Price action yesterday during FOMC and today leads me to talk about the “type of market environment you are trading”.

Yesterday we saw extremely volatile action both sides of the market with the end result a sharp down move.

Today we saw again, volatile, at times sporadic price moves both up and down.

Volume both days was heavy.

- My opinion is that there are 3 main types of trading days.

1. Most common is two sided trading action with swings up and down – this type of trading day is most suitable for using support and resistance levels along with overbought/oversold indicators.

2. Strong trending day, mostly one directional – this type of trading day is the least common, many times will happen on Mondays and maybe 3-5 times a month at most – this type of trading day is most suitable for using ADX, MACD crossovers and pretty much looking for pullbacks to jump on the trend

3. Slow and/ or choppy trading day – this type of trading day is best suited for taking small profits from the market by looking at volume spikes, using stochastics as possible entry signals and usually wait for a pullback before jumping in.

- Good question is how can one asses what type of trading day we will have while the market is still trading….I am doing some work about it and will be happy to hear feedback via email but here are some initial observations:

- Was the overnight session a wide, two sided trading range? If the answer is yes, good chances for similar trading day during the primary session ( primary session is when the cash/ stock market is open)

- Mondays have the highest chance for trending days

- The behavior of the first hour of trading can also suggests the type of action for the rest of the day.

- If the first 30 minutes have good volume, better chances for type 1 or type 2 trading days.

- low volume during first 30 minutes can suggest a choppy (type 3 trading day)

As always, plan your trade and trade your plan. Please contact your broker or Cannon Trading with any questions.

Trading Futures, Options on Futures, and retail off-exchange foreign currency transactions involves substantial risk of loss and is not suitable for all investors. You should carefully consider whether trading is suitable for you in light of your circumstances, knowledge, and financial resources. You may lose all or more of your initial investment. Opinions, market data, and recommendations are subject to change at any time when it comes to Futures Trading.

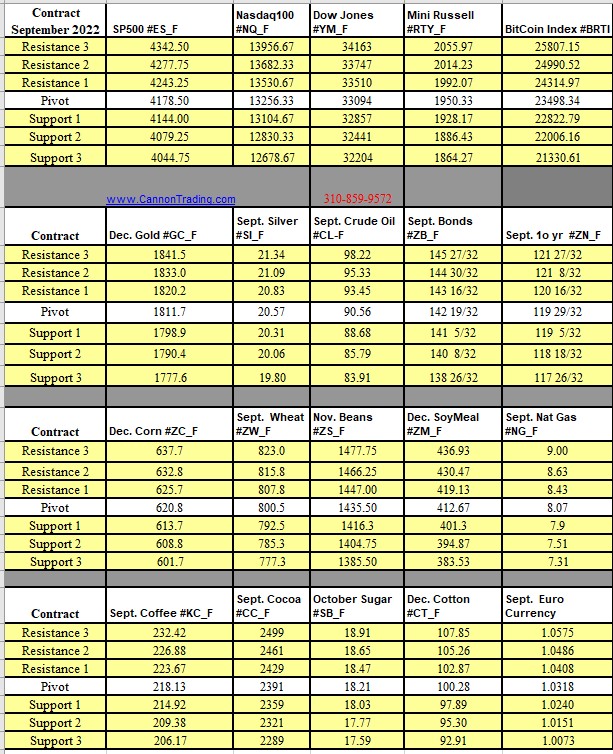

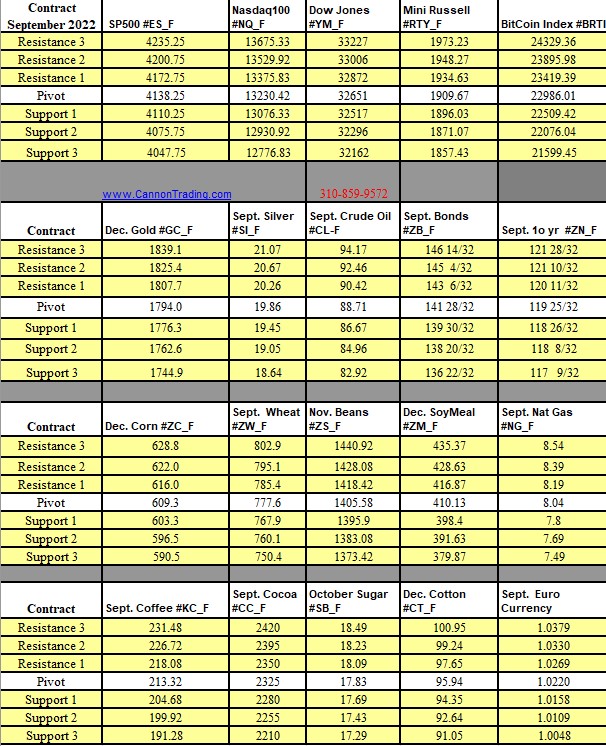

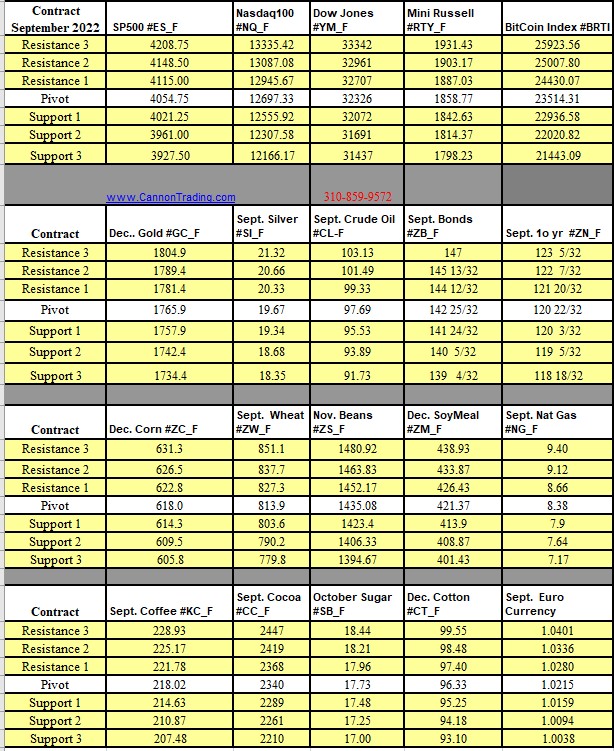

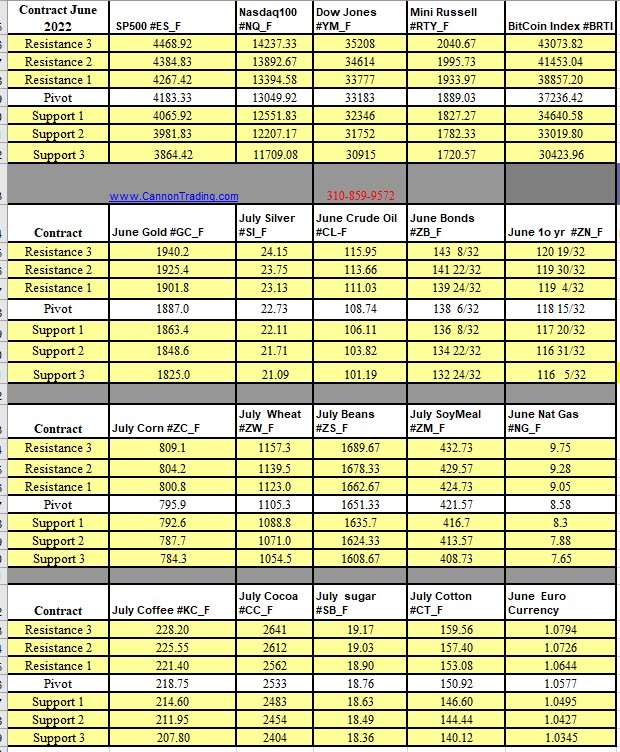

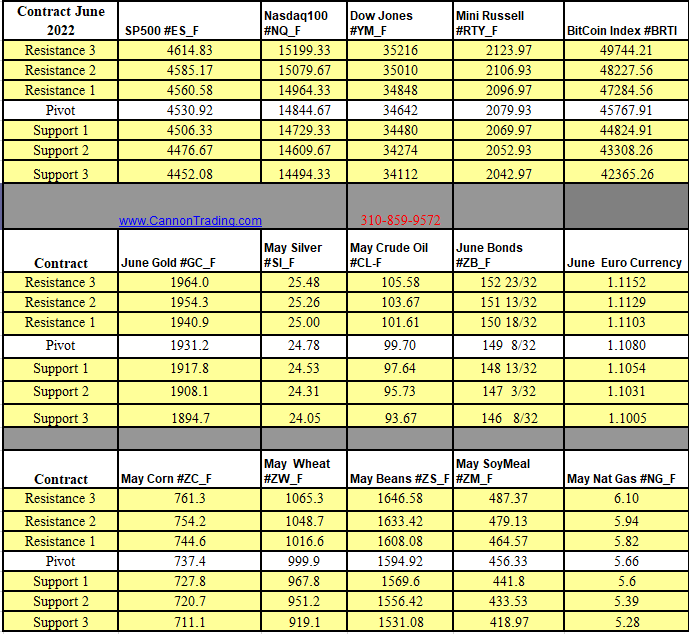

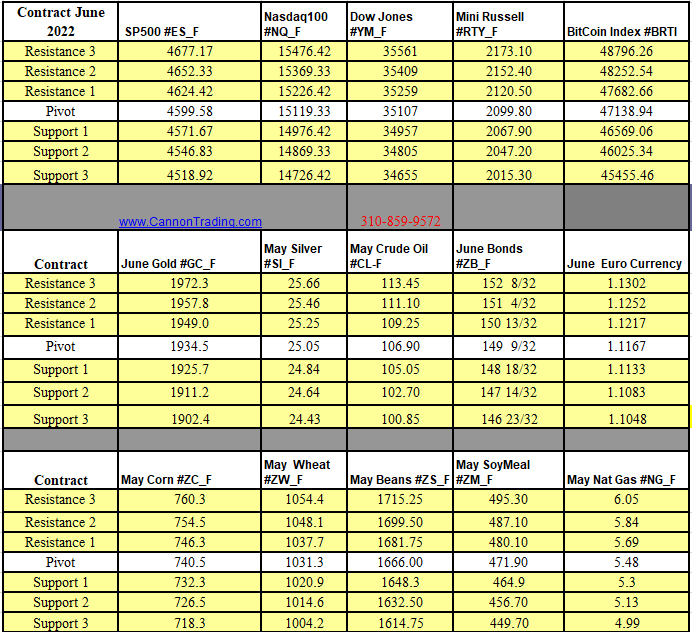

Futures Trading Levels

09-23-2022

Improve Your Trading Skills

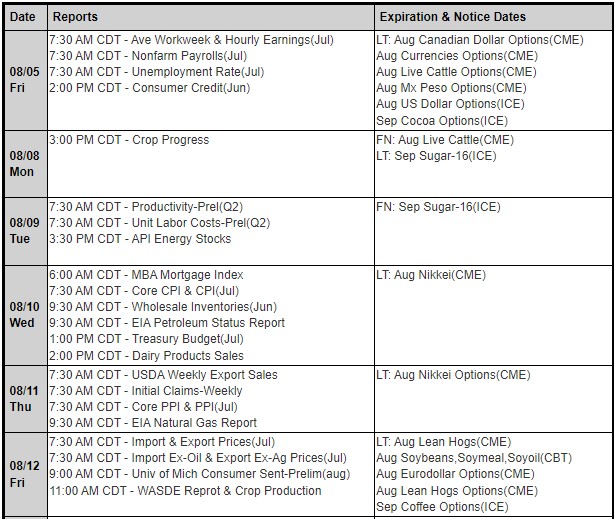

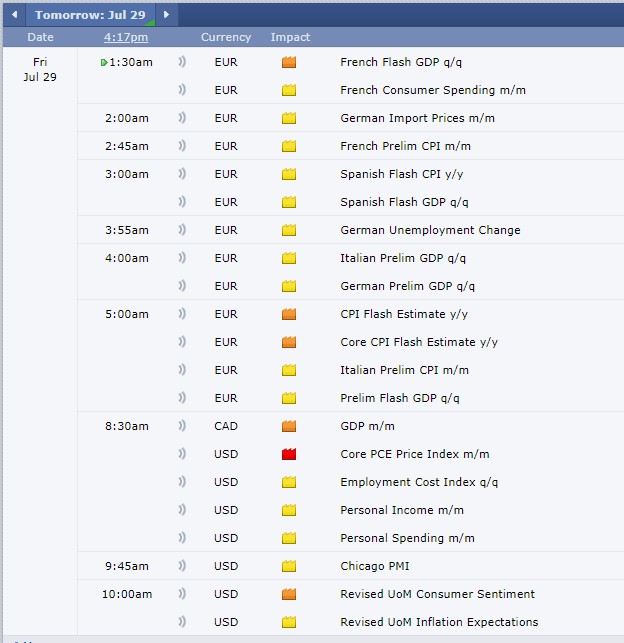

Economic Reports, Source:

This is not a solicitation of any order to buy or sell, but a current market view provided by Cannon Trading Inc. Any statement of facts here in contained are derived from sources believed to be reliable, but are not guaranteed as to accuracy, nor they purport to be complete. No responsibility is assumed with respect to any such statement or with respect to any expression of opinion herein contained. Readers are urged to exercise their own judgement in trading.