Preview: Nonfarm Payrolls due Friday 5th May 2023 at

13:30 BST / 08:30 EDT

Provided by our friends at NewSquawk. Get a free trial to audio and text breaking news alerts as well as commentary

SUMMARY: Headline NFP is expected to rise by 180k in April, cooling from the prior 236k while the unemployment rate

is seen ticking up slightly to 3.6% from 3.5%. The wages will be eyed to gauge inflationary pressures, and M/M wages are expected to maintain a pace of 0.3% while the Y/Y is seen rising 4.2%, the same pace in March. Labour market proxies have been mixed: initial jobless claims rose in the week that coincides with the BLS survey period, while continued claims moved lower; the ADP added jobs well above expectations, but wages were cool; ISM Manufacturing employment gauge returned to expansionary territory, and the Services employment remained in expansionary territory,

but it did slow from March.

The jobs report will be used to gauge the Fed’s next move, whether that be a pause, or lead to some “additional policy firming”, but it is worth stressing there is plenty of data between now and the June 14th FOMC, while the expected and actual tightening of credit conditions will also be key, particularly after First Republic (FRC) saga and more recently, PacWest (PACW) exploring options.

EXPECTATIONS: Headline NFP is expected to show 180k jobs were added in April, down from March’s 236k, while analyst forecasts range from 94k-265k. This compares to the 3-,6-, and 12-month averages of 345k, 315k, and 345k, respectively. 180k would mark a cooling in the growth of the labour market to levels more consistent with pre-COVID trends, coming down from extremely hot levels. The unemployment rate is seen rising to 3.6% from 3.5%, with forecasts ranging between 3.4-3.7%, but still well below the FOMC’s median view of 4.5% by year-end and at 4.6% by the end of

2024.

Plan your trade and trade your plan.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

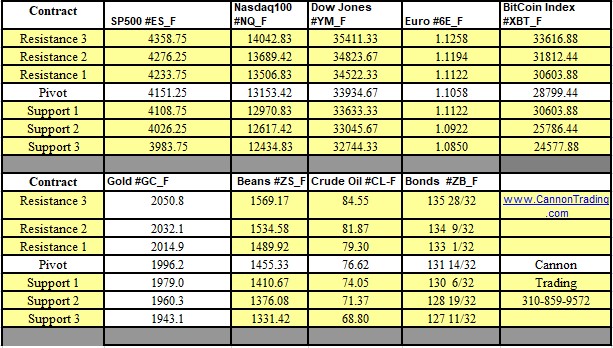

Futures Trading Levels

for 05-05-2023

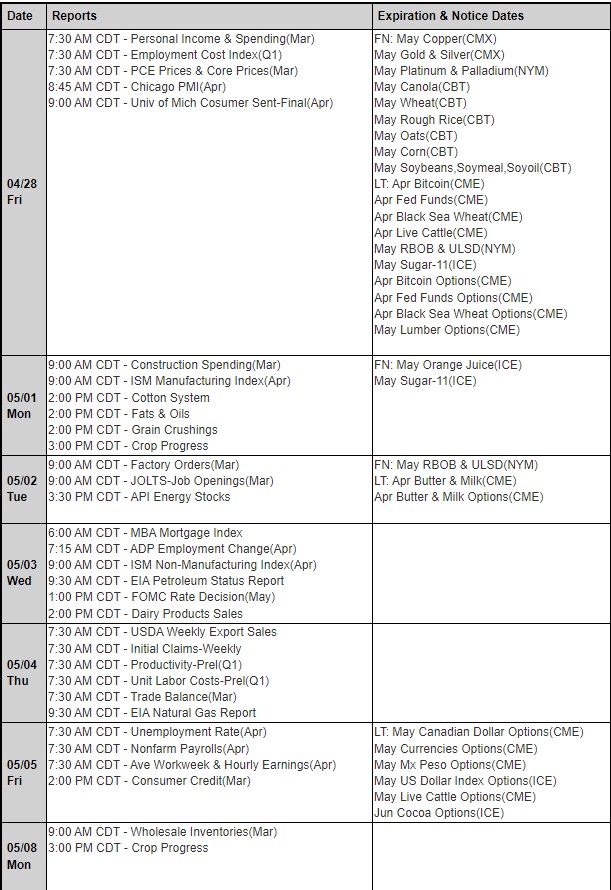

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.