, weather patterns, and geopolitical tensions in oil-producing regions are critical to monitor, as they have direct impacts on oil supply and demand.

- Risk Management: Setting stop-loss orders, understanding margin requirements, and using technical and fundamental analysis are essential risk management techniques in how trade oil futures effectively.

Advantages and Disadvantages of Trading Oil Futures

For Retail Traders

Advantages:

- Access to Leverage: Retail traders can control large positions with relatively small amounts of capital due to leverage, allowing for potentially high returns.

- Profit from Volatility: Retail traders often look for quick returns, and the volatility in the crude oil market can provide these opportunities.

- Diverse Strategies: From day trading to holding long-term positions, retail traders can employ a variety of trading strategies to benefit from both short and long-term price movements.

Disadvantages:

- High Risk: Leverage can be a double-edged sword. High volatility in oil prices, combined with leverage, can lead to significant losses.

- Complex Market Factors: The oil market is influenced by numerous complex factors, including geopolitical tensions, natural disasters, and supply chain disruptions, which can be challenging for retail traders to analyze.

- Margin Calls: If the market moves against a leveraged position, the trader might receive a margin call, requiring additional funds or leading to forced liquidation of the position.

For Institutional Traders

Advantages:

- Risk Management: Institutional traders can hedge against other investments in energy or oil-dependent industries, allowing them to mitigate risks in their broader portfolios.

- Access to Superior Data: Institutional traders have access to advanced trading platforms, market data, and analysis tools, giving them a competitive advantage in crude oil futures trading.

- Liquidity and Execution: Institutional traders benefit from enhanced liquidity and can execute large trades with minimal slippage due to their established relationships with brokerages and exchanges.

Disadvantages:

- High Costs: Institutional trading often involves high costs, including transaction fees, data feeds, and sophisticated trading technology.

- Regulatory Scrutiny: Institutional traders are subject to regulatory requirements, which can restrict certain trading activities and require additional compliance.

For Hedgers

Advantages:

- Price Stabilization: Companies in oil-dependent industries use crude oil futures to lock in prices, allowing them to stabilize costs and protect against price volatility.

- Enhanced Budgeting and Planning: By locking in prices, hedgers can budget more effectively, making it easier to forecast costs and profits.

- Reduced Exposure to Geopolitical Events: Oil prices are often sensitive to global political events, and hedgers can reduce their risk of exposure to such events by securing future oil prices.

Disadvantages:

- Opportunity Costs: By locking in prices, hedgers may miss out on favorable price movements if the oil market shifts unexpectedly.

- Initial Costs and Margins: Hedgers need to meet margin requirements, which may tie up capital that could be used elsewhere.

- Complexity: Effective hedging requires a deep understanding of futures markets, as well as continuous monitoring of global oil trends.

Speculation on Oil Prices for the End of the Year

The price of crude oil futures heading into the end of the year is likely to be influenced by several critical factors, including global demand recovery, OPEC+ production decisions, and geopolitical issues.

- Global Economic Recovery: As economies recover from global events, the demand for oil is expected to rise, pushing up prices. However, any setbacks, such as renewed economic slowdowns or shifts in energy policies, could temper demand.

- OPEC+ Production Policies: OPEC+ decisions on production quotas will continue to be a key factor in crude oil futures trading. Tightening or loosening production levels could have an immediate impact on oil prices, as these decisions directly affect global supply.

- Energy Transition Policies: The ongoing shift toward renewable energy may gradually dampen long-term oil demand, but in the short term, supply constraints and increased demand for conventional energy sources could drive prices higher.

Based on current market conditions, analysts predict that oil prices could remain relatively high through the end of the year, with potential spikes if any supply disruptions occur. Crude oil futures may see increased buying pressure, but price sensitivity to unforeseen disruptions could cause fluctuations. Retail and institutional traders, as well as hedgers, should remain vigilant, monitoring relevant indicators and adjusting their strategies accordingly. Given these factors, how to trade oil futures effectively will require a close watch on economic reports, OPEC announcements, and geopolitical developments.

Understanding how to trade oil futures requires a grasp of market mechanics, key influences, and the reasons behind the popularity of crude oil futures trading. With high liquidity, volatility, and a strong influence from global factors, oil futures present unique opportunities and risks for traders of all kinds. For retail traders, the potential for high returns is met with significant risk. Institutional traders benefit from data and scale, but face regulatory challenges, while hedgers achieve price stability at the cost of flexibility.

The outlook for crude oil futures remains complex, with oil prices predicted to face various pressures that may drive prices higher or, conversely, cause corrections. As oil remains essential to the global economy, futures trading in this sector will continue to be a focal point for market participants. For anyone engaging in crude oil futures trading, maintaining a strategic approach and staying informed of global events are essential for navigating the unpredictable and profitable world of oil futures.

For more information, click here.

Ready to start trading futures? Call us at 1(800)454-9572 – Int’l (310)859-9572 (International), or email info@cannontrading.com to speak with one of our experienced, Series-3 licensed futures brokers and begin your futures trading journey with Cannon Trading Company today.

Disclaimer: Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involve substantial risk of loss and are not suitable for all investors. Past performance is not indicative of future results. Carefully consider if trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time.

Important: Trading commodity futures and options involves a substantial risk of loss. The recommendations contained in this article are opinions only and do not guarantee any profits. This article is for educational purposes. Past performances are not necessarily indicative of future results.

This article has been generated with the help of AI Technology and modified for accuracy and compliance.

Follow us on all socials: @cannontrading

Post-Election Market Surge: Commodities, Equities Rally Ahead of FOMC Rate Decision

|

|

Markets Hold Breath: Elections, Iran Tensions, and FOMC Decision Awaited

|

|

Rising VIX Amid Market Highs: Understanding Elevated Volatility in Record-Breaking Times

|

|

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010